Insurance Expense On Balance Sheet

Insurance Expense On Balance Sheet - The costs that have expired should be reported in income. Your balance sheet is a summary of how much your business owns and how much it owes. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web does insurance expense go on the balance sheet? It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Insurance companies calculate insurance expense. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web insurance expense and insurance payable are interrelated;

Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web insurance expense and insurance payable are interrelated; Insurance companies calculate insurance expense. Web does insurance expense go on the balance sheet? Balance sheet vs income statement. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. The costs that have expired should be reported in income. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web when the insurance premiums are paid in advance, they are referred to as prepaid.

Balance sheet vs income statement. The costs that have expired should be reported in income. Your balance sheet is a summary of how much your business owns and how much it owes. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web when the insurance premiums are paid in advance, they are referred to as prepaid. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web insurance expense is also known as the insurance premium. Web does insurance expense go on the balance sheet?

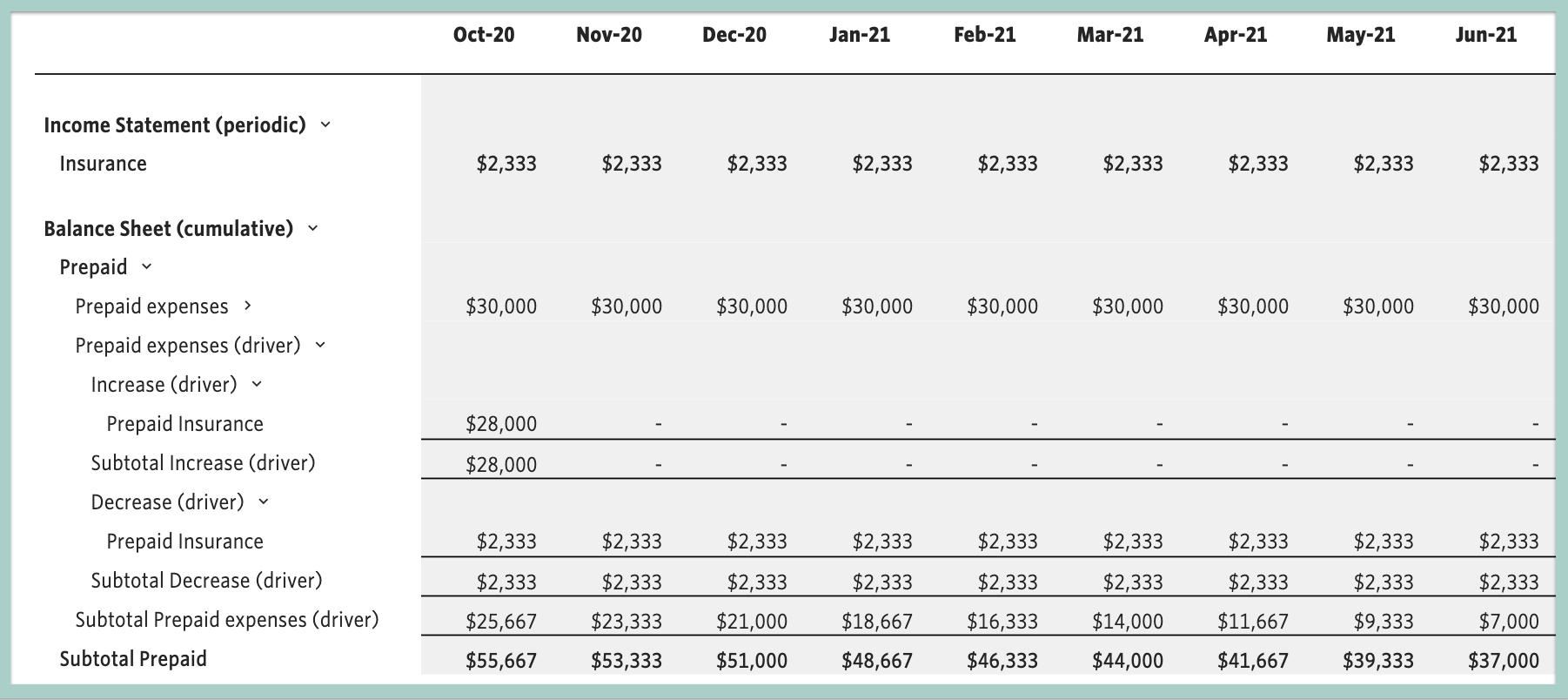

Overview Plan for Prepaid Insurance

Web does insurance expense go on the balance sheet? The costs that have expired should be reported in income. Balance sheet vs income statement. Web insurance expense and insurance payable are interrelated; Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance.

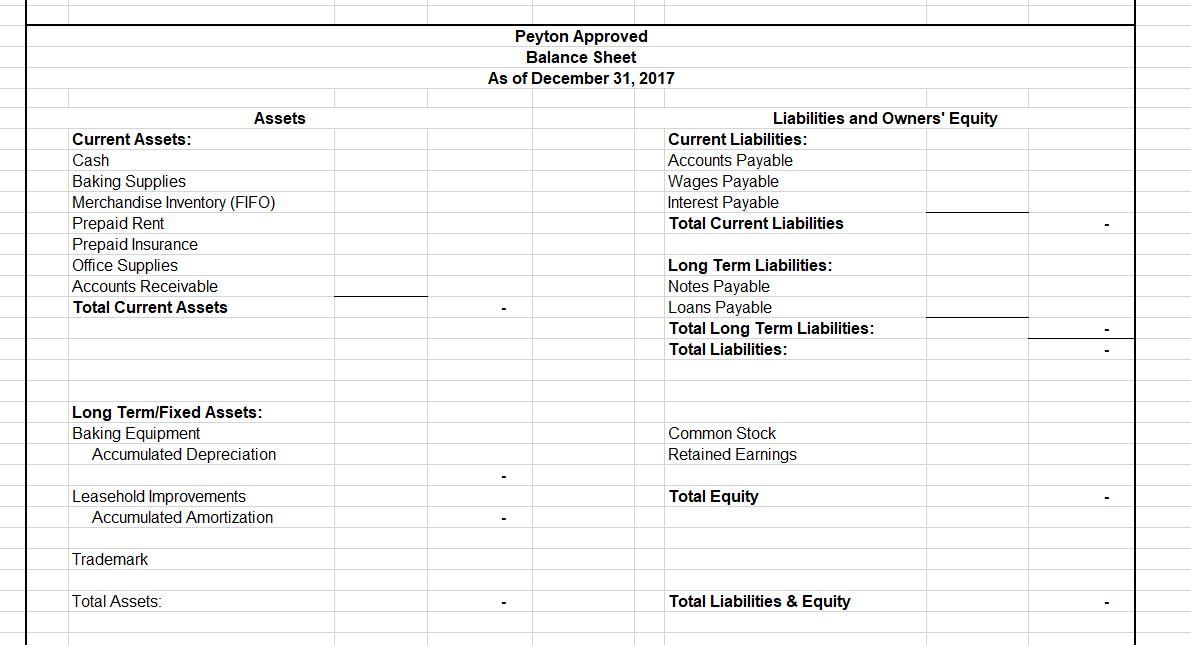

Prepare Financial Statements From Adjusted Trial Balance Worksheet

Web insurance expense and insurance payable are interrelated; It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web when the insurance premiums are paid in advance, they are referred to as prepaid. The costs that have expired should be reported in income. Web any insurance premium costs that have not expired as.

The Adjusting Process And Related Entries

Web when the insurance premiums are paid in advance, they are referred to as prepaid. The costs that have expired should be reported in income. Insurance companies calculate insurance expense. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web does insurance expense go on the balance sheet?

And Bills Spreadsheet in Expenses Sheet Template Pics Expense

Your balance sheet is a summary of how much your business owns and how much it owes. The costs that have expired should be reported in income. Web does insurance expense go on the balance sheet? At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web insurance.

Solved Please help with these tables below. In your final

Web insurance expense is also known as the insurance premium. Your balance sheet is a summary of how much your business owns and how much it owes. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web does insurance expense go on the.

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

Insurance companies calculate insurance expense. Your balance sheet is a summary of how much your business owns and how much it owes. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web insurance expense is also known.

Understanding Insurance Expense on Balance Sheet Insure Scope 360

Insurance companies calculate insurance expense. The costs that have expired should be reported in income. Web does insurance expense go on the balance sheet? Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Web insurance expense is also known as the insurance premium.

Insurance expense insurance

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such.

Solved The statement and selected balance sheet

Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web insurance.

Prepaid Expenses and Balance Sheet YouTube

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web when the insurance premiums are paid in advance, they are referred.

Your Balance Sheet Is A Summary Of How Much Your Business Owns And How Much It Owes.

Web insurance expense and insurance payable are interrelated; Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web insurance expense is also known as the insurance premium. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current.

It Is The Amount Paid To Insurance Companies To Cover The Uncertain Risks From Unexpected Life Events.

The costs that have expired should be reported in income. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Balance sheet vs income statement. Insurance companies calculate insurance expense.

Web Does Insurance Expense Go On The Balance Sheet?

Insurance payable exists on a company’s balance sheet only if there is an insurance expense.