Iowa W4 Form 2023

Iowa W4 Form 2023 - Stay informed, subscribe to receive updates. Do not claim more allowances than necessary or you will not have enough tax withheld. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Do not claim more allowances than necessary or you will not have enough tax withheld. Beginning in tax year 2023, there. On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding: Web sunday, january 1, 2023. Web official state of iowa website here is how you know.

Web official state of iowa website here is how you know. Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding: On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. Stay informed, subscribe to receive updates. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Do not claim more allowances than necessary or you will not have enough tax withheld. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Web sunday, january 1, 2023. Do not claim more allowances than necessary or you will not have enough tax withheld.

Web sunday, january 1, 2023. Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding: Stay informed, subscribe to receive updates. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Beginning in tax year 2023, there. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Web official state of iowa website here is how you know. Do not claim more allowances than necessary or you will not have enough tax withheld. Do not claim more allowances than necessary or you will not have enough tax withheld. On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years.

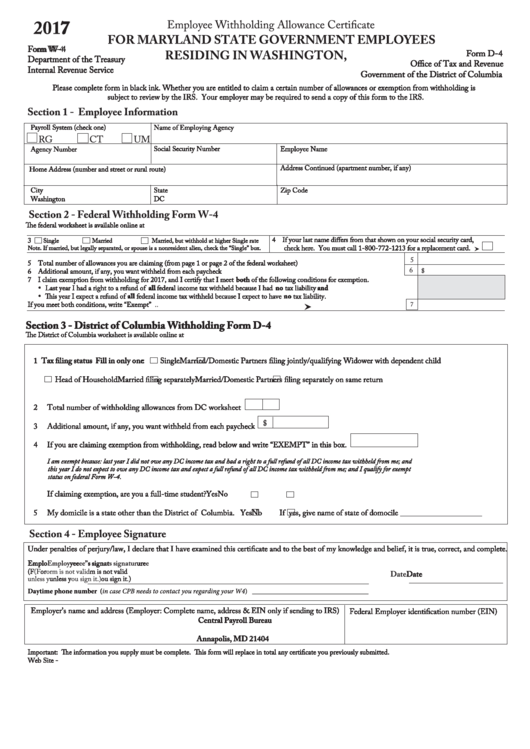

Fillable Form W4 Employee Withholding Allowance Certificate

Beginning in tax year 2023, there. Web sunday, january 1, 2023. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Do not claim more allowances than necessary or you will not have enough tax withheld. Do not claim more allowances than necessary or you will not have enough tax.

Ms Printable W4 Forms 2021 2022 W4 Form

Do not claim more allowances than necessary or you will not have enough tax withheld. Web official state of iowa website here is how you know. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Persons below the annual income levels shown below are eligible to claim exemption from.

2023 W4 Form Printable Get Latest News 2023 Update

Beginning in tax year 2023, there. Stay informed, subscribe to receive updates. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Web sunday, january 1, 2023. Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding:

Iowa w 4 form Fill out & sign online DocHub

Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding: Web sunday, january 1, 2023. Web official state of iowa website here is how you know. Stay informed, subscribe to receive updates. On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate.

ezAccounting Payroll How to Print Form W2

You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Do not claim more allowances than necessary or you will not have enough tax withheld. Do not claim more allowances than necessary or you will not have enough tax withheld. Beginning in tax year 2023, there. Web sunday, january 1,.

IowaW4 Withholding Tax Taxes

Stay informed, subscribe to receive updates. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Beginning in tax year 2023, there. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Do not claim more allowances than necessary or you will not.

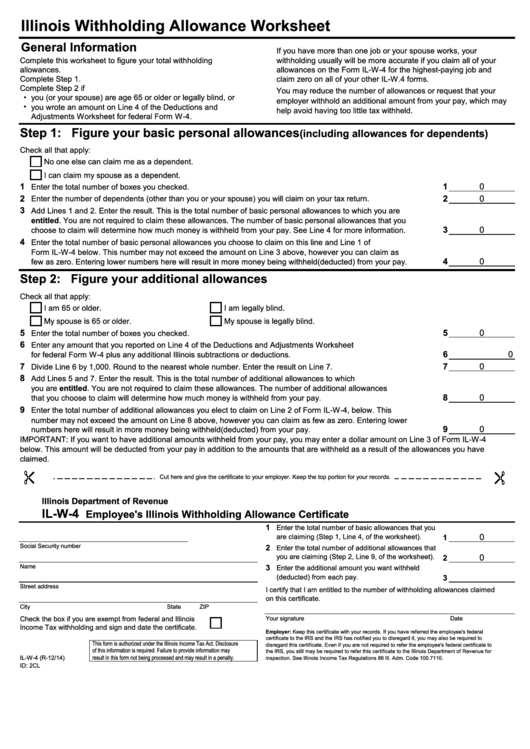

Illinois W 4 Form Printable 2022 W4 Form

On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. Stay informed, subscribe to receive updates. Web all publicly distributed iowa tax forms.

2023 IRS W 4 Form HRdirect Fillable Form 2023

Beginning in tax year 2023, there. Do not claim more allowances than necessary or you will not have enough tax withheld. On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years. You may notice a change in your iowa tax.

Iowa w 4 form Fill out & sign online DocHub

Stay informed, subscribe to receive updates. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Web official state of iowa website here is how you know. Do not claim more allowances than necessary or you will not have enough tax withheld. Beginning in tax year 2023, there.

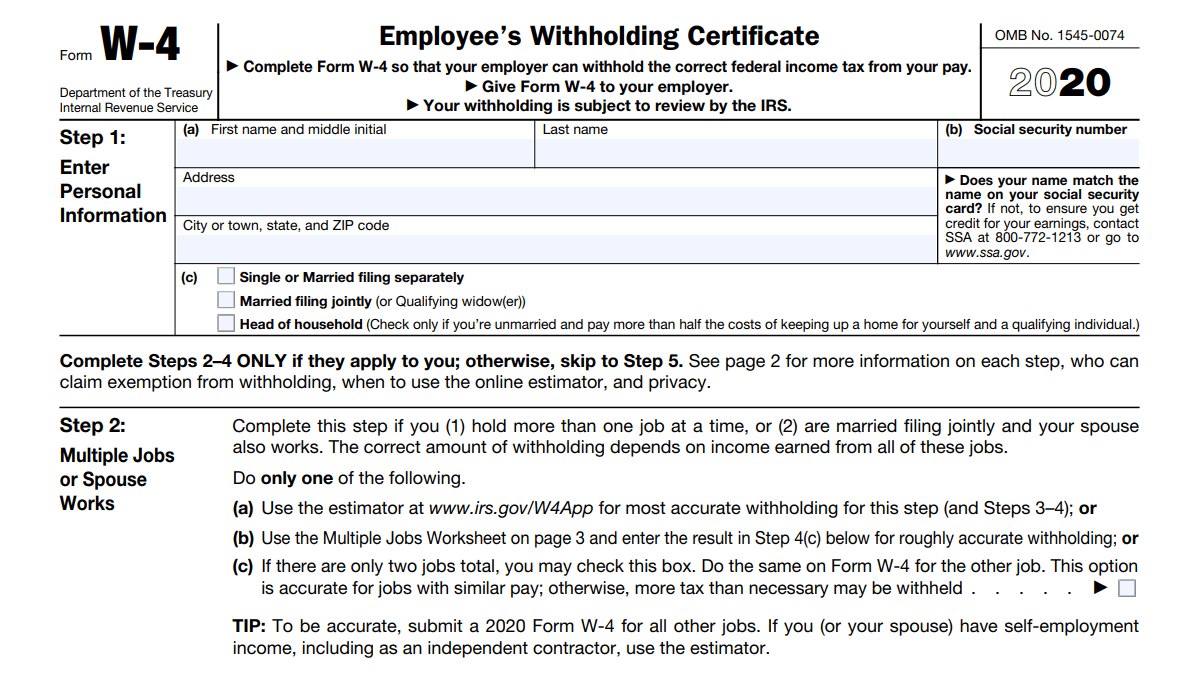

Form W4 Employee's Withholding Certificate Definition

Web sunday, january 1, 2023. Do not claim more allowances than necessary or you will not have enough tax withheld. Do not claim more allowances than necessary or you will not have enough tax withheld. Web official state of iowa website here is how you know. On march 1, 2022, governor reynolds signed into law a tax reform bill which.

Do Not Claim More Allowances Than Necessary Or You Will Not Have Enough Tax Withheld.

Stay informed, subscribe to receive updates. Web the department has updated the online withholding estimator to help individuals calculate their 2023 withholding amounts. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Web sunday, january 1, 2023.

Web All Publicly Distributed Iowa Tax Forms Can Be Found On The Iowa Department Of Revenue's Tax Form Index Site.

Persons below the annual income levels shown below are eligible to claim exemption from iowa withholding: Do not claim more allowances than necessary or you will not have enough tax withheld. Beginning in tax year 2023, there. On march 1, 2022, governor reynolds signed into law a tax reform bill which includes establishing a 3.9 flat income tax rate that will be phased in over four years.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at6.15.36PM-5e31046e8de14a21a3719fd399a682b3.png)