Maine State Tax Form 2021

Maine State Tax Form 2021 - Complete, edit or print tax forms instantly. Web a state of maine extension request form is not required. (from schedule 1s, line 29.). For tax years beginning on or after january 1, 2021 but not later than december 31, 2022, the amount of maine covid disaster relief. Get ready for tax season deadlines by completing any required tax forms today. Alphabetical listing by tax type or program. Web we last updated the 1040me income tax return in january 2023, so this is the latest version of form 1040me, fully updated for tax year 2022. (from schedule 1a, line 12.) 15a. Web maine has a state income tax that ranges between 5.8% and 7.15%. Web 10 rows general forms.

For tax years beginning on or after january 1, 2021 but not later than december 31, 2022, the amount of maine covid disaster relief. The forms below are not specific to a particular tax type or. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Information on maine income tax forms, tax brackets and rates by tax year. Web a state of maine extension request form is not required. Web we last updated the 1040me income tax return in january 2023, so this is the latest version of form 1040me, fully updated for tax year 2022. Web of the 2021 tax bill was paid in 2022, the requested reimbursement for that tax year would be 50% of assessed tax in section 3 of form 801a and form 801b for taxes assessed. (from schedule 1s, line 29.). Maine state income tax forms for tax year 2022 (jan. Web maine estate tax forms.

Web of the 2021 tax bill was paid in 2022, the requested reimbursement for that tax year would be 50% of assessed tax in section 3 of form 801a and form 801b for taxes assessed. Taxformfinder provides printable pdf copies of 62. (from schedule 1s, line 29.). Web 10 rows general forms. Complete, edit or print tax forms instantly. Maine state income tax forms for tax year 2022 (jan. Alphabetical listing by tax type or program. Get ready for tax season deadlines by completing any required tax forms today. If you are unable to fi le your return by the original due date of the return,. Web maine estate tax forms.

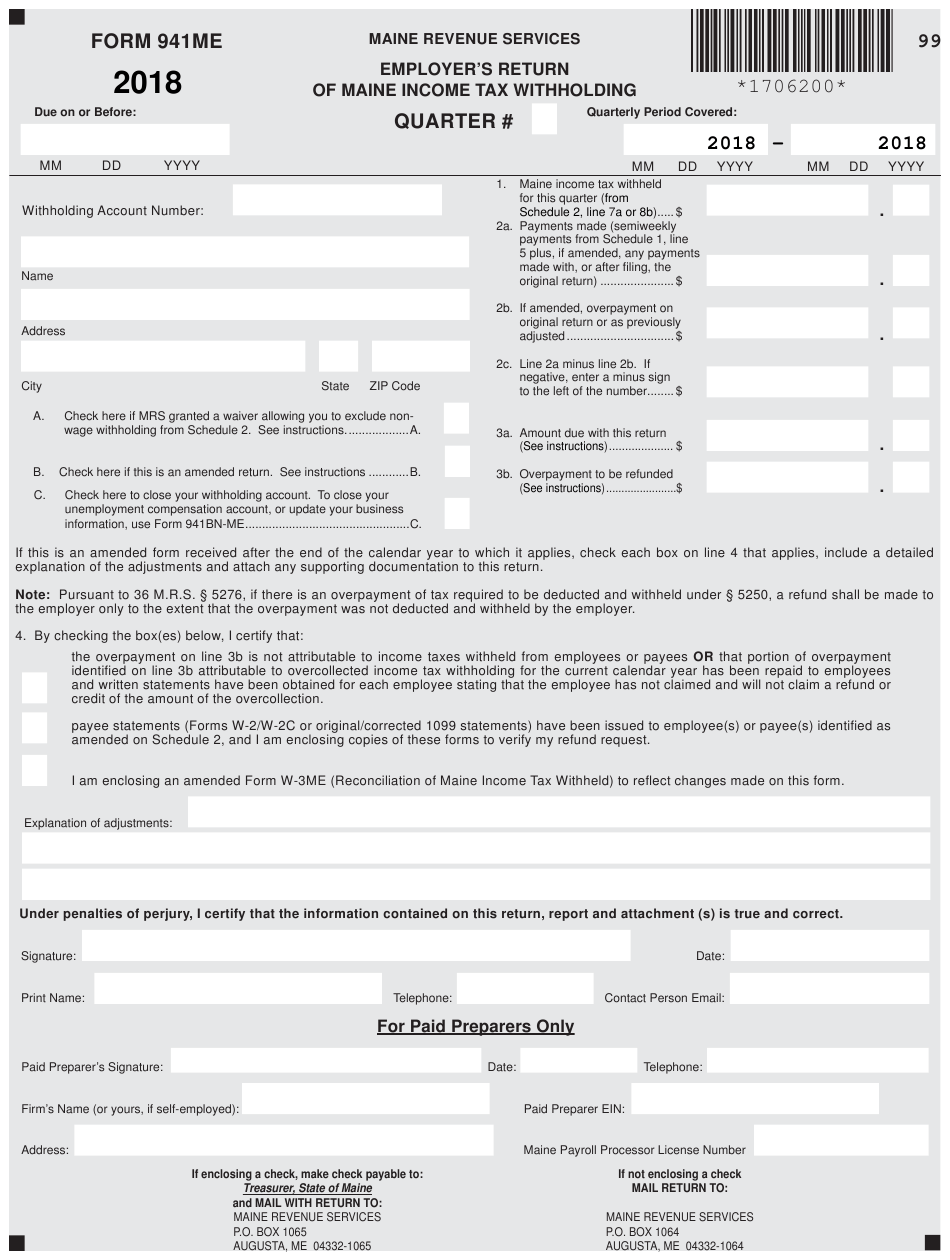

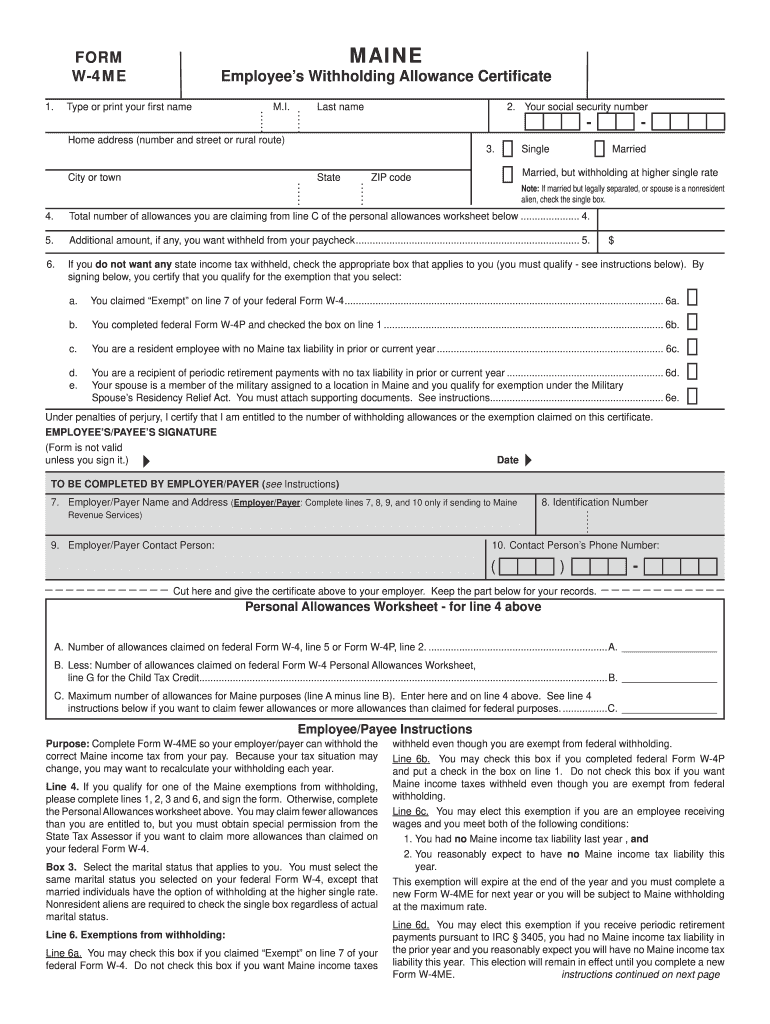

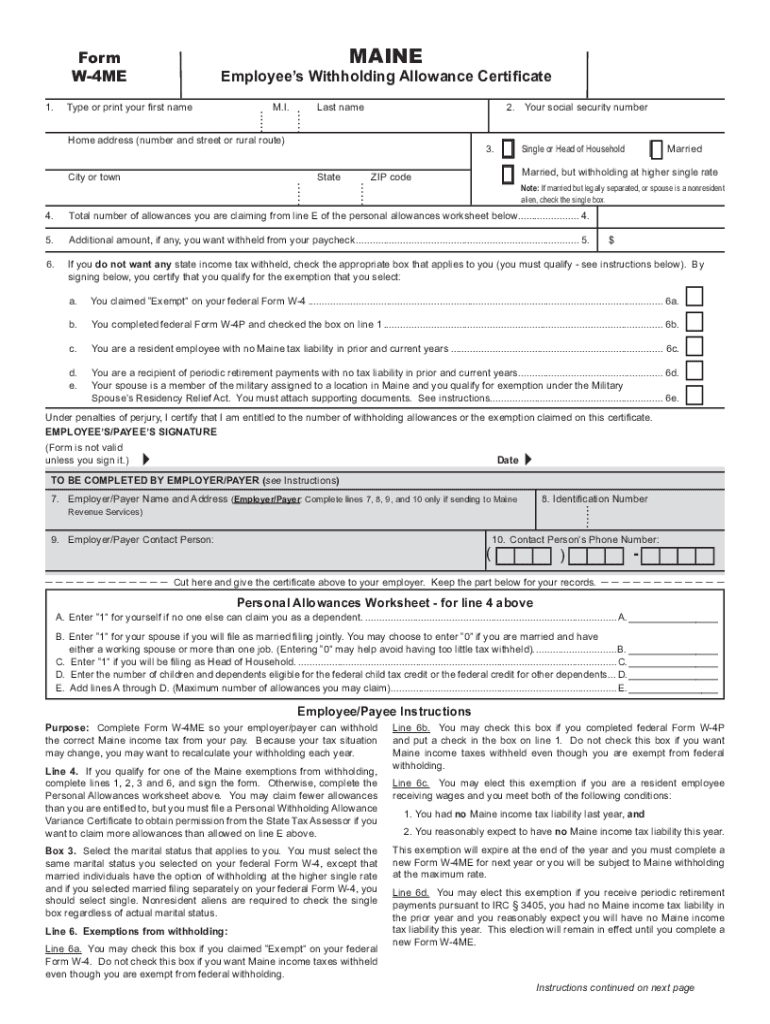

Maine State Tax Withholding Form 2022

You can download or print. Web of the 2021 tax bill was paid in 2022, the requested reimbursement for that tax year would be 50% of assessed tax in section 3 of form 801a and form 801b for taxes assessed. Web a state of maine extension request form is not required. Ad prevent tax liens from being imposed on you..

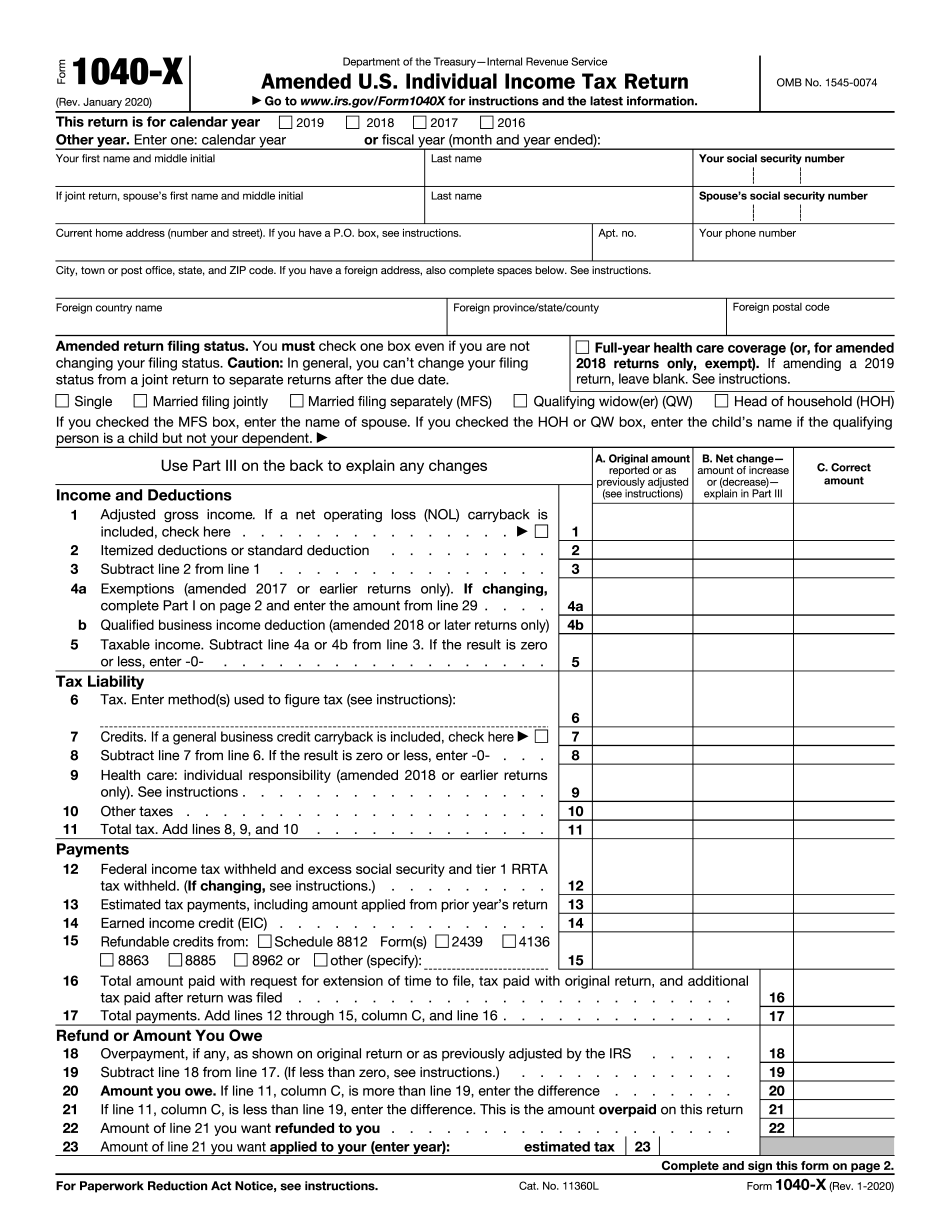

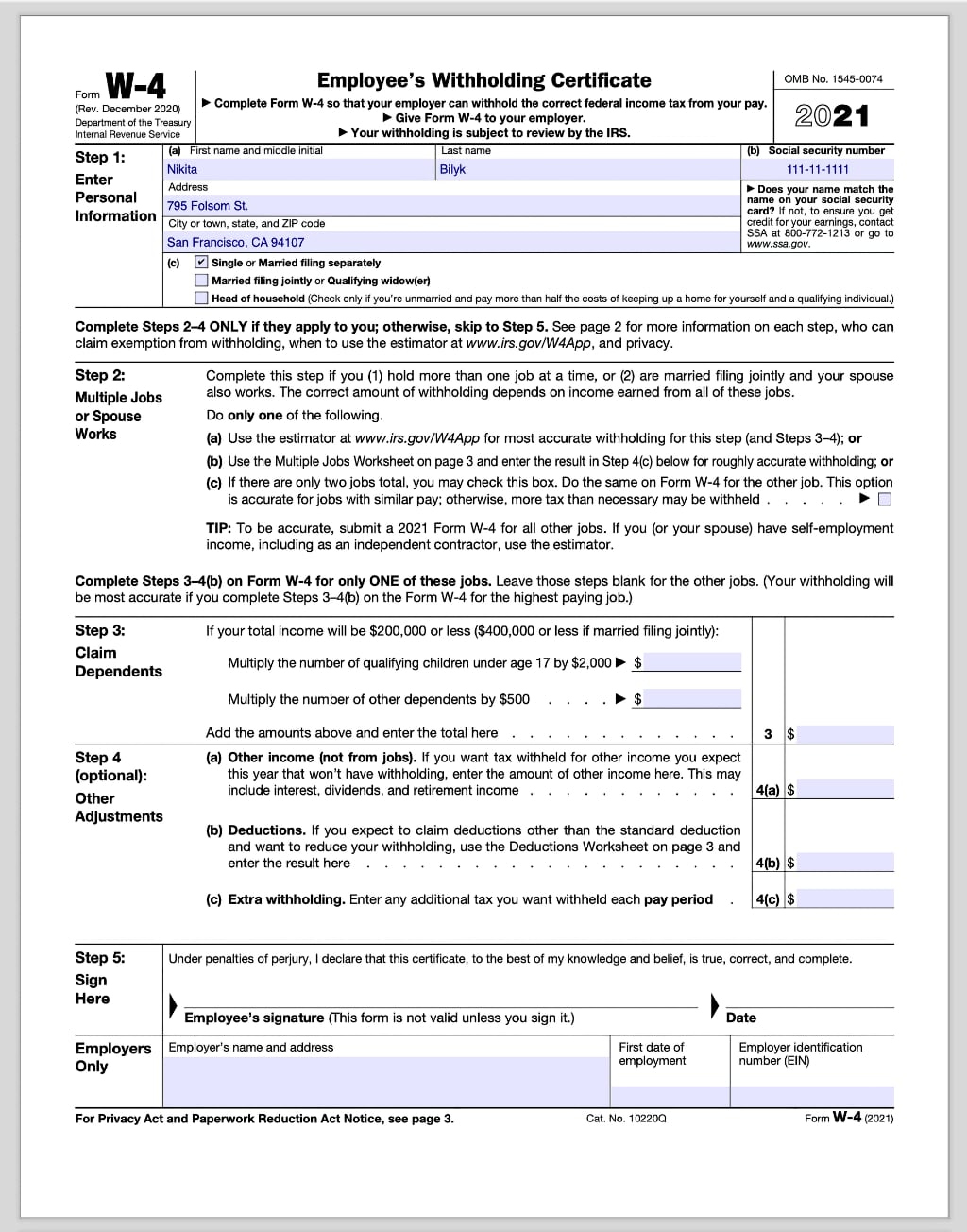

1040X Form Download A Template Or Complete Online 2021 Tax Forms 1040

706me (pdf) maine estate tax return. Complete, edit or print tax forms instantly. (from schedule 1s, line 29.). Web maine has a state income tax that ranges between 5.8% and 7.15%. Maine state income tax forms for tax year 2022 (jan.

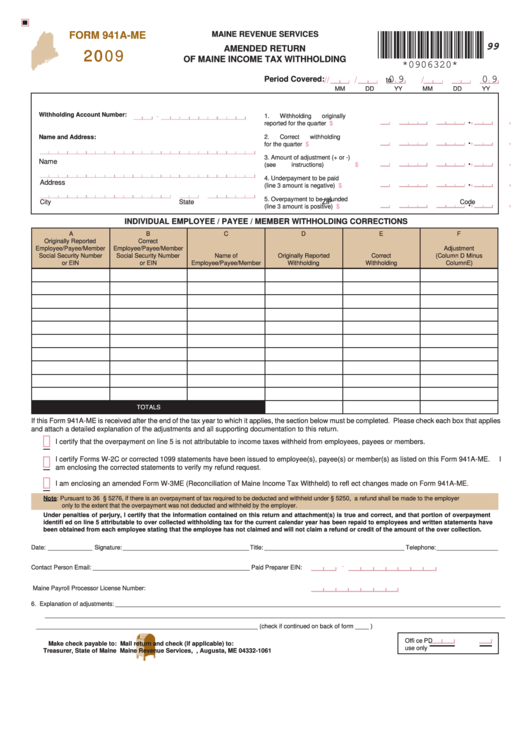

Form 941aMe Amended Return Of Maine Tax Withholding 2009

Calculate the penalty on the amount of the. 706me (pdf) maine estate tax return. Web maine estate tax forms. Alphabetical listing by tax type or program. Maine state income tax forms for tax year 2022 (jan.

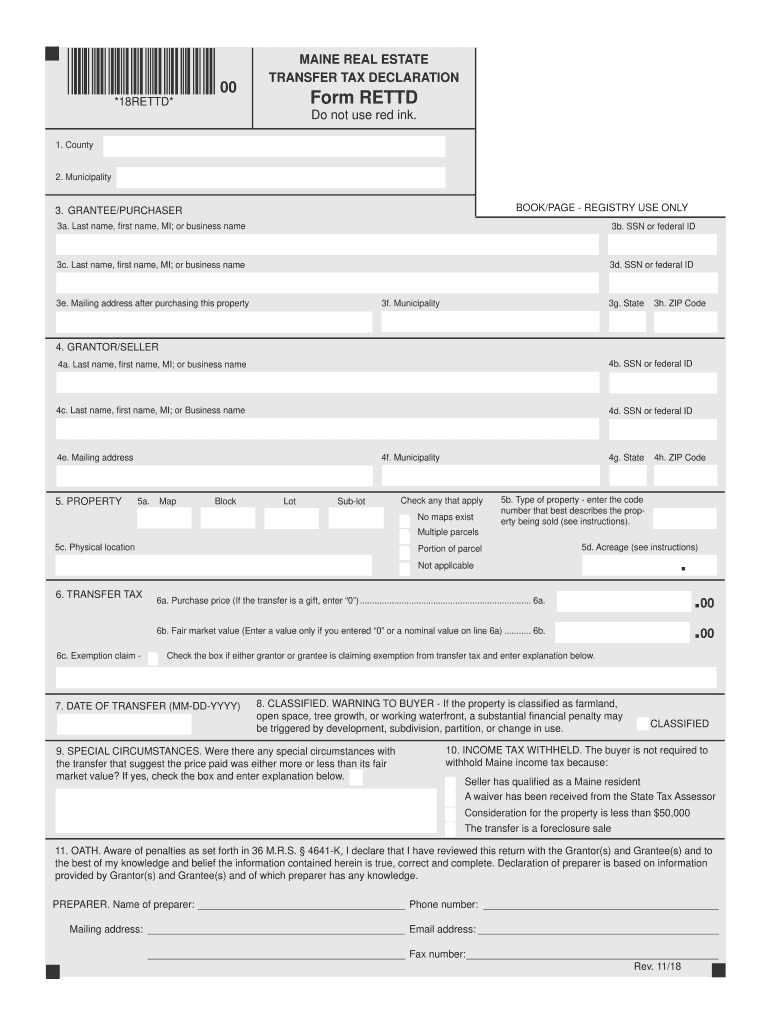

Maine Transfer Tax Declaration Form Fill Out and Sign Printable PDF

Calculate the penalty on the amount of the. Information on maine income tax forms, tax brackets and rates by tax year. Complete, edit or print tax forms instantly. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax..

What Is The Purpose Of A Tax File Number Declaration Form Tyler

Calculate the penalty on the amount of the. 706me (pdf) maine estate tax return. Maine state income tax forms for tax year 2022 (jan. For tax years beginning on or after january 1, 2021 but not later than december 31, 2022, the amount of maine covid disaster relief. Web 10 rows general forms.

Maine W4 Forms 2021 Printable 2022 W4 Form

Maine state income tax forms for tax year 2022 (jan. Ad prevent tax liens from being imposed on you. Web 10 rows general forms. Ad register and subscribe now to work on your me form 1040me & more fillable forms. Web we last updated the 1040me income tax return in january 2023, so this is the latest version of form.

ME W4ME 20212022 Fill out Tax Template Online US Legal Forms

(from schedule 1s, line 29.). You can download or print. The forms below are not specific to a particular tax type or. Web of the 2021 tax bill was paid in 2022, the requested reimbursement for that tax year would be 50% of assessed tax in section 3 of form 801a and form 801b for taxes assessed. Information on maine.

Michigan W 4 2021 2022 W4 Form

You can download or print. Web maine has a state income tax that ranges between 5.8% and 7.15%. Taxformfinder provides printable pdf copies of 62. Ad prevent tax liens from being imposed on you. Web maine estate tax forms.

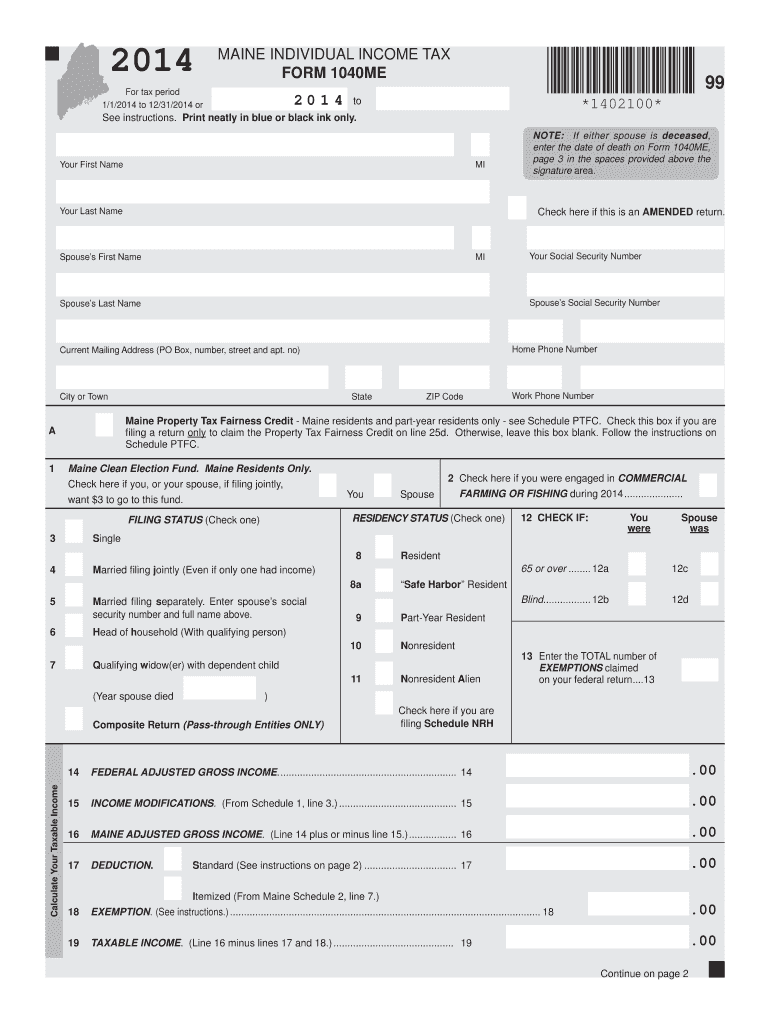

2014 Form ME 1040ME Fill Online, Printable, Fillable, Blank pdfFiller

Web maine has a state income tax that ranges between 5.8% and 7.15%. Get ready for tax season deadlines by completing any required tax forms today. You can download or print. Ad register and subscribe now to work on your me form 1040me & more fillable forms. (from schedule 1s, line 29.).

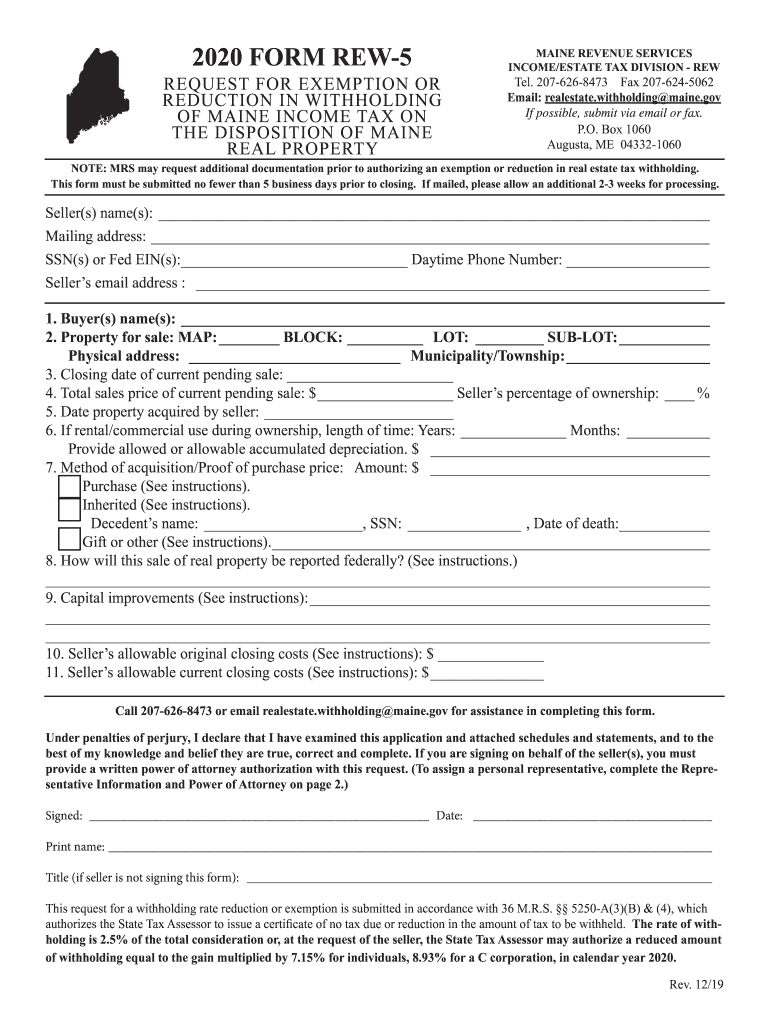

2020 Form ME MRS REW5 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web we last updated the 1040me income tax return in january 2023, so this is the latest version of form 1040me, fully updated for tax year 2022. Taxformfinder provides printable pdf copies of 62. (from schedule 1a, line 12.) 15a. Alphabetical listing by tax type or program.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Complete, edit or print tax forms instantly. Web maine has a state income tax that ranges between 5.8% and 7.15%. Ad prevent tax liens from being imposed on you. Maine state income tax forms for tax year 2022 (jan.

Information On Maine Income Tax Forms, Tax Brackets And Rates By Tax Year.

Alphabetical listing by tax type or program. Taxformfinder provides printable pdf copies of 62. 706me (pdf) maine estate tax return. Web a state of maine extension request form is not required.

The Forms Below Are Not Specific To A Particular Tax Type Or.

Ad register and subscribe now to work on your me form 1040me & more fillable forms. Web 10 rows general forms. If you are unable to fi le your return by the original due date of the return,. (from schedule 1s, line 29.).

(From Schedule 1A, Line 12.) 15A.

For tax years beginning on or after january 1, 2021 but not later than december 31, 2022, the amount of maine covid disaster relief. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web maine estate tax forms. Web of the 2021 tax bill was paid in 2022, the requested reimbursement for that tax year would be 50% of assessed tax in section 3 of form 801a and form 801b for taxes assessed.