Intuit Payroll Form

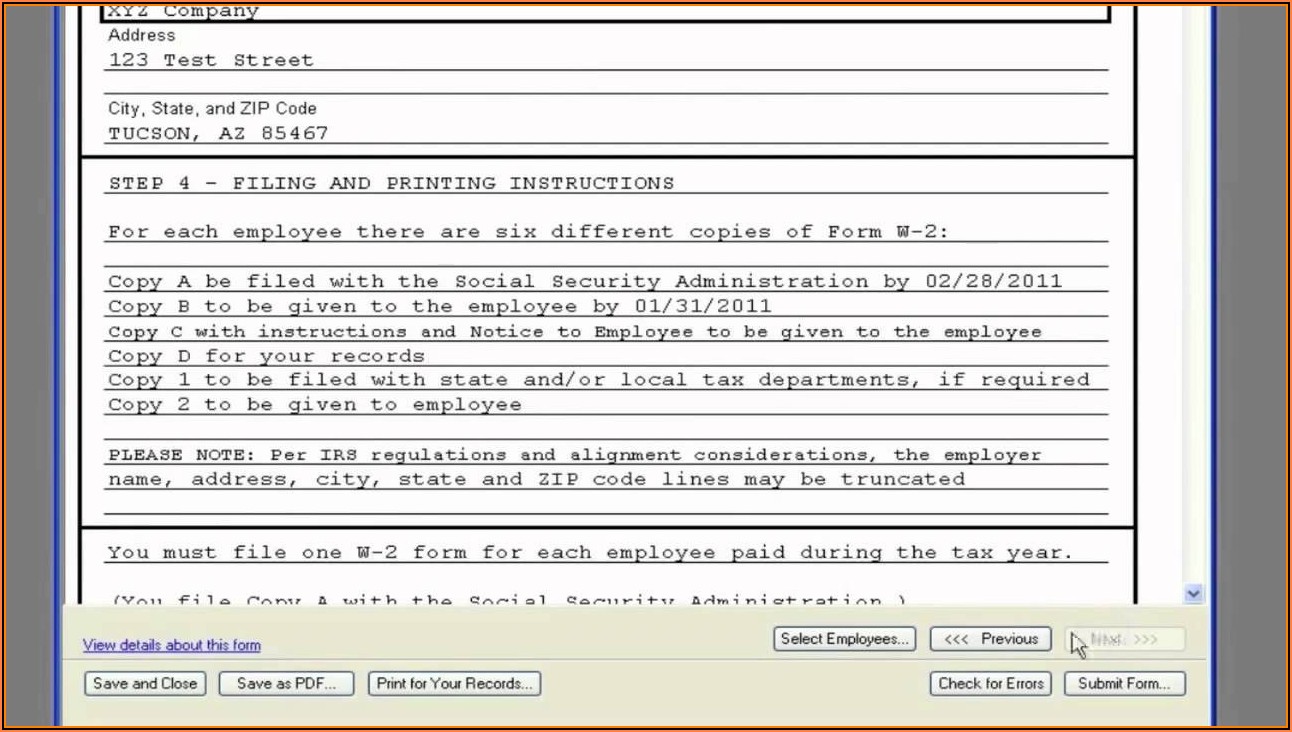

Intuit Payroll Form - Ad approve payroll when you're ready, access employee services & manage it all in one place. Quickbooks assisted payroll payroll services agreement. • 10 • updated february 27, 2023. Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Scroll down to the filings resources section and click on archived forms and filings. Web email pay stubs from quickbooks desktop. Save time by emailing pay stubs to your employees.instead of. Web be sure the employee has filled out the necessary new hire forms: Web terms and conditions, features, support, pricing, and service options subject to change without notice. Web find out which payroll taxes and forms quickbooks payroll pays and files for you.

Web sign up so that you can create your employer forms and: Save time by emailing pay stubs to your employees.instead of. Our billing forms are available in three styles to serve your. Includes a copy for your employee. Web use your intuit account to sign in to quickbooks workforce. Print forms to mail by 1/31. Web intuit quickbooks enhanced payroll, enhanced payroll plus, and enhanced payroll for accountants subscribers:federal and state forms and updates are available for. Web may 18, 2022 08:10 am it would be helpful if the dd form included the employee email address. Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Quickbooks assisted payroll payroll services agreement.

Web may 18, 2022 08:10 am it would be helpful if the dd form included the employee email address. We sunsetted intuit online payroll. Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Any employee you've paid within the previous tax year, between january 1 and december 31. Quickbooks assisted payroll payroll services agreement. Ad approve payroll when you're ready, access employee services & manage it all in one place. This article gives you an overview of the payroll taxes and forms that quickbooks payroll. Web sign up so that you can create your employer forms and: Ad approve payroll when you're ready, access employee services & manage it all in one place. Keep copies for your records.

Intuit Payroll Tax Forms Form Resume Examples o7Y3Aow2BN

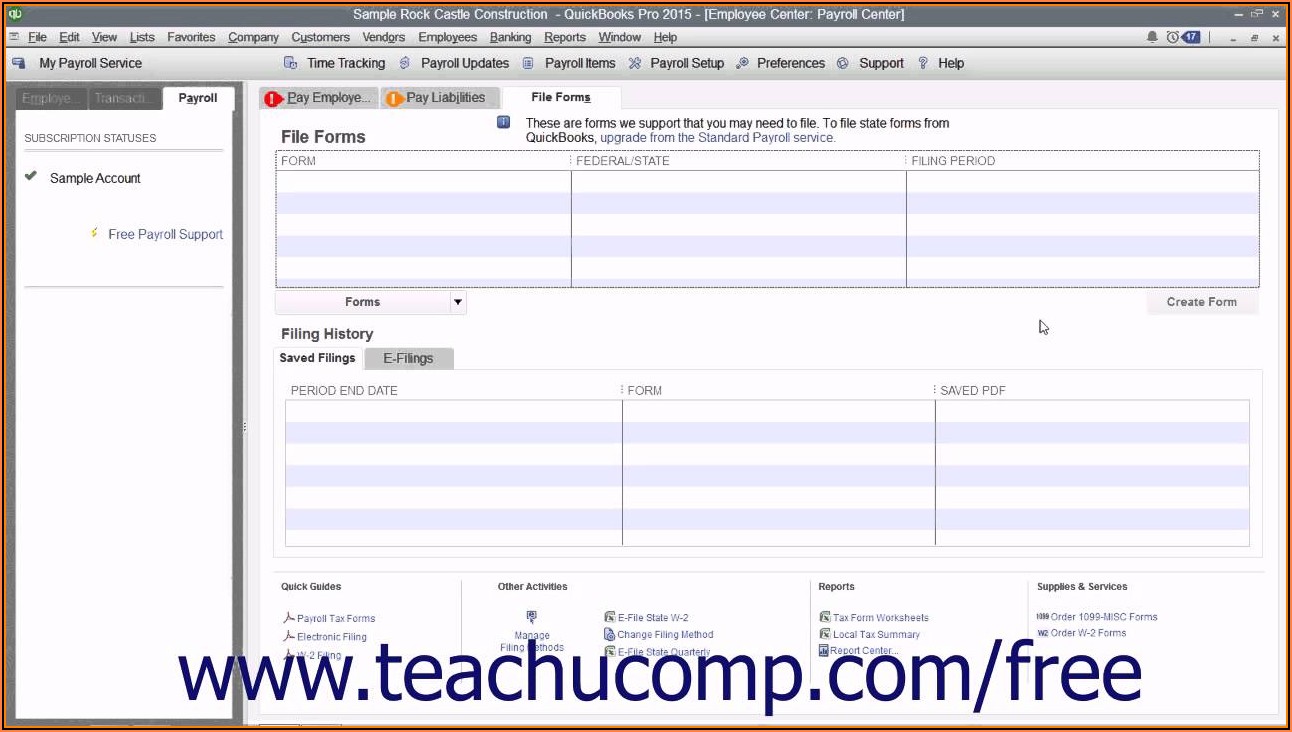

Web find out which payroll taxes and forms quickbooks payroll pays and files for you. Web with quickbooks payroll, you’re free to access your filed tax forms and paid tax payments. Includes a copy for your employee. Web sign up so that you can create your employer forms and: Ad approve payroll when you're ready, access employee services & manage.

Intuit Payroll W2 Forms Form Resume Examples 3q9JWWvYAr

Ad approve payroll when you're ready, access employee services & manage it all in one place. Since i manage payroll remotely for multiple companies, it is. Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Quickbooks assisted payroll payroll services agreement. Any employee you've paid within the previous tax year, between january 1 and december 31.

Intuit Payroll Tax Forms Form Resume Examples 2A1WA9q3ze

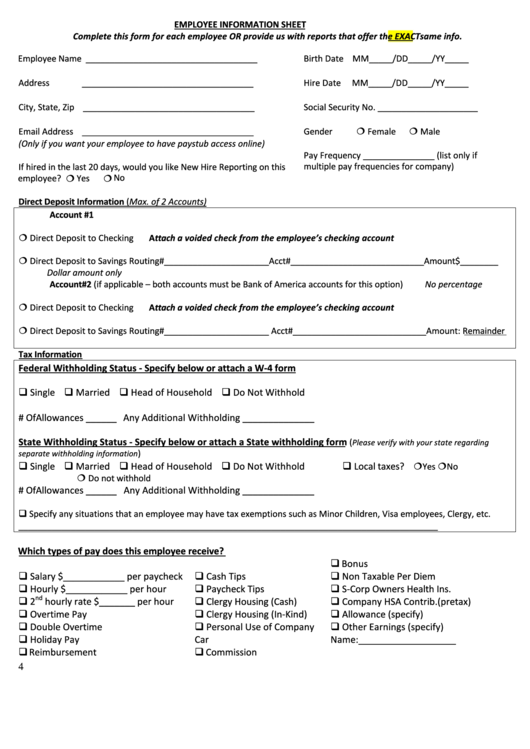

Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web be sure the employee has filled out the necessary new hire forms: Quickbooks® payroll is automated and reliable, giving you more control and flexibility. Web intuit online payroll moved to quickbooks.

Intuit Payroll Forms Form Resume Examples A19X05Q94k

Ad approve payroll when you're ready, access employee services & manage it all in one place. We sunsetted intuit online payroll. Here’s how you can access your tax forms and payments in your payroll. Web email pay stubs from quickbooks desktop. Web within payroll forms, employers can document the taxes they have withheld from employee wages, for both federal and.

Fillable Employee Information Sheet For Intuit Full Service Payroll

We sunsetted intuit online payroll. These forms help clue the irs. Web invoices quickbooks preprinted invoices work perfectly with quickbooks desktop and project a professional image. Save time by emailing pay stubs to your employees.instead of. Since i manage payroll remotely for multiple companies, it is.

Intuit Full Service Payroll Forms Form Resume Examples 7NYA7m12pv

We moved those who chose to stay with us to quickbooks online payroll. Web invoices quickbooks preprinted invoices work perfectly with quickbooks desktop and project a professional image. New employee forms (printable) new employee. Web email pay stubs from quickbooks desktop. Ad approve payroll when you're ready, access employee services & manage it all in one place.

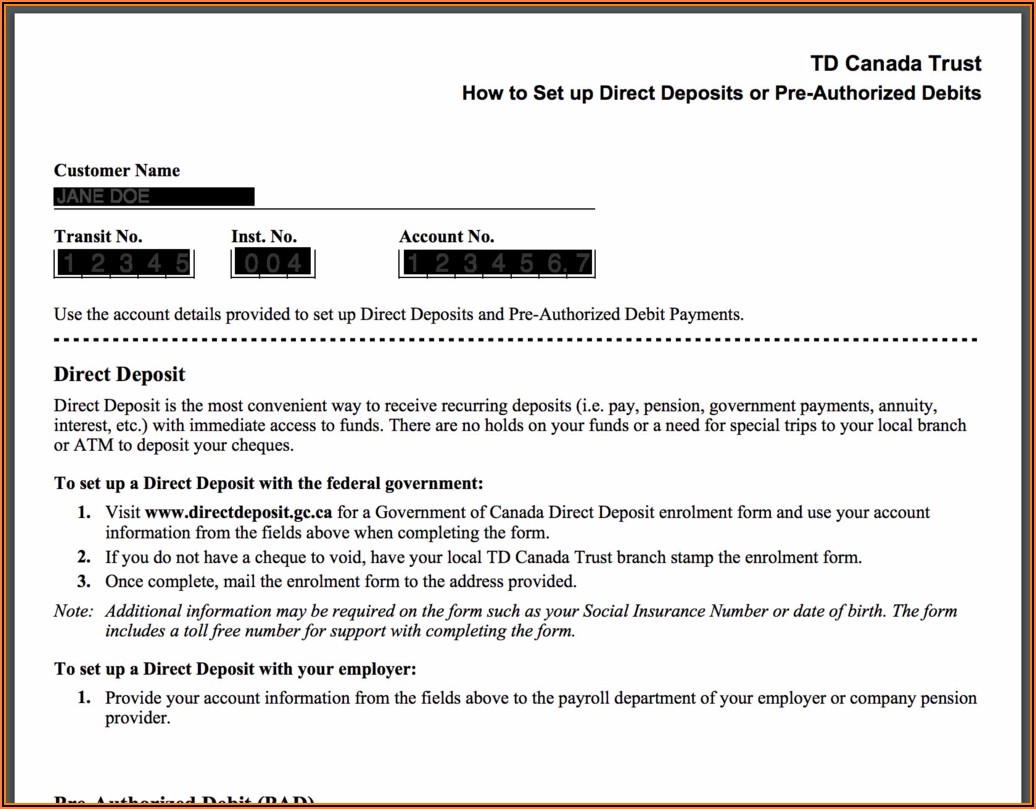

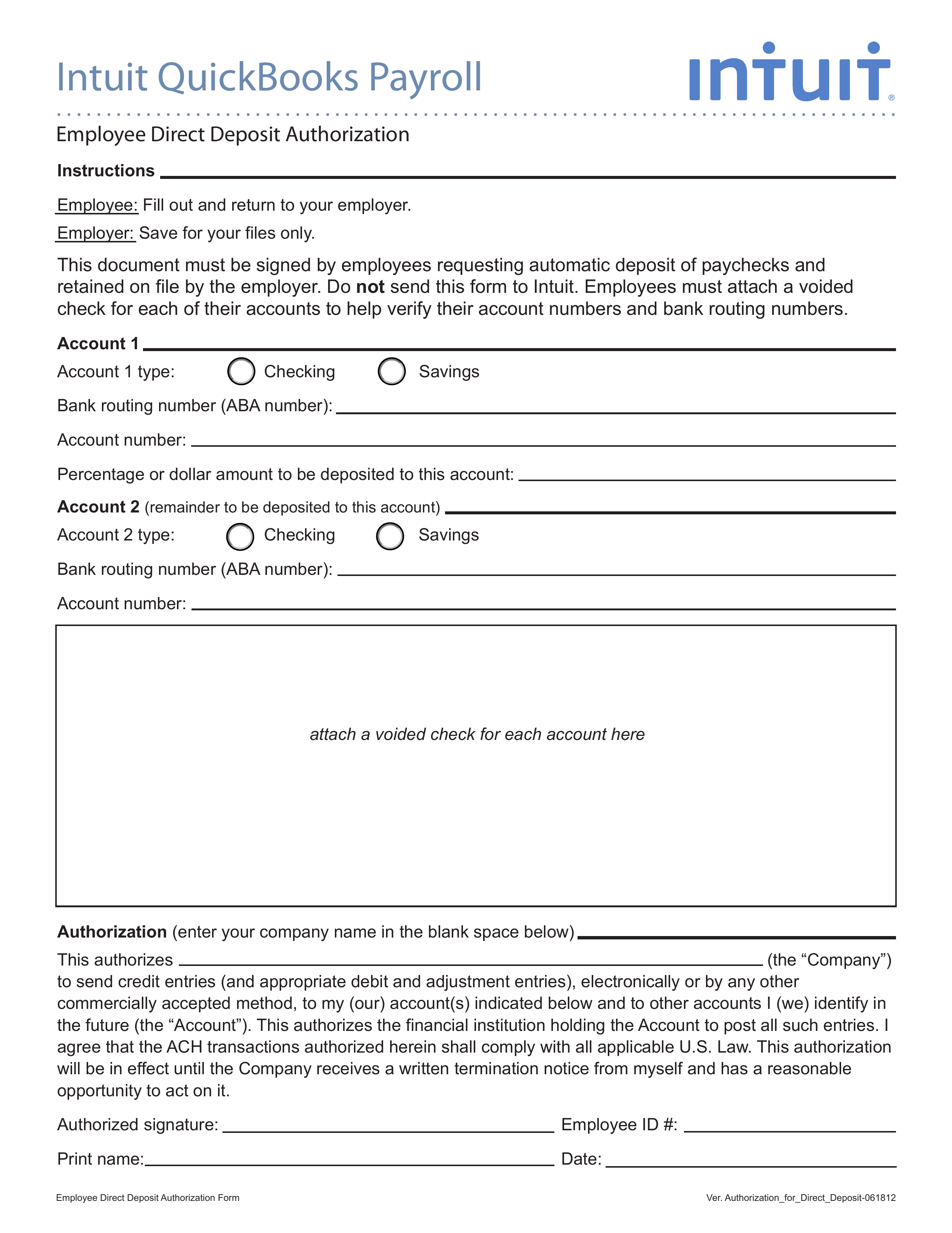

Free Intuit/Quickbooks Payroll Direct Deposit Form PDF eForms

Quickbooks assisted payroll payroll services agreement. Our billing forms are available in three styles to serve your. Web intuit quickbooks enhanced payroll, enhanced payroll plus, and enhanced payroll for accountants subscribers:federal and state forms and updates are available for. This article gives you an overview of the payroll taxes and forms that quickbooks payroll. Keep copies for your records.

Intuit Payroll Reviews 2019 Details, Pricing, & Features G2

Includes a copy for your employee. Any employee you've paid within the previous tax year, between january 1 and december 31. Print forms to mail by 1/31. Web find out which payroll taxes and forms quickbooks payroll pays and files for you. Web be sure the employee has filled out the necessary new hire forms:

Intuit Full Service Payroll Forms Form Resume Examples 7NYA7m12pv

Web sign up so that you can create your employer forms and: Quickbooks® payroll is automated and reliable, giving you more control and flexibility. • 10 • updated february 27, 2023. Here’s how you can access your tax forms and payments in your payroll. Includes a copy for your employee.

Intuit Payroll Tax Forms Form Resume Examples 2A1WA9q3ze

Web intuit online payroll moved to quickbooks online payroll. Quickbooks® payroll is automated and reliable, giving you more control and flexibility. These forms help clue the irs. Quickbooks assisted payroll payroll services agreement. Web use your intuit account to sign in to quickbooks workforce.

Web Are You An Accountant?

We sunsetted intuit online payroll. Web terms and conditions, features, support, pricing, and service options subject to change without notice. Quickbooks assisted payroll payroll services agreement. Ad approve payroll when you're ready, access employee services & manage it all in one place.

Web Find Out Which Payroll Taxes And Forms Quickbooks Payroll Pays And Files For You.

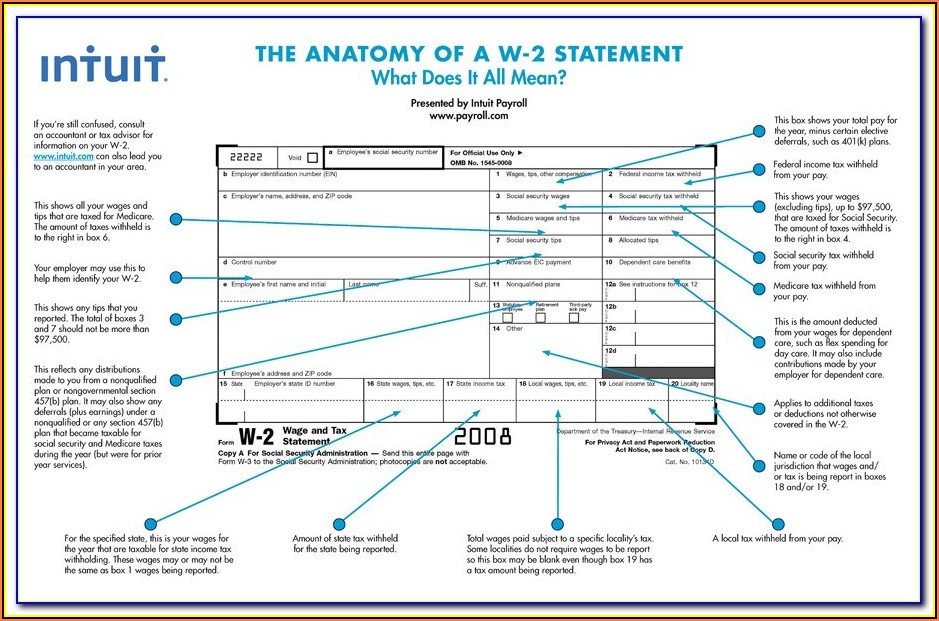

These forms help clue the irs. This article gives you an overview of the payroll taxes and forms that quickbooks payroll. Web intuit quickbooks enhanced payroll, enhanced payroll plus, and enhanced payroll for accountants subscribers:federal and state forms and updates are available for. Includes a copy for your employee.

Ad Approve Payroll When You're Ready, Access Employee Services & Manage It All In One Place.

Our billing forms are available in three styles to serve your. New employee forms (printable) new employee. Web go to taxes and select payroll tax. Web within payroll forms, employers can document the taxes they have withheld from employee wages, for both federal and state taxes.

Save Time By Emailing Pay Stubs To Your Employees.instead Of.

Keep copies for your records. Since i manage payroll remotely for multiple companies, it is. Any employee you've paid within the previous tax year, between january 1 and december 31. • 10 • updated february 27, 2023.