Irs Tax Payment Calendar

Irs Tax Payment Calendar - These postponements are automatic and apply to all. To make your tax life simpler, the irs releases a tax calendar each year. However, penalties and interest will continue to accrue as applicable until you pay the full balance. 22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers to gather their necessary information and visit irs.gov for. Web the irs can hit you with penalties and interest if you miss a tax deadline. The deadline has been pushed from april 15 this year, but this does not. Web get all your electronic federal tax payment system and payroll calendar forms here. Use the calendar below to track the due dates for irs tax filings each month. View amount due, payment plan details, payment history and scheduled payments; Web payment of federal taxes:

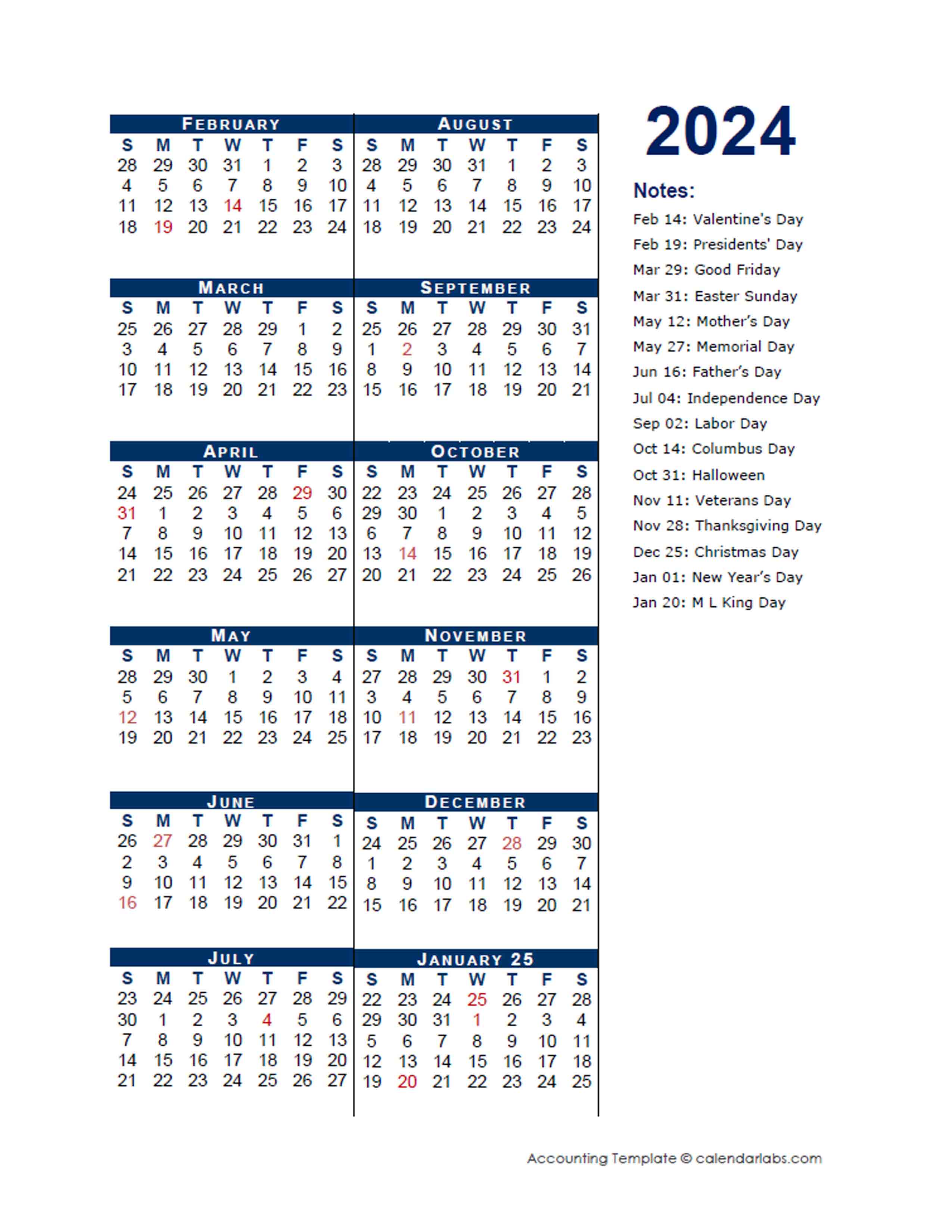

Web when are taxes due? Web most federal tax return filing and payment deadlines are postponed from april 15 to july 15, 2020. These postponements are automatic and apply to all. Web every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage payments and related. Debit card, credit card, or digital wallet:. An irs tax calendar is like a year planner split into quarters. Web for most taxpayers, the main income tax return deadline for 2020 tax returns is may 17, 2021 — aka irs tax day 2021. Web according to the irs refunds will generally be paid within 21 days. Our tax refund chart lists the federal tax refund dates for direct deposits and mailed. Irs accepts full and partial payments, including payments toward a payment plan (including installment agreement).

An irs tax calendar is like a year planner split into quarters. For example, the standard penalty for failing to file your annual tax return on time is 5% of. For most taxpayers, the main income tax return deadline for 2021 tax returns is april 18 — aka irs tax day 2022. Irs accepts full and partial payments, including payments toward a payment plan (including installment agreement). Our tax refund chart lists the federal tax refund dates for direct deposits and mailed. These postponements are automatic and apply to all. However, penalties and interest will continue to accrue as applicable until you pay the full balance. Web 2022 estimated tax payment dates. The deadline has been pushed from april 15 this year, but this does not. View amount due, payment plan details, payment history and scheduled payments;

Irs Tax Return 2024 Schedule Hallie Laurie

Web 2022 estimated tax payment dates. These postponements are automatic and apply to all. Pay your individual tax bill or estimated tax payment directly from your checking or savings account at no cost to you. Web review information about due dates and when to file tax returns. Web use this secure service to pay your taxes for form 1040 series,.

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants

Web there are four payment due dates in 2024 for estimated tax payments: Web most federal tax return filing and payment deadlines are postponed from april 15 to july 15, 2020. These postponements are automatic and apply to all. Web review information about due dates and when to file tax returns. Web the irs can hit you with penalties and.

Irs Tax Calendar 2024 2024 Calendar Printable

Web 2024 tax deadline: Web review information about due dates and when to file tax returns. Web the 2024 tax refund schedule for the 2023 tax year starts on january 29th. Web there are four payment due dates in 2024 for estimated tax payments: Web according to the irs refunds will generally be paid within 21 days.

How to View Your IRS Tax Payments Online • Countless

Web 2024 tax deadline: Web every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage payments and related. Web 2022 estimated tax payment dates. Our tax refund chart lists the federal tax refund dates for direct deposits and mailed. For most taxpayers, the main income tax return.

Irs Tax Payments 2024 Online Carlin Carolina

The deadline has been pushed from april 15 this year, but this does not. Web make payments on your balance, payment plan, estimated tax and more; Web use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you. Web 2022 estimated.

When Are IRS Estimated Tax Payments Due?

These postponements are automatic and apply to all. Use the calendar below to track the due dates for irs tax filings each month. For most taxpayers, the main income tax return deadline for 2021 tax returns is april 18 — aka irs tax day 2022. Web use this secure service to pay your taxes for form 1040 series, estimated taxes.

2024 Estimated Tax Due Dates Irs Reiko Charlean

Web most federal tax return filing and payment deadlines are postponed from april 15 to july 15, 2020. Find out how to request an extension of time to file. This includes accepting, processing and disbursing approved refund payments via direct. Pay your individual tax bill or estimated tax payment directly from your checking or savings account at no cost to.

Irs Tax Filing Calendar 2024 Annie Tricia

It’s important to note that taxpayers. Web 2022 estimated tax payment dates. Final payment due in january 2025. Find out how to request an extension of time to file. This includes accepting, processing and disbursing approved refund payments via direct.

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench

Web when are taxes due? Web 2022 estimated tax payment dates. This includes accepting, processing and disbursing approved refund payments via direct. It’s important to note that taxpayers. Final payment due in january 2025.

IRS Payment Plan How It Works Tax Relief Center

Web when are taxes due? Our tax refund chart lists the federal tax refund dates for direct deposits and mailed. Web review information about due dates and when to file tax returns. Web payment of federal taxes: For example, the standard penalty for failing to file your annual tax return on time is 5% of.

This Includes Accepting, Processing And Disbursing Approved Refund Payments Via Direct.

Debit card, credit card, or digital wallet:. View amount due, payment plan details, payment history and scheduled payments; Web 2022 estimated tax payment dates. Web every employer engaged in a trade or business who pays remuneration for services performed by employees must report to the irs the wage payments and related.

For Most Taxpayers, The Main Income Tax Return Deadline For 2021 Tax Returns Is April 18 — Aka Irs Tax Day 2022.

22, 2023 — with the 2023 tax filing season in full swing, the irs reminds taxpayers to gather their necessary information and visit irs.gov for. Web payment of federal taxes: Web make payments on your balance, payment plan, estimated tax and more; An irs tax calendar is like a year planner split into quarters.

To Make Your Tax Life Simpler, The Irs Releases A Tax Calendar Each Year.

Web the irs can hit you with penalties and interest if you miss a tax deadline. Web 2024 irs tax calendar. Web according to the irs refunds will generally be paid within 21 days. Web for most taxpayers, the main income tax return deadline for 2020 tax returns is may 17, 2021 — aka irs tax day 2021.

Use The Calendar Below To Track The Due Dates For Irs Tax Filings Each Month.

Pay your individual tax bill or estimated tax payment directly from your checking or savings account at no cost to you. Unless otherwise noted, the dates are when the forms are. These postponements are automatic and apply to all. Web review information about due dates and when to file tax returns.