Irs Estimated Tax Payment Calendar

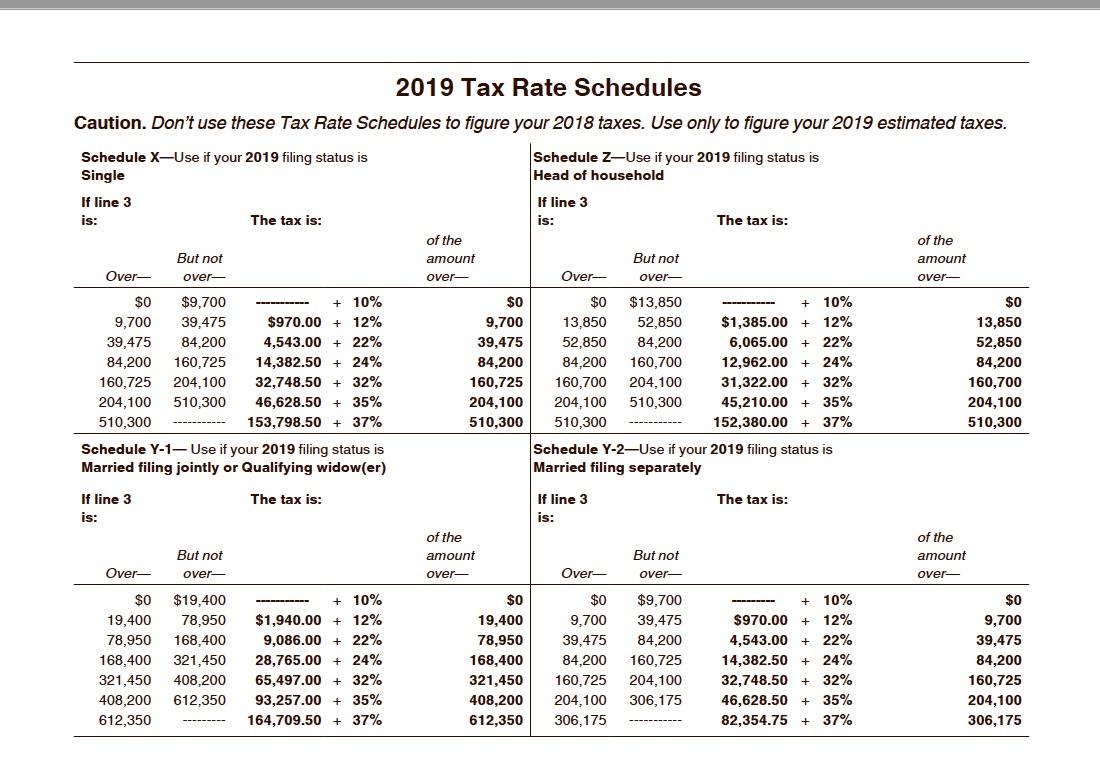

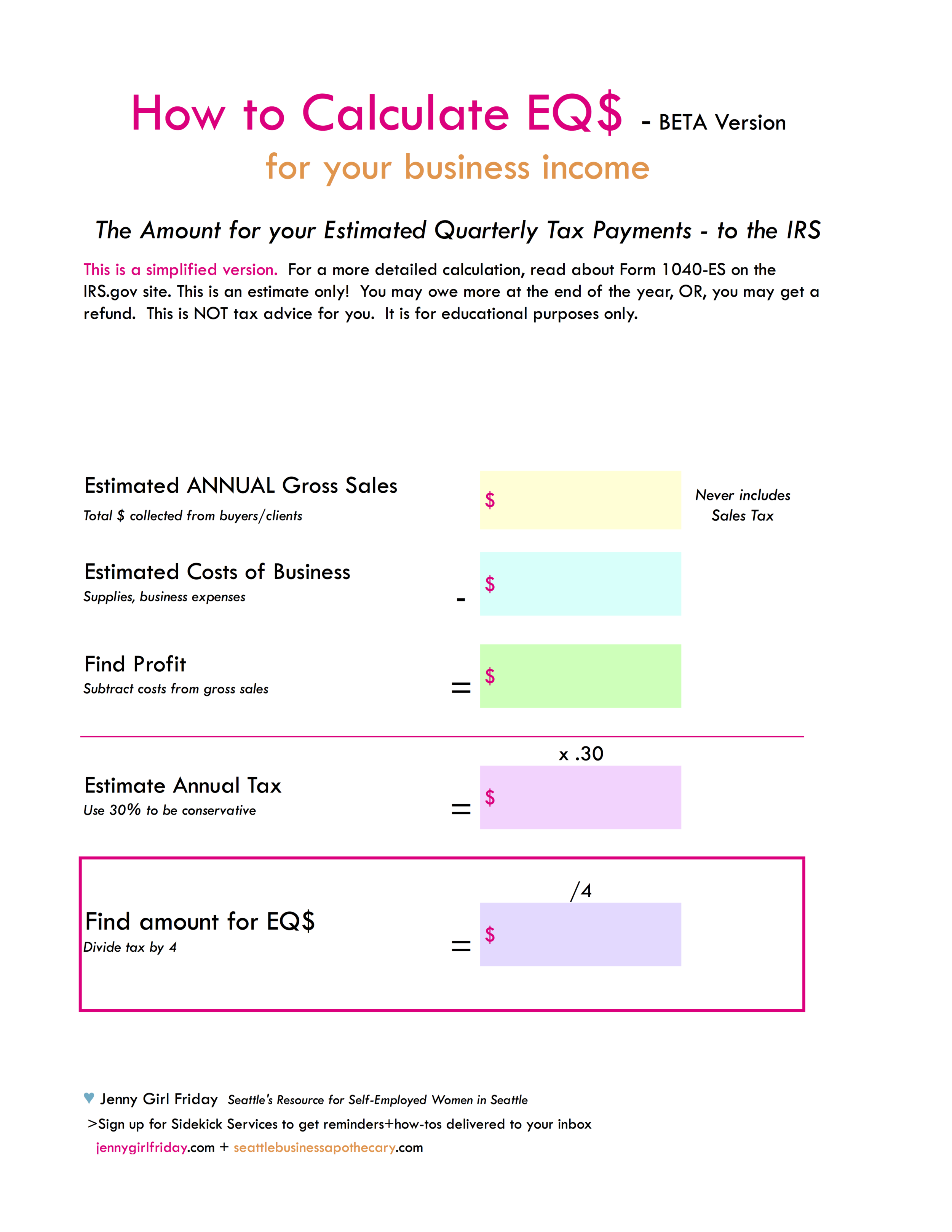

Irs Estimated Tax Payment Calendar - Web you may be able to annualize your income and make an estimated tax payment or an increased estimated tax payment for the quarter in which you realize the capital gain. January 15 (of the next year) june is only two months after april. €149 flat feemade by expats for expatssimple and affordable30 minutes to file You'd expect to owe at least $1,000 in taxes for the current year (after subtracting. Web an important irs deadline is coming up. 16 to avoid a possible penalty or tax bill when filing in 2024. €149 flat feemade by expats for expatssimple and affordable30 minutes to file Here's a rule of thumb for taxpayers who may need to pay, according to the irs. Web in most cases, you must pay estimated tax for 2024 if both of the following apply: Knowing these dates will help ensure that you pay your taxes on time and avoid.

€149 flat feemade by expats for expatssimple and affordable30 minutes to file Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of the 1st month after your tax. Web according to the united states internal revenue service, federal estimated tax payments are due on this schedule: Web use the irs tax calendar to view filing deadlines and actions each month. Web 2022 estimated tax payment dates. View amount due, payment plan details, payment history and scheduled payments; 16, you're required to pay estimated taxes on any untaxed income you earned from june through the end of. Access the calendar online from your mobile device or desktop. You also have the option when you file your return to apply some or all of your refund to your estimated tax payments for the coming tax year. Web you may be able to annualize your income and make an estimated tax payment or an increased estimated tax payment for the quarter in which you realize the capital gain.

16, you're required to pay estimated taxes on any untaxed income you earned from june through the end of. You also have the option when you file your return to apply some or all of your refund to your estimated tax payments for the coming tax year. €149 flat feemade by expats for expatssimple and affordable30 minutes to file Filing deadline for 2023 taxes. Web there are four different deadlines throughout the year for estimated taxes in 2024. Due dates that fall on a weekend or a legal holiday are shifted to the next business day. January 15 (of the next year) june is only two months after april. The deadlines for tax year 2024 quarterly payments are: I would expect estimated tax payments to be evenly spaced three months apart. Web an important irs deadline is coming up.

Estimated Tax Payment Dates 2024 Schedule Pdf Download Pippy Brittney

Web see the specific dates for estimated tax payments 2022 in the table below. Web in most cases, you must pay estimated tax for 2024 if both of the following apply: €149 flat feemade by expats for expatssimple and affordable30 minutes to file I would expect estimated tax payments to be evenly spaced three months apart. The deadlines for tax.

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench

You also have the option when you file your return to apply some or all of your refund to your estimated tax payments for the coming tax year. I would expect estimated tax payments to be evenly spaced three months apart. €149 flat feemade by expats for expatssimple and affordable30 minutes to file Web you may be able to annualize.

When Are IRS Estimated Tax Payments Due?

Web according to the united states internal revenue service, federal estimated tax payments are due on this schedule: Web 2022 estimated tax payment dates. The deadlines for tax year 2024 quarterly payments are: Web an important irs deadline is coming up. Final estimated tax payment for 2023 due.

Irs Estimated Tax Payments 2024 Due Dates Meggy Silvana

€149 flat feemade by expats for expatssimple and affordable30 minutes to file Access the calendar online from your mobile device or desktop. Web 2022 estimated tax payment dates. Web an important irs deadline is coming up. The deadlines for tax year 2024 quarterly payments are:

Irs Estimated Tax Payments 2024 Dotti Gianina

Web additional estimated tax payment options, including direct debit, credit card, cash, and wire transfer, are available at the irs payment website. €149 flat feemade by expats for expatssimple and affordable30 minutes to file By turbotax• 151• updated 9 months ago. €149 flat feemade by expats for expatssimple and affordable30 minutes to file 16 to avoid a possible penalty or.

Irs Estimated Tax Payment Schedule 2024 Rosie Koralle

Web there are four different deadlines throughout the year for estimated taxes in 2024. The deadlines for tax year 2024 quarterly payments are: January 15 (of the next year) june is only two months after april. Web see the specific dates for estimated tax payments 2022 in the table below. You'd expect to owe at least $1,000 in taxes for.

Irs Estimated Tax Payment Due Dates 2024 Schedule Bianca Jennifer

January 15 (of the next year) june is only two months after april. 16 due date for final 2023 quarterly estimated tax payments. Web you may be able to annualize your income and make an estimated tax payment or an increased estimated tax payment for the quarter in which you realize the capital gain. Web when are federal estimated taxes.

Irs Estimated Tax Payment Deadlines 2024 Drucy Giralda

Filing deadline for 2023 taxes. Due dates that fall on a weekend or a legal holiday are shifted to the next business day. By turbotax• 151• updated 9 months ago. €149 flat feemade by expats for expatssimple and affordable30 minutes to file Web according to the united states internal revenue service, federal estimated tax payments are due on this schedule:

Irs Estimated Tax Payment Calendar Angie Bobette

January 15 (of the next year) june is only two months after april. Final estimated tax payment for 2023 due. Web 2022 estimated tax payment dates. You'd expect to owe at least $1,000 in taxes for the current year (after subtracting. Due dates that fall on a weekend or a legal holiday are shifted to the next business day.

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants

Irs begins processing 2023 tax returns. January 15 (of the next year) june is only two months after april. Knowing these dates will help ensure that you pay your taxes on time and avoid. Final estimated tax payment for 2023 due. Filing deadline for 2023 taxes.

You Also Have The Option When You File Your Return To Apply Some Or All Of Your Refund To Your Estimated Tax Payments For The Coming Tax Year.

€149 flat feemade by expats for expatssimple and affordable30 minutes to file Here's a rule of thumb for taxpayers who may need to pay, according to the irs. Due dates that fall on a weekend or a legal holiday are shifted to the next business day. You'd expect to owe at least $1,000 in taxes for the current year (after subtracting.

Web When Are Federal Estimated Taxes For Individual Returns Due?

€149 flat feemade by expats for expatssimple and affordable30 minutes to file Web in most cases, you must pay estimated tax for 2024 if both of the following apply: Web make payments on your balance, payment plan, estimated tax and more; January 15 (of the next year) june is only two months after april.

Web Use The Irs Tax Calendar To View Filing Deadlines And Actions Each Month.

By turbotax• 151• updated 9 months ago. Payments are due on the 15th day of the 4th, 6th, and 9th months of your tax year and on the 15th day of the 1st month after your tax. I would expect estimated tax payments to be evenly spaced three months apart. Access the calendar online from your mobile device or desktop.

Final Estimated Tax Payment For 2023 Due.

The deadlines for tax year 2024 quarterly payments are: 16 due date for final 2023 quarterly estimated tax payments. Web there are four different deadlines throughout the year for estimated taxes in 2024. 16, you're required to pay estimated taxes on any untaxed income you earned from june through the end of.