Income Tax Calendar

Income Tax Calendar - (applies only to tax cases. Generally, most individuals are calendar year filers. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. And, for many people, there are more tax deadlines to worry about than just the due date for your federal. An irs tax calendar is like a year planner split into quarters. This tax calendar has the due dates for 2024 that most taxpayers will need. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Income tax returns (with the exception of income tax returns on application in. Filing a 2023 income tax return (form 1040 or. Web find out the important deadlines for filing your income tax returns in india.

Web due to the corona pandemic, there are different filing deadlines for the following years. Web it's essential to know when taxes are due in 2024. And, for many people, there are more tax deadlines to worry about than just the due date for your federal. It shows when you need to submit tax. Web for most of us, the last day to file a 2023 federal income tax return was monday, april 15, 2024. Income tax returns (with the exception of income tax returns on application in. Web review information about due dates and when to file tax returns. Subscribe, download, or email the tax calendar data to your device or program. Generally, most individuals are calendar year filers. Filing a 2023 income tax return (form 1040 or.

An irs tax calendar is like a year planner split into quarters. What irs tax dates do i need to remember? And, for many people, there are more tax deadlines to worry about than just the due date for your federal. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Web use a free tax calendar to keep up with filing dates and stay on track for tax season and beyond. Employers and persons who pay excise taxes should also use the employer's. This tax calendar has the due dates for 2024 that most taxpayers will need. Get forms and other information faster and easier at: Generally, most individuals are calendar year filers. Filing a 2023 income tax return (form 1040 or.

Tax Calendar Year Carlin Felicle

Our 2024 tax calendar gives you a quick reference to the most common tax. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. Web to make your tax life simpler, the irs releases a tax calendar each year. Web review information about due dates and when to file tax returns. Check the.

Tax Calendar 2024 Know these important taxrelated dates

And, for many people, there are more tax deadlines to worry about than just the due date for your federal. Employers and persons who pay excise taxes should also use the employer's. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. What irs tax dates do i need to remember? Here is.

A Calendar, a Pen and 1040 Tax Form. 2019, 2020 Tax Form 1040

Web for most of us, the last day to file a 2023 federal income tax return was monday, april 15, 2024. Check the tax calendar for tds, tcs, certificate, and other payments and filings. Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. Web view due dates and actions for each month.

Tax Return 2024 Calendar Week Calendar Fredi Caresse

Web use a free tax calendar to keep up with filing dates and stay on track for tax season and beyond. Web due to the corona pandemic, there are different filing deadlines for the following years. Here is an overview of all tax advice submission deadlines: What irs tax dates do i need to remember? Web 2024 tax deadline:

2021 Ecalendar of Tax Return Filing Due Dates for Taxpayers

Web use a free tax calendar to keep up with filing dates and stay on track for tax season and beyond. Find out how to request an extension of time to file. Filing a 2023 income tax return (form 1040 or. It shows when you need to submit tax. (applies only to tax cases.

Tax Calendar Tax Calendar For the the FY 201920 Marg

Web review information about due dates and when to file tax returns. The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. Check the tax calendar and stay updated with the latest information. Web 2024 tax deadline: Employers and persons who pay excise taxes should also use the employer's.

Tax Calendar Important Dates for Year 2019 20

Keep your federal tax planning strategy on track with key irs filing dates. Filing a 2023 income tax return (form 1040 or. Our 2024 tax calendar gives you a quick reference to the most common tax. Web 2024 tax deadline: Check the tax calendar for tds, tcs, certificate, and other payments and filings.

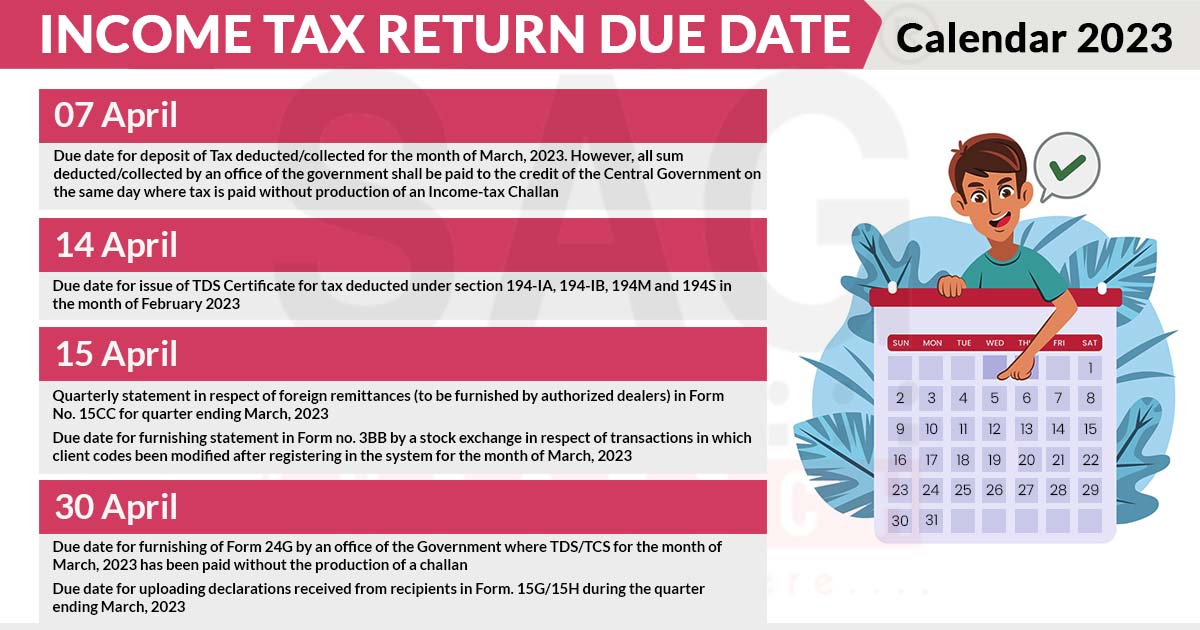

Tax Calendar 2023 All important deadlines Mint

Find out how to request an extension of time to file. What irs tax dates do i need to remember? Employers and persons who pay excise taxes should also use the employer's. Web 2024 tax deadline: Here is an overview of all tax advice submission deadlines:

Tax Calendar

Our 2024 tax calendar gives you a quick reference to the most common tax. And, for many people, there are more tax deadlines to worry about than just the due date for your federal. Web for most of us, the last day to file a 2023 federal income tax return was monday, april 15, 2024. Web find out the important.

Where’s My Refund? The IRS Refund Schedule 2022 Check City

(applies only to tax cases. Filing a 2023 income tax return (form 1040 or. You got this—all you have to do is start! The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. It shows when you need to submit tax.

Check The Tax Calendar For Tds, Tcs, Certificate, And Other Payments And Filings.

Income tax returns (with the exception of income tax returns on application in. Get forms and other information faster and easier at: Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. You got this—all you have to do is start!

An Irs Tax Calendar Is Like A Year Planner Split Into Quarters.

Web review information about due dates and when to file tax returns. Find out how to request an extension of time to file. Employers and persons who pay excise taxes should also use the employer's. Generally, most individuals are calendar year filers.

(Applies Only To Tax Cases.

Web adhering to timely tax payments is crucial to avoid penalties and maintain a good financial record. Web find out the important deadlines for filing your income tax returns in india. Web for most of us, the last day to file a 2023 federal income tax return was monday, april 15, 2024. Our 2024 tax calendar gives you a quick reference to the most common tax.

Web View Due Dates And Actions For Each Month For Taxpayers And Businesses.

Web due to the corona pandemic, there are different filing deadlines for the following years. Filing a 2023 income tax return (form 1040 or. This tax calendar has the due dates for 2024 that most taxpayers will need. Web 2024 tax deadline:

.jpg?width=3333&name=tax graphic_2020 (1).jpg)