Irs Pay Calendar

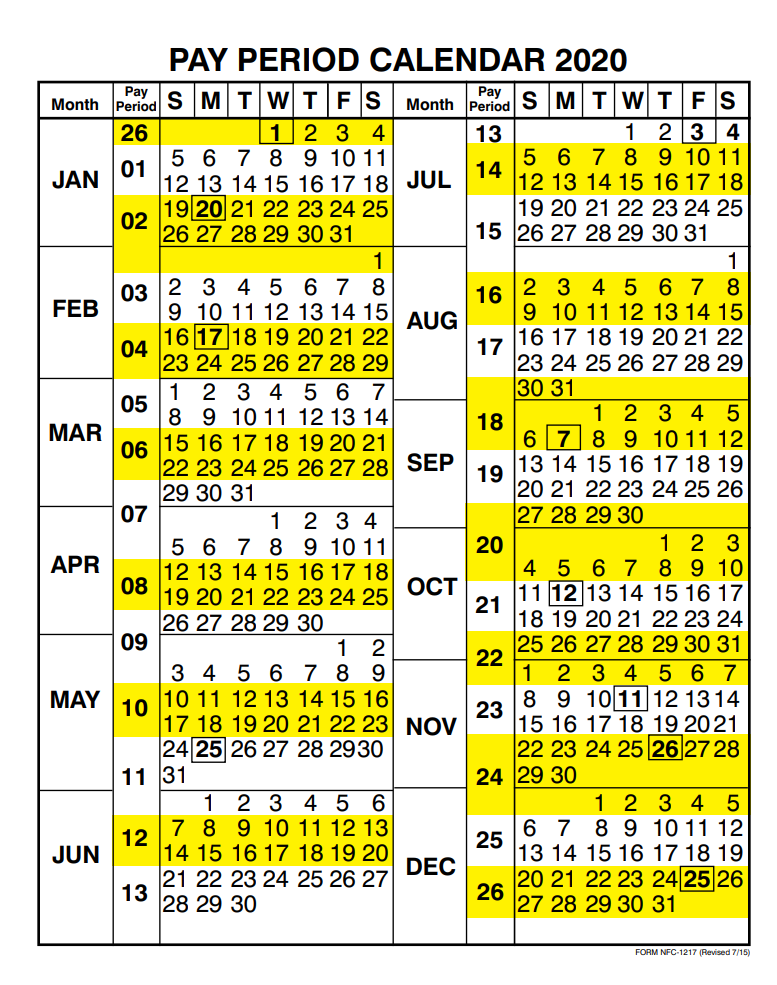

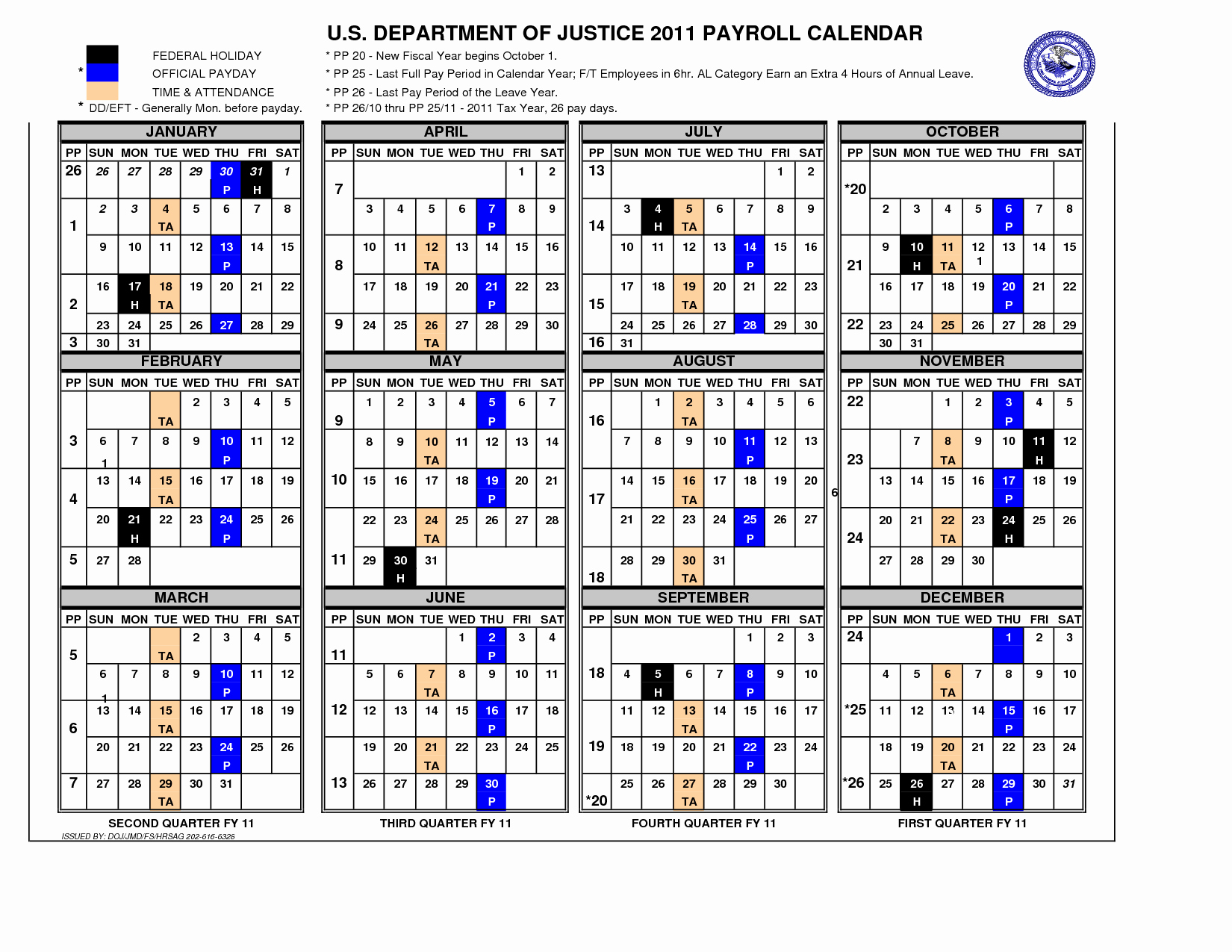

Irs Pay Calendar - Web use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. There are usually 26 pay periods in a year. Web a table showing the semiweekly deposit due dates for payroll taxes for 2024. Add the gsa payroll calendar to your personal calendar. When will i receive my tax refund? Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. Web in general, there are four options you can consider for your payroll calendar, which is essentially a schedule that helps you pay your employees. Make a payment or view 5 years of payment history and any pending or scheduled payments. Pay periods begin on a sunday and end 2 weeks later on a saturday. To make your tax life simpler, the irs releases a tax calendar each year.

Pay using irs online account. Generally, most individuals are calendar year filers. Download the gsa payroll calendar ics file. Among the reminders in the publication are the payment deadlines for amounts of the. The 2023 publication 509, tax. Web washington — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service. Web 2024 irs tax refund schedule (2023 tax year): Make a payment or view 5 years of payment history and any pending or scheduled payments. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. 2 3 4 5 6 7 8 9 10 11 12 13 14 15.

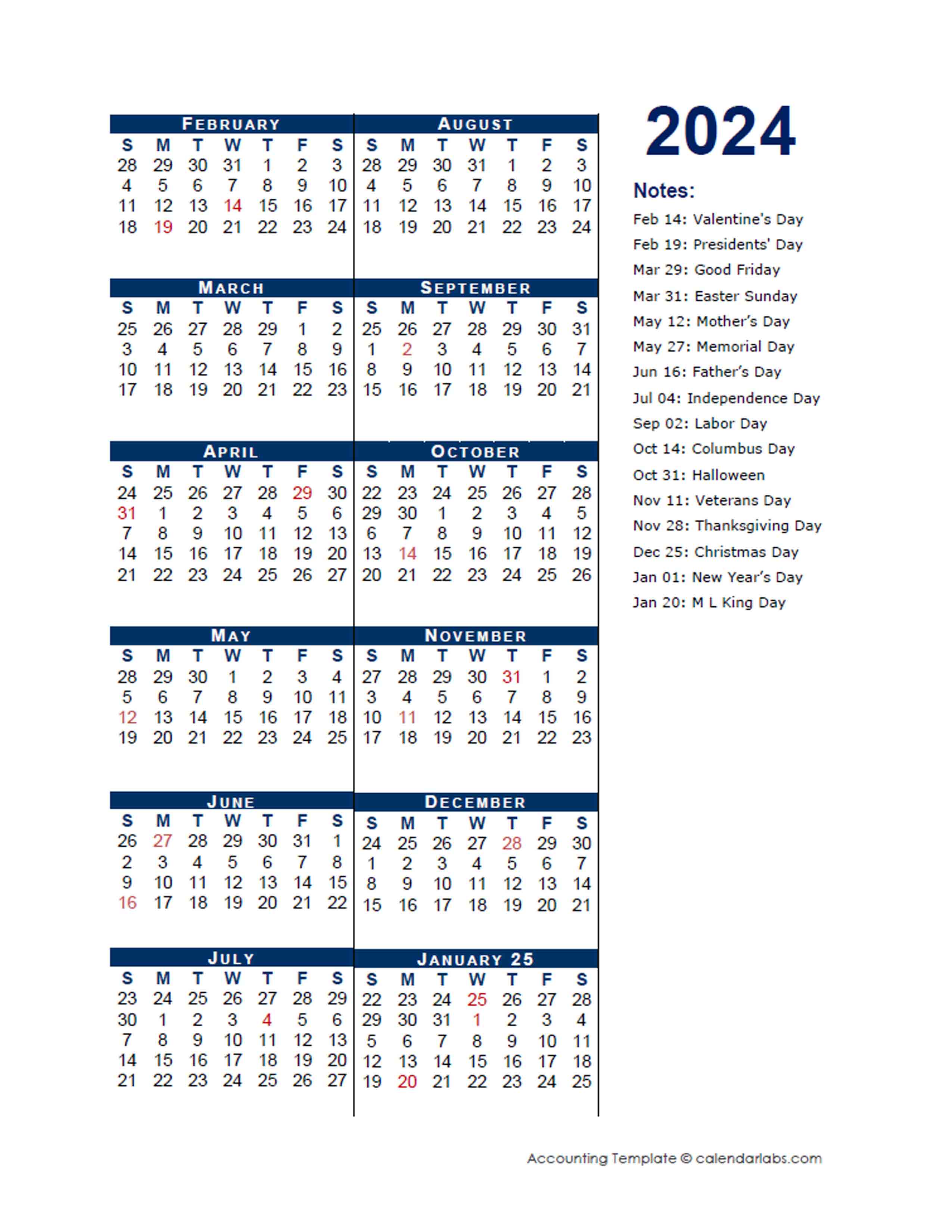

Web pay period calendar 2024 month. Web the holiday is june 19, and is to be observed monday, june 20, in 2022. Web the finalized 2023 federal tax calendars for employers and other taxpayers were released dec. €149 flat feesimple and affordablemade by expats for expats This option allows taxpayers to view their. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. €149 flat feesimple and affordablemade by expats for expats Web make payments on your balance, payment plan, estimated tax and more; Add the gsa payroll calendar to your personal calendar. Web a chart and irs refund schedule that shows you when you can expect your tax refund in 2024.

2024 Federal Pay Period Calendar

The universal calendar format (ics) is used by several email and calendar programs, including. When will i receive my tax refund? View amount due, payment plan details, payment history and scheduled payments; Web pay period calendar 2024 month. There are usually 26 pay periods in a year.

Irs Pay Period Calendar 2025 Poppy Sondra

€149 flat feesimple and affordablemade by expats for expats Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. Add the gsa payroll calendar to your personal calendar..

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants

Web this option allows taxpayers to schedule a payment in advance of the jan. Web payroll tax calendar and tax due dates. Web these calendars apply to employees of agencies who receive payroll services from the interior business center. Web use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings.

Irs Pay Dates 2024 Sadye Conchita

Searching for a deposit due date or filing deadline? Web 2024 irs tax refund schedule (2023 tax year): This option allows taxpayers to view their. Web a chart and irs refund schedule that shows you when you can expect your tax refund in 2024. €149 flat feesimple and affordablemade by expats for expats

Irs Pay Period Calendar 2025 Poppy Sondra

€149 flat feesimple and affordablemade by expats for expats Access the calendar online from your mobile device or desktop. To make your tax life simpler, the irs releases a tax calendar each year. When will i receive my tax refund? Web washington — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue.

IRS Payment Plan How It Works Tax Relief Center

Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. When will i receive my tax refund? The universal calendar format (ics) is used by several email and calendar programs, including. Web washington — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer.

Irs Pay Dates 2024 Sadye Conchita

Searching for a deposit due date or filing deadline? Download the gsa payroll calendar ics file. Web the finalized 2023 federal tax calendars for employers and other taxpayers were released dec. 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Also, how to check the status of your refund.

2024 Irs Payment Calendar Cyndi Dorelle

Web use the irs tax calendar to view filing deadlines and actions each month. Among the reminders in the publication are the payment deadlines for amounts of the. Web this option allows taxpayers to schedule a payment in advance of the jan. Web see payment plan details or apply for a new payment plan. Web the due date for filing.

Irs Pay Period Calendar 2025 Poppy Sondra

Download the gsa payroll calendar ics file. Every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage. Web a table showing the semiweekly deposit due dates for payroll taxes for 2024. Web this option allows taxpayers to schedule a payment in advance of the jan. When will.

What Is The Irs Tax Refund Calendar For 2024 Dareen Maddalena

Web the holiday is june 19, and is to be observed monday, june 20, in 2022. Web payroll tax calendar and tax due dates. Download the gsa payroll calendar ics file. Searching for a deposit due date or filing deadline? Pay using irs online account.

Pay Using Irs Online Account.

The 2024 tax refund schedule for the 2023 tax year starts on january 29th. Web 28 rows fiscal and calendar year pay calendars. This option allows taxpayers to view their. The 2023 publication 509, tax.

Web Use The Irs Tax Calendar To View Filing Deadlines And Actions Each Month.

Also, how to check the status of your refund. Web use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost. Pay periods begin on a sunday and end 2 weeks later on a saturday. Web these calendars apply to employees of agencies who receive payroll services from the interior business center.

Every Employer Engaged In A Trade Or Business Who Pays Remuneration For Services Performed By Employees Must Report To The Irs The Wage.

When will i receive my tax refund? Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Web make payments on your balance, payment plan, estimated tax and more; Add the gsa payroll calendar to your personal calendar.

16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Searching for a deposit due date or filing deadline? Make a payment or view 5 years of payment history and any pending or scheduled payments. 2 3 4 5 6 7 8 9 10 11 12 13 14 15. Generally, most individuals are calendar year filers.