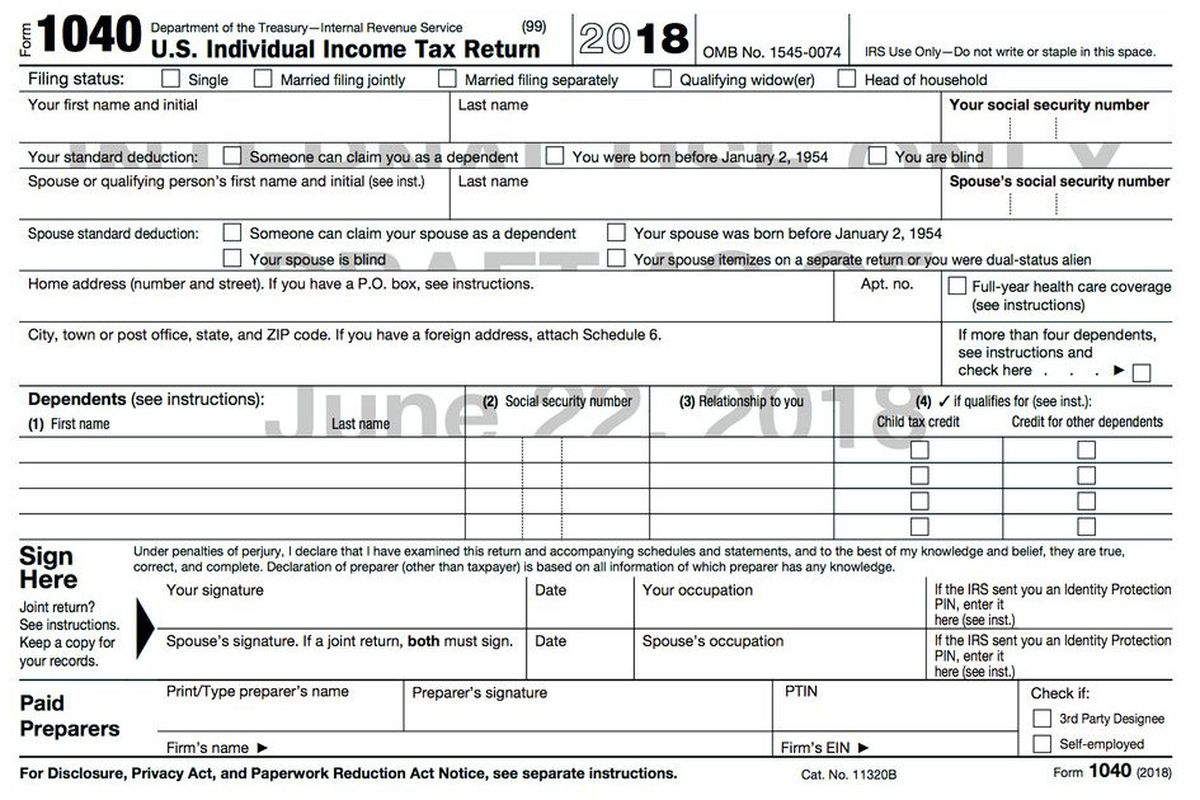

Il 2019 Form 1040

Il 2019 Form 1040 - Annual income tax return filed by citizens or residents of the united states. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use. Personal information print or type your current social. Ad enjoy discounts & hottest sales on 1040 tax forms. Filing online is quick and easy! These where to file addresses. Request for taxpayer identification number (tin) and. Individual tax return form 1040 instructions; The illinois income tax rate is 4.95 percent (.0495). Single married filing jointly married filing separately (mfs) head of.

Web we would like to show you a description here but the site won’t allow us. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use. Add lines 1 through 3. Ad shop a wide variety of tax forms from top brands at staples®. Staples provides custom solutions to help organizations achieve their goals. Filing online is quick and easy! Web click on new document and choose the file importing option: The illinois income tax rate is 4.95 percent (.0495). You + spouse # of checkboxes x $1,000 10c d if you are claiming dependents, enter the amount from sch. These where to file addresses.

You + spouse # of checkboxes x $1,000 10c d if you are claiming dependents, enter the amount from sch. Request for taxpayer identification number (tin) and. Single married filing jointly married filing separately (mfs) head of. The illinois income tax rate is 4.95 percent (.0495). Web form 1040 (2020) us individual income tax return for tax year 2020. Filing status check only one box. Filing online is quick and easy! For more information about the illinois income tax, see the illinois income tax. Individual tax return form 1040 instructions; Web follow the simple instructions below:

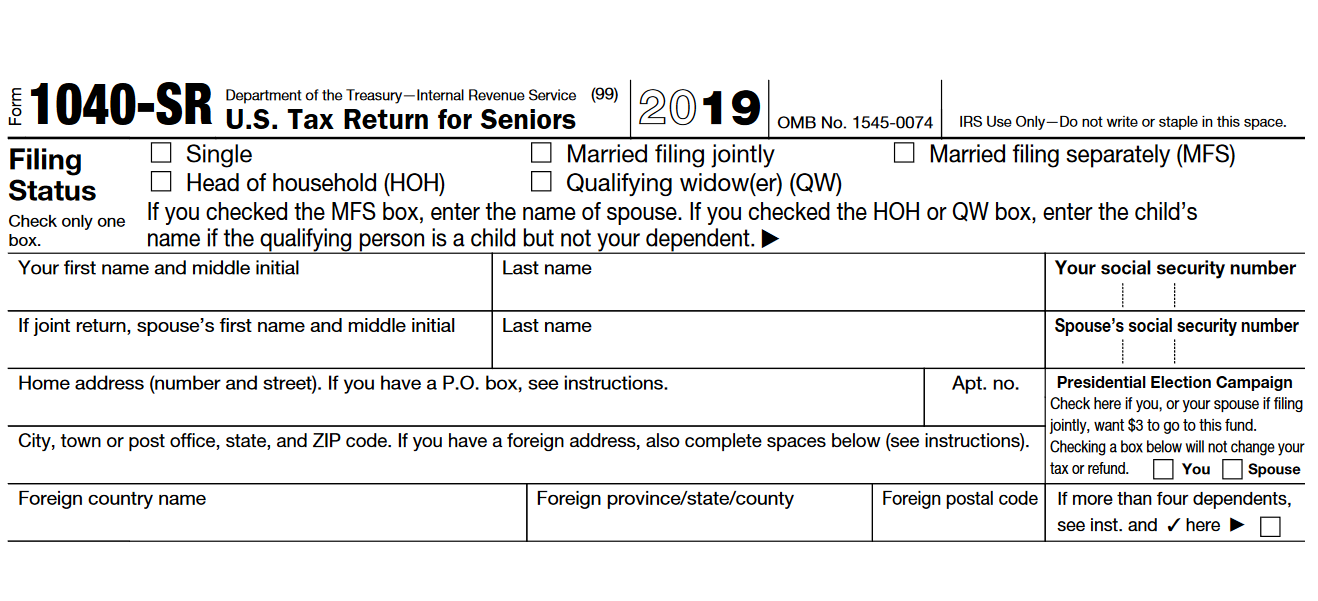

1040 SR Form 2019 Printable 1040 Form Printable

You + spouse # of checkboxes x $1,000 10c d if you are claiming dependents, enter the amount from sch. Web follow the simple instructions below: Web file individuals where to file where to file addresses for taxpayers and tax professionals filing form 1040 where to file addresses for taxpayers and tax. These where to file addresses. Single married filing.

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

The illinois income tax rate is 4.95 percent (.0495). Web form 1040 (2020) us individual income tax return for tax year 2020. Filing status check only one box. Web click on new document and choose the file importing option: Best deals on 1040 tax forms.

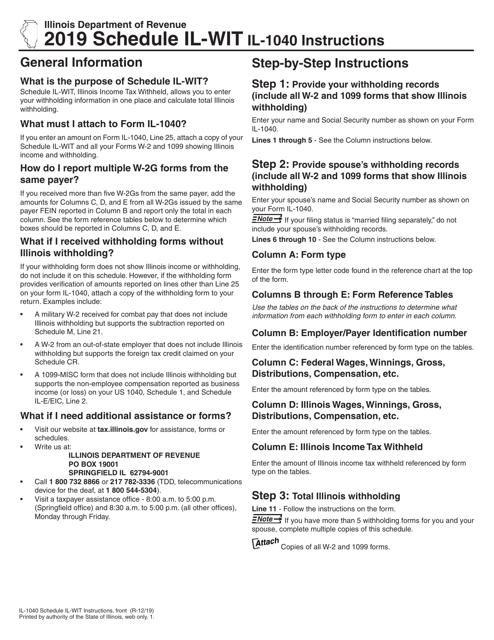

Download Instructions for Form IL1040 Schedule ILWIT Illinois

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. Printable illinois state tax forms for the 2022 tax. Fill out your information to learn how to download your 1040 tax form Web follow the simple instructions below: The illinois income tax rate is 4.95 percent (.0495).

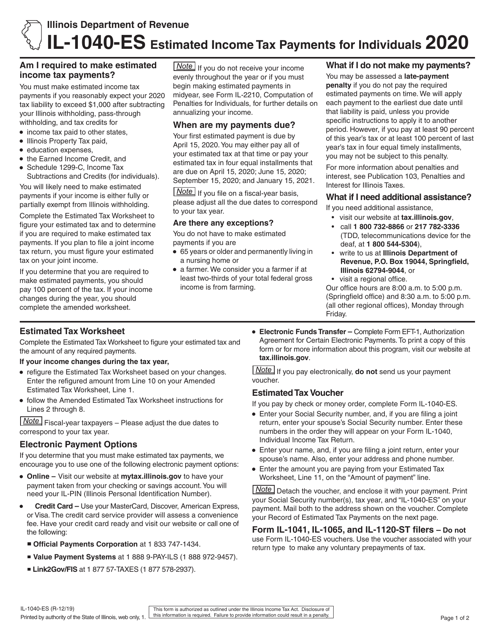

Form IL1040ES Download Fillable PDF or Fill Online Estimated

Payment voucher for individual income tax. Filing online is quick and easy! Printable illinois state tax forms for the 2022 tax. Filing online is quick and easy! Ad shop a wide variety of tax forms from top brands at staples®.

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Ad our free guide provides helpful information about how to get assistance in areas. Ad get ready for tax season deadlines by completing any required tax forms today. For more information about the illinois income tax, see the illinois income tax. Add lines 1 through 3. Web form 1040 (2020) us individual income tax return for tax year 2020.

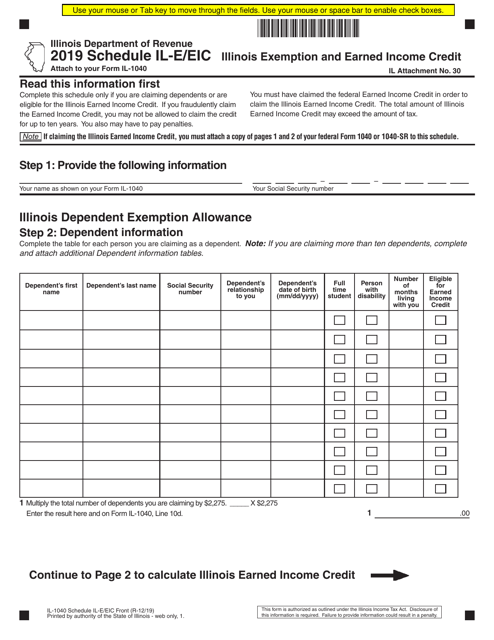

Form IL1040 Schedule ILE/EIC Download Fillable PDF or Fill Online

Experience all the key benefits of completing and submitting documents online. Request for taxpayer identification number (tin) and. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use. Annual income tax return filed by citizens or residents of the united states. These where to file addresses.

Irs 1040 Form 2020 Printable Illinois 1040 Tax Form 2019 1040 Form

Web click on new document and choose the file importing option: Filing online is quick and easy! The illinois income tax rate is 4.95 percent (.0495). Web form 1040 (2020) us individual income tax return for tax year 2020. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use.

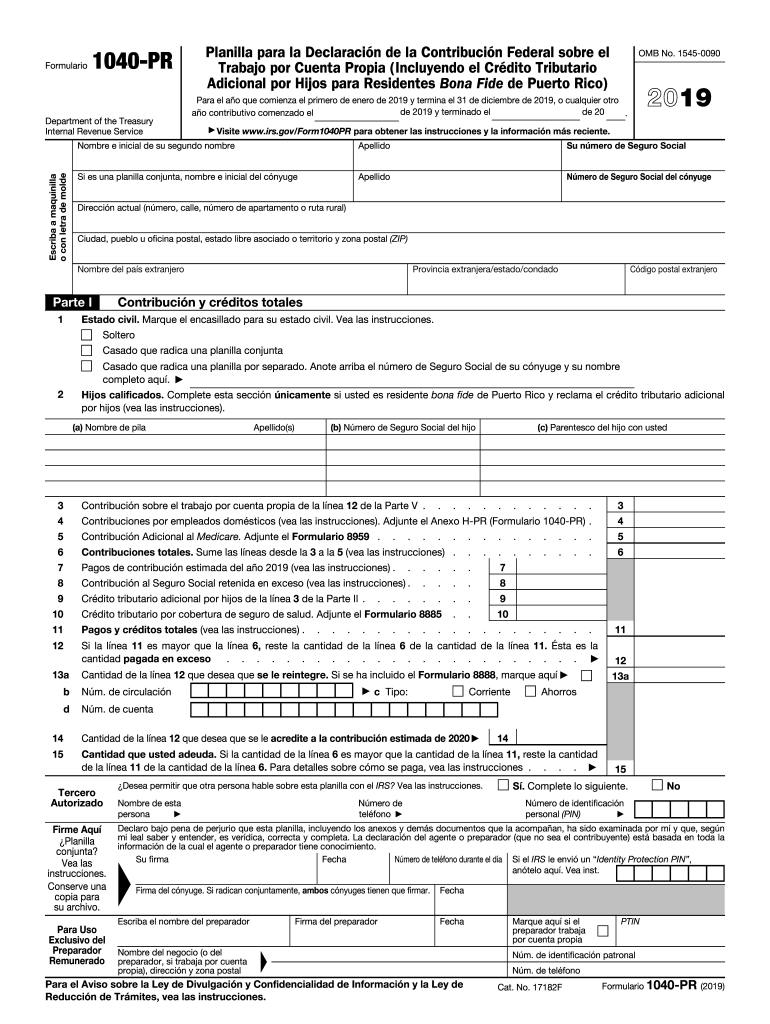

1040 Pr Fill Out and Sign Printable PDF Template signNow

Add lines 1 through 3. Request for taxpayer identification number (tin) and. Filing online is quick and easy! Payment voucher for individual income tax. Ad enjoy discounts & hottest sales on 1040 tax forms.

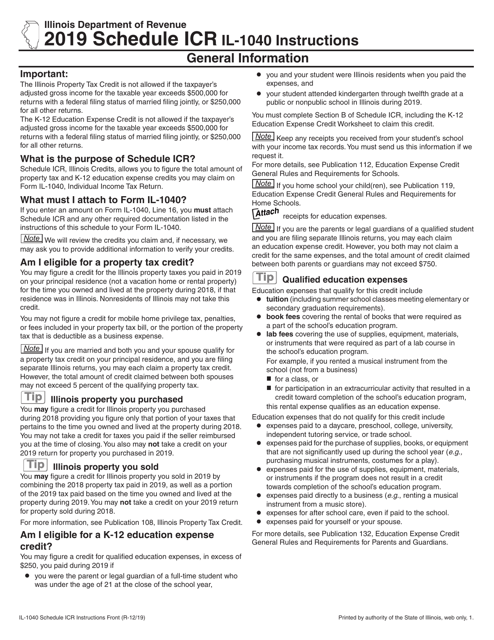

Download Instructions for Form IL1040 Schedule ICR Illinois Credits

Individual tax return form 1040 instructions; Amended individual income tax return. These where to file addresses. Personal information print or type your current social. Annual income tax return filed by citizens or residents of the united states.

1040 Es Form 2019 Form Resume Examples xm1eZ2EKrL

Web we would like to show you a description here but the site won’t allow us. These where to file addresses. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use. Web follow the simple instructions below: Ad our free guide provides helpful information about how to get assistance.

These Where To File Addresses.

Complete, edit or print tax forms instantly. Make your check payable to and mail to. Annual income tax return filed by citizens or residents of the united states. For more information about the illinois income tax, see the illinois income tax.

Ad Our Free Guide Provides Helpful Information About How To Get Assistance In Areas.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in illinois. Web form 1040 (2020) us individual income tax return for tax year 2020. Ad get ready for tax season deadlines by completing any required tax forms today. If your annual use tax liability is over $600 ($1,200 if married filing jointly), you must file and pay your use.

Individual Tax Return Form 1040 Instructions;

Payment voucher for individual income tax. Single married filing jointly married filing separately (mfs) head of. Printable illinois state tax forms for the 2022 tax. Filing online is quick and easy!

The Illinois Income Tax Rate Is 4.95 Percent (.0495).

You + spouse # of checkboxes x $1,000 10c d if you are claiming dependents, enter the amount from sch. Ad shop a wide variety of tax forms from top brands at staples®. Web we would like to show you a description here but the site won’t allow us. Filing status check only one box.