Kentucky Form 725

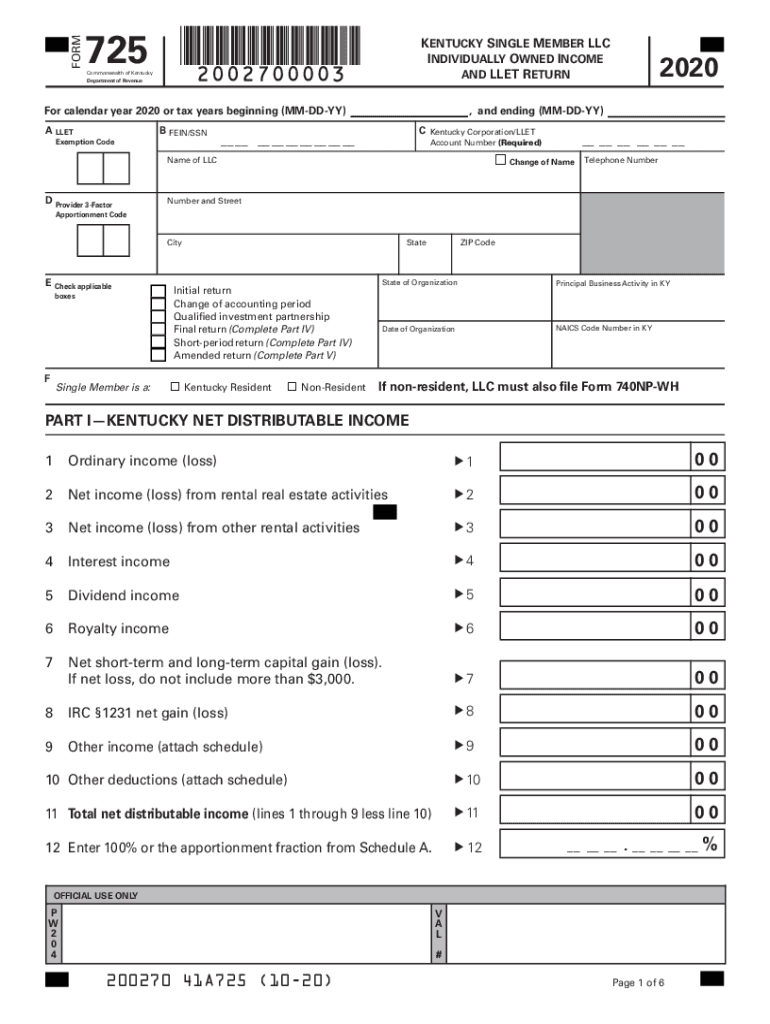

Kentucky Form 725 - This form is for income earned in tax year 2022, with tax returns due in april 2023. Web download or print the 2022 kentucky form 725 instructions (single member llc individually owned income and llet return instructions) for free from the kentucky department of revenue. This form is only applicable for forms 720, 720u, 725, and pte and must be submitted to We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. Net income (loss) from other rental activities. 1 gross receipts from all sources were $3,000,000 or less. 2 all of the llc’s activities were in kentucky. 2 net income (loss) from rental real estate activities. Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. Web use form 725 if any of the following statements are false.

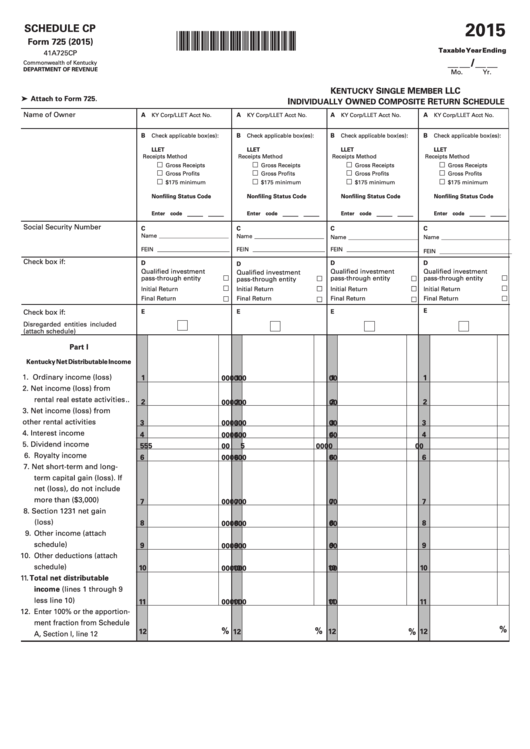

1 gross receipts from all sources were $3,000,000 or less. Web use form 725 if any of the following statements are false. An individual who owns more than one single member llc can file schedule cp, kentucky single member llc individually owned composite return schedule, rather than filing multiple forms (form. We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. 202b lex et justitia c o m m o n w e a l t h o f k e n t u c k y c o u r t of j u s t i e (aoc form 726, order setting final hearing, must be completed and attached if venue is retained. Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; This form is only applicable for forms 720, 720u, 725, and pte and must be submitted to Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. Net income (loss) from other rental activities.

An individual who owns more than one single member llc can file schedule cp, kentucky single member llc individually owned composite return schedule, rather than filing multiple forms (form. This form is only applicable for forms 720, 720u, 725, and pte and must be submitted to How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. 2 net income (loss) from rental real estate activities. We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; This form is for income earned in tax year 2022, with tax returns due in april 2023. 202b lex et justitia c o m m o n w e a l t h o f k e n t u c k y c o u r t of j u s t i e (aoc form 726, order setting final hearing, must be completed and attached if venue is retained. Web download or print the 2022 kentucky form 725 instructions (single member llc individually owned income and llet return instructions) for free from the kentucky department of revenue. Net income (loss) from other rental activities.

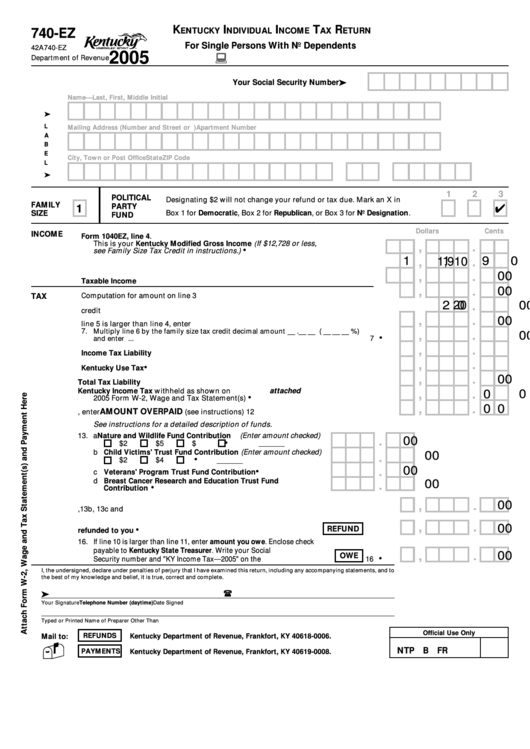

Fillable Form 740Ez Kentucky Individual Tax Return 2005

Net income (loss) from other rental activities. Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. How to obtain additional.

Form 725 Kentucky Fill Out and Sign Printable PDF Template signNow

Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. 2 all of the llc’s activities were in kentucky. 2 net income (loss) from rental real estate activities. An individual who owns more than one single member llc.

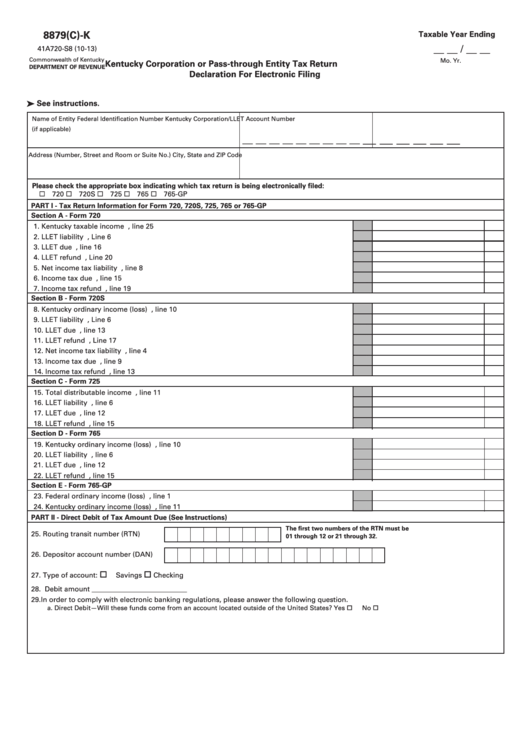

Form 8879(C)K Kentucky Corporation Or PassThrough Entity Tax Return

Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; 1 gross receipts from all sources were $3,000,000 or less. Web download or print the 2022 kentucky form 725 instructions (single member llc individually owned income and llet return instructions) for free from the kentucky department of.

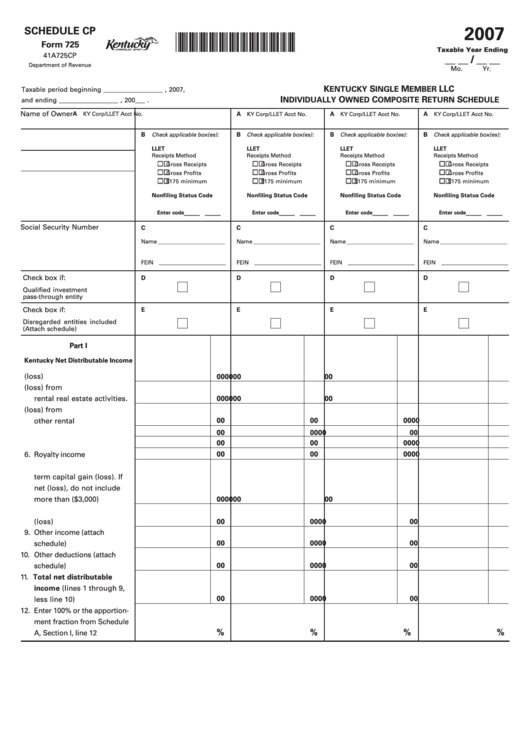

Fillable Form 725 Schedule Cp Kentucky Single Member Llc

2 all of the llc’s activities were in kentucky. 1 gross receipts from all sources were $3,000,000 or less. Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; This form is for income earned in tax year 2022, with tax returns due in april 2023. How.

Form 725 Schedule Cp Kentucky Single Member Llc Individually Owned

Net income (loss) from other rental activities. Web use form 725 if any of the following statements are false. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. This form is for income earned in tax.

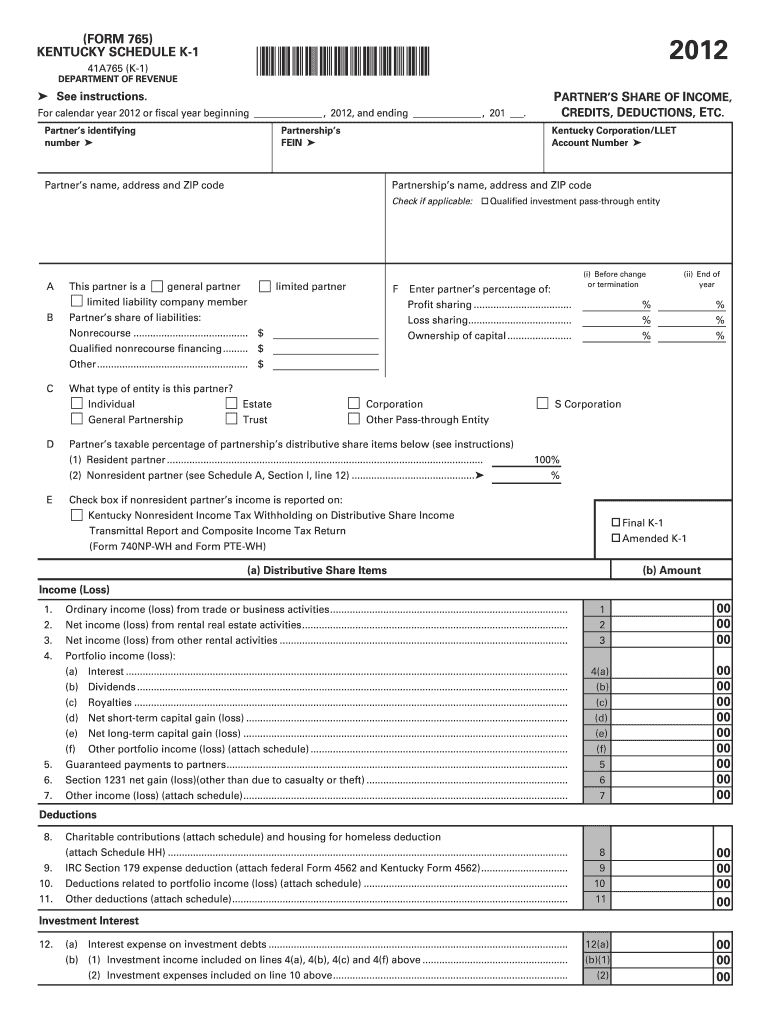

Kentucky form 765 Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; 2 net income (loss) from rental real estate activities. Web we last updated the kentucky single member llc individually owned.

Pro form 725 TL treadmillWorks (Please read description before

Net income (loss) from other rental activities. We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. An individual who owns more than one single member llc can file schedule cp, kentucky single member llc individually owned.

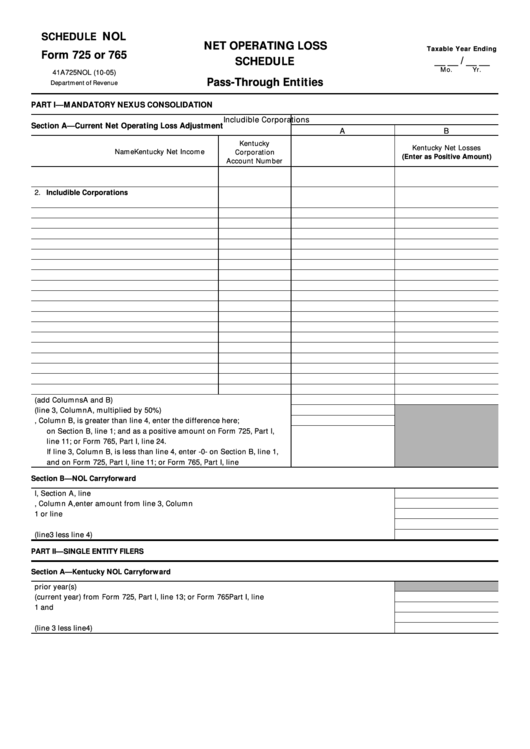

Form 725 Or 765 Net Operating Loss Schedule 2005 printable pdf download

Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or; This form is for income earned in tax year 2022, with tax returns due in april 2023. Web download or print the 2022 kentucky form 725 instructions (single member llc individually owned income and llet return instructions).

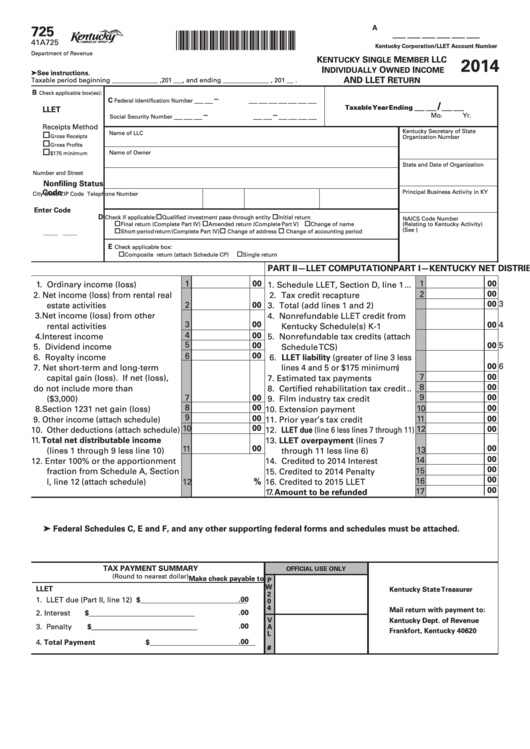

Form 725 Kentucky Single Member Llc Individually Owned And

Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. 2 all of the llc’s activities were in kentucky. This.

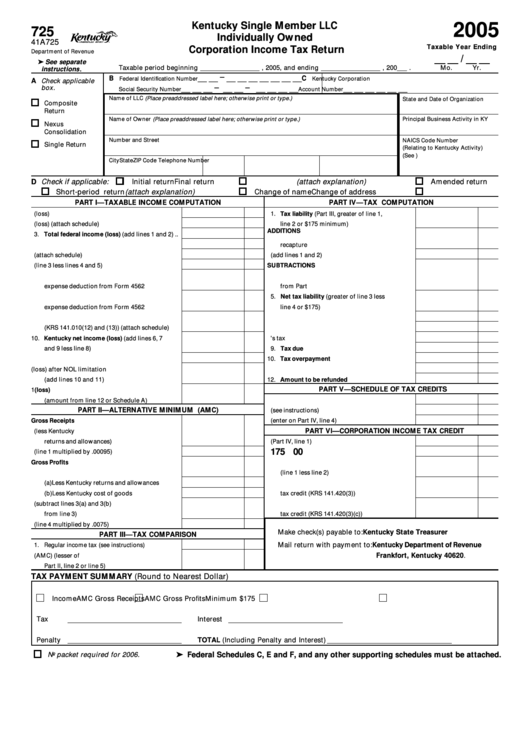

Form 725 Individually Owned Corporation Tax Return 2005

How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. We last updated kentucky form 725 in february 2023 from the kentucky department of revenue. 2 net income (loss) from rental real estate activities. Web member llc is required by law to file a kentucky single member llc individually owned income and.

Net Income (Loss) From Other Rental Activities.

An individual who owns more than one single member llc can file schedule cp, kentucky single member llc individually owned composite return schedule, rather than filing multiple forms (form. How to obtain additional forms forms and instructions are available at all kentucky taxpayer service centers (see page. This form is only applicable for forms 720, 720u, 725, and pte and must be submitted to We last updated kentucky form 725 in february 2023 from the kentucky department of revenue.

2 Net Income (Loss) From Rental Real Estate Activities.

Web we last updated the kentucky single member llc individually owned & llet return in february 2023, so this is the latest version of form 725, fully updated for tax year 2022. Web use form 725 if any of the following statements are false. 202b lex et justitia c o m m o n w e a l t h o f k e n t u c k y c o u r t of j u s t i e (aoc form 726, order setting final hearing, must be completed and attached if venue is retained. Web download or print the 2022 kentucky form 725 instructions (single member llc individually owned income and llet return instructions) for free from the kentucky department of revenue.

1 Gross Receipts From All Sources Were $3,000,000 Or Less.

This form is for income earned in tax year 2022, with tax returns due in april 2023. 2 all of the llc’s activities were in kentucky. Web member llc is required by law to file a kentucky single member llc individually owned income and llet return (form 725) or;