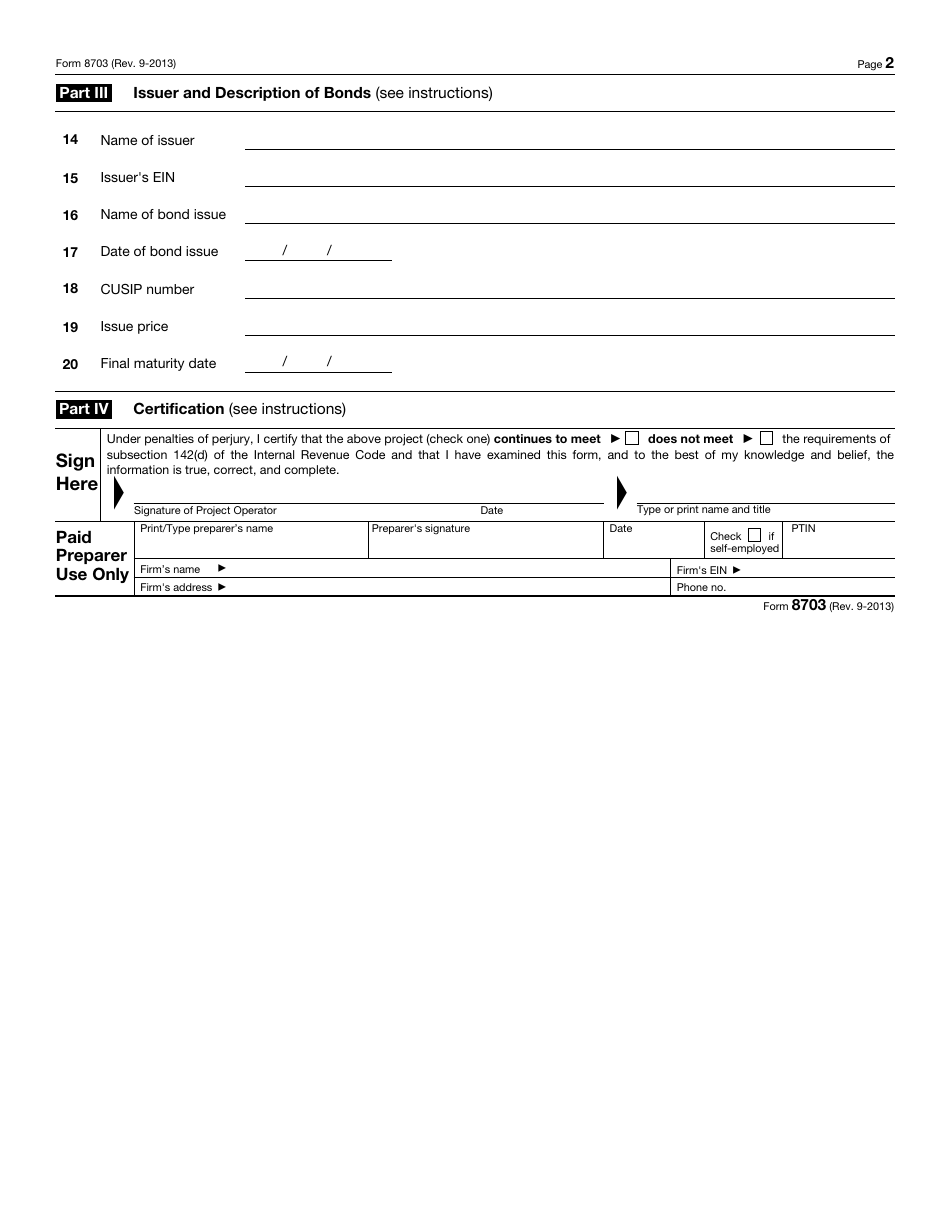

Irs Form 8703

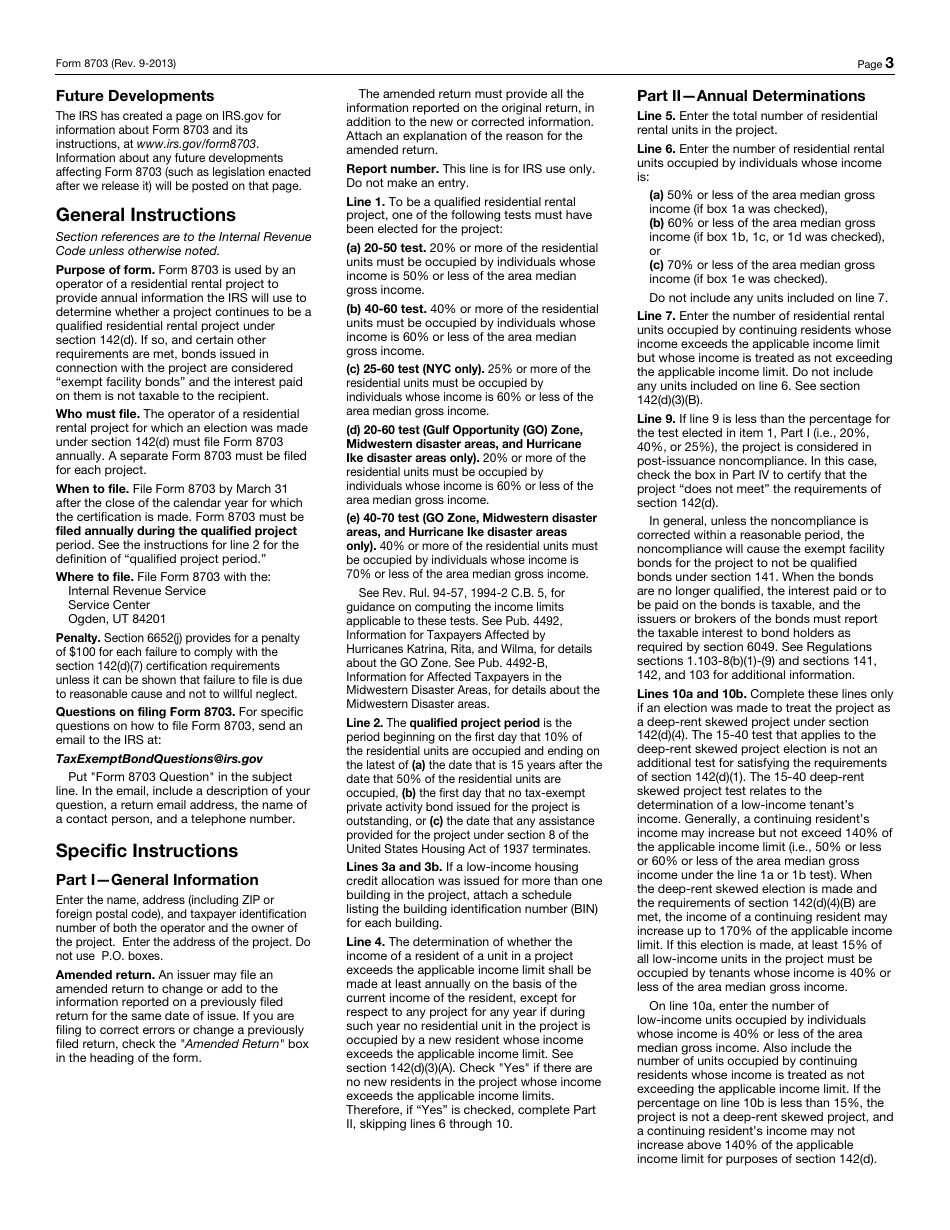

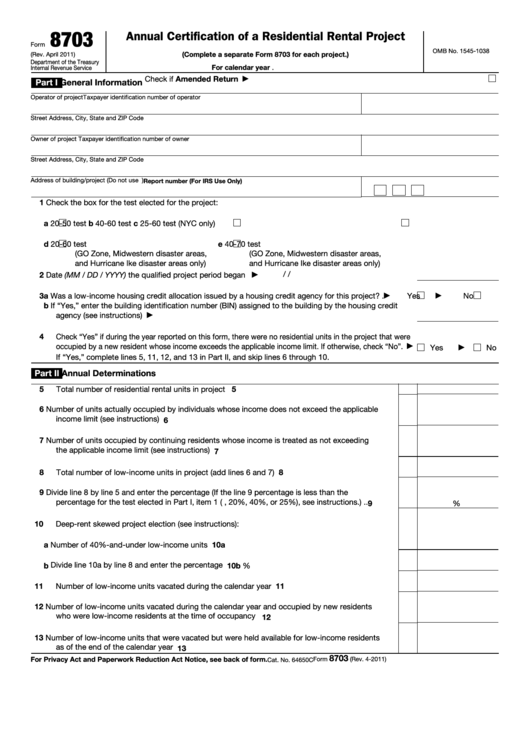

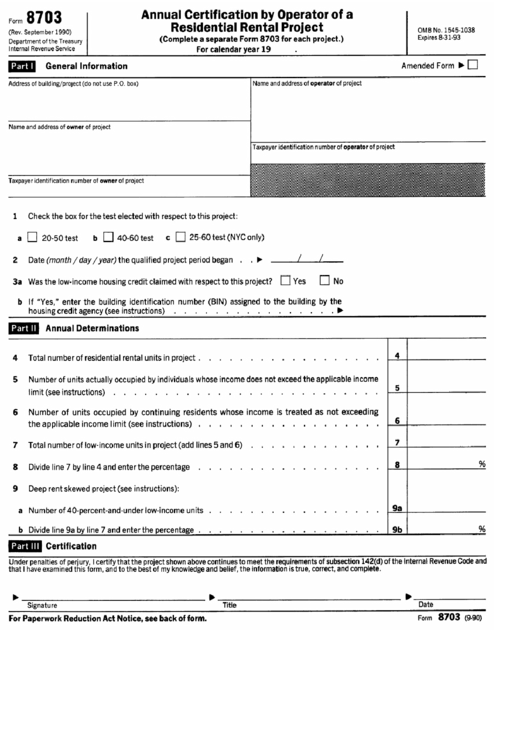

Irs Form 8703 - Web all reports are due by friday, april 30, 2021. Web get federal tax return forms and file by mail. Annual certification of a residential rental project (complete a separate form 8703 for. File form 8703 with the:. Web of the internal revenue code must file form 8703 annually during the qualified project period. Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine. Web get federal tax forms. Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Web we last updated the annual certification of a residential rental project in february 2023, so this is the latest version of form 8703, fully updated for tax year 2022. Section references are to the internal revenue code unless otherwise noted.

For specific questions on how to file form 8703, send an email to the irs at: Irs form 8703 must be filed annually during. Web all reports are due by friday, april 30, 2021. Web employer's quarterly federal tax return. This form must be filed by march 31 after the close of the. This form must be filed by march 31 after the close of the calendar year for which. Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Section references are to the internal revenue code unless otherwise noted. Taxexemptbondquestions@irs.gov put form 8703 question in.

Web of the internal revenue code must file form 8703 annually during the qualified project period. Web of the internal revenue code must file form 8703 annually during the qualified project period. Web all reports are due by friday, april 30, 2021. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. This form must be filed by march 31 after the close of the. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Annual certification of a residential rental project (complete a separate form 8703 for. File form 8703 with the:. Web get federal tax forms. Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Taxexemptbondquestions@irs.gov put form 8703 question in. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. Web questions on filing form 8703. Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine. Web get federal tax.

14 Form Irs Seven Signs You’re In Love With 14 Form Irs AH STUDIO Blog

Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web of the internal revenue code must file form 8703 annually during the qualified project period. Web we last updated.

Irs Form 8379 File Online Universal Network

Impact of rising utility costs on residents of multifamily housing programs ii. For specific questions on how to file form 8703, send an email to the irs at: Get the current filing year’s forms, instructions, and publications for free from the irs. Web 8703 is, and for the certification period was, true, correct and is based upon a review of.

IRS Form 8703 Download Fillable PDF or Fill Online Annual Certification

Web of the internal revenue code must file form 8703 annually during the qualified project period. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. Web of the internal revenue code must file form 8703 annually during the qualified.

IRS FORM 12257 PDF

Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine. Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a. Web irs form 8703 must be filed with the.

709 Form 2005 Sample 3B4

Taxexemptbondquestions@irs.gov put form 8703 question in. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web all reports are due by friday, april 30, 2021. Get paper copies of federal.

IRS Form 8703 Download Fillable PDF or Fill Online Annual Certification

Get the current filing year’s forms, instructions, and publications for free from the irs. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Annual certification of a residential rental project (complete a separate form 8703 for. Web get federal tax return forms and file by mail. Impact of rising utility costs.

Fillable Form 8703 Annual Certification Of A Residential Rental

Section references are to the internal revenue code unless otherwise noted. Get the current filing year’s forms, instructions, and publications for free from the irs. File form 8703 with the:. December 2021) department of the treasury internal revenue service. Web of the internal revenue code must file form 8703 annually during the qualified project period.

Irs Form 8379 Electronically Universal Network

Web of the internal revenue code must file form 8703 annually during the qualified project period. Web employer's quarterly federal tax return. This form must be filed by march 31 after the close of the. Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues.

Form 8703 Annual Certification By Operator Of A Residential Rental

This form must be filed by march 31 after the close of the calendar year for which. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web of the internal revenue code must file form 8703 annually during the qualified project period. Taxexemptbondquestions@irs.gov put form 8703 question in. Web irs form.

Web Irs Form 8703 Must Be Filed With The Irs By March 31St After The Close Of The Calendar Year For Which The Certification Is Being Made.

Web employer's quarterly federal tax return. Web get federal tax forms. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Impact of rising utility costs on residents of multifamily housing programs ii.

This Form Must Be Filed By March 31 After The Close Of The Calendar Year For Which.

File form 8703 with the:. Web we last updated the annual certification of a residential rental project in february 2023, so this is the latest version of form 8703, fully updated for tax year 2022. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Get the current filing year’s forms, instructions, and publications for free from the irs.

Web Questions On Filing Form 8703.

December 2021) department of the treasury internal revenue service. Web 8703 is, and for the certification period was, true, correct and is based upon a review of the records kept by the project owner pursuant to the irs regulations and hdc’s monitoring. Taxexemptbondquestions@irs.gov put form 8703 question in. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio.

Web An Irs Form 8703 Annual Certification Of A Residential Rental Project Must Be Completed When A Bond Property Falls Under Section 142 Of The Internal Revenue Code Of 1986.

Web get federal tax return forms and file by mail. For specific questions on how to file form 8703, send an email to the irs at: Form 8703 is used by an operator of residential rental project(s) to provide annual information the irs will use to determine whether a project continues to be a. Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine.

.jpg)

:max_bytes(150000):strip_icc()/Screenshot17-2d147df3078d4785ab879aac9d4b8f61.png)