Instructions Form 1310

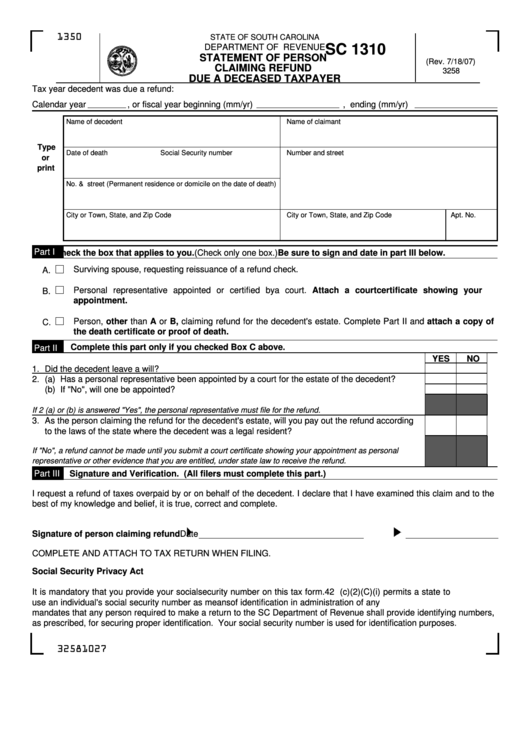

Instructions Form 1310 - Green died on january 4 before filing his tax return. Web you must attach form 1310 to all returns and claims for refund. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal representative, 3=other claiming refund (mandatory)(form 1310, part i, boxes a, b, or c). On april 3 of the same year, you were appointed Complete, edit or print tax forms instantly. Web how do i file form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. Go to screen 63, deceased taxpayer (1310). Ad access irs tax forms. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies:

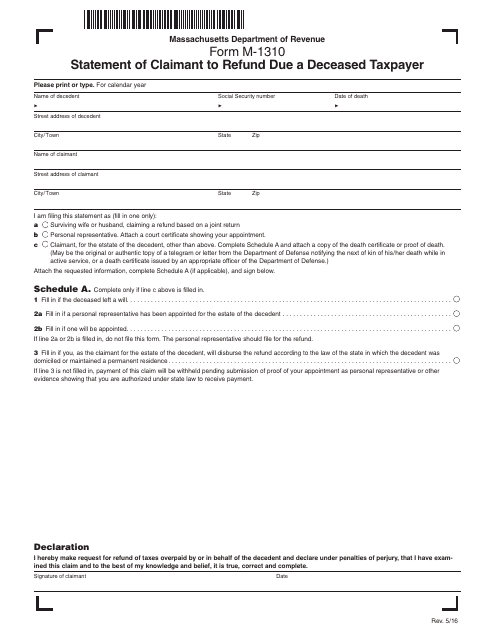

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web you must attach form 1310 to all returns and claims for refund. You are not a surviving spouse who is filing a joint return with the decedent. Get ready for tax season deadlines by completing any required tax forms today. This could be an original or amended joint return. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Ad access irs tax forms. Where do i mail form 1310? Web follow these steps to generate form 1310:

Complete, edit or print tax forms instantly. Go to screen 63, deceased taxpayer (1310). You are not a surviving spouse who is filing a joint return with the decedent. Complete, edit or print tax forms instantly. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal representative, 3=other claiming refund (mandatory)(form 1310, part i, boxes a, b, or c). You are a surviving spouse filing an original or amended joint return with the decedent, or Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Get ready for tax season deadlines by completing any required tax forms today. However, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier.

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. However, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier. Web developments related to form 1310 and its instructions, such as.

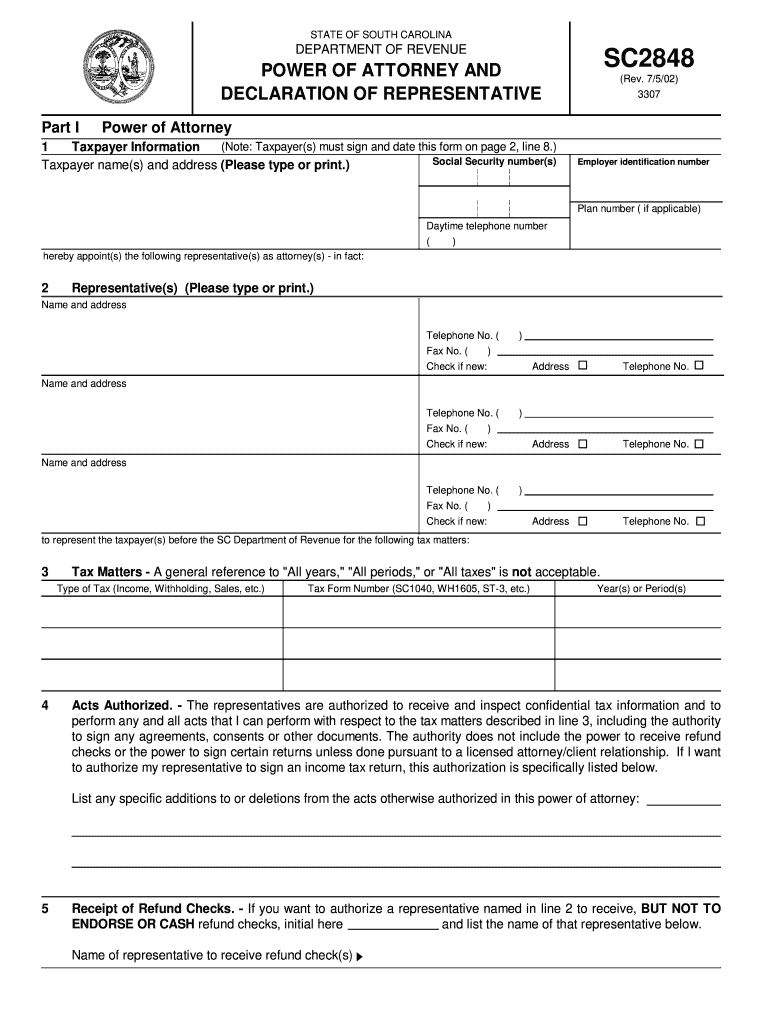

SC DoR SC2848 2002 Fill out Tax Template Online US Legal Forms

Use form 1310 to claim a refund on behalf of a deceased taxpayer. However, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal representative, 3=other claiming refund (mandatory)(form 1310, part i, boxes a, b, or.

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased

Where do i mail form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must. However, for exceptions to filing form 1310, see form 1310, statement of person claiming refund due a deceased taxpayer, under refund, earlier. On april 3 of the.

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

On april 3 of the same year, you were appointed Use form 1310 to claim a refund on behalf of a deceased taxpayer. Get ready for tax season deadlines by completing any required tax forms today. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased.

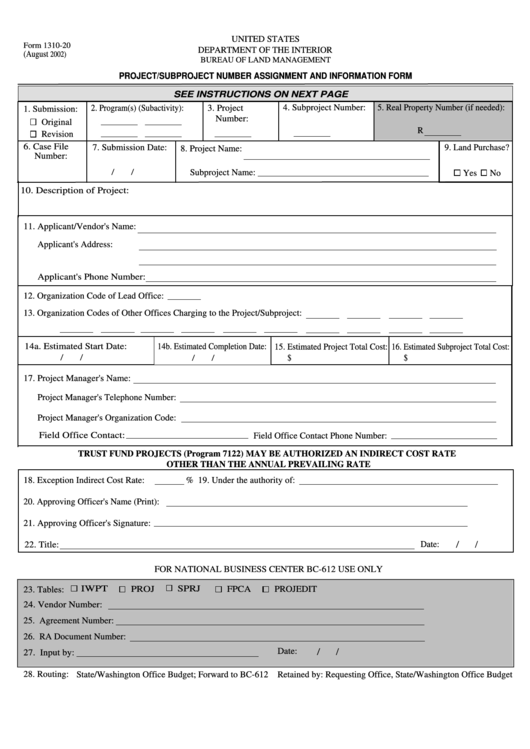

Fillable Form 131020 Project/subproject Number Assignment And

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Go to screen 63, deceased taxpayer (1310). If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Get ready for tax season deadlines by completing any required tax forms today. If you are claiming.

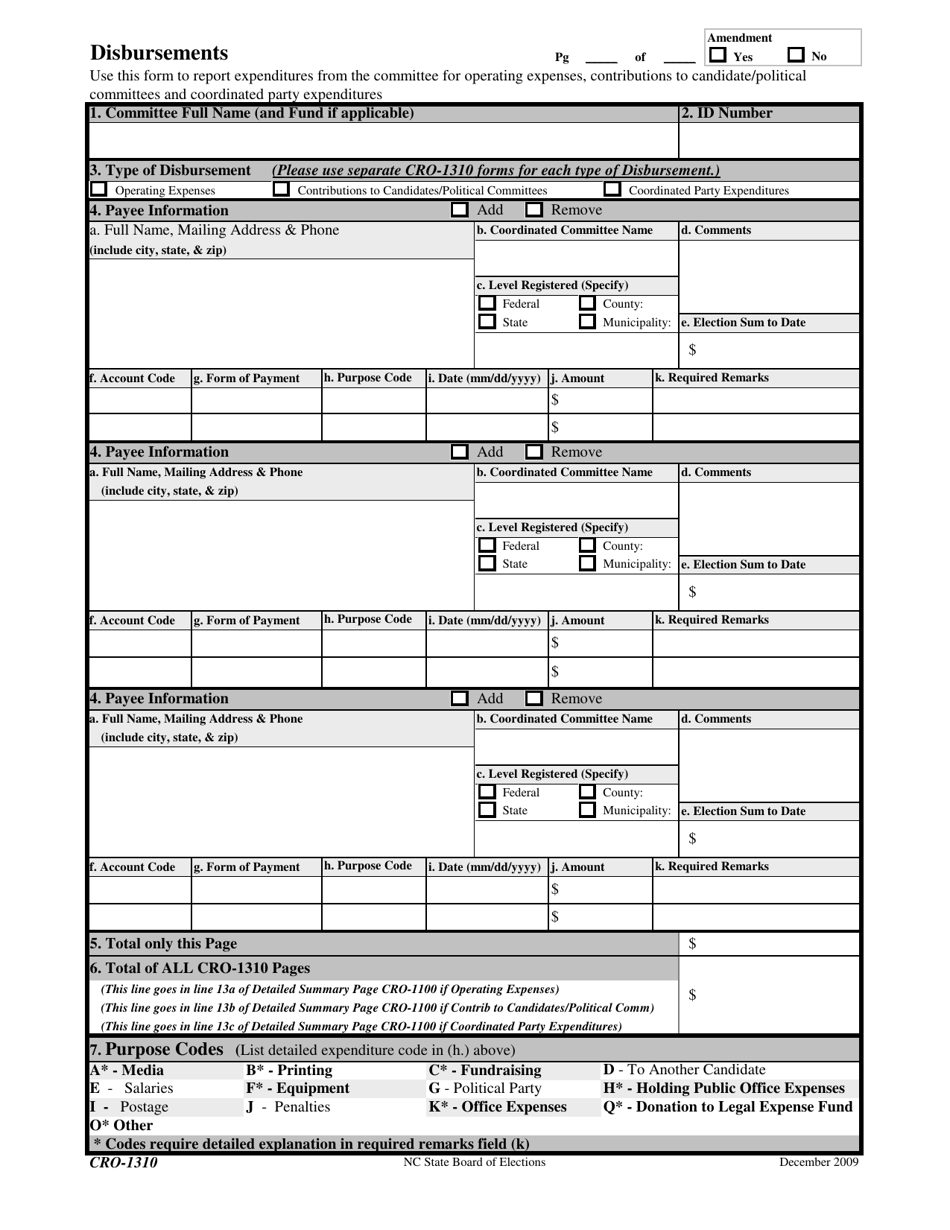

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal representative, 3=other claiming refund (mandatory)(form 1310, part i, boxes a, b, or c). Green died on january 4 before filing his tax return. Where do i mail form 1310? On april 3 of the same year, you were appointed Web developments related to form 1310 and its.

Form 1310 2014 2019 Blank Sample to Fill out Online in PDF

Where do i mail form 1310? On april 3 of the same year, you were appointed This could be an original or amended joint return. You are not a surviving spouse who is filing a joint return with the decedent. If you are claiming a refund on behalf of a deceased taxpayer, you must.

Irs Form 1310 Printable Master of Documents

You are a surviving spouse filing an original or amended joint return with the decedent, or Go to screen 63, deceased taxpayer (1310). Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return.

IRS Instructions 941 2020 Fill out Tax Template Online US Legal Forms

Get ready for tax season deadlines by completing any required tax forms today. On april 3 of the same year, you were appointed Where do i mail form 1310? Web according to the tax form, you must file form 1310 both of the following conditions apply: This could be an original or amended joint return.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web follow these steps to generate form 1310: If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Use form 1310 to claim a refund on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Complete, edit or.

Go To Screen 63, Deceased Taxpayer (1310).

Get ready for tax season deadlines by completing any required tax forms today. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Green died on january 4 before filing his tax return. Web developments related to form 1310 and its instructions, such as legislation enacted after they were published, go to.

Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

You are not a surviving spouse who is filing a joint return with the decedent. Ad access irs tax forms. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Complete, edit or print tax forms instantly.

Web According To The Tax Form, You Must File Form 1310 Both Of The Following Conditions Apply:

Web you must attach form 1310 to all returns and claims for refund. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Get ready for tax season deadlines by completing any required tax forms today. You are a surviving spouse filing an original or amended joint return with the decedent, or

However, For Exceptions To Filing Form 1310, See Form 1310, Statement Of Person Claiming Refund Due A Deceased Taxpayer, Under Refund, Earlier.

Web form 1310 is an irs form used to claim a federal tax refund for the beneficiary of a recently deceased taxpayer. Web follow these steps to generate form 1310: Web how do i file form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer.