Inheritance Tax Waiver Form Ny

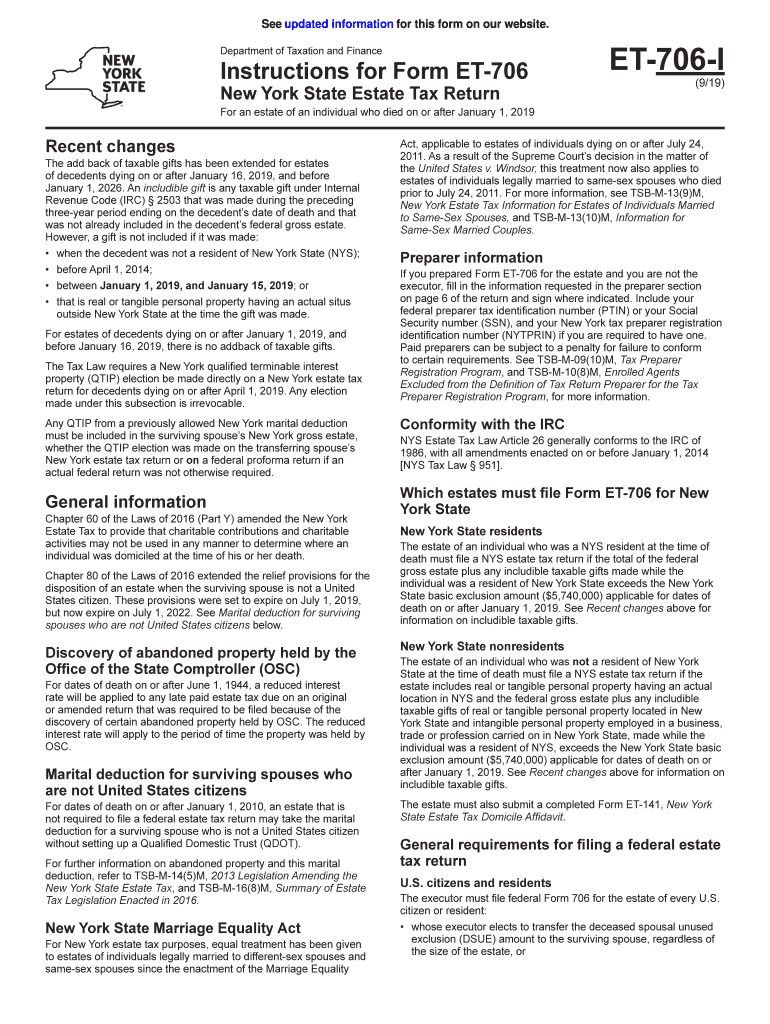

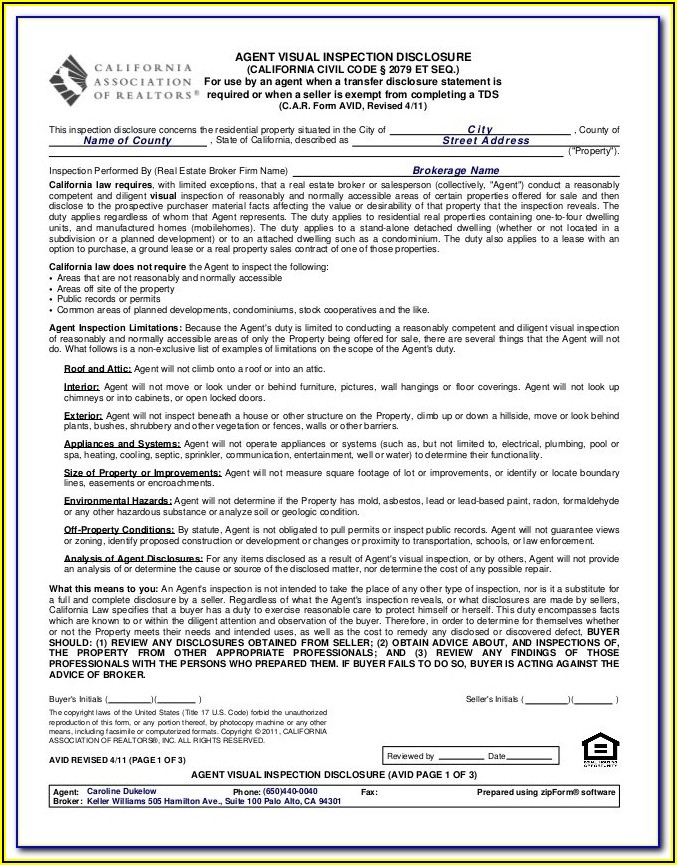

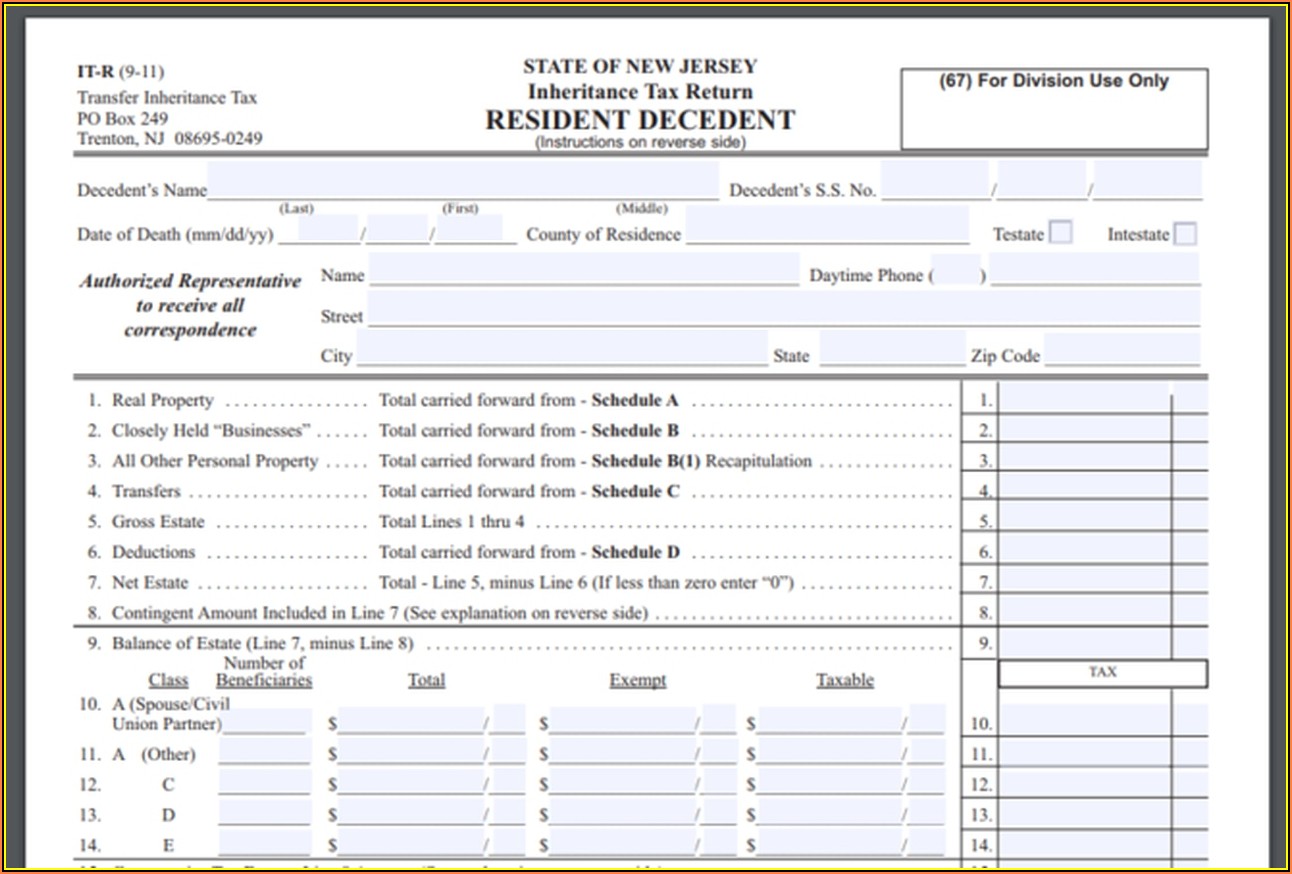

Inheritance Tax Waiver Form Ny - View a list of forms based on the individual's date of death: Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. The state has set a $6.58 million estate tax exemption (up from $6.11. Web does new york have an inheritance tax? Name address city, state, zip code type or print the name and mailing address of the person to whom this form should be returned. For details, see publication 603, estate tax waivers. Web make these fast steps to edit the pdf nys inheritance tax waiver form online free of charge: This is a new york form and can be use in dept of taxation. Register and log in to your account. Send filled & signed et 30 fillable form or save.

Easily sign the et30 with your finger. Open the inheritance tax waiver form new york and follow the instructions. Web does new york state require an inheritance tax waiver? And you also have to be mindful of the federal inheritance tax, which applies to. Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. To ensure a timely issuance, you. Web all requests for a waiver of citation and consent on any estate tax matter pending before the surrogate’s court are handled by estate tax audit. On or afterjanuary 1, 2022; Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations.

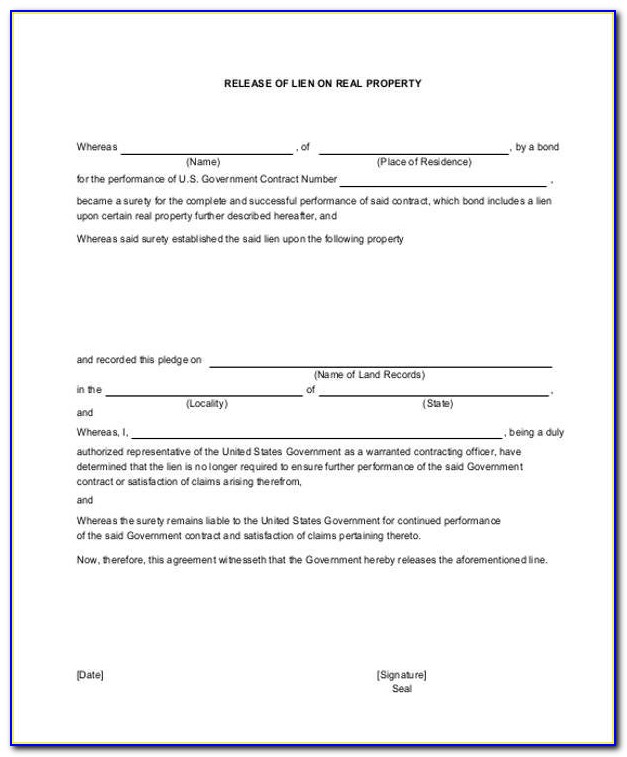

And you also have to be mindful of the federal inheritance tax, which applies to. Web (10/16) there is no fee for a release of lien. On or afterjanuary 1, 2022; Web what is a inheritance tax waiver form? Web aarp en español published march 09, 2022 / updated march 21, 2023 most people don't have to worry about the federal estate tax, which excludes up to $12.92. The state has set a $6.58 million estate tax exemption (up from $6.11. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Open the inheritance tax waiver form new york and follow the instructions. Web does new york have an inheritance tax? View a list of forms based on the individual's date of death:

Inheritance Tax Waiver Form Ny Fill Out and Sign Printable PDF

Web new york state does not require waivers for estates of anyone who died on or after february 1, 2000. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Open the inheritance tax waiver form new york and follow the instructions. On or afterjanuary 1, 2022; Not on most estates,.

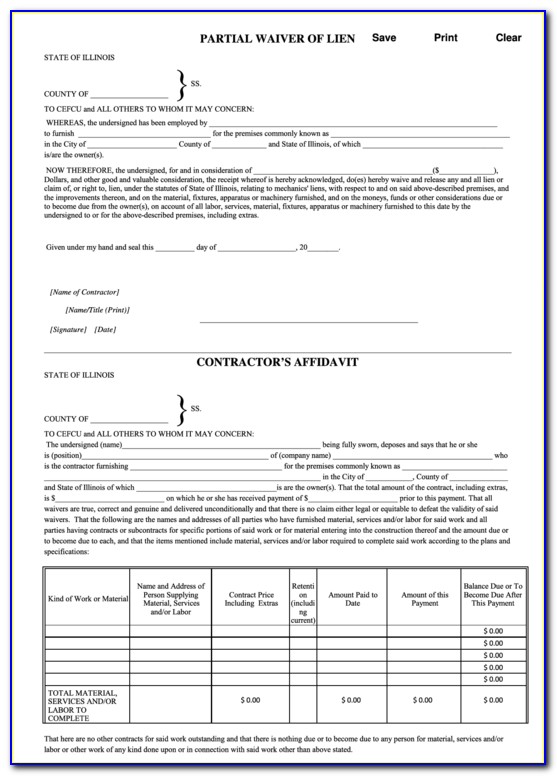

Illinois Inheritance Tax Waiver Form Fill Online, Printable, Fillable

This is a new york form and can be use in dept of taxation. Web (10/16) there is no fee for a release of lien. Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will. Web all requests for a waiver of citation and consent on any estate.

Inheritance Tax Waiver Form New York State Form Resume Examples

If the deadline passes without a waiver being filed, the. Web while new york doesn’t charge an inheritance tax, it does include an estate tax in its laws. This is a new york form and can be use in dept of taxation. Web (10/16) there is no fee for a release of lien. View a list of forms based on.

Missouri State Inheritance Tax Waiver Form NY TT102 1991 Fill out

And you also have to be mindful of the federal inheritance tax, which applies to. The state has set a $6.58 million estate tax exemption (up from $6.11. When authorization is required for the release of personal property, it is usually referred to as an estate. Easily sign the et30 with your finger. On or afterjanuary 1, 2022;

Inheritance Tax Waiver Form Form Resume Examples l6YNqRm93z

Web search nycourts.gov new york state unified court system document 2021 estate tax waiver your download should start automatically in a few seconds. For details, see publication 603, estate tax waivers. Not on most estates, but yes on very large estates. On or afterjanuary 1, 2022; To ensure a timely issuance, you.

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

It’s usually issued by a state tax authority. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Not on most estates, but yes on very large estates. Web while new york doesn’t charge an inheritance tax, it does include an estate tax in its laws. Register and log in to.

Inheritance Tax Illinois ellieldesign

For details, see publication 603, estate tax waivers. This is a new york form and can be use in dept of taxation. When authorization is required for the release of personal property, it is usually referred to as an estate. Web search nycourts.gov new york state unified court system document 2021 estate tax waiver your download should start automatically in.

Il Inheritance Tax Waiver Form Form Resume Examples EVKYl5g010

And you also have to be mindful of the federal inheritance tax, which applies to. For details, see publication 603, estate tax waivers. Easily sign the et30 with your finger. 10/20/2022 wiki user ∙ 12y ago study now see answer (1) best answer copy only required in nys if. Web does new york state require an inheritance tax waiver?

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Send filled & signed et 30 fillable form or save. Web aarp en español published march 09, 2022 / updated march 21, 2023 most people don't have to worry about the federal estate tax, which excludes up to $12.92. Open the inheritance tax waiver form new york and follow the instructions. Register and log in to your account. It’s usually.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

10/20/2022 wiki user ∙ 12y ago study now see answer (1) best answer copy only required in nys if. Easily sign the et30 with your finger. For details, see publication 603, estate tax waivers. To ensure a timely issuance, you. When authorization is required for the release of personal property, it is usually referred to as an estate.

Sign In To The Editor With Your Credentials Or.

Web aarp en español published march 09, 2022 / updated march 21, 2023 most people don't have to worry about the federal estate tax, which excludes up to $12.92. And you also have to be mindful of the federal inheritance tax, which applies to. This is a new york form and can be use in dept of taxation. The state has set a $6.58 million estate tax exemption (up from $6.11.

It’s Usually Issued By A State Tax Authority.

When authorization is required for the release of personal property, it is usually referred to as an estate. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated. Web the minimum amount that an estate can be valued at without being subjected to an estate tax in new york is $5.93 million (at which point an estate executor must. Web make these fast steps to edit the pdf nys inheritance tax waiver form online free of charge:

Web Search Nycourts.gov New York State Unified Court System Document 2021 Estate Tax Waiver Your Download Should Start Automatically In A Few Seconds.

Web how do you obtain a ny inheritance tax waiver? Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Not on most estates, but yes on very large estates. Web timing and taxes typically, a waiver is due within nine months of the death of the person who made the will.

Inheritance Tax Was Repealed For Individuals Dying After December 31, 2012.

If the deadline passes without a waiver being filed, the. On or afterjanuary 1, 2022; Open the inheritance tax waiver form new york and follow the instructions. Web (10/16) there is no fee for a release of lien.