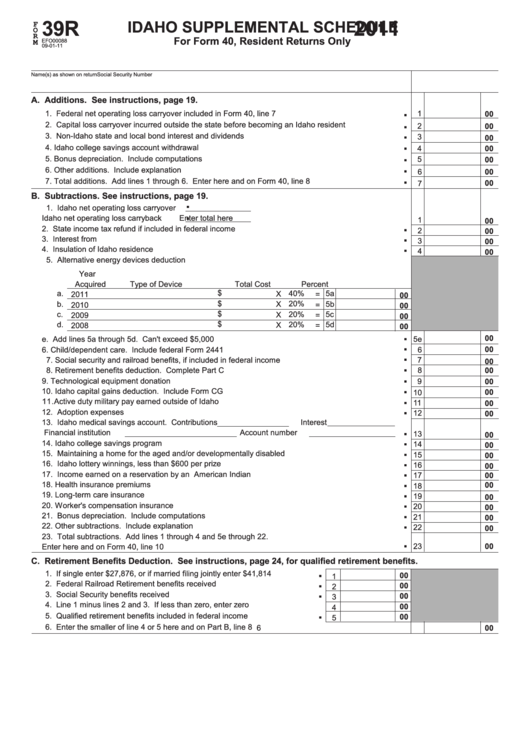

Idaho Form 39R Instructions

Idaho Form 39R Instructions - Web if you receive retirement income from the military, u.s. Web additional information, per idaho form 39r instructions, page 23: Idaho residents on active military duty, complete part d below. Line 15 maintaining a home for the aged you can deduct $1,000 for each family member, not including. This form is for income earned in tax year 2022, with tax returns due. Web the form 39r instructions for that line read as follows: This credit is being claimed for taxes paid to: 40, 43, 39r, 39nr, tax tables. Individual income tax forms (current). Additional information, per idaho form 39r instructions, page 32:

This credit is being claimed for taxes paid to: This credit is being claimed for taxes paid to: This information is for general guidance only. Web if you receive retirement income from the military, u.s. Web business income tax forms (archive) cigarette taxes forms. 40, 43, 39r, 39nr, tax tables. Web we last updated idaho form 39r in february 2023 from the idaho state tax commission. Credit for income tax paid to other states. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Deduct premiums you paid for health insurance for yourself, your spouse and your dependents if those.

Web additional information, per idaho form 39r instructions, page 23: Web additional information, per idaho form 39r instructions, page 32: This form is for income earned in tax year 2022, with tax returns due. This credit is being claimed for taxes paid to: 40, 43, 39r, 39nr, tax tables. Use form 43 if you’re a: Web nonresidents can’t claim this credit. Web file form 43 and include form 39nr with your return. Line 15 maintaining a home for aged and/or developmentally disabled you may deduct. Form 39nr complete form 39nr if you're fi ling a form 43.

Idaho Form 850 PDF Fill Out and Sign Printable PDF Template signNow

Web additional information, per idaho form 39r instructions, page 23: Line 15 maintaining a home for aged and/or developmentally disabled you may deduct. Web page 2 social security number d. 40, 43, 39r, 39nr, tax tables. Web form 39r resident supplemental schedule 2021 names as shown on return social security number a.

Instructions For Form 967 Idaho Annual Withholding Report printable

Web use form 39r if you file form 40 and claim any additions, subtractions, or certain credits. This form is for income earned in tax year 2022, with tax returns due. Form 39nr complete form 39nr if you're fi ling a form 43. Web if you receive retirement income from the military, u.s. Additional information, per idaho form 39r instructions,.

Instructions For Idaho Form 41es printable pdf download

Web additional information, per idaho form 39r instructions, page 32: 40, 43, 39r, 39nr, tax tables. Web download or print the 2022 idaho form 39r (idaho supplemental schedule (resident)) for free from the idaho state tax commission. Civil service, idaho’s firemen’s retirement fund, or policeman’s retirement, compute the allowable deduction on id form. Credit for income tax paid to other.

Download Instructions for Form 40, 43, 39R, 39NR Individual Tax

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Fuels taxes and fees forms. Line 15 maintaining a home for aged and/or developmentally disabled you may deduct. Web page 2 social security number d. This form is for.

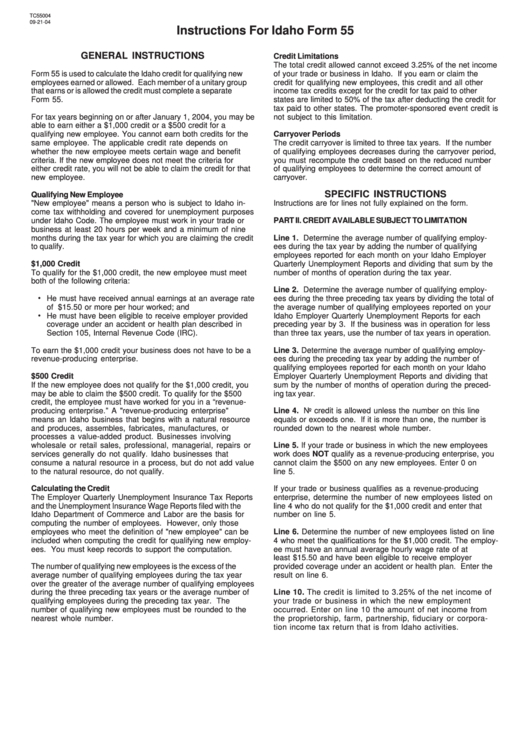

Instructions For Idaho Form 55 2004 printable pdf download

40, 43, 39r, 39nr, tax tables. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Credit for income tax paid to other states. Individual income tax forms (current). Form 39nr complete form 39nr if you're fi ling a.

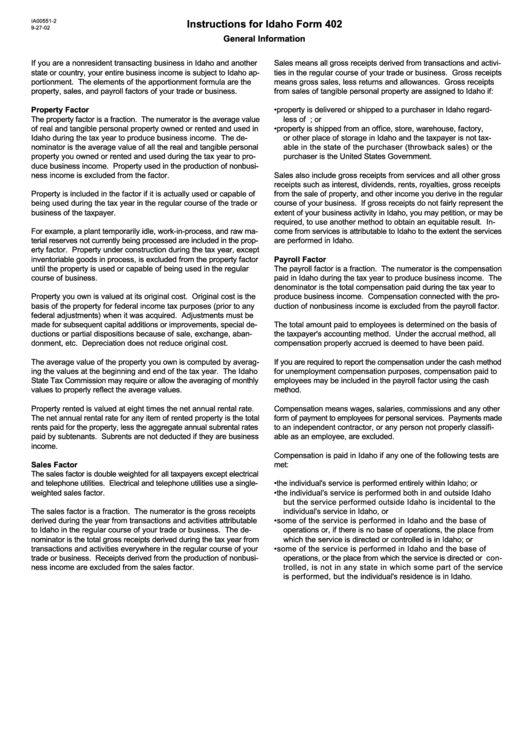

Instructions For Idaho Form 402 printable pdf download

Web page 2 social security number d. Form 39nr complete form 39nr if you're fi ling a form 43. 40, 43, 39r, 39nr, tax tables. This information is for general guidance only. Only residents, including idaho residents on active military duty outside idaho, can claim this credit.

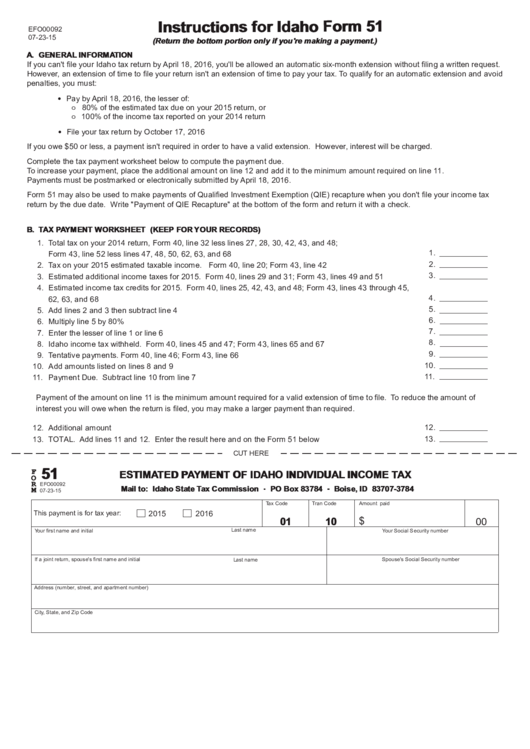

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

This information is for general guidance only. Civil service, idaho’s firemen’s retirement fund, or policeman’s retirement, compute the allowable deduction on id form. Web nonresidents can’t claim this credit. Web the form 39r instructions for that line read as follows: Use form 43 if you’re a:

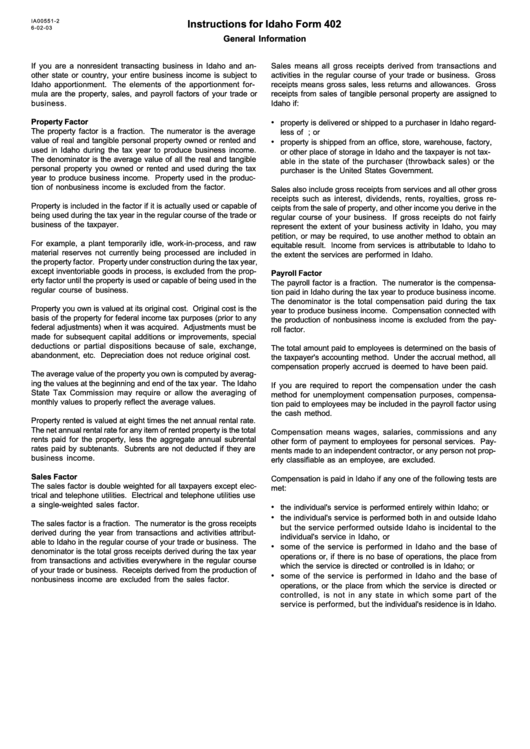

Instructions For Idaho Form 402 printable pdf download

This form is for income earned in tax year 2022, with tax returns due. Web nonresidents can’t claim this credit. Line 15 maintaining a home for aged and/or developmentally disabled you may deduct. Web business income tax forms (archive) cigarette taxes forms. Idaho residents on active military duty, complete part d below.

Fillable Form 39r Idaho Supplemental Schedule For Form 40, Resident

Idaho residents on active military duty, complete part d below. Web nonresidents can’t claim this credit. Web form 39r resident supplemental schedule 2021 names as shown on return social security number a. Fuels taxes and fees forms. Web use form 39r if you file form 40 and claim any additions, subtractions, or certain credits.

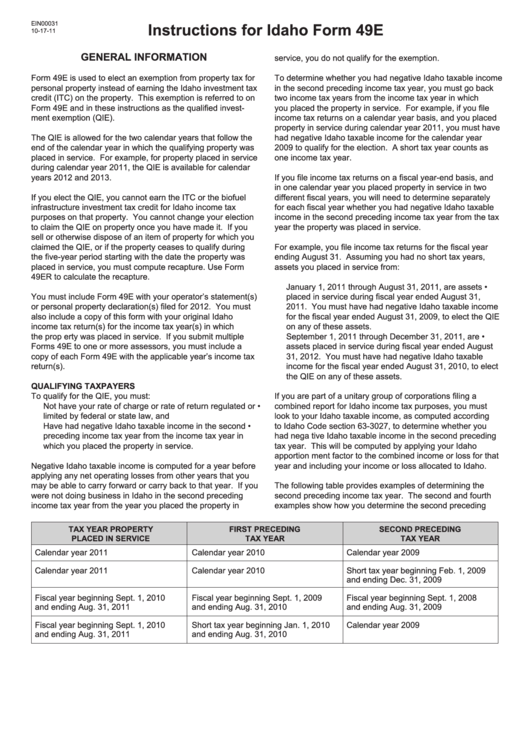

Instructions For Idaho Form 49e printable pdf download

Credit for income tax paid to other states. Additional information, per idaho form 39r instructions, page 32: This credit is being claimed for taxes paid to: Web if you receive retirement income from the military, u.s. Line 15 maintaining a home for the aged you can deduct $1,000 for each family.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

Fuels taxes and fees forms. 40, 43, 39r, 39nr, tax tables. Web the form 39r instructions for that line read as follows: Civil service, idaho’s firemen’s retirement fund, or policeman’s retirement, compute the allowable deduction on id form.

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In Either A.

This credit is being claimed for taxes paid to: This information is for general guidance only. Web additional information, per idaho form 39r instructions, page 32: Web use form 39r if you file form 40 and claim any additions, subtractions, or certain credits.

Line 15 Maintaining A Home For The Aged You Can Deduct $1,000 For Each Family Member, Not Including.

Web page 2 social security number d. Use form 43 if you’re a: Web file form 43 and include form 39nr with your return. Line 15 maintaining a home for aged and/or developmentally disabled you may deduct.

Web We Last Updated Idaho Form 39R In February 2023 From The Idaho State Tax Commission.

Web business income tax forms (archive) cigarette taxes forms. Line 15 maintaining a home for the aged you can deduct $1,000 for each family. Web if you receive retirement income from the military, u.s. 40, 43, 39r, 39nr, tax tables.