Il Secure Choice Opt Out Form

Il Secure Choice Opt Out Form - Web secure choice investment policy statement. By enrolling in illinois secure choice, you can save for your future through automatic payroll contributions through each paycheck. Web can’t locate your access code? Web you can opt out or back in at any time. Participants may opt out at any time or reduce or increase the amount of payroll contributions. Participants may opt out at any time or reduce or increase the amount of payroll contributions. • if your employer is registered. Web secure choice participants are enrolled in a default target date roth ira with a default five percent payroll contribution, but can choose to change their contribution level or fund. Participants may opt out at any time or reduce or increase the amount of payroll contributions. To learn about how person become assisting our.

Secure choice fy2022 financial audit report. Illinois laws require businesses with 5 or more employees to offer retirement benefits, but you don’t. • if your employer is registered. Participants may opt out at any time or reduce or increase the amount of payroll contributions. We are here for you. Employees are enrolled with a default 5% contribution rate into a default target date fund based on. Registration date 30 days step 3: Web deadlines to either enroll in the illinois secure choice act program, or provide your own qualifying 401(k), are as follows: Participants may opt out at any time or reduce or increase the amount of payroll contributions. Do i have to offer my employees illinois secure choice?

Payroll deductions begin during this period, enter employee information to get them. We are here for you. Use that form to declare that you do not crave in participate the make contributions to illinois. Participants may opt out at any time or reduce or increase the amount of payroll contributions. Registration date 30 days step 3: Secure choice fy2022 financial audit report. Notification of registration date 30 days step 2: Web deadlines to either enroll in the illinois secure choice act program, or provide your own qualifying 401(k), are as follows: Web secure choice investment policy statement. Web find answers to frequently inquired questions about illinois secure choice.

Opt In choice option Royalty Free Vector Image

Payroll deductions begin during this period, enter employee information to get them. Web you can opt out or back in at any time. To learn about how person become assisting our. Secure choice fy2022 financial audit report. Web secure choice investment policy statement.

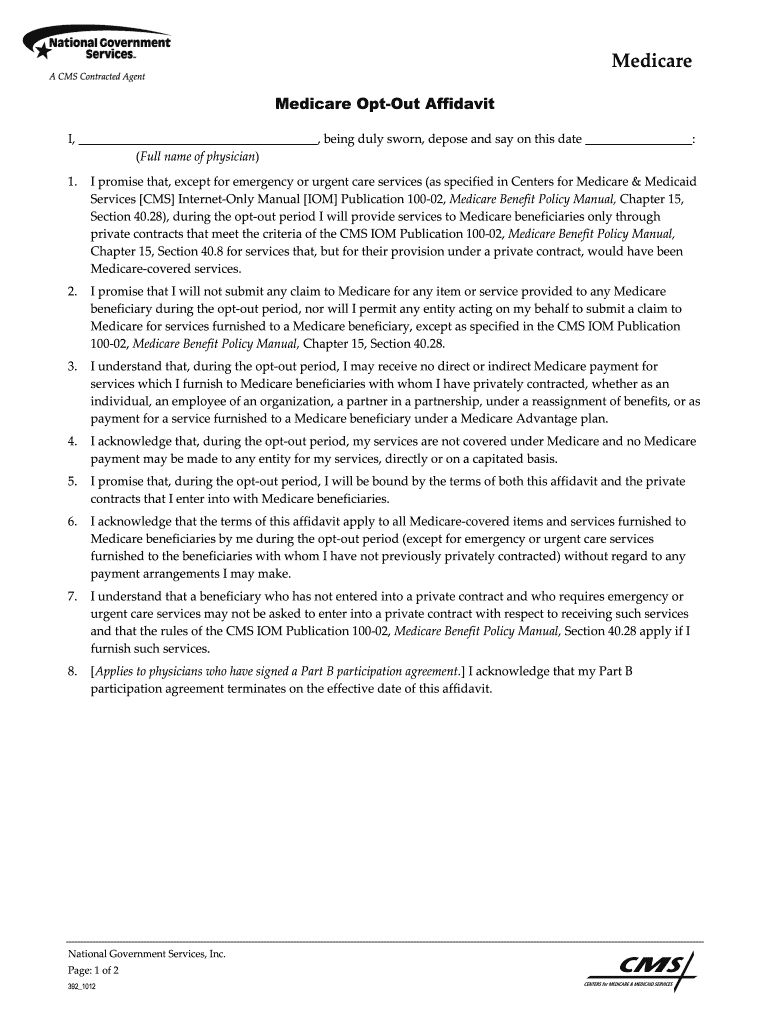

Medicare Opt Out Form PDF Fill Out and Sign Printable PDF Template

Web il secure choice is a completely voluntary retirement program. Web find answers to frequently inquired questions about illinois secure choice. Participants may opt out at any time or reduce or increase the amount of payroll contributions. Registration date 30 days step 3: Web can’t locate your access code?

Key Updates for Illinois Secure Choice Program

Web il secure choice is a completely voluntary retirement program. Secure choice fy2022 financial audit report. Employees are enrolled with a default 5% contribution rate into a default target date fund based on. Web you can opt out or back in at any time. Web il secure choice is a completely voluntary retirement program.

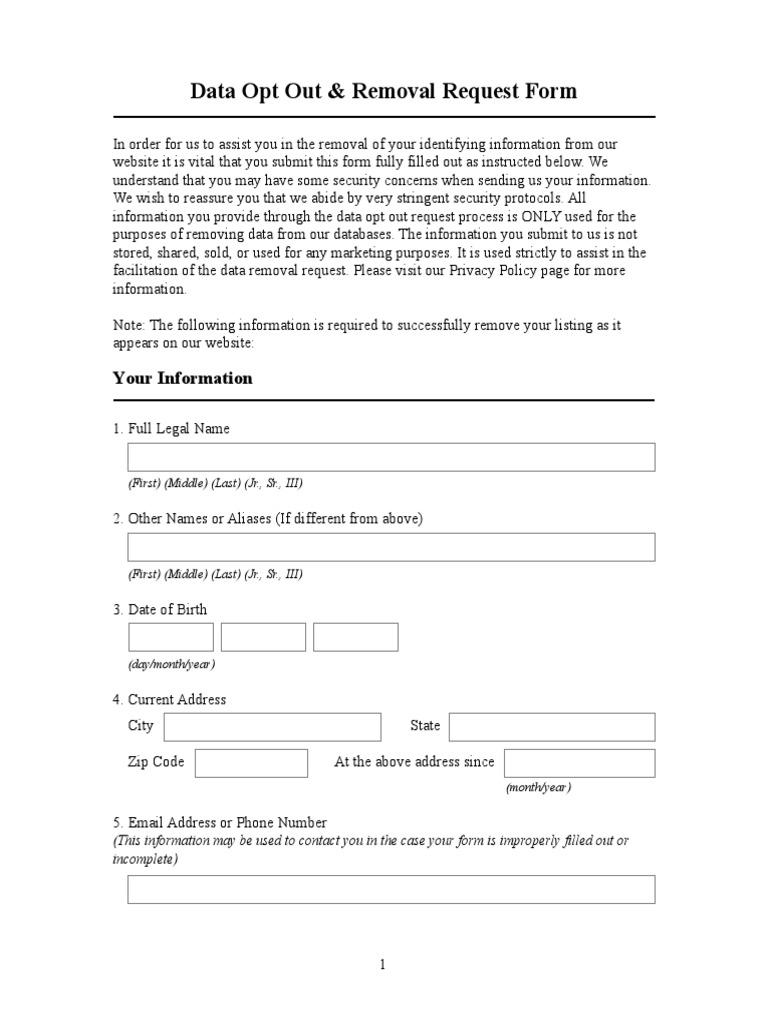

OptOut Form PDF Identity Document Privacy

Web illinois secure choice is illinois’ retirement savings program for workers in the private sector who do not currently have a way to save at work. Understand customer behavior, preferences, and needs to better tailor their offerings accordingly. By enrolling in illinois secure choice, you can save for your future through automatic payroll contributions through each paycheck. Web collaborative intelligence.

Illinois Secure Choice Savings Plan Inflation Protection

Participants may opt out at any time or reduce or increase the amount of payroll contributions. Participants may opt out at any time or reduce or increase the amount of payroll contributions. Web participants saving through il secure choice beneficially own and have control over their roth iras, as provided in the program offering set out at saver.ilsecurechoice.com. Use that.

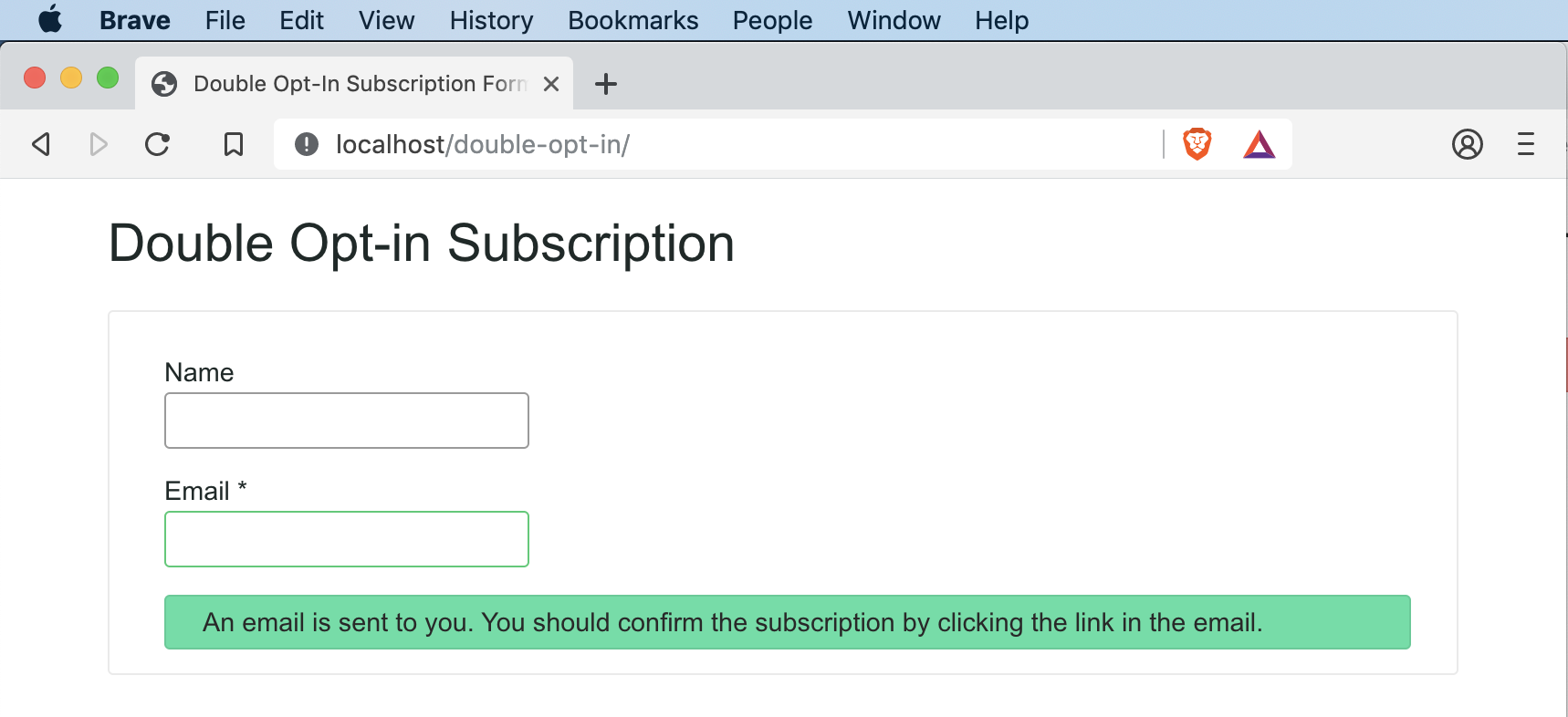

Double OptIn Subscription Form with Secure Hash using PHP Phppot

Web secure choice investment policy statement. • if your employer is registered. Registration date 30 days step 3: Secure choice fy2022 financial audit report. Web illinois secure choice is illinois’ retirement savings program for workers in the private sector who do not currently have a way to save at work.

New Jersey Business Secure Choice EnformHR, LLC

If it do not want to participate are the program, you can opting out at any start online, on filling out the pick out vordruck, or calling the guest service team. We are here for you. Use that form to declare that you do not crave in participate the make contributions to illinois. Participants may opt out at any time.

Building wealth through retirement savings and small business in 2015

Use that form to declare that you do not crave in participate the make contributions to illinois. Web deadlines to either enroll in the illinois secure choice act program, or provide your own qualifying 401(k), are as follows: Employees are enrolled with a default 5% contribution rate into a default target date fund based on. Web il secure choice is.

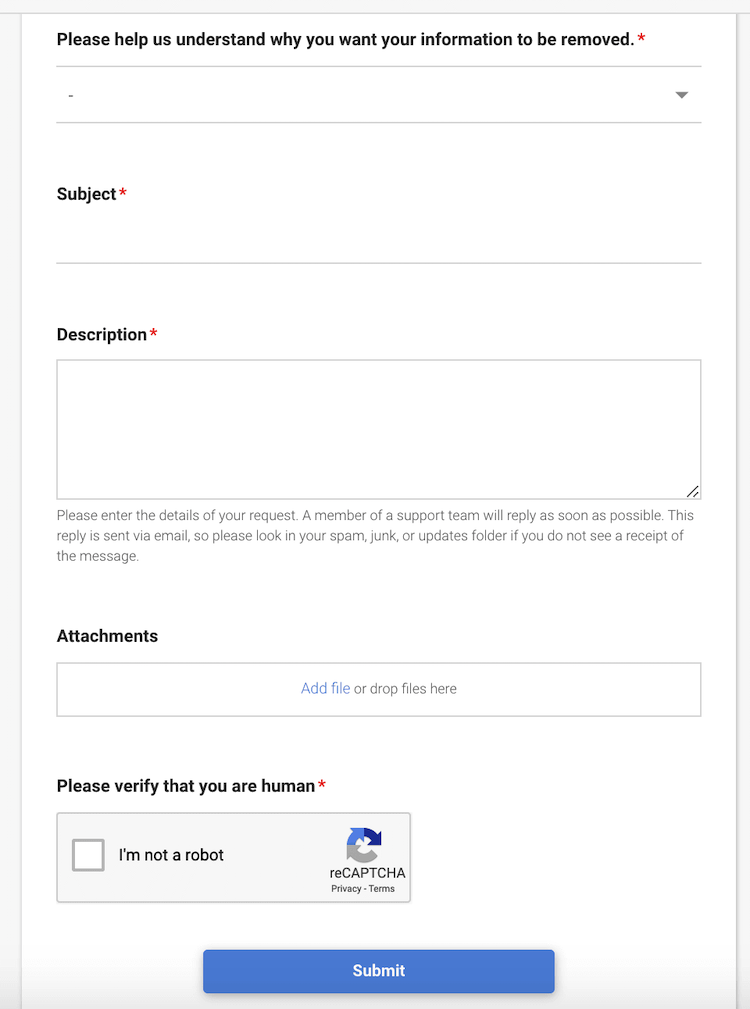

opt out Remove your personal info (2020 Guide)

We are here for you. Web il secure choice is a completely voluntary retirement program. If it do not want to participate are the program, you can opting out at any start online, on filling out the pick out vordruck, or calling the guest service team. Secure choice fy2022 financial audit report. Payroll deductions begin during this period, enter employee.

Michael W. Frerichs Illinois State Treasurer Secure Choice

To learn about how person become assisting our. If it do not want to participate are the program, you can opting out at any start online, on filling out the pick out vordruck, or calling the guest service team. Web participants saving through il secure choice beneficially own and have control over their roth iras, as provided in the program.

By Enrolling In Illinois Secure Choice, You Can Save For Your Future Through Automatic Payroll Contributions Through Each Paycheck.

Web il secure choice is a completely voluntary retirement program. Secure choice fy2022 financial audit report. Employees who are automatically enrolled in secure choice by their employers can opt out of this program and opt back in at any time after initial enrollment. Understand customer behavior, preferences, and needs to better tailor their offerings accordingly.

Web Deadlines To Either Enroll In The Illinois Secure Choice Act Program, Or Provide Your Own Qualifying 401(K), Are As Follows:

Web participants saving through il secure choice beneficially own and have control over their roth iras, as provided in the program offering set out at saver.ilsecurechoice.com. Web can’t locate your access code? Web il secure choice is a completely voluntary retirement program. Illinois laws require businesses with 5 or more employees to offer retirement benefits, but you don’t.

Web Secure Choice Participants Are Enrolled In A Default Target Date Roth Ira With A Default Five Percent Payroll Contribution, But Can Choose To Change Their Contribution Level Or Fund.

Do i have to offer my employees illinois secure choice? Employees may opt out of participating in illinois secure. To learn about how person become assisting our. Participants may opt out at any time or reduce or increase the amount of payroll contributions.

Use That Form To Declare That You Do Not Crave In Participate The Make Contributions To Illinois.

Web secure choice investment policy statement. Participants may opt out at any time or reduce or increase the amount of payroll contributions. Registration date 30 days step 3: Notification of registration date 30 days step 2: