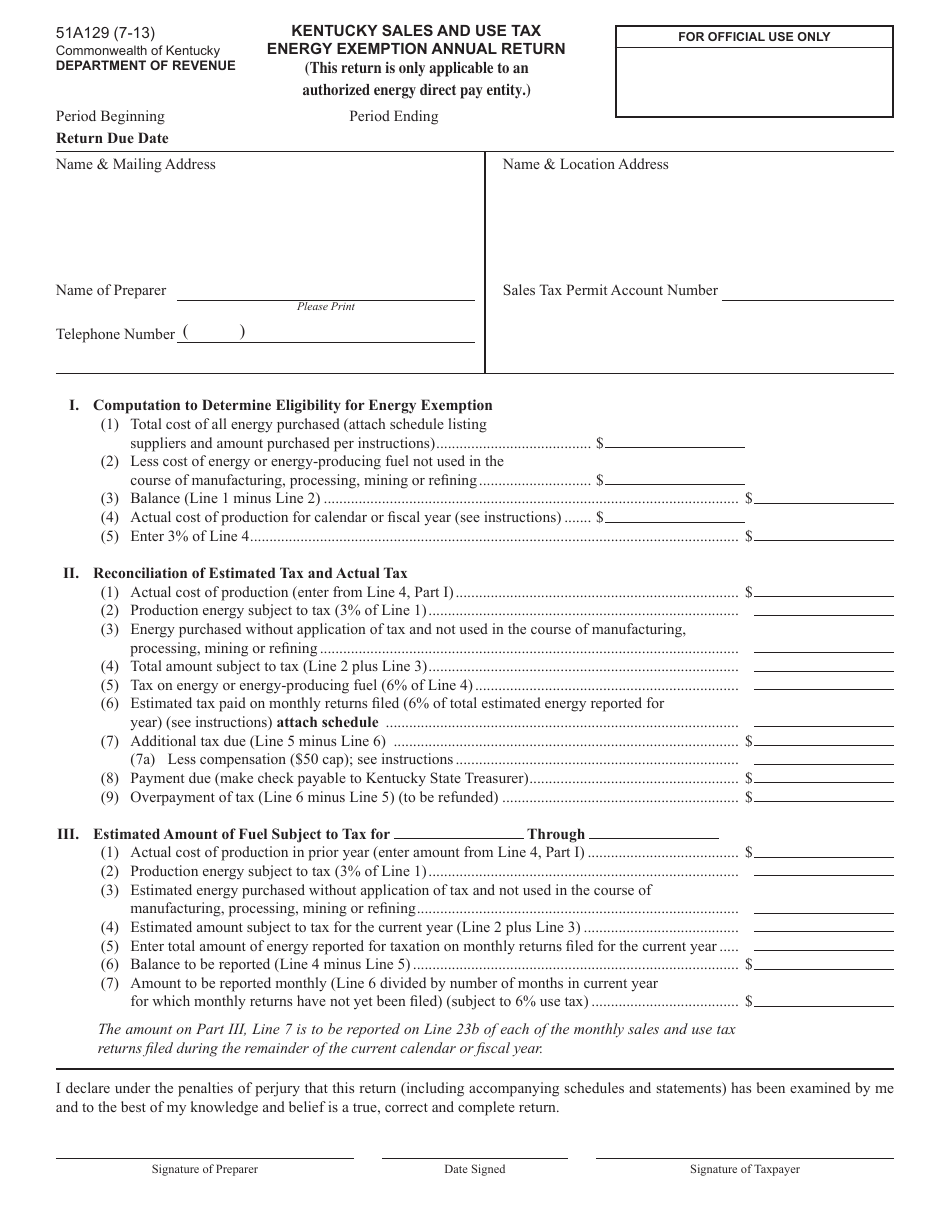

Ky Utility Tax Exemption Form

Ky Utility Tax Exemption Form - Computation to determine eligibility for energy exemption (1) total cost of all energy purchased (attach schedule listing. Download or email ky 51a126 & more fillable forms, register and subscribe now! Utility gross receipts license tax (ugrlt) energy exemption annual return. We ask that you complete the entire form. Web a provider seeking relief from this electronic filing and payment requirement must submit a written request for a hardship exemption. Pdf format new facility locate agreement form: (weht) — utility customers around kentucky will soon see another tax tacked onto their bill — unless they fill out an exemption form. Kenergy is one of 26 electric. Web instructions submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. The kentucky sales and use tax law exempts from.

We ask that you complete the entire form. Web commonwealth of kentucky department of revenue utility gross receipts license tax (ugrlt) energy exemption annual return. The kentucky sales and use tax law exempts from. Complete, edit or print tax forms instantly. Web commonwealth of kentucky department of revenue utility gross receipts license tax (ugrlt) energy exemption annual return. This certifi cate cannot be issued or used in any way by a construction contractor to purchase. If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption. Average local sales tax rate: (weht) — utility customers around kentucky will soon see another tax tacked onto their bill — unless they fill out an exemption form. Web kentucky statute of limitations on tax refund.

The kentucky sales and use tax law exempts from. Web name of exempt institution name of vendor address caution toseller: Average local sales tax rate: Web commonwealth of kentucky department of revenue utility gross receipts license tax (ugrlt) energy exemption annual return. To claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Web instructions submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. Web kentucky statute of limitations on tax refund. Web a provider seeking relief from this electronic filing and payment requirement must submit a written request for a hardship exemption. Complete, edit or print tax forms instantly. Pdf format new facility locate agreement form:

You Must Apply for a Utility Sales Tax Exemption and Refund—Separately

Web tax exemption forms may be submitted to kentucky american water by regular mail at one water street, camden, new jersey 08102, attn: Average local sales tax rate: The kentucky sales and use tax law exempts from. This certifi cate cannot be issued or used in any way by a construction contractor to purchase. Web beginning january 1, 2023, only.

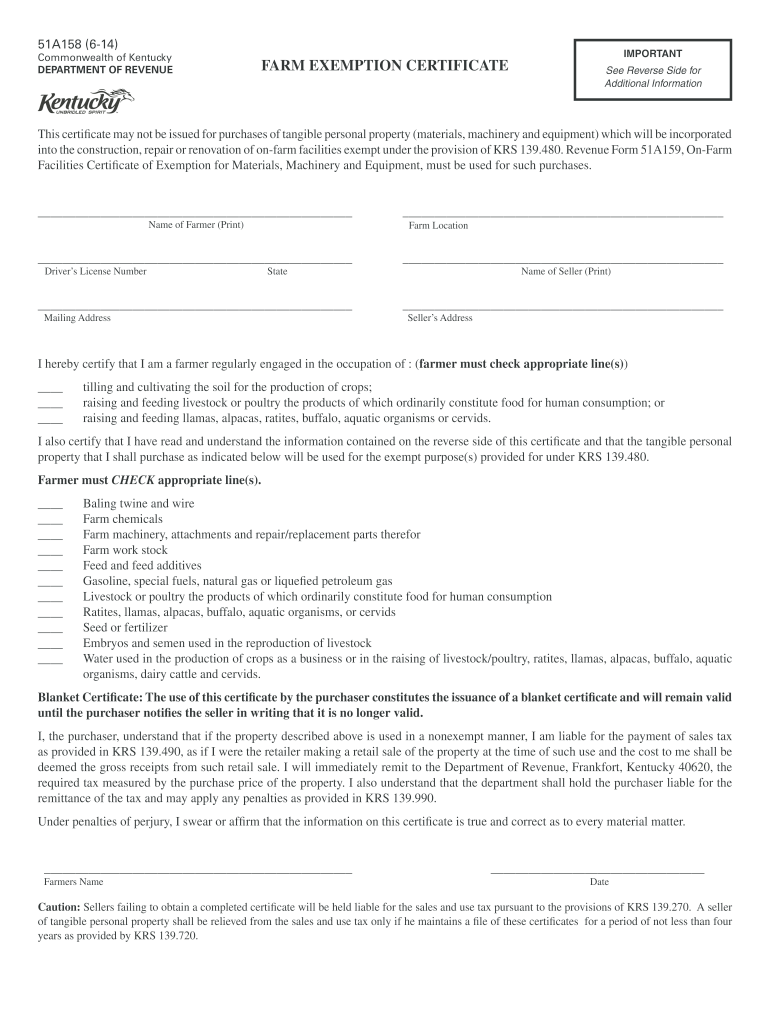

Kentucky farm tax exempt Fill out & sign online DocHub

Web name of exempt institution name of vendor address caution toseller: Web utility companies are referring members to the department of revenue for further clarification. Kenergy is one of 26 electric. Complete, edit or print tax forms instantly. Each resident may have only.

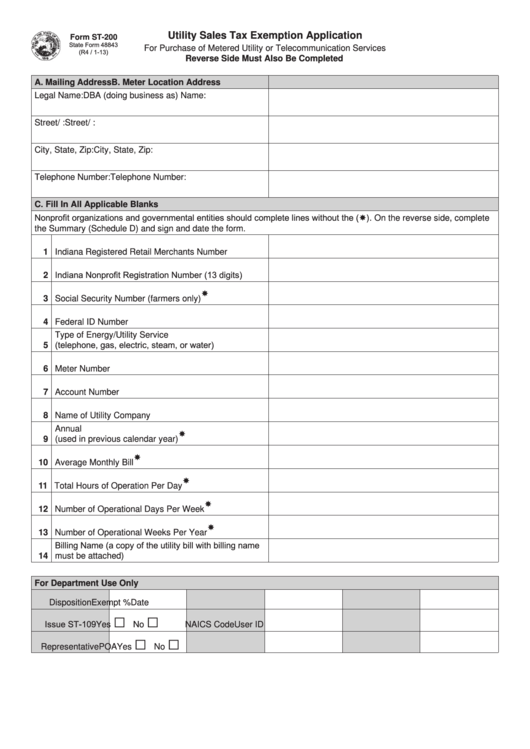

Fillable Form St200 Utility Sales Tax Exemption Application

(weht) — utility customers around kentucky will soon see another tax tacked onto their bill — unless they fill out an exemption form. Kenergy is one of 26 electric. The amount on line 9 is to be. Pdf format new facility locate agreement form: Download or email ky 51a126 & more fillable forms, register and subscribe now!

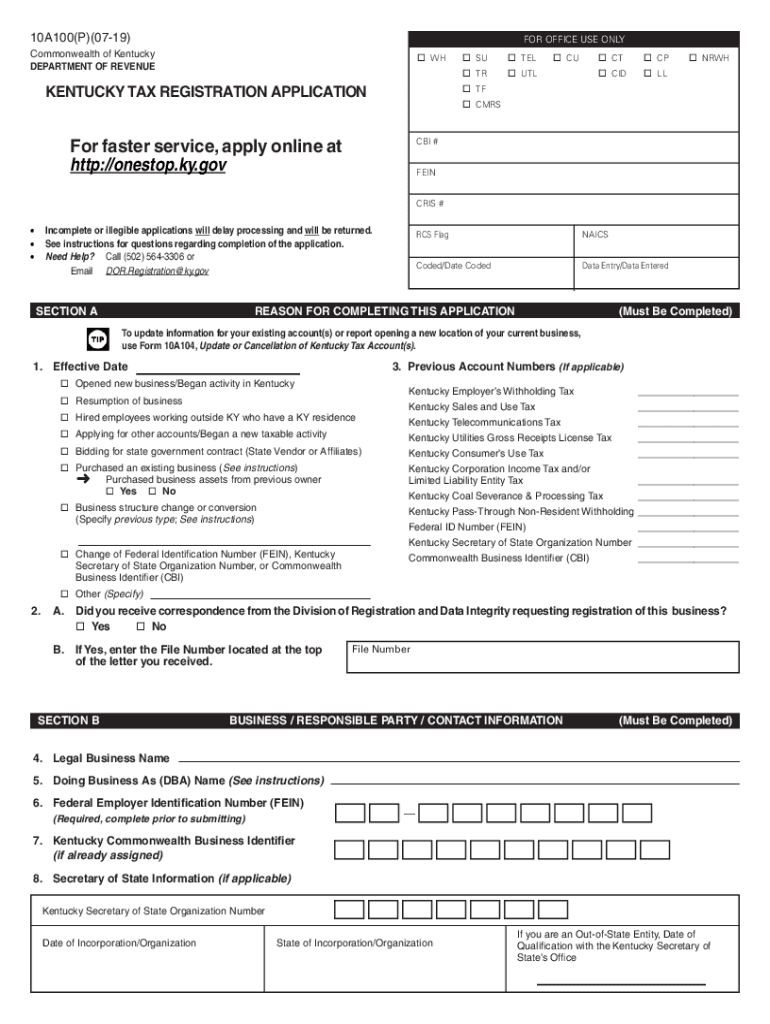

Form Kentucky Taxes Fill Out and Sign Printable PDF Template signNow

Pdf format new facility locate agreement form: Web for more information, please see the kdor website. Computation to determine eligibility for energy exemption (1) total cost of all energy purchased (attach schedule listing. Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of. The kentucky sales and use tax.

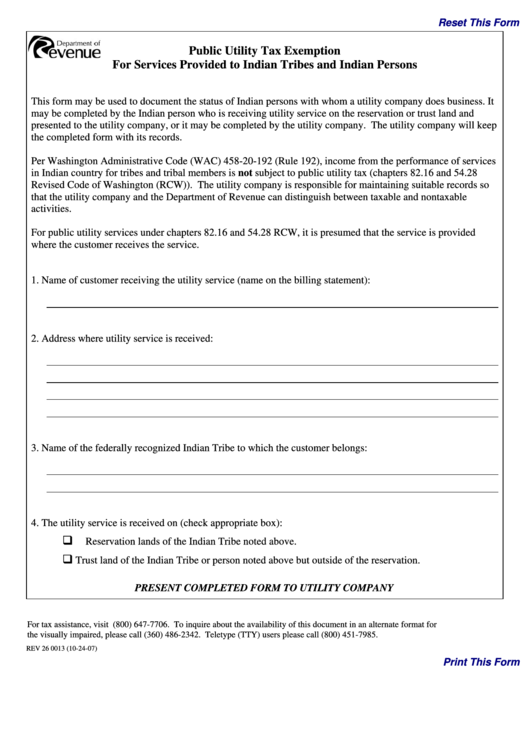

Fillable Form Rev 26 0013 Public Utility Tax Exemption For Services

Each resident may have only. Web for more information, please see the kdor website. Kenergy is one of 26 electric. The amount on line 9 is to be. Web beginning january 1, 2023, only a person’s “domicile” (primary residence) will be exempt from sales tax on utility services, including electric bills.

2015 Form CA C0185 Los Angeles Fill Online, Printable, Fillable

Web commonwealth of kentucky department of revenue utility gross receipts license tax (ugrlt) energy exemption annual return. Computation to determine eligibility for energy exemption (1) total cost of all energy purchased (attach schedule listing. If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption. (weht) — utility customers.

Ohio Tax Exempt Form Fill and Sign Printable Template Online US

Web beginning january 1, 2023, only a person’s “domicile” (primary residence) will be exempt from sales tax on utility services, including electric bills. If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption. Web water sewer forms for all utilities new facility locate agreement faq: Web name of.

Form 51A129 Download Printable PDF or Fill Online Energy Exemption

If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption. Utility gross receipts license tax (ugrlt) energy exemption annual return. Download or email ky 51a126 & more fillable forms, register and subscribe now! Web a provider seeking relief from this electronic filing and payment requirement must submit a.

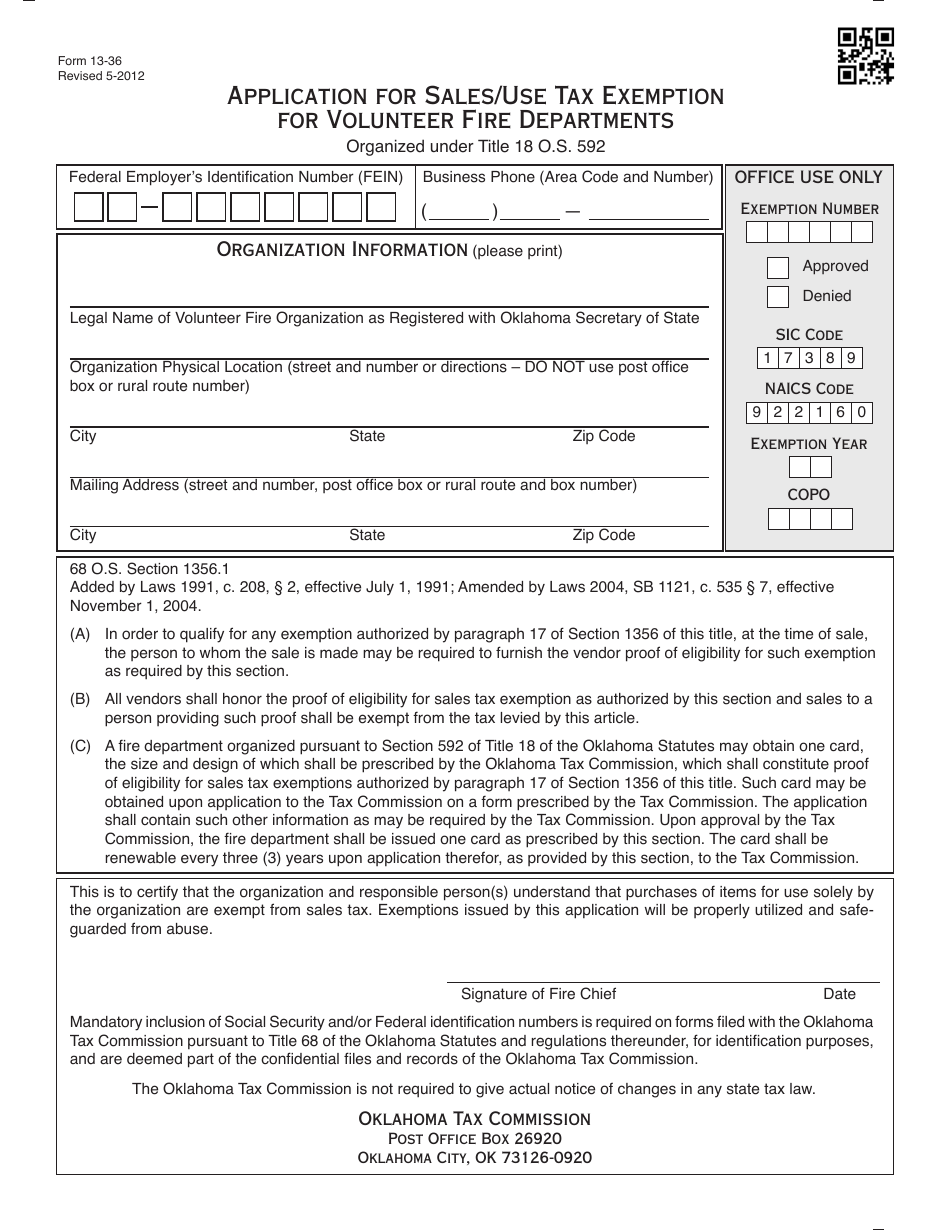

How To Get A Tax Id Number Oklahoma Gallery Wallpaper

Average local sales tax rate: All fields marked with an asterisk ( *) are required. Web for more information, please see the kdor website. Web a griculture exemption number search. Web kentucky statute of limitations on tax refund.

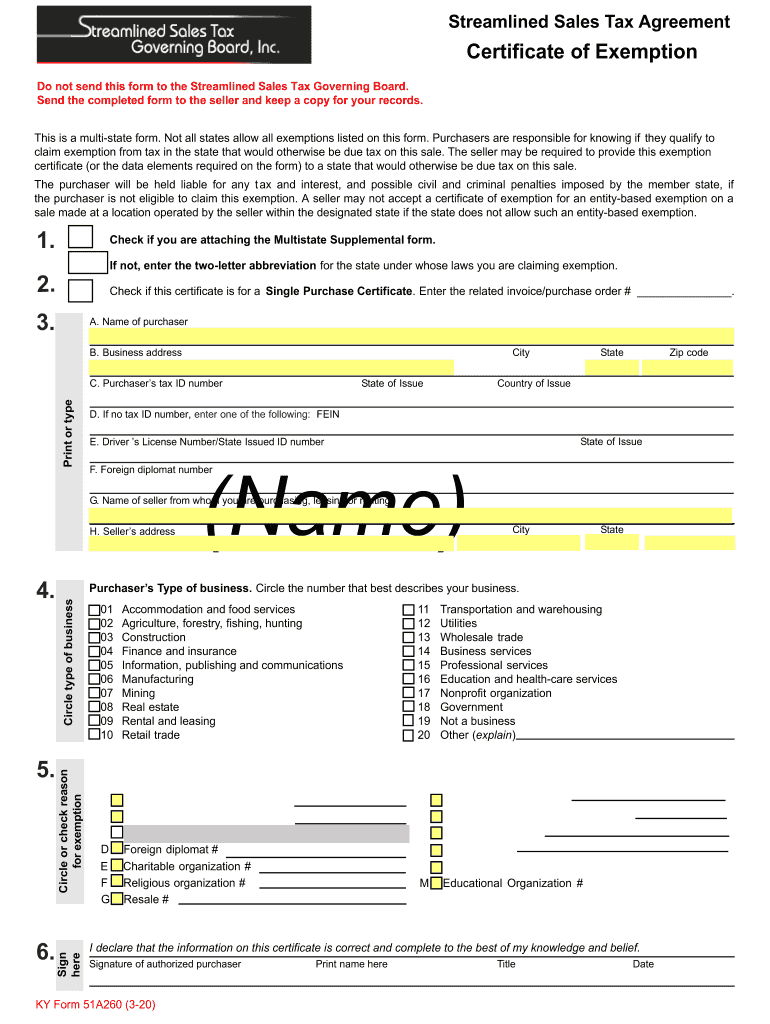

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

The amount on line 9 is to be. If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption. (july 15, 2019)—due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105)to. Web commonwealth of kentucky department of revenue utility gross receipts license.

Web Commonwealth Of Kentucky Department Of Revenue Utility Gross Receipts License Tax (Ugrlt) Energy Exemption Annual Return.

Download or email ky 51a126 & more fillable forms, register and subscribe now! Web instructions submit the declaration of domicile to each applicable utility provider or rural electric cooperative, not to the department of revenue. (july 15, 2019)—due to recent legislative changes, the department of revenue (dor) has updated the resale certificate (form 51a105)to. View the 51a380 tax exemption form here:

The Kentucky Sales And Use Tax Law Exempts From.

Web for more information, please see the kdor website. Web a griculture exemption number search. The amount on line 9 is to be. If you have multiple accounts with us, you can claim exemption to your primary residence by filling out the required tax exemption.

Pdf Format New Facility Locate Agreement Form:

Web kentucky statute of limitations on tax refund. Sales and use tax faqs (09/06 /22) kentucky sales and use tax is imposed at the rate of 6 percent of. Each resident may have only. Computation to determine eligibility for energy exemption (1) total cost of all energy purchased (attach schedule listing.

Web A Provider Seeking Relief From This Electronic Filing And Payment Requirement Must Submit A Written Request For A Hardship Exemption.

To claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Average local sales tax rate: (weht) — utility customers around kentucky will soon see another tax tacked onto their bill — unless they fill out an exemption form. The amount on line 9 is to be.