Long Calendar Spread

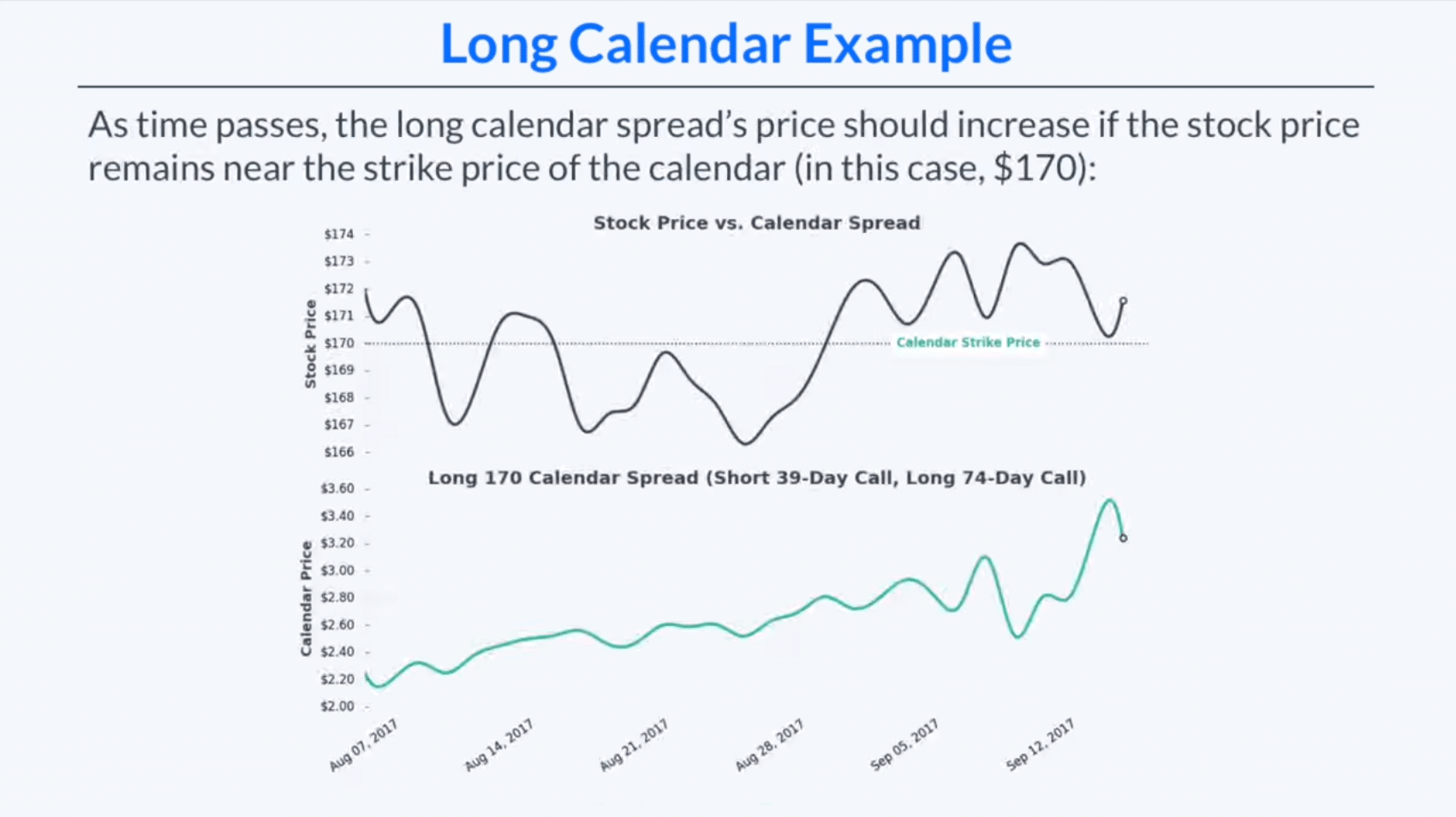

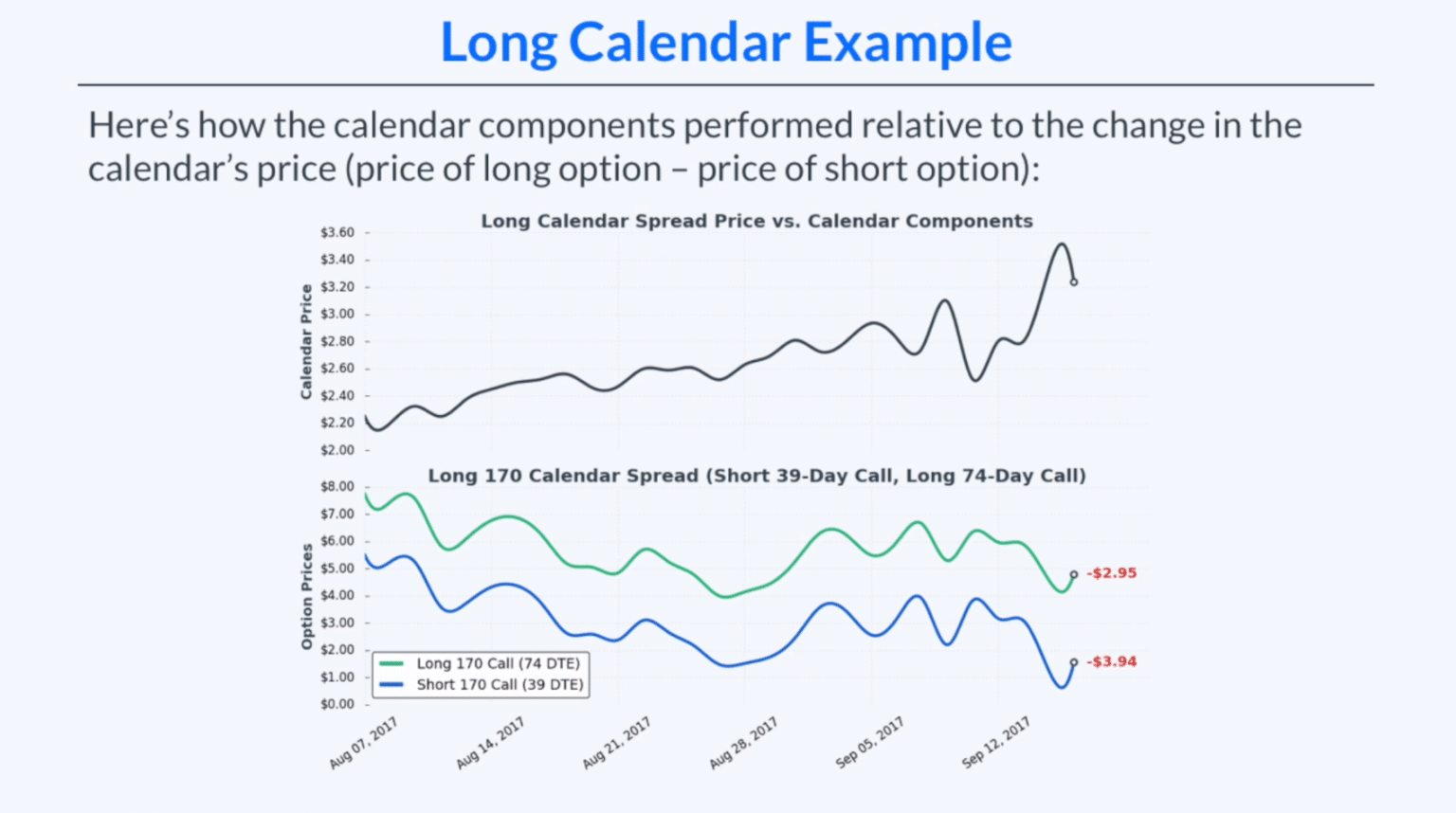

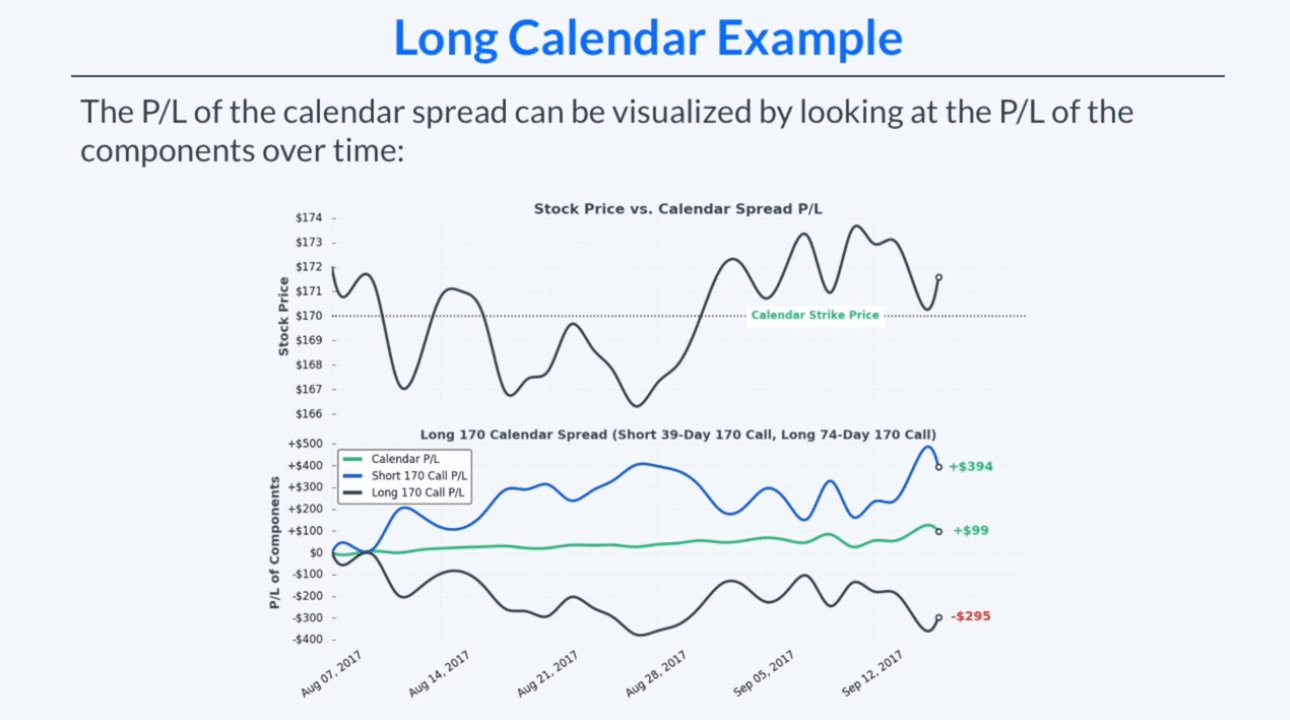

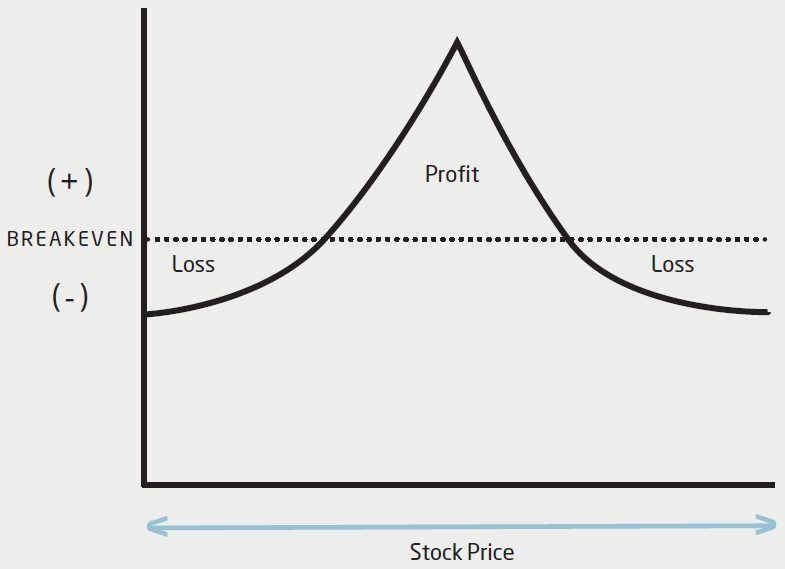

Long Calendar Spread - See examples, logic, and steps to identify and. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. Web ein long call calendar spread (auch: Web lesson 7 of 12. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. See examples of long and short call and put. What you need to know. Find out the profit, loss,.

Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Find out the profit, loss,. See examples of long and short call and put. Web lesson 7 of 12. Web ein long call calendar spread (auch: Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. What you need to know. See examples, logic, and steps to identify and. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay.

Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web lesson 7 of 12. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. Web ein long call calendar spread (auch: Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. See examples of long and short call and put. Find out the profit, loss,. What you need to know. See examples, logic, and steps to identify and.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. What you need to know. Find out the profit, loss,. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call.

Long Calendar Spreads for Beginner Options Traders projectfinance

What you need to know. Web lesson 7 of 12. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit.

Printable Calendar Spreads on Behance

Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web ein long call calendar spread (auch: See examples of long and short call and put. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options.

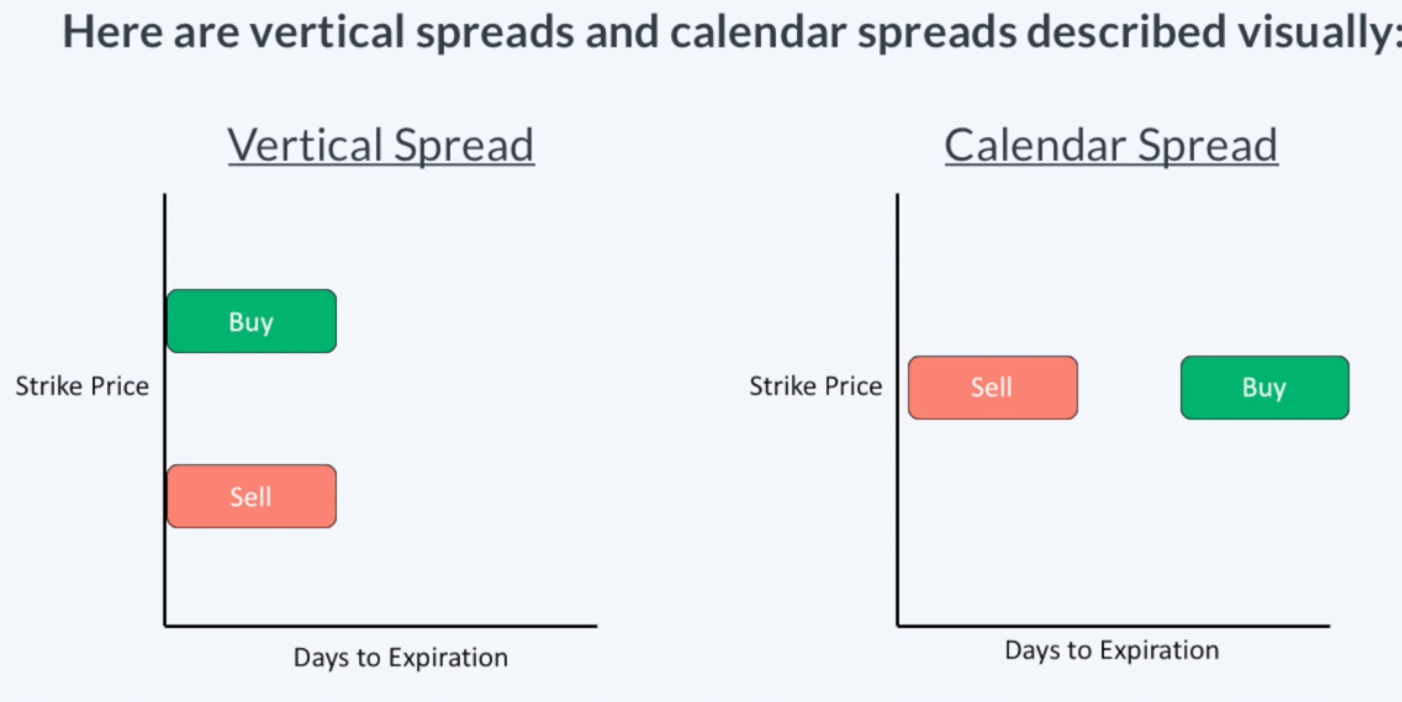

How to Trade Options Calendar Spreads (Visuals and Examples)

Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web ein long call calendar spread (auch: What you need to know. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. See examples, logic, and steps to identify and.

Long Calendar Spreads for Beginner Options Traders projectfinance

See examples of long and short call and put. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. See examples, logic, and steps to identify and. Web lesson 7 of 12. Web ein long call calendar spread (auch:

The Long Calendar Spread Explained 1 Options Trading Software

Web lesson 7 of 12. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web ein long call calendar spread (auch: Find out the profit, loss,. See examples, logic, and steps to identify and.

Mastering Long Calendar Spreads A Comprehensive Guide

What you need to know. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability. Web ein long call calendar spread (auch: See examples, logic, and steps to identify and. Web lesson 7 of 12.

Long Calendar Spread with Puts Strategy With Example

Find out the profit, loss,. Web the long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. See examples of.

Long Calendar Spreads for Beginner Options Traders projectfinance

See examples, logic, and steps to identify and. See examples of long and short call and put. What you need to know. Web lesson 7 of 12. Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability.

Long Calendar Spreads Unofficed

Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. See examples, logic, and steps to identify and. Web ein long call calendar spread (auch: Web the long calendar spread (or long call calendar spread) is a strategy for traders betting on stability..

Web The Long Calendar Spread (Or Long Call Calendar Spread) Is A Strategy For Traders Betting On Stability.

Web lesson 7 of 12. Find out the profit, loss,. Web learn how to use a calendar spread, a neutral option trading strategy that involves buying and selling options with different expiration dates, to profit from changes. See examples, logic, and steps to identify and.

Web The Long Calendar Spread Allows You To Buy And Sell Option Contracts With Different Expiration Dates, With The Likelihood Of Profiting From Time Decay.

What you need to know. See examples of long and short call and put. Web learn how to use a long call calendar spread to combine a bullish and a bearish outlook on a stock. Web ein long call calendar spread (auch: