Irs Mileage Tracking Form

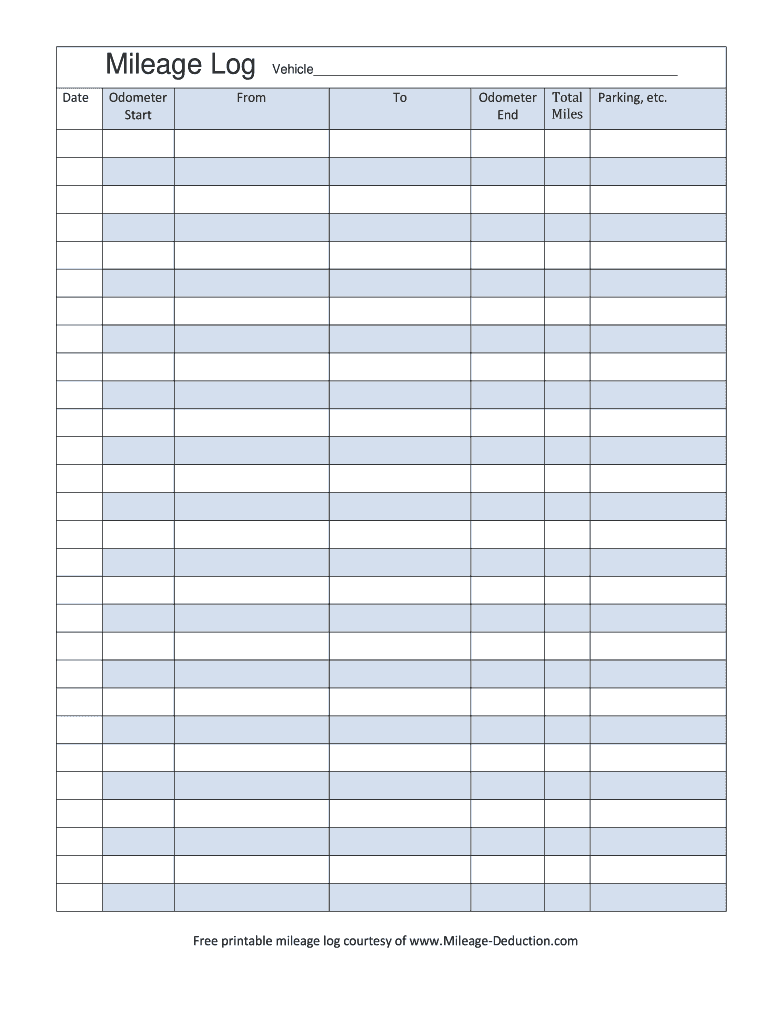

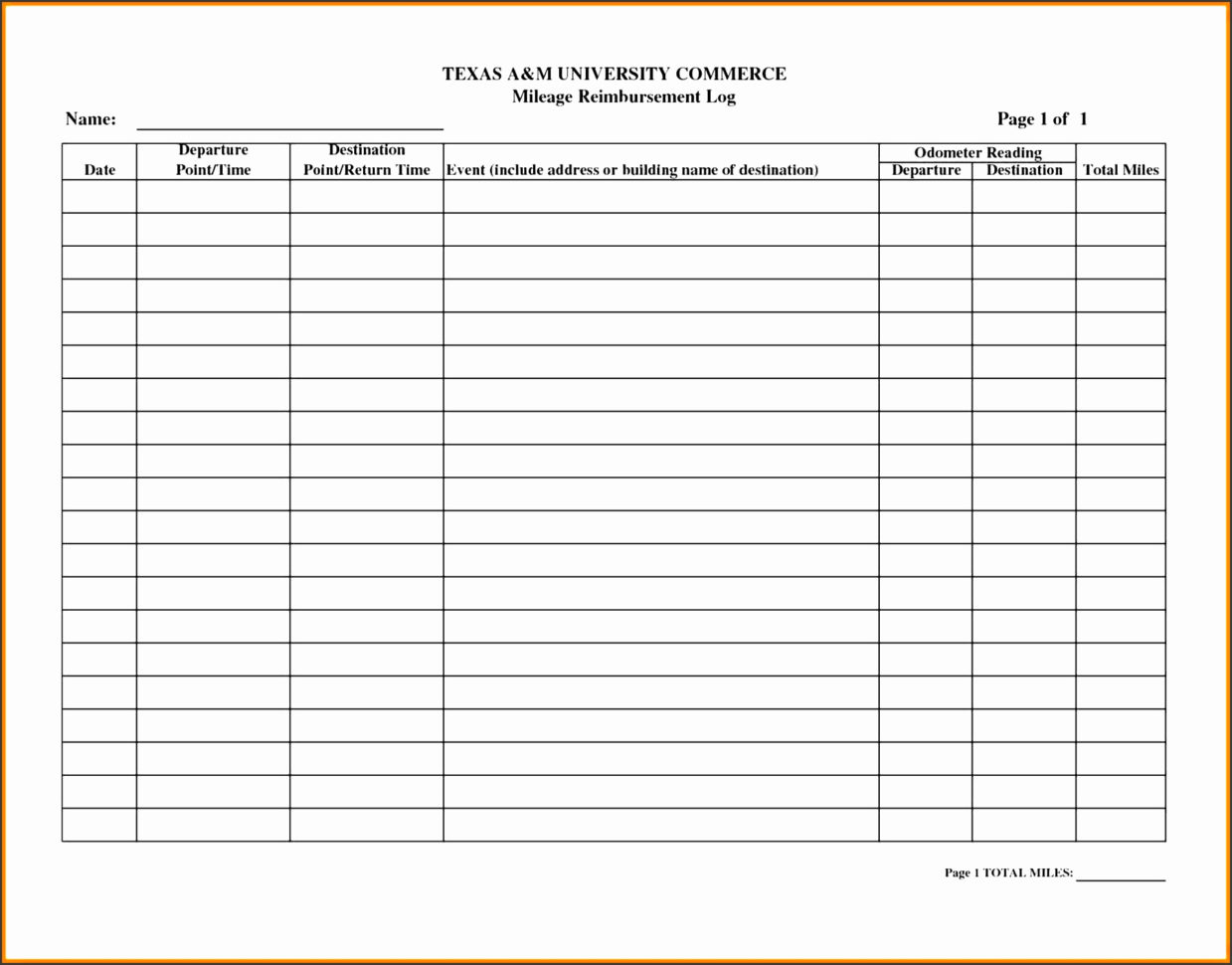

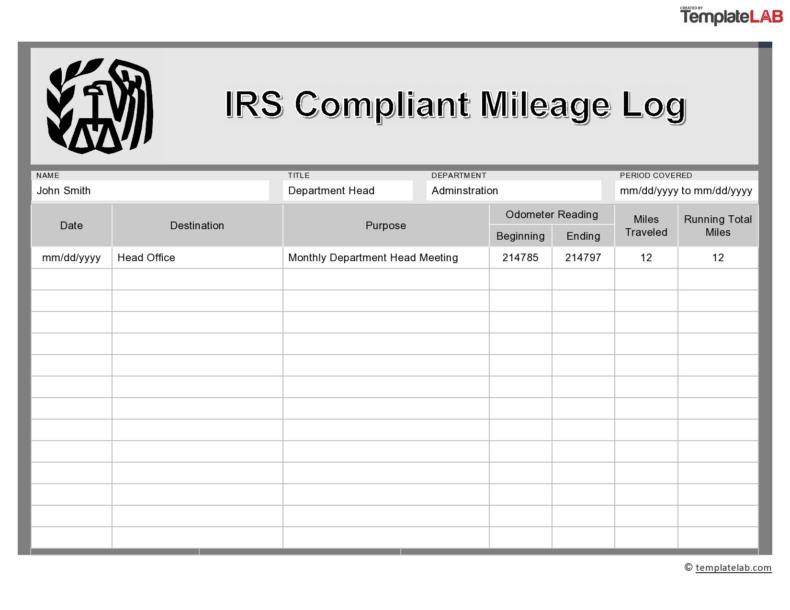

Irs Mileage Tracking Form - Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. The first way is by reporting mileage using the standard mileage rate. Web this mileage tracker app knows everything other mileage trackers know. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Then keep track of your business miles and expenses for each business trip using this detailed template. What's new standard mileage rate. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Web mileage reimbursement form | 2022 irs rates.

The other is by reporting actual expenses, also known as the actual expenses method. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Web business mileage tracker form. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Depreciation limits on cars, trucks, and vans. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims.

The first way is by reporting mileage using the standard mileage rate. Web business mileage tracker form. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Car expenses and use of the standard mileage rate are explained in chapter 4. Depreciation limits on cars, trucks, and vans. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. The other is by reporting actual expenses, also known as the actual expenses method. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Remember to use the 2022 irs mileage rate if you log trips for. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106.

25 Printable Irs Mileage Tracking Templates Gofar With Mileage Report

A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Web business mileage tracker form. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. The other is by reporting actual expenses, also known as the actual expenses method. The first way.

Irs Mileage Tracking Form Form Resume Examples qeYzGzWV8X

What's new standard mileage rate. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Car expenses and use of the standard mileage rate are explained in chapter 4. All in all, it’s a perfect solution for your own taxes — or for.

25 Printable Irs Mileage Tracking Templates Gofar Inside Best Vehicle

Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Then keep track of your business miles and expenses for each business trip using this detailed template. Remember to use the 2022 irs mileage rate if you log trips for. Web business mileage tracker form. Enter.

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Web an irs mileage reimbursement form is used by an employee to keep.

Peerless Google Sheets Mileage Template Best Powerpoint Templates 2018 Free

All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Depreciation limits on cars, trucks, and vans. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Then keep track of your business miles and expenses for each business trip using.

Irs Mileage Log Excel Excel Templates

The other is by reporting actual expenses, also known as the actual expenses method. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Download pdf [541 kb] download jpg [647 kb] Web this mileage tracker app knows everything other mileage trackers know. Web when you.

Search Results Irs Mileage Log Template BestTemplatess

What's new standard mileage rate. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Depreciation limits on cars, trucks,.

Mileage Spreadsheet For Irs Best Of Free Irs Mileage Log Template

What's new standard mileage rate. Remember to use the 2022 irs mileage rate if you log trips for. Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Car expenses and use of the standard mileage rate are explained in chapter 4. Enter your personal, company.

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims. Car expenses and use of the standard mileage rate are explained in chapter 4. The other is by reporting actual expenses,.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Car expenses and use of the standard mileage rate are explained in chapter 4. The other is by reporting actual expenses, also known as the actual expenses method. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Web mileage reimbursement form | 2022 irs rates..

Download Pdf [541 Kb] Download Jpg [647 Kb]

Web when you visit the irs’s website in search of the mileage log requirements, you’ll notice that there are two ways to report mileage. Enter your personal, company and vehicle details at the top of this business mileage tracker form along with the tracking period and the irs standard mileage rates. Web an irs mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. The first way is by reporting mileage using the standard mileage rate.

All In All, It’s A Perfect Solution For Your Own Taxes — Or For Requesting A Mileage Reimbursement From A Customer Or Employer.

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Remember to use the 2022 irs mileage rate if you log trips for. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Plus, you can create mileage logs from scratch or pieces to support your past mileage claims.

Depreciation Limits On Cars, Trucks, And Vans.

Web business mileage tracker form. Web for the latest developments related to form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. What's new standard mileage rate. The other is by reporting actual expenses, also known as the actual expenses method.

Then Keep Track Of Your Business Miles And Expenses For Each Business Trip Using This Detailed Template.

Web mileage reimbursement form | 2022 irs rates. Web this mileage tracker app knows everything other mileage trackers know. Car expenses and use of the standard mileage rate are explained in chapter 4.