Irs Letter 12C Response Template

Irs Letter 12C Response Template - The irs will tell you exactly what information they need. Web use a irs letter 12c response template template to make your document workflow more streamlined. Web july 18, 2021 irs just received the irs letter 12c? Web a reply is needed within 20 days from the date of this letter. To minimize additional interest and penalty. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web what should you do in response to letter 12c? Ssn here (if you and your spouse filed jointly, use the ssn that appears first. Full name and spouse's full name if applicable. Along the course of your tax life, you are bound to receive many notices from the irs, one of which may be a.

Along the course of your tax life, you are bound to receive many notices from the irs, one of which may be a. Web sections of letter 12c. If a taxpayer doesn't agree with the irs, they should mail a letter explaining why they dispute the notice. This letter is frequently used to reconcile payments of the. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Full name and spouse's full name if applicable. Web how to write a response letter to the irs (with examples) published on: Where can i see all the supporting documents that turbotax already. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs.

Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Ssn here (if you and your spouse filed jointly, use the ssn that appears first. Keep a copy for yourself & send the original to the irs by. This letter is frequently used to reconcile payments of the. Web let the irs know of a disputed notice. Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. To minimize additional interest and penalty. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. May 25, 2023 by real person taxes content provided.

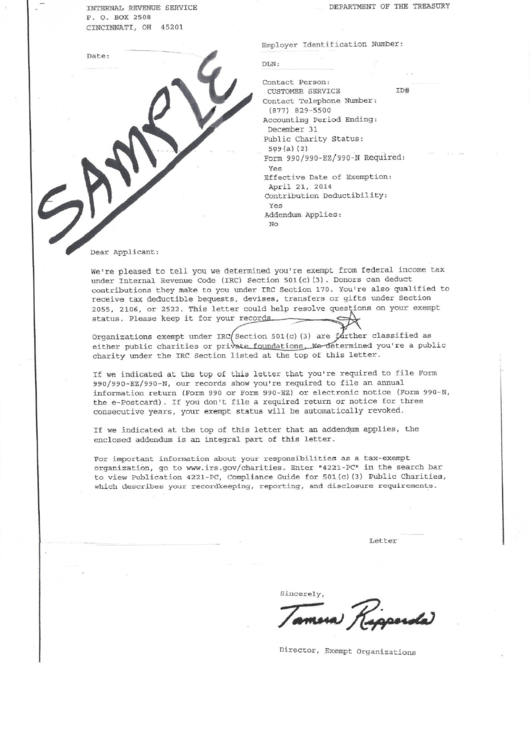

Example Of Irs Letter Template printable pdf download

Web use a irs letter 12c response template template to make your document workflow more streamlined. Web 1 min read the irs sent letter 12c to inform you that additional information is needed to process the return filed. Allow at least 30 days for a response from the irs. Web respond to letter 12c if the irs is asking for.

TaxAudit What Should I Do With An IRS Letter 12C? TaxAudit Blog

Full name and spouse's full name if applicable. Web respond to letter 12c if the irs is asking for a signature, just sign the attestation clause attached to the letter 12c. If a taxpayer doesn't agree with the irs, they should mail a letter explaining why they dispute the notice. Keep a copy for yourself & send the original to.

Irs Tax Attorney Austin Tx Irs Notice Cp523 Intent To Terminate Your

Have a copy of your tax return and the. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Web 1 min read the irs sent letter 12c to inform you that additional information is needed to process the return filed. Allow at least 30 days for a response from the.

How to Respond to IRS Letter 12C SuperMoney

Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Allow at least 30 days for a response from the irs. Web sections of letter 12c. Keep a copy for yourself & send the original to the irs by. This might be.

Irs Name Change Letter Sample / 12 INFO IRS TAX NOTICE LETTER 12C PRINT

Web 1 min read the irs sent letter 12c to inform you that additional information is needed to process the return filed. Edit your irs letter 12c sample online type text, add images, blackout confidential details, add comments, highlights and more. Along the course of your tax life, you are bound to receive many notices from the irs, one of.

IRS Audit Letter 12C Sample 1

Edit your irs letter 12c sample online type text, add images, blackout confidential details, add comments, highlights and more. Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Web let the irs know of a disputed notice. Web may 6, 2022.

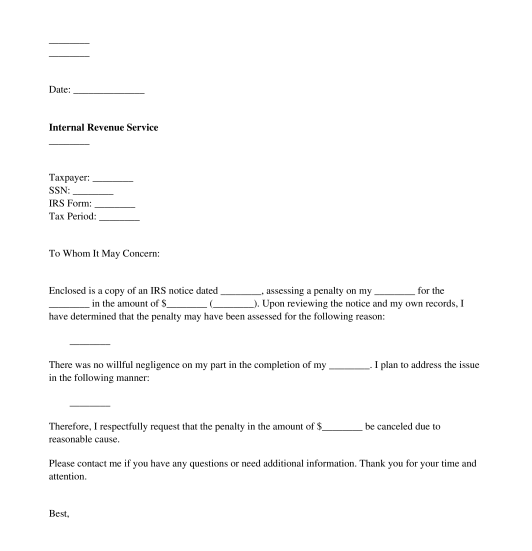

How To Write An Irs Abatement Letter

Ssn here (if you and your spouse filed jointly, use the ssn that appears first. Web what should you do in response to letter 12c? Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: May 25, 2023 by real person taxes content provided. To minimize additional.

Written Explanation Sample Letter To Irs slide share

If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. The irs will tell you exactly what information they need. July 25, 2022 | last.

IRS Letter 12C Missing Form 8962 YouTube

This might be a form you receive from an employer or health. Web 1 min read the irs sent letter 12c to inform you that additional information is needed to process the return filed. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply:.

IRS Audit Letter 324C Sample 1

Where can i see all the supporting documents that turbotax already. Web july 18, 2021 irs just received the irs letter 12c? To minimize additional interest and penalty. Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. July 25, 2022 |.

Web 1 Min Read The Irs Sent Letter 12C To Inform You That Additional Information Is Needed To Process The Return Filed.

Web how to write a response letter to the irs (with examples) published on: Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. May 25, 2023 by real person taxes content provided. Along the course of your tax life, you are bound to receive many notices from the irs, one of which may be a.

This Letter Is Frequently Used To Reconcile Payments Of The.

Keep a copy for yourself & send the original to the irs by. Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Edit your irs letter 12c sample online type text, add images, blackout confidential details, add comments, highlights and more. Web july 18, 2021 irs just received the irs letter 12c?

Web Use A Irs Letter 12C Response Template Template To Make Your Document Workflow More Streamlined.

If you have questions, call the telephone number in the letter. Web respond to letter 12c if the irs is asking for a signature, just sign the attestation clause attached to the letter 12c. Web a reply is needed within 20 days from the date of this letter. The irs will tell you exactly what information they need.

Web What Should You Do In Response To Letter 12C?

Sign it in a few clicks draw your. Ssn here (if you and your spouse filed jointly, use the ssn that appears first. If a taxpayer doesn't agree with the irs, they should mail a letter explaining why they dispute the notice. July 25, 2022 | last updated on: