Louisiana Tax Exempt Form

Louisiana Tax Exempt Form - And (c) you and your spouse maintain your domicile in another state. (d) the wages are not paid for employment as a. Web under penalties of perjury, i declare that i have examined this exemption certificate and to the best of my knowledge and belief, it is true, correct, and complete. Louisiana sales tax exemption certificate louisiana rev. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; If any of these links are broken, or you can't find the form you need, please let us know. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. 47:305(a)(4)(a), 47:305(a)(4)(b)(ii) louisiana department of revenue revenue processing center Web for your wages to be exempt from louisiana income taxes, (a) you must be a nonresident of louisiana;

(b) you are here in louisiana solely to be with your spouse; Louisiana sales tax exemption certificate louisiana rev. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. File your clients' individual, corporate and composite partnership extension in bulk. (d) the wages are not paid for employment as a. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; You can find resale certificates for other states here. If any of these links are broken, or you can't find the form you need, please let us know. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel.

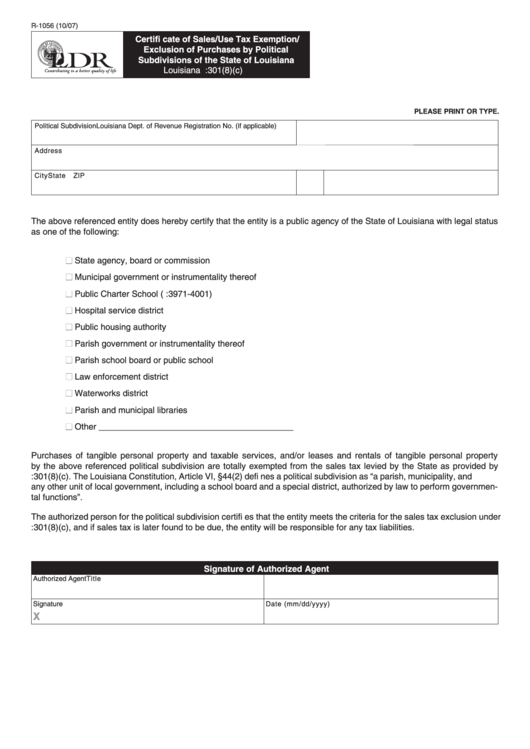

47:305(a)(4)(a), 47:305(a)(4)(b)(ii) louisiana department of revenue revenue processing center Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. (d) the wages are not paid for employment as a. (b) you are here in louisiana solely to be with your spouse; (c) you performed employment duties in more than one state during the calendar year; And (c) you and your spouse maintain your domicile in another state. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. Web under penalties of perjury, i declare that i have examined this exemption certificate and to the best of my knowledge and belief, it is true, correct, and complete. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by the above referenced political subdivision are totally exempted from the sales tax levied by the state as provided by r.s. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year;

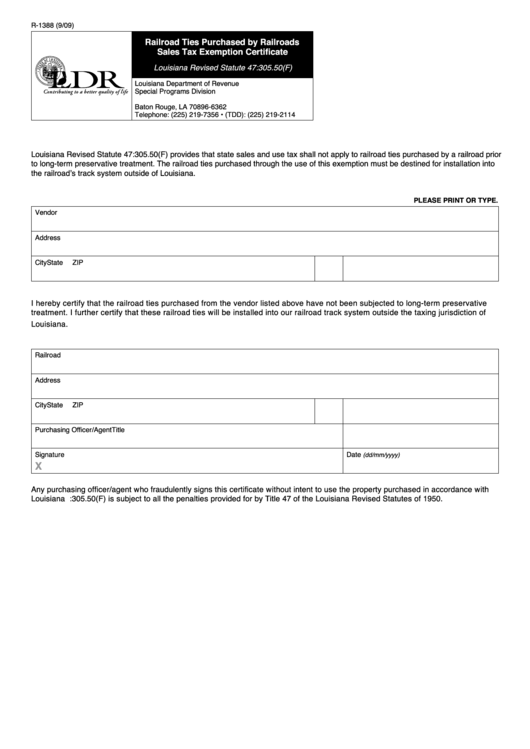

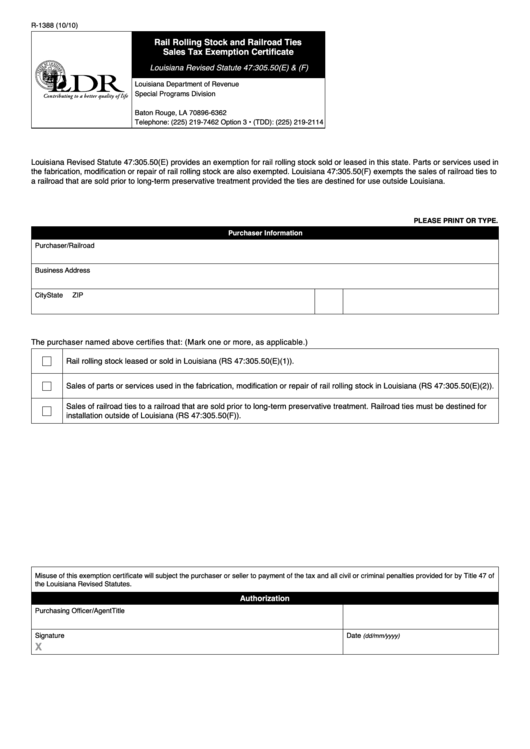

Fillable Form R1388 Railroad Ties Purchased By Railroads Sales Tax

(d) the wages are not paid for employment as a. Web this form is to be completed by an authorized buyer and forwarded to the seller for retention. Misuse of the certificate by the seller or the purchaser will subject either party to the civil and criminal penalties provided by law. (c) you performed employment duties in more than one.

Louisiana tax exempt form Docs & forms

(d) the wages are not paid for employment as a. (c) you performed employment duties in more than one state during the calendar year; And (c) you and your spouse maintain your domicile in another state. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. Web we have four louisiana sales tax.

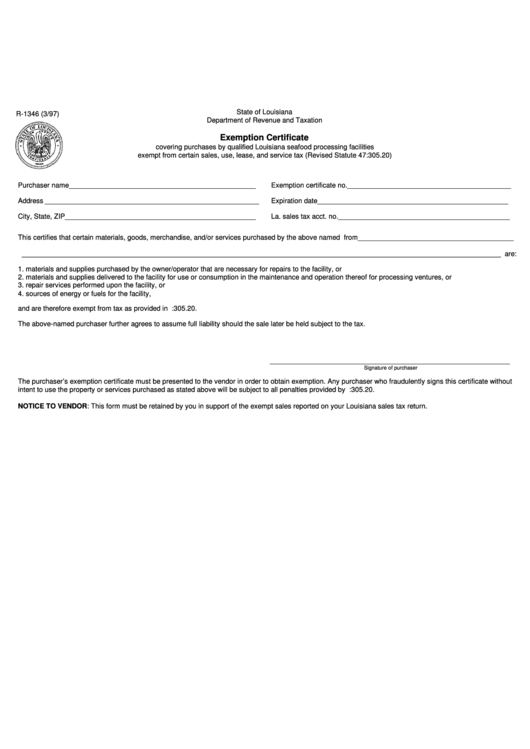

Fillable Form R1346 Exemption Certificate State Of Louisiana

(b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; File your clients' individual, corporate and composite partnership extension in bulk. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption.

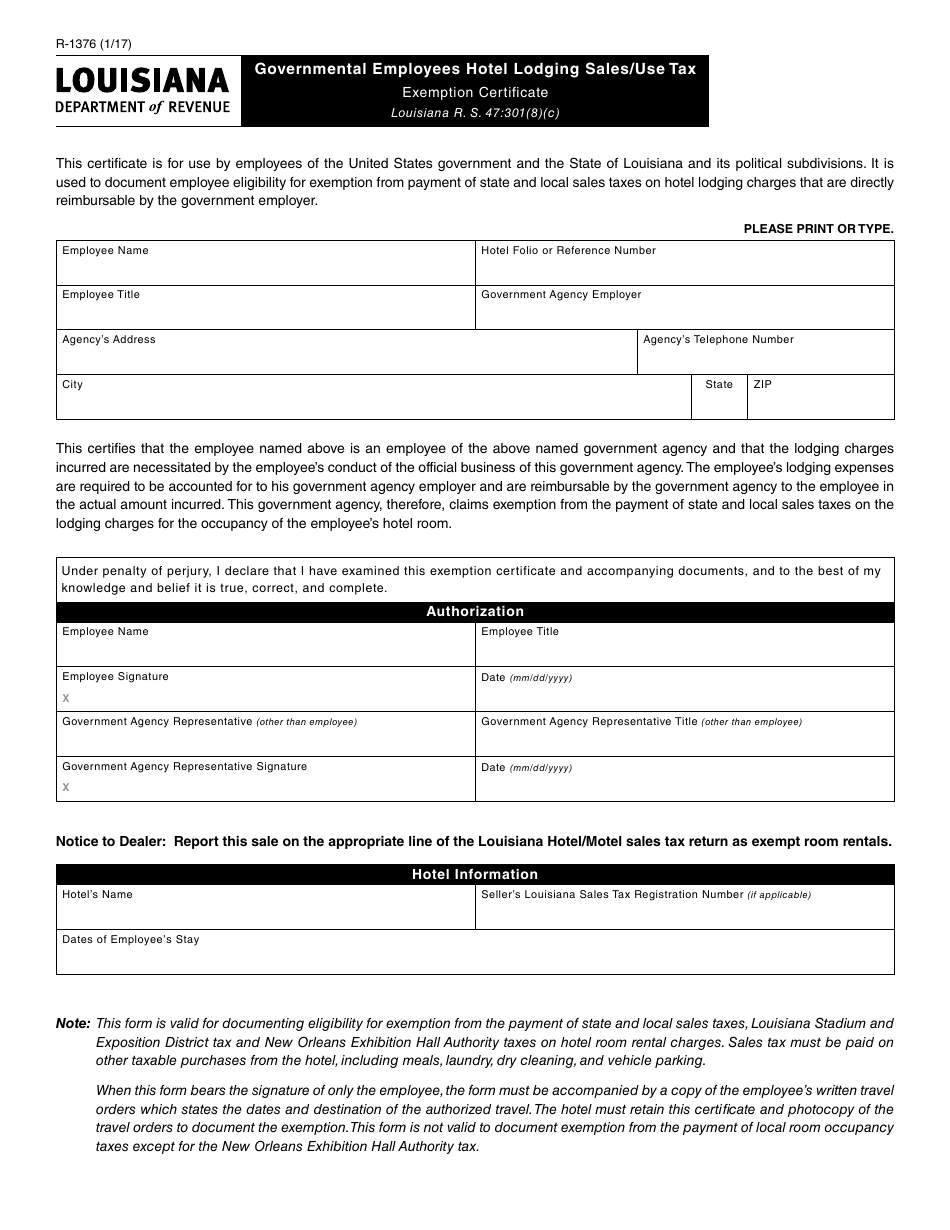

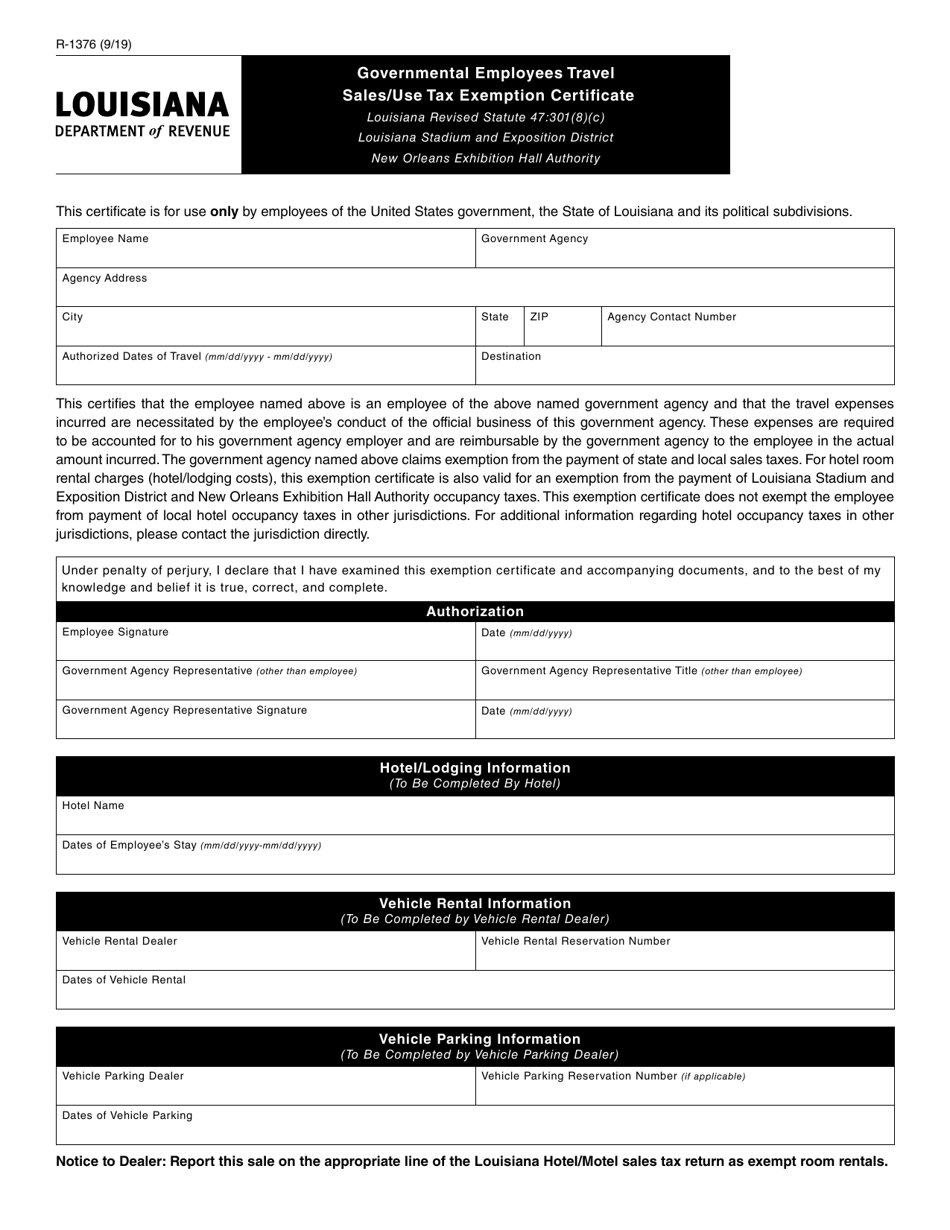

Form R1376 Download Fillable PDF or Fill Online Governmental Employees

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by the above referenced political subdivision are totally exempted from the sales tax levied by the state as provided by r.s. You can find resale certificates.

Louisiana Hotel Tax Exempt Form Fill Online, Printable, Fillable

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; You can find resale certificates for other states here. And (c) you and your spouse maintain your domicile in another state. Web.

Tax Exemption Form Fill Online, Printable, Fillable, Blank pdfFiller

If any of these links are broken, or you can't find the form you need, please let us know. Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. File your clients' individual, corporate and composite partnership extension in bulk. Web for your wages to be exempt from.

Fillable Form R1056 Certifi Cate Of Sales/use Tax Exemption

File your clients' individual, corporate and composite partnership extension in bulk. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. Web under penalties of perjury, i declare that i have examined this exemption certificate.

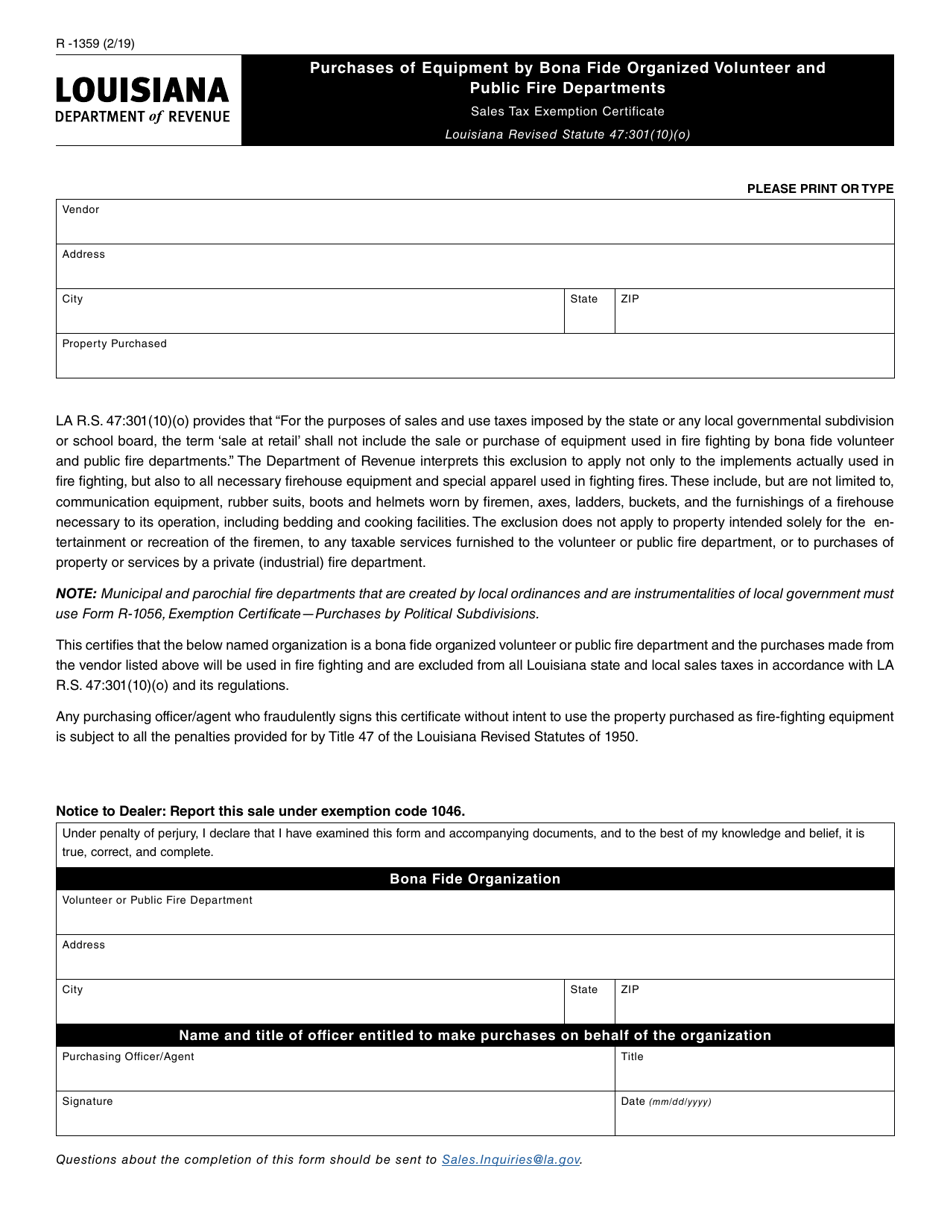

Form R1359 Download Fillable PDF or Fill Online Sales Tax Exemption

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. And (c) you and your spouse maintain your domicile in another state. Web under penalties of perjury, i declare that i have examined this exemption certificate and to the best of my knowledge and belief, it is true, correct, and complete. Web for.

Form R1376 Download Fillable PDF or Fill Online Governmental Employees

If any of these links are broken, or you can't find the form you need, please let us know. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. (c) you performed employment duties in.

Top 46 Louisiana Tax Exempt Form Templates free to download in PDF format

Misuse of the certificate by the seller or the purchaser will subject either party to the civil and criminal penalties provided by law. Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. File your.

47:305(A)(4)(A), 47:305(A)(4)(B)(Ii) Louisiana Department Of Revenue Revenue Processing Center

Web purchases of tangible personal property and taxable services, and/or leases and rentals of tangible personal property by the above referenced political subdivision are totally exempted from the sales tax levied by the state as provided by r.s. See the estimated amount of cap available for solar tax credits and motion picture investor and infrastructure tax credits. (b) you will be paid wages for employment duties performed in louisiana for 25 or fewer days in the calendar year; Web this certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions.

Web Find Out When All State Tax Returns Are Due.

Web if the louisiana account number entered holds a valid resale exemption, a message will appear with the account number and name confirming the account holder’s resale exemption and the expiration date of the exemption. (b) you are here in louisiana solely to be with your spouse; And (c) you and your spouse maintain your domicile in another state. Louisiana sales tax exemption certificate louisiana rev.

You Can Find Resale Certificates For Other States Here.

Web this form is to be completed by an authorized buyer and forwarded to the seller for retention. Misuse of the certificate by the seller or the purchaser will subject either party to the civil and criminal penalties provided by law. Web we have four louisiana sales tax exemption forms available for you to print or save as a pdf file. If any of these links are broken, or you can't find the form you need, please let us know.

(D) The Wages Are Not Paid For Employment As A.

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel. Web for your wages to be exempt from louisiana income taxes, (a) your spouse must be a member of the armed forces stationed in louisiana in compliance with military orders; (c) you performed employment duties in more than one state during the calendar year; File your clients' individual, corporate and composite partnership extension in bulk.