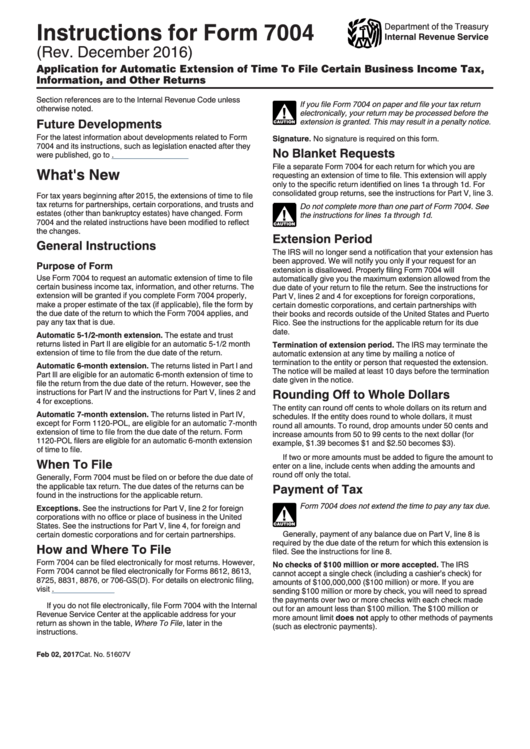

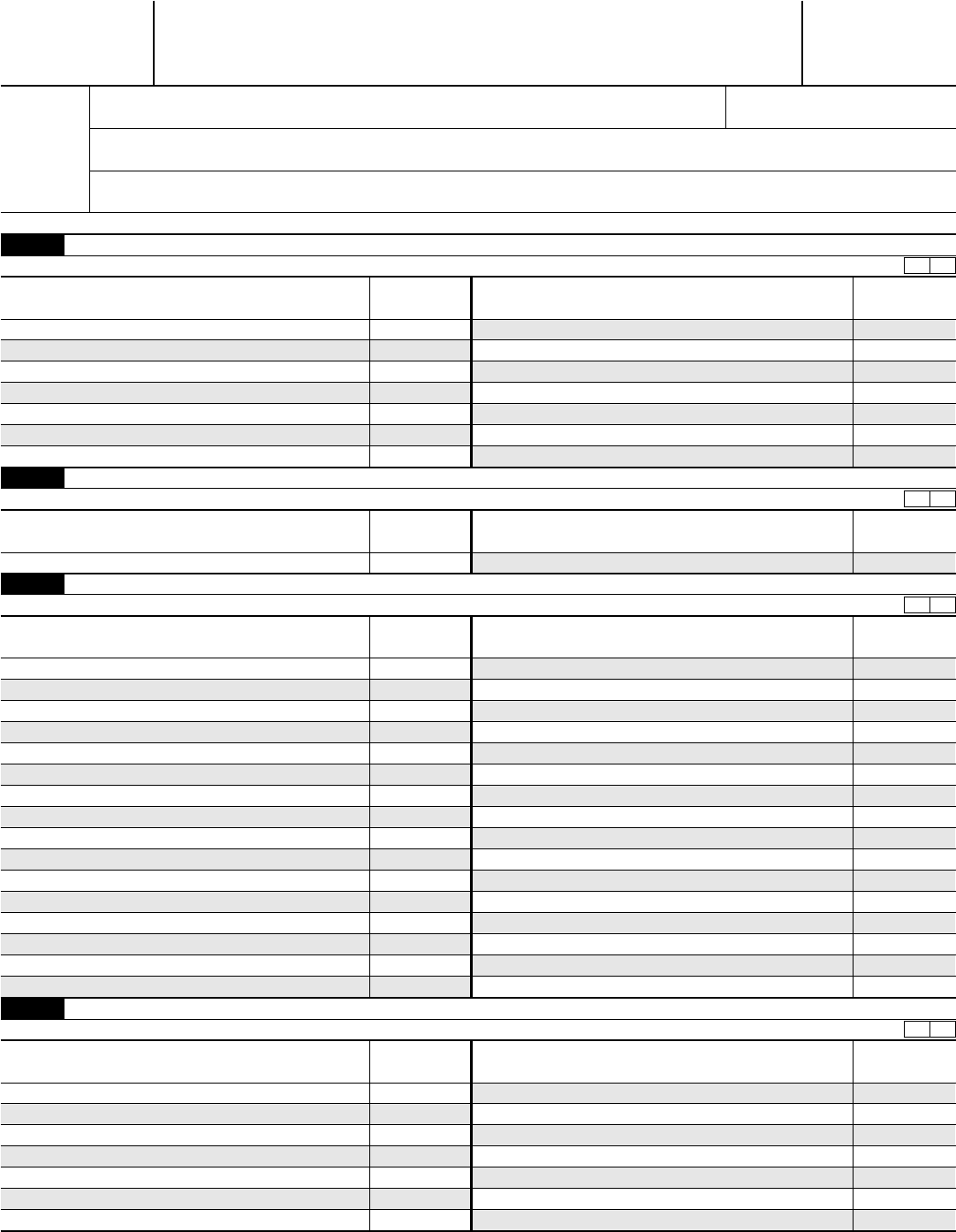

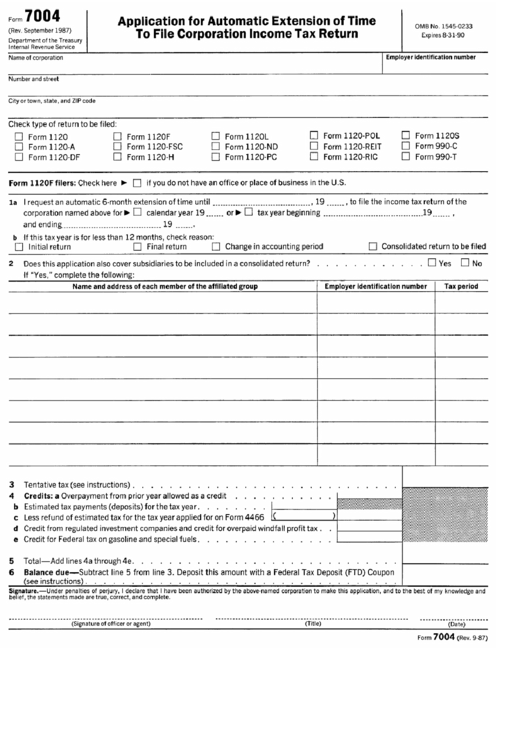

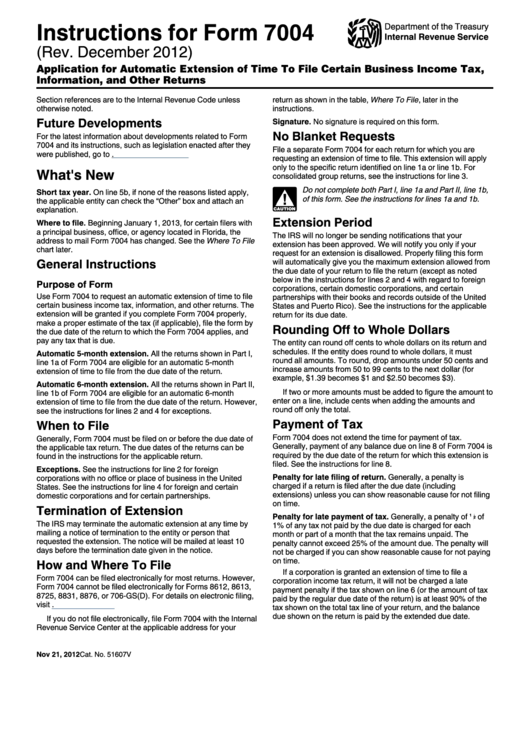

Instructions For Form 7004

Instructions For Form 7004 - Complete, edit or print tax forms instantly. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web you can file an irs form 7004 electronically for most returns. Web follow these steps to print a 7004 in turbotax business: Web the purpose of form 7004: Get ready for tax season deadlines by completing any required tax forms today. Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Requests for a tax filing extension. With your return open, select search and enter extend; Web follow these steps to complete your business tax extension form 7004 using expressextension:

Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web follow these steps to print a 7004 in turbotax business: However, form 7004 cannot be filed electronically for forms 8612, 8613,. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. Web generally, form 7004 must be filed by the due date of the return with the internal revenue service center where the corporation will file its income tax return. Web follow these steps to complete your business tax extension form 7004 using expressextension: Requests for a tax filing extension. Web form 7004 has changed for some entities. Thankfully, this is a fairly short form, which only requires a handful of key details. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more.

General instructions purpose of form use form 7004 to request an automatic extension of time to file certain. There are three different parts to this tax. See where to file, later. Here are the general form 7004 instructions, so you. Complete, edit or print tax forms instantly. Choose form 7004 and select the form. Web form 7004 is used to request an automatic extension to file the certain returns. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web form 7004 has changed for some entities. Web form 7004 instructions.

Instructions For Form 7004 Application For Automatic Extension Of

Web you can file an irs form 7004 electronically for most returns. See where to file, later. Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Web a business of all tax.

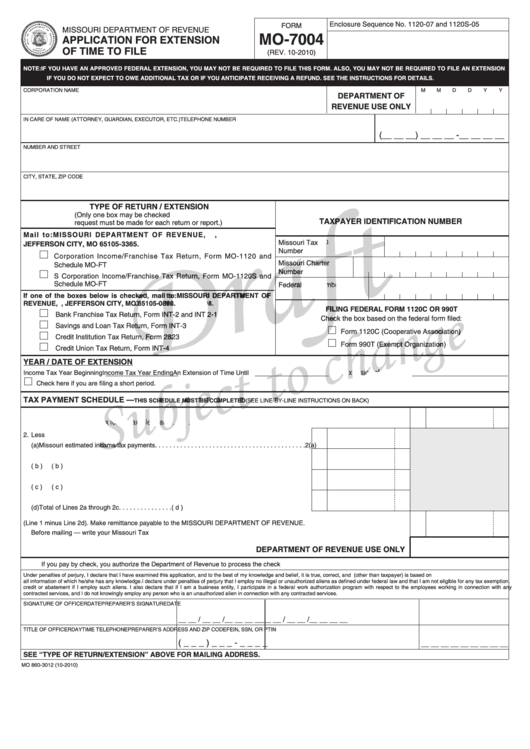

Form Mo7004 Draft Application For Extension Of Time To File 2010

Web form 7004 has changed for some entities. See the form 7004 instructions for a list of the exceptions. See where to file in. Web form 7004 has changed for some entities. Web follow these steps to print a 7004 in turbotax business:

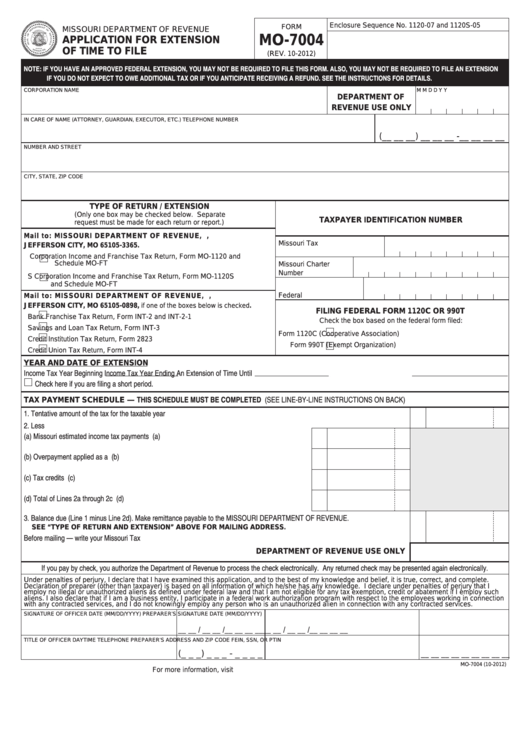

Fillable Form Mo7004 Application For Extension Of Time To File

See where to file in. Choose form 7004 and select the form. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Web a business of all tax classifications can request an extension to get more time to file returns. Here are the general form 7004 instructions, so you.

Instructions For Form 7004 Application For Automatic Extension Of

Web form 7004 has changed for some entities. See where to file in. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. By the tax filing due date (april 15th for most businesses) who needs to file: Web follow these.

Form 7004 Edit, Fill, Sign Online Handypdf

Web you can file an irs form 7004 electronically for most returns. Get ready for tax season deadlines by completing any required tax forms today. Web form 7004 instructions. Thankfully, this is a fairly short form, which only requires a handful of key details. Requests for a tax filing extension.

Form 7004 Application For Automatic Extension Of Time To File

Web generally, form 7004 must be filed by the due date of the return with the internal revenue service center where the corporation will file its income tax return. Select extension of time to. Web form 7004 is used to request an automatic extension to file the certain returns. See where to file, later. Web form 7004 has changed for.

IRS Form 7004 Automatic Extension for Business Tax Returns

Requests for a tax filing extension. Web filling out the blank pdf correctly can be a straightforward process if you follow these irs 7004 form instructions. See where to file, later. However, form 7004 cannot be filed electronically for forms 8612, 8613,. There are three different parts to this tax.

Instructions For Form 7004 (Rev. December 2012) printable pdf download

Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Select extension of time to. Form 7004 can be filed electronically with tax2efile for most returns or through paper. Choose form 7004 and select the form. There are three different parts to this tax.

Form 7004 Application for Automatic Extension of Time To File Certain

Complete, edit or print tax forms instantly. However, form 7004 cannot be filed electronically for forms 8612, 8613,. Web form 7004 has changed for some entities. Web follow these steps to complete your business tax extension form 7004 using expressextension: Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply.

Form 7004 Printable PDF Sample

By the tax filing due date (april 15th for most businesses) who needs to file: Web form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and wisconsin. Web form 7004 has changed for some entities. With your return open, select search and enter extend; Web form 7004 has changed for some entities.

Web Irs Form 7004 Instructions Are Used By Various Types Of Businesses To Complete The Form That Extends The Filing Deadline On Their Taxes.

Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Web form 7004 is used to request an automatic extension to file the certain returns. Web follow these steps to complete your business tax extension form 7004 using expressextension: See where to file, later.

See The Form 7004 Instructions For A List Of The Exceptions.

There are three different parts to this tax. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain. Thankfully, this is a fairly short form, which only requires a handful of key details. General instructions purpose of form use form 7004 to request an automatic extension of time to file certain.

See Where To File, Later.

See where to file, later. Complete, edit or print tax forms instantly. Web you can file an irs form 7004 electronically for most returns. Web generally, form 7004 must be filed by the due date of the return with the internal revenue service center where the corporation will file its income tax return.

Requests For A Tax Filing Extension.

By the tax filing due date (april 15th for most businesses) who needs to file: Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. Form 7004 can be filed electronically with tax2efile for most returns or through paper. With your return open, select search and enter extend;