Interest Income Balance Sheet

Interest Income Balance Sheet - Interest income is added to the overall profit that a company. Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

Interest income is added to the overall profit that a company. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate.

Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Interest income is added to the overall profit that a company.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Interest income is added to the overall profit that a company.

Minority Interest Explained with Examples MyDollarsView

Interest income is added to the overall profit that a company. Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

Interest Expense in a Monthly Financial Model (Cash Interest vs

Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate. Interest income is added to the overall profit that a company.

Tutorial Download Balance Sheet For Free Printable PDF DOC

Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate. Interest income is added to the overall profit that a company.

Interest Term Glossary CSIMarket

Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate. Interest income is added to the overall profit that a company.

Noncontrolling Interest Much More Than a Name Change

Interest income is added to the overall profit that a company. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate.

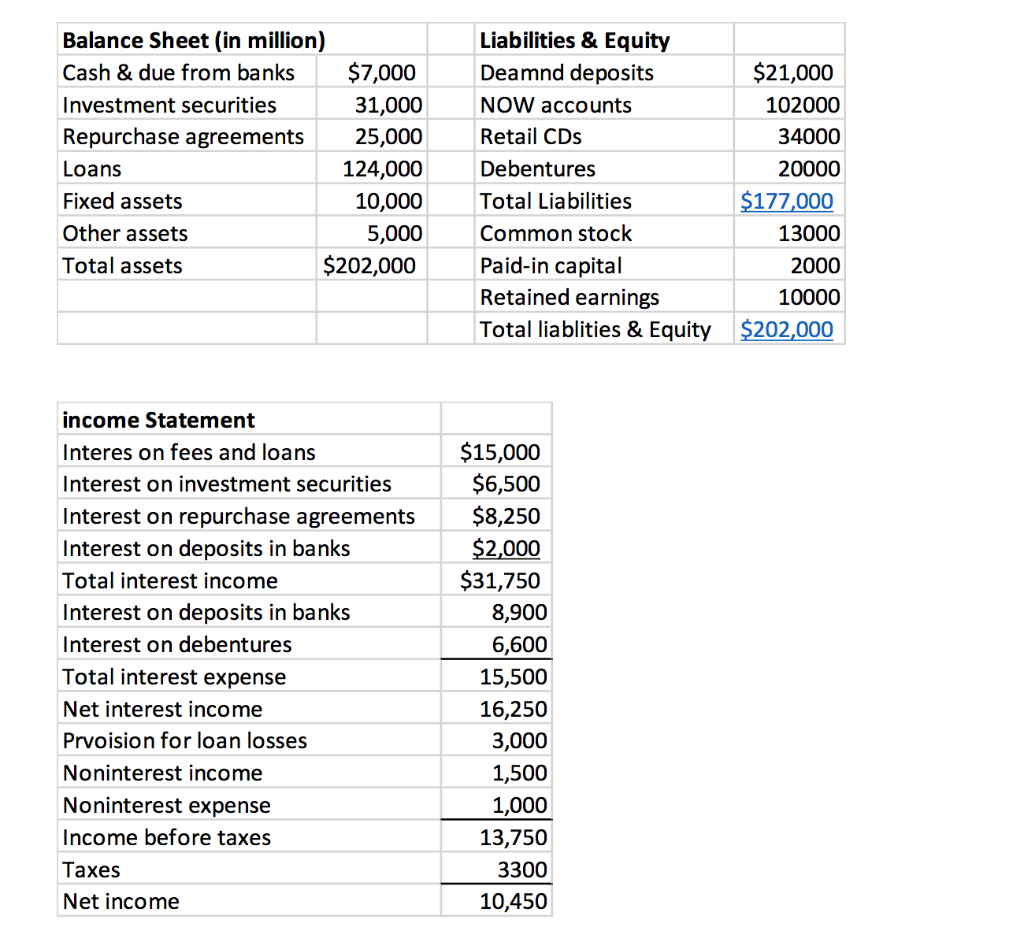

Solved KMT Bank has the following balance sheet and

Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Interest income is added to the overall profit that a company.

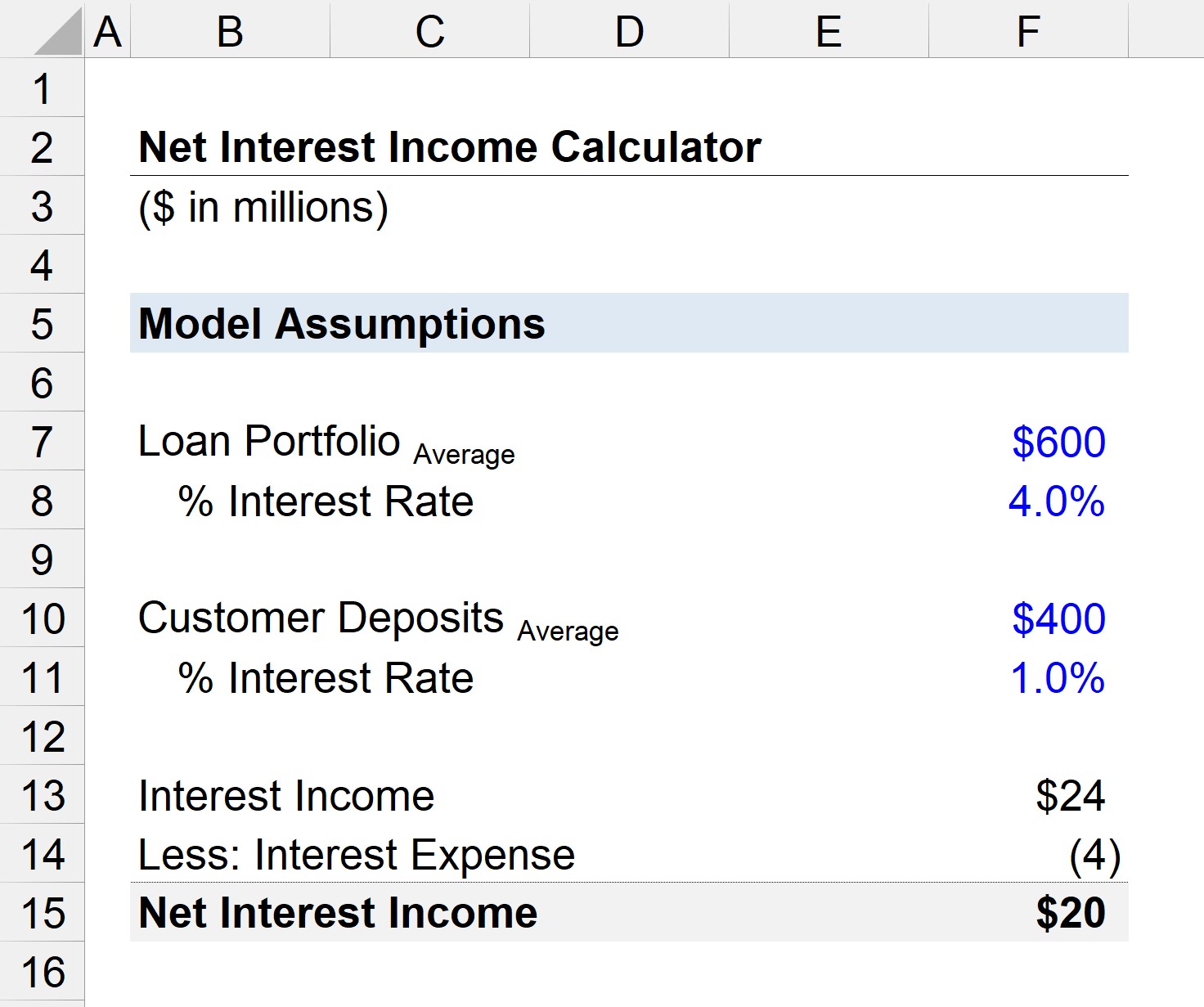

Net Interest (NII) Formula + Calculator

Interest income is added to the overall profit that a company. Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

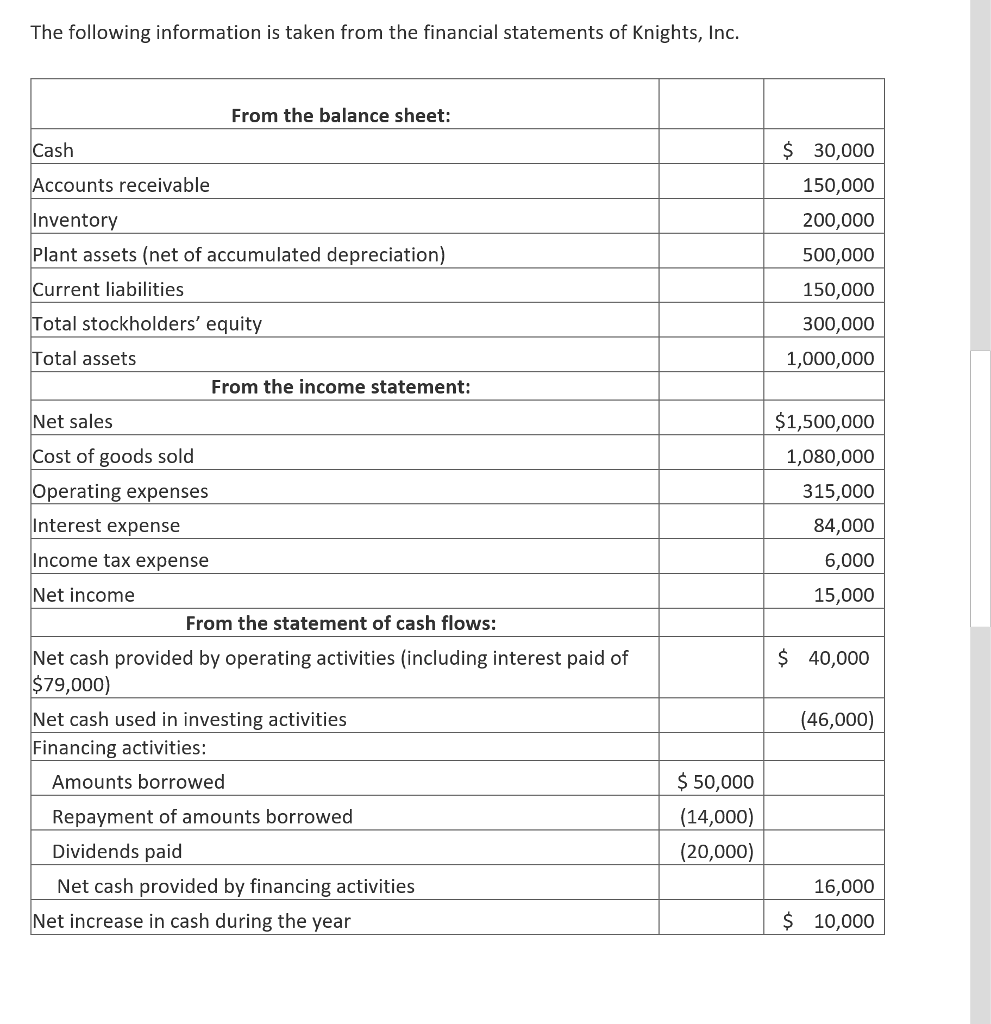

Solved Explain how the interest expense shown in the

Web most interest is taxed at the ordinary income tax rate. Interest income is added to the overall profit that a company. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

Noncontrolling Interests The Full Consolidation Accounting Tutorial

Interest income is added to the overall profit that a company. Web most interest is taxed at the ordinary income tax rate. Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

Interest Income Is Added To The Overall Profit That A Company.

Web on a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project. Web most interest is taxed at the ordinary income tax rate.