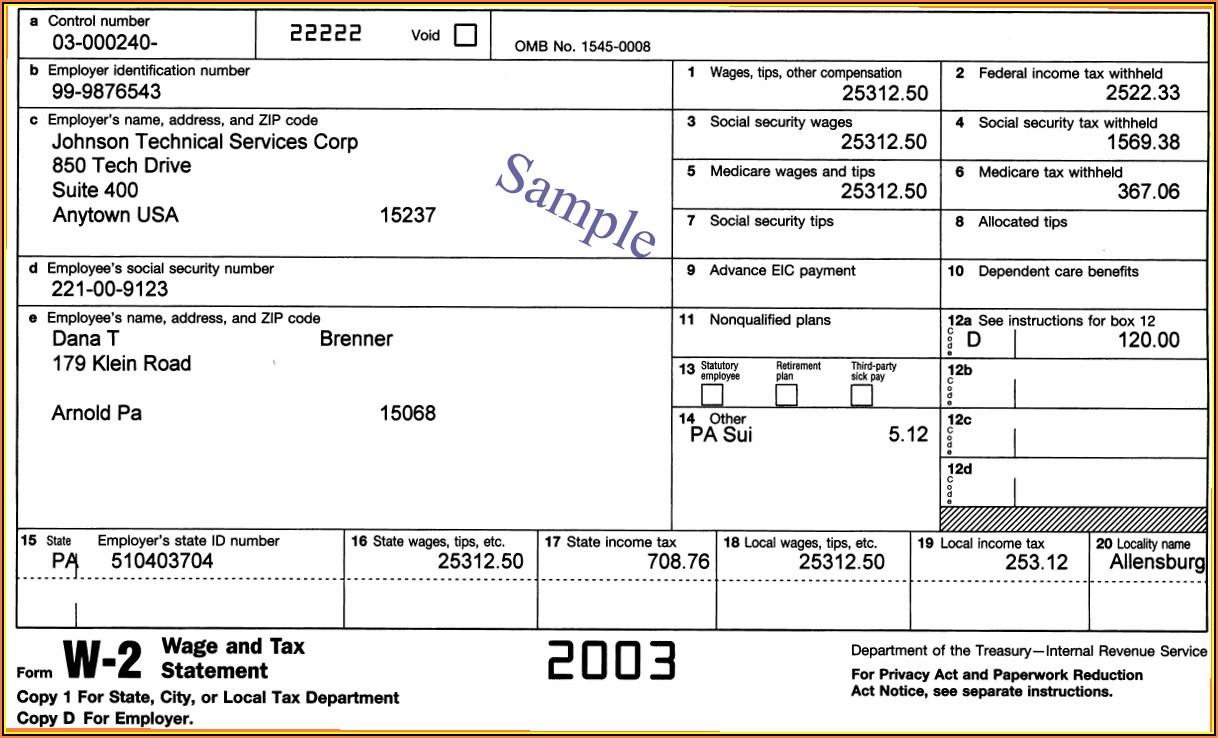

Income Reported To You On Form W-2 As Statutory Employee

Income Reported To You On Form W-2 As Statutory Employee - The following examples use small dollar. Web copy 2 is used to report any state, city, or local income taxes. Earnings as a statutory employee are. Scroll down to the box 13 subsection. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Copy c is for your records.

The following examples use small dollar. Copy c is for your records. Scroll down to the box 13 subsection. Earnings as a statutory employee are. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Social security and medicare tax should have been. Web copy 2 is used to report any state, city, or local income taxes.

The following examples use small dollar. Earnings as a statutory employee are. Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Social security and medicare tax should have been. Copy c is for your records.

Statutory From Employment / A triple whammy! Tax & Delay

Earnings as a statutory employee are. Web copy 2 is used to report any state, city, or local income taxes. Copy c is for your records. Social security and medicare tax should have been. Scroll down to the box 13 subsection.

Statutory Employees and Your Retail Business Deputy

Earnings as a statutory employee are. Web copy 2 is used to report any state, city, or local income taxes. Scroll down to the box 13 subsection. Copy c is for your records. Social security and medicare tax should have been.

Checking your W2 FireWalker Development Group

Earnings as a statutory employee are. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). The following examples use small dollar. Scroll down to the box 13 subsection.

Statutory Employee Definition, Examples, And Management Tips Sling

Web copy 2 is used to report any state, city, or local income taxes. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. Social security and medicare tax should have been. Earnings as a statutory employee are.

Box 12a State Of Alabama Withholding Form

Copy c is for your records. The following examples use small dollar. Social security and medicare tax should have been. Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes.

Form W2 Everything You Ever Wanted To Know

Copy c is for your records. Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes. Earnings as a statutory employee are. The following examples use small dollar.

Form W2 Easy to Understand Tax Guidelines 2020

Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Copy c is for your records. Scroll down to the box 13 subsection. Social security and medicare tax should have been. Earnings as a statutory employee are.

W2 Form Statutory Employee Form Resume Examples mx2Wxez96E

Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Copy c is for your records.

IRS Form W2 Guide Understand How To Fill Out a W2 Form Ageras

Copy c is for your records. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Web copy 2 is used to report any state, city, or local income taxes. Earnings as a statutory employee are.

Statutory Employee Definition, Examples, And Management Tips Sling

Copy c is for your records. Social security and medicare tax should have been. Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Copy C Is For Your Records.

Social security and medicare tax should have been. Scroll down to the box 13 subsection. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Web copy 2 is used to report any state, city, or local income taxes.

Earnings As A Statutory Employee Are.

The following examples use small dollar.