It 204 Form

It 204 Form - Used to report income, deductions, gains, losses and credits from the operation of a partnership. Certificate of exemption from withholding. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Keep this certificate with your records. Web employee's withholding allowance certificate.

Web employee's withholding allowance certificate. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Certificate of exemption from withholding. Keep this certificate with your records. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Web employee's withholding allowance certificate. Certificate of exemption from withholding. Keep this certificate with your records.

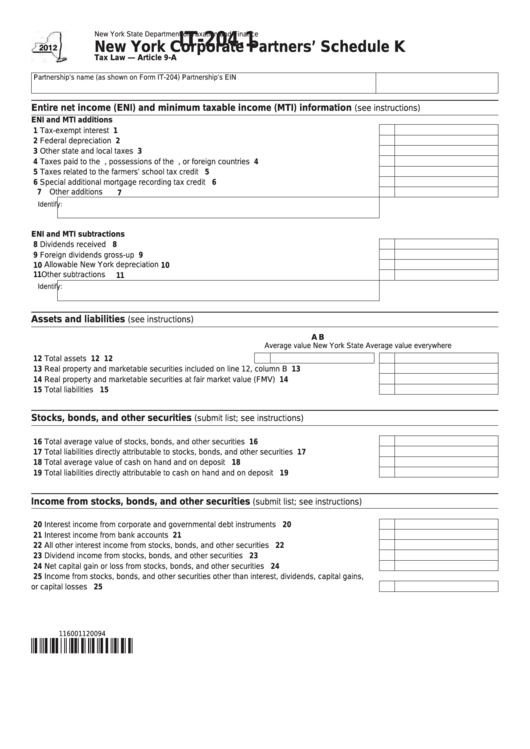

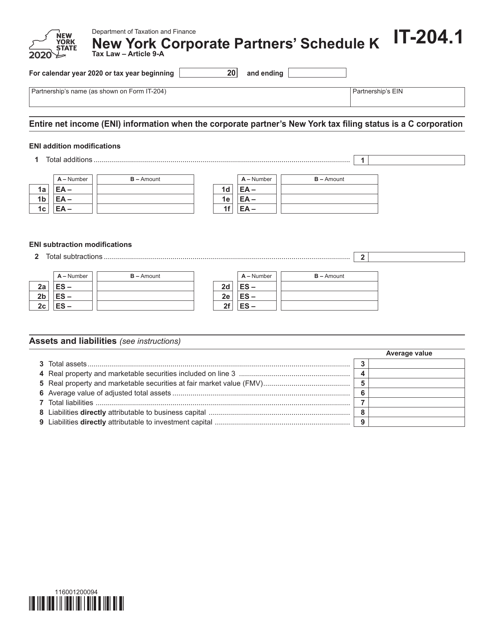

Fillable Form It204.1 New York Corporate Partners' Schedule K 2012

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Certificate of exemption from withholding. Keep this certificate with your records. Web employee's withholding allowance certificate. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions.

204 Form YouTube

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Certificate of exemption from withholding. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Keep this certificate with your records. Web employee's withholding allowance certificate.

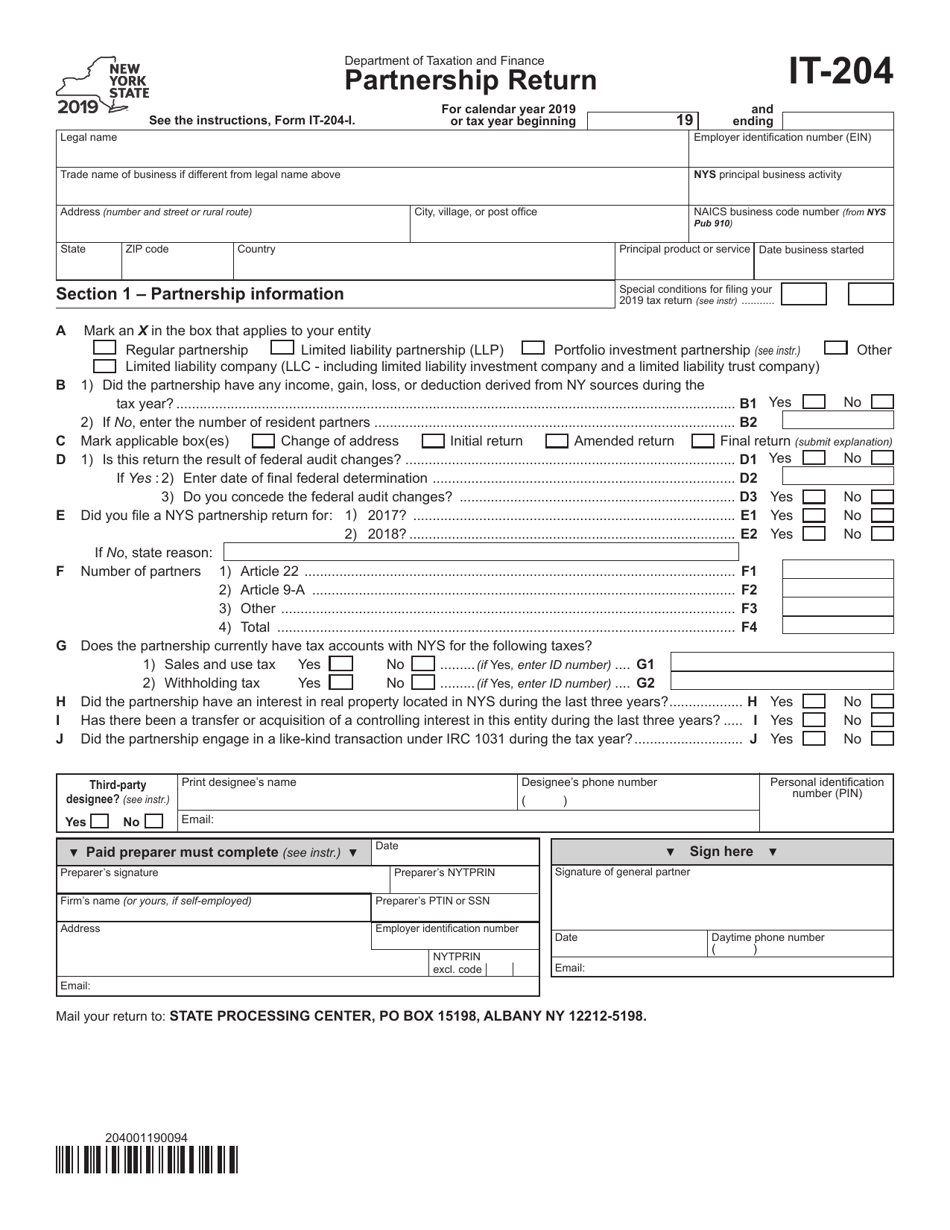

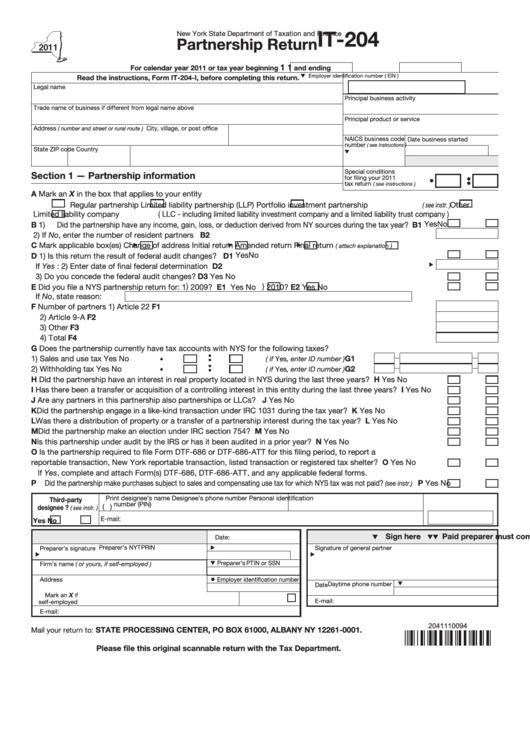

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Certificate of exemption from withholding. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Keep this certificate with your records. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web employee's withholding allowance certificate.

Iowa Form 204 Fill Online, Printable, Fillable, Blank pdfFiller

Keep this certificate with your records. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Certificate of exemption from withholding. Web employee's withholding allowance certificate. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

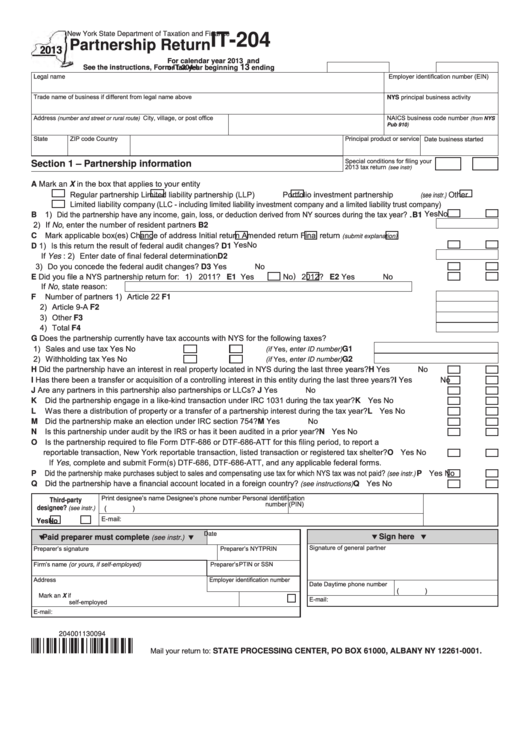

Fillable Form It204 Partnership Return 2013 printable pdf download

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Keep this certificate with your records. Web employee's withholding allowance certificate. Certificate of exemption from withholding.

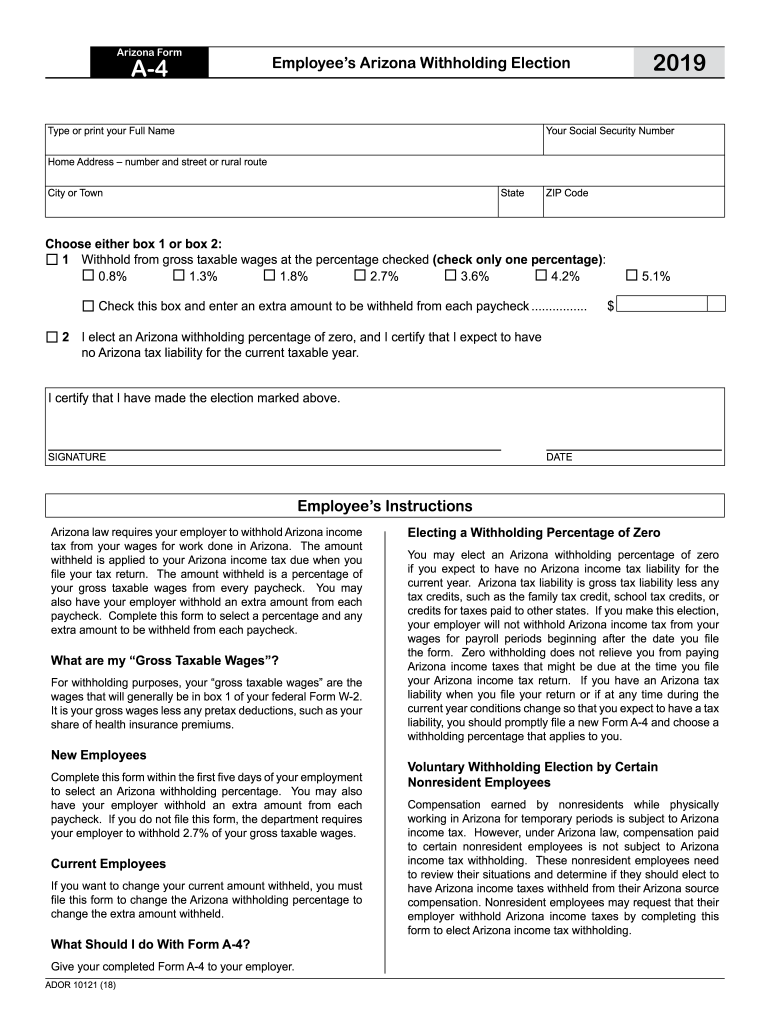

A4 form Fill out & sign online DocHub

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Keep this certificate with your records. Web employee's withholding allowance certificate. Certificate of exemption from withholding.

Form IT204.1 2020 Fill Out, Sign Online and Download Fillable PDF

Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Web employee's withholding allowance certificate. Certificate of exemption from withholding. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Keep this certificate with your records.

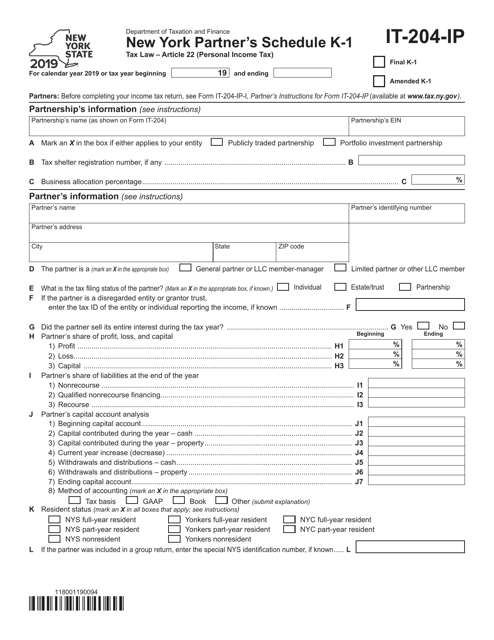

Form IT204IP Download Fillable PDF or Fill Online New York Partner's

Keep this certificate with your records. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web employee's withholding allowance certificate. Certificate of exemption from withholding.

Ny it 204 Fill out & sign online DocHub

Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Certificate of exemption from withholding. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web employee's withholding allowance certificate. Keep this certificate with your records.

Fillable Form It204 Partnership Return 2011 printable pdf download

Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Web employee's withholding allowance certificate. Keep this certificate with your records. Certificate of exemption from withholding. Used to report income, deductions, gains, losses and credits from the operation of a partnership.

Web Employee's Withholding Allowance Certificate.

Keep this certificate with your records. Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the instructions. Certificate of exemption from withholding. Used to report income, deductions, gains, losses and credits from the operation of a partnership.