Instructions For 8995 Form

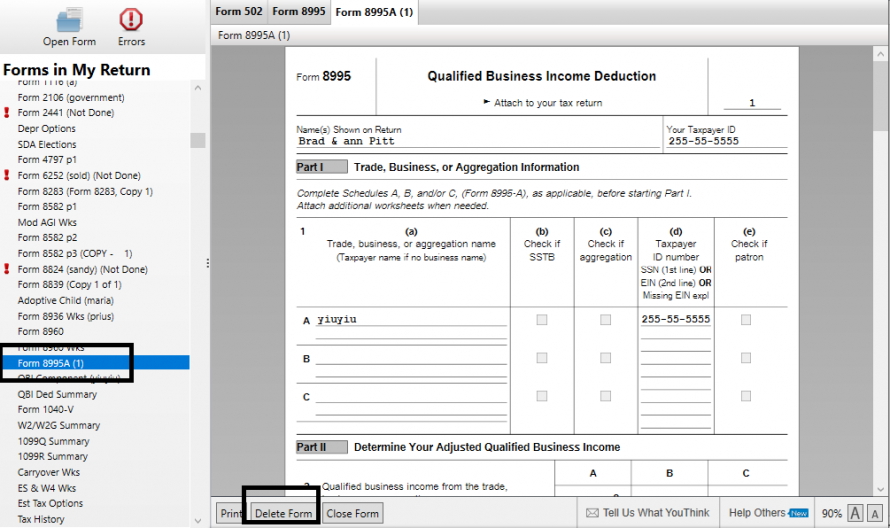

Instructions For 8995 Form - Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Step by step instructions in 2018, the tax. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web form 8995 is the simplified form and is used if all of the following are true: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. 10 minutes watch video get the form! Web according to the irs: What is the purpose of the irs form 8995, and when do you need to use it? • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. Fear not, for i am.

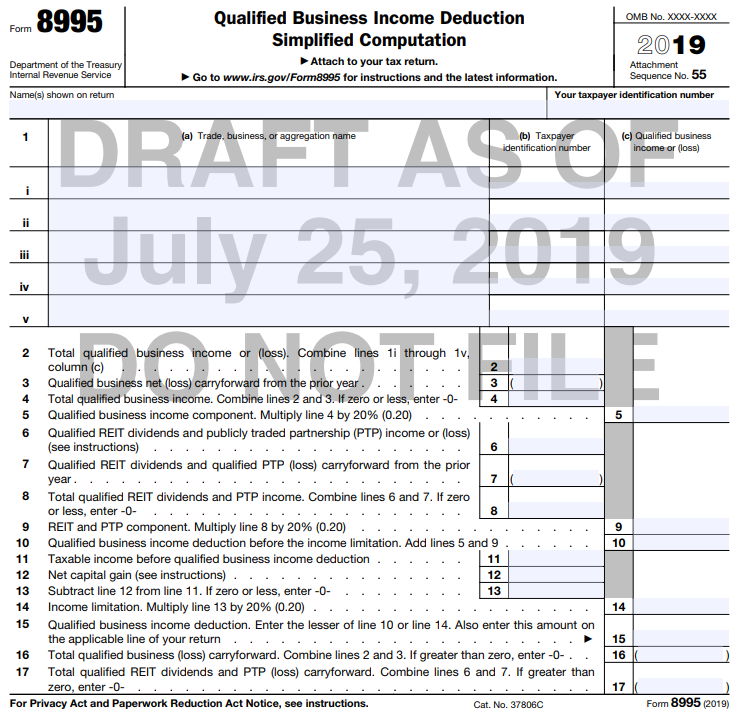

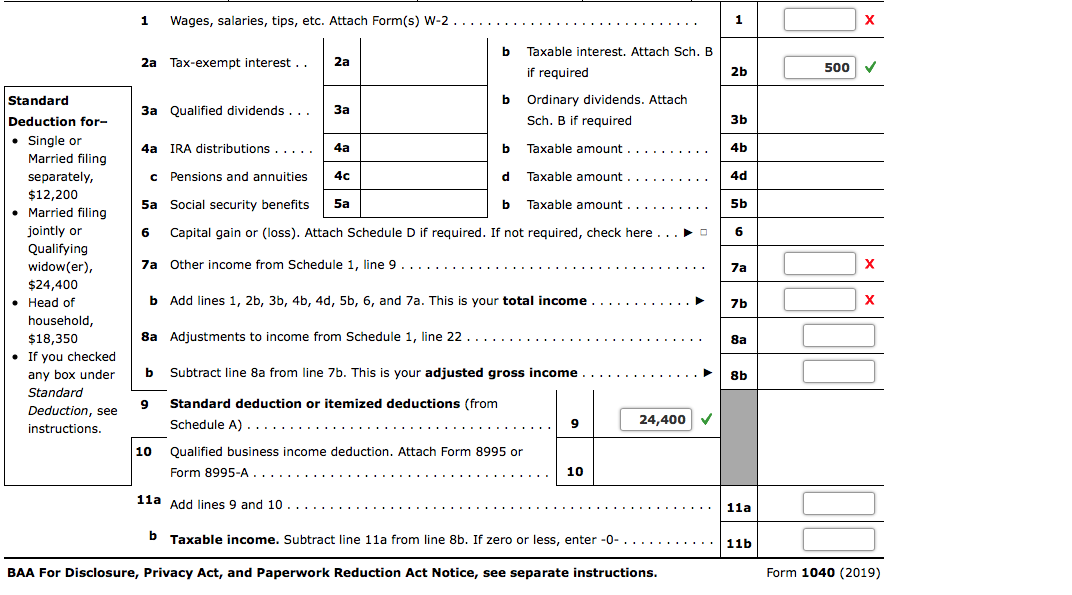

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web according to the irs: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This form calculates the qualified business income (qbi) deduction for. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. What is the purpose of the irs form 8995, and when do you need to use it? 10 minutes watch video get the form! The qbi deduction will flow to line 10 of form. Web so, let's start with the basics.

Step by step instructions in 2018, the tax. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no. What is the purpose of the irs form 8995, and when do you need to use it? Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web according to the irs: Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: Web form 8995 is the simplified form and is used if all of the following are true: This form calculates the qualified business income (qbi) deduction for. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. The qbi deduction will flow to line 10 of form.

Flowchart for partially preemptive scheduling technique with

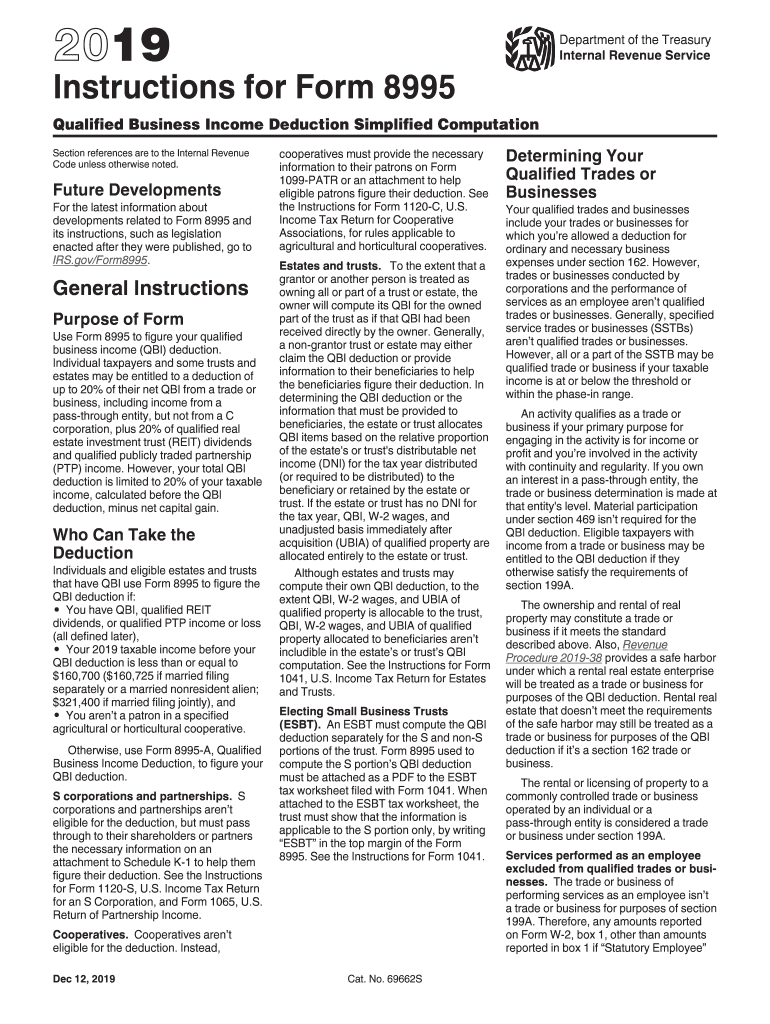

The qbi deduction will flow to line 10 of form. Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise. Step by step instructions in 2018, the tax. Fear not, for i am. Web so, let's start with the basics.

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

• if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. Step by step instructions in 2018, the tax. 10 minutes watch video get the form! Include the following schedules (their specific instructions are. This form calculates the qualified business income (qbi) deduction for.

8995 Instructions 2022 2023 IRS Forms Zrivo

Web instructions for form 8995 qualified business income deduction simplified computation section references are to the internal revenue code unless otherwise. What is the purpose of the irs form 8995, and when do you need to use it? Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï The qbi deduction will.

Mason + Rich Blog NH’s CPA Blog

The qbi deduction will flow to line 10 of form. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web so, let's start with the basics. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

• if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form. Fear not, for i am. Web so, let's start with the basics. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the draft instructions for 2020 form 8995,.

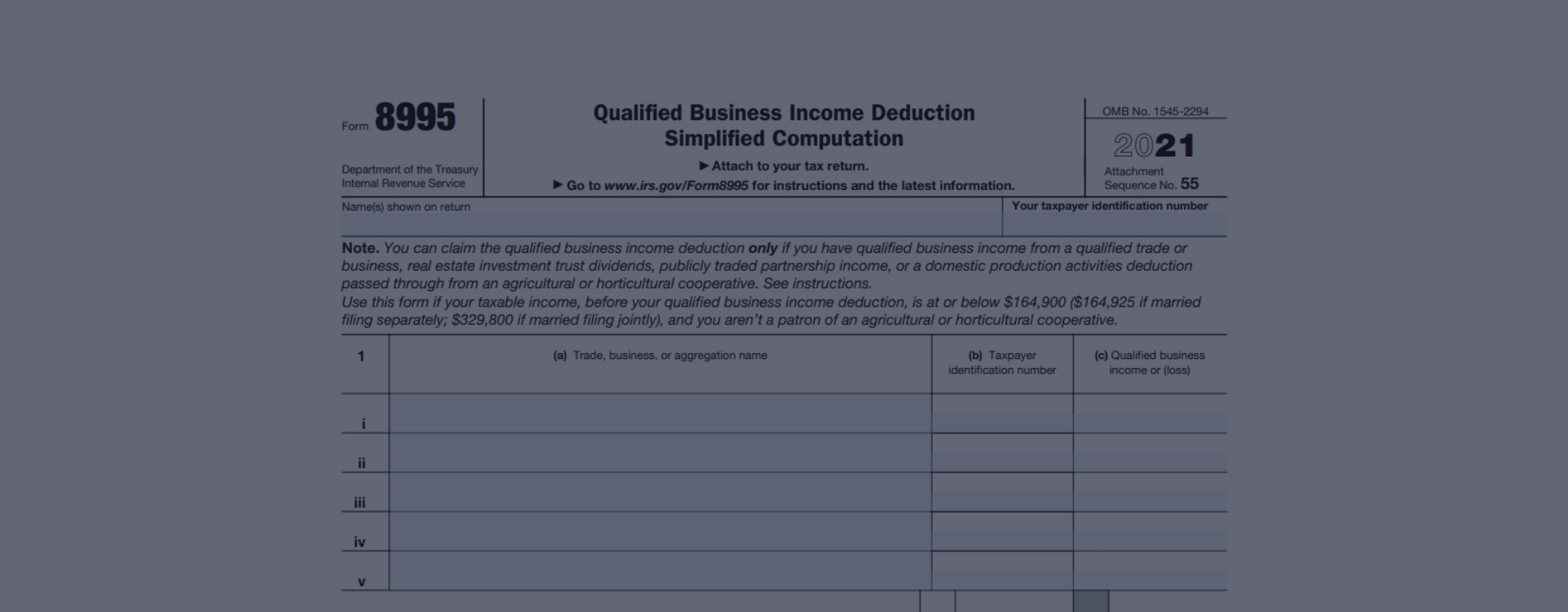

Instructions for Form 8995 (2021) Internal Revenue Service

Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file.

Printable Form 8995 Blog 8995 Form Website

Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). • if you own, are a partner in,.

8995 Form 📝 Get IRS Form 8995 With Instructions Printable PDF Sample

10 minutes watch video get the form! Web form 8995 is the simplified form and is used if all of the following are true: What is the purpose of the irs form 8995, and when do you need to use it? This form calculates the qualified business income (qbi) deduction for. Step by step instructions in 2018, the tax.

Note This problem is for the 2019 tax year. Alfred

Web so, let's start with the basics. Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to.

Ignoring IRS 8995 Instructions to Doublededuct Selfemployed Health

Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: Fear not, for i am. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This form calculates the qualified business income (qbi) deduction for.

10 Minutes Watch Video Get The Form!

Web so, let's start with the basics. What is the purpose of the irs form 8995, and when do you need to use it? Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web instructions to fill out 8995 tax form for 2022 filling out the tax form 8995 for 2022 might seem daunting at first, but with a little guidance, you can tackle it with ease.

This Form Calculates The Qualified Business Income (Qbi) Deduction For.

Fear not, for i am. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Web irs form 8995 instructions by forrest baumhover april 3, 2023 reading time: • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form.

Web Instructions For Form 8995 Qualified Business Income Deduction Simplified Computation Section References Are To The Internal Revenue Code Unless Otherwise.

Web according to the irs: Web form 8995 is the simplified form and is used if all of the following are true: Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp.

Web 2022 Irs Form 8995 Instructions 4 April 2023 Imagine Navigating Through A Maze Of Tax Regulations Only To Find Yourself Lost In A Sea Of Forms And Instructions.

Step by step instructions in 2018, the tax. Include the following schedules (their specific instructions are. The qbi deduction will flow to line 10 of form.