Ira Withdrawal Form

Ira Withdrawal Form - Web simple ira withdrawal in the first two years (no irs penalty exception). Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Applicable law or policies of the ira custodian/trustee may require additional documentation. Ira inherit an ira from a spouse or non. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Deadline for receiving required minimum distribution: Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). You can also complete many of these transactions online. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Please obtain a transfer form from the new institution.

Deadline for receiving required minimum distribution: Applicable law or policies of the ira custodian/trustee may require additional documentation. To transfer your ira to another institution. Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Your ira savings is always yours when you need it—whether for retirement or emergency funds. What you need to know Web simple ira withdrawal in the first two years (no irs penalty exception). Authorize the return of an excess ira contribution. A separate distribution form must be completed for each distribution reason.

What you need to know Please obtain a transfer form from the new institution. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. Authorize the return of an excess ira contribution. For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. Deadline for receiving required minimum distribution: To transfer your ira to another institution. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Web withdrawing from an ira. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal.

Ira Withdrawal Authorization Form 20202021 Fill and Sign Printable

Please obtain a transfer form from the new institution. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. For distributions due to death, please complete a withdrawal and tax.

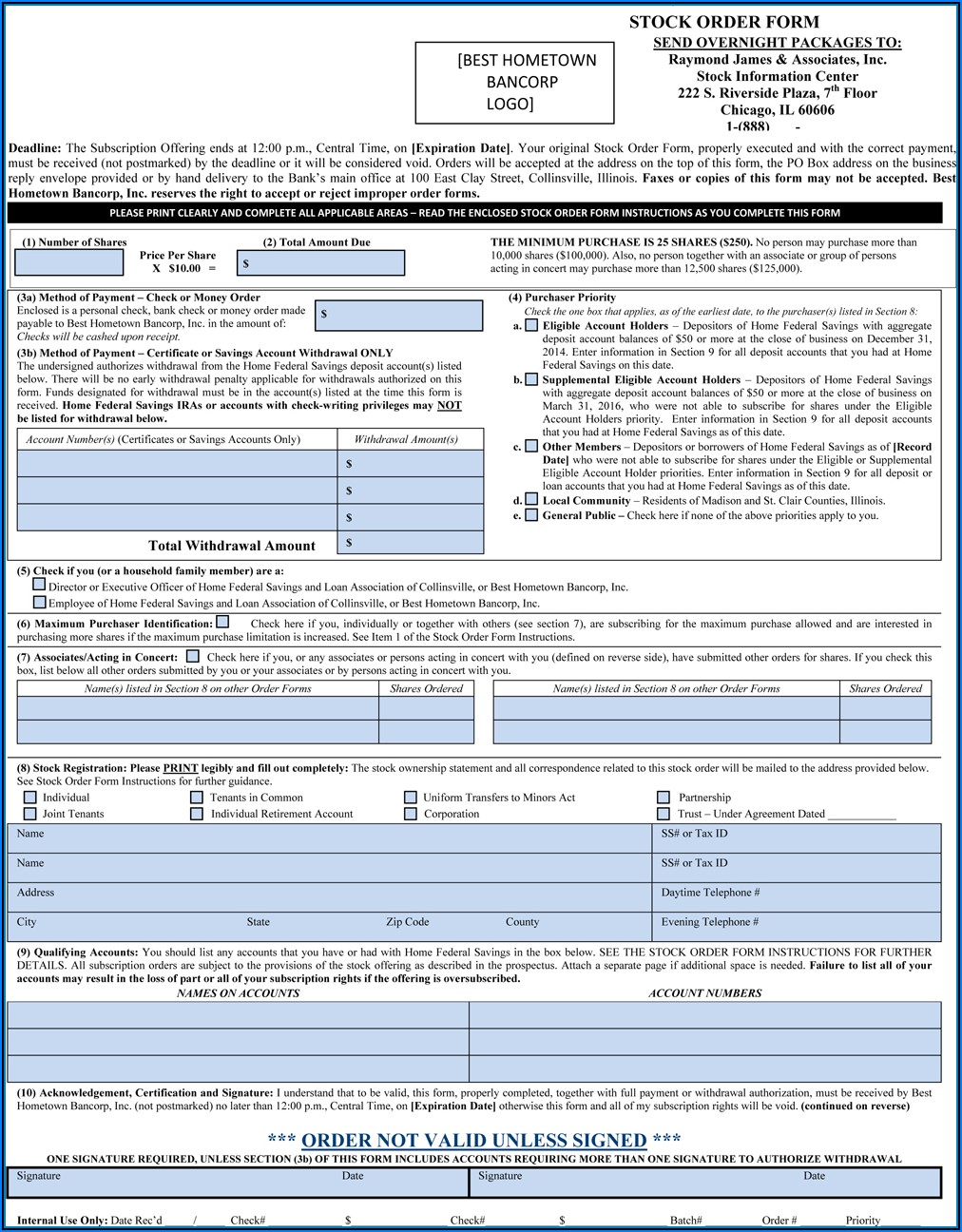

Raymond James Ira Withdrawal Form Form Resume Examples 1ZV8a11N23

Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Deadline for receiving required minimum distribution: Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your form 1040..

Ira Withdrawal Form Merrill Lynch Universal Network

A separate distribution form must be completed for each distribution reason. Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. To transfer your ira to another institution. Applicable law or policies of the ira custodian/trustee may require additional documentation. Deadline for receiving required minimum distribution:

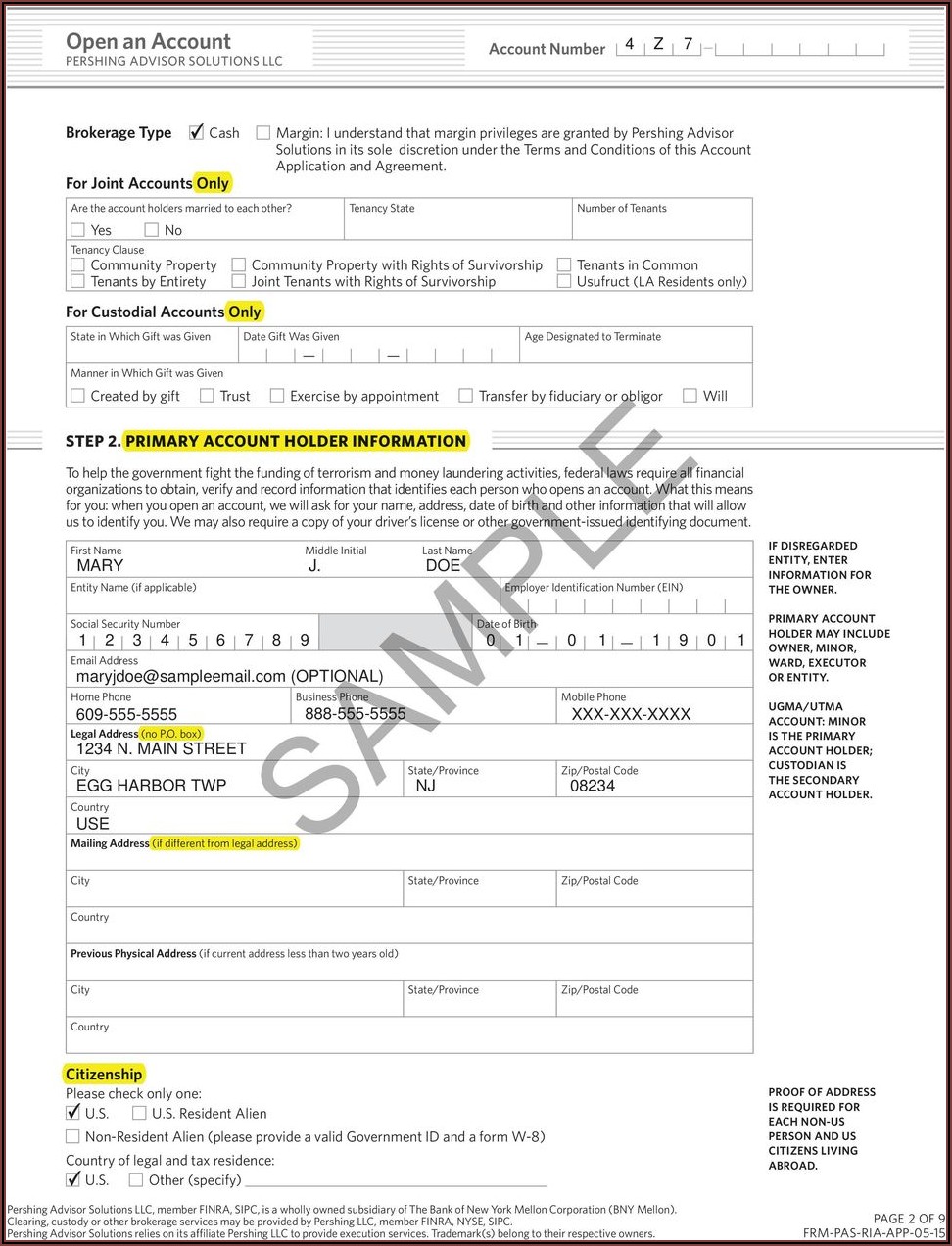

Pershing Ira Distribution Form Fill Online, Printable, Fillable

What you need to know Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and.

Traditional Ira Distribution Tax Form Universal Network

Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Applicable law or policies of the ira custodian/trustee may require additional documentation. Before you withdraw, we’ll help you understand below how your age and other factors.

Metlife Ira Withdrawal Form Universal Network

Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Applicable law or policies of the ira custodian/trustee may require additional documentation. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. To transfer your ira to another institution..

Hr Block Ira Withdrawal Form Universal Network

Web if your traditional ira includes nondeductible contributions and you received a distribution from it in 2022, you must use form 8606 to figure how much of your 2022 ira distribution is tax free. Please obtain a transfer form from the new institution. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document.

Fidelity Ira Distribution Request Form Universal Network

Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Web withdrawing from an ira. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Web use this form to request a new distribution from or change an existing distribution instruction.

Roth Ira Withdrawal Form Universal Network

Web use this form to request a new distribution from or change an existing distribution instruction for your schwab ira account. Please obtain a transfer form from the new institution. Morgan securities llc (jpms) roth or traditional individual retirement account (ira) (including sep and beneficiary ira). To transfer your ira to another institution. Web simple ira withdrawal in the first.

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Deadline for receiving required minimum distribution: Web simple ira withdrawal in the first two years (no irs penalty exception). To transfer your ira to another institution. You can also complete many of these transactions online. Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal.

Morgan Securities Llc (Jpms) Roth Or Traditional Individual Retirement Account (Ira) (Including Sep And Beneficiary Ira).

Web simple ira withdrawal in the first two years (no irs penalty exception). Deadline for receiving required minimum distribution: You can also complete many of these transactions online. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account.

Web If Your Traditional Ira Includes Nondeductible Contributions And You Received A Distribution From It In 2022, You Must Use Form 8606 To Figure How Much Of Your 2022 Ira Distribution Is Tax Free.

Authorize the return of an excess ira contribution. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your form 1040. A separate distribution form must be completed for each distribution reason. Web withdrawing from an ira.

Web Use This Form To Request A New Distribution From Or Change An Existing Distribution Instruction For Your Schwab Ira Account.

What you need to know For distributions due to death, please complete a withdrawal and tax election form for beneficiaries. Before you withdraw, we’ll help you understand below how your age and other factors impact the way the irs. Please obtain a transfer form from the new institution.

Applicable Law Or Policies Of The Ira Custodian/Trustee May Require Additional Documentation.

Web regardless of your age, you will need to file a form 1040 and show the amount of the ira withdrawal. Your ira savings is always yours when you need it—whether for retirement or emergency funds. Web the ira distribution form for traditional (including sep), roth, and simple iras is used to document and instruct us of your distribution related decisions. To transfer your ira to another institution.