Md 504 Form

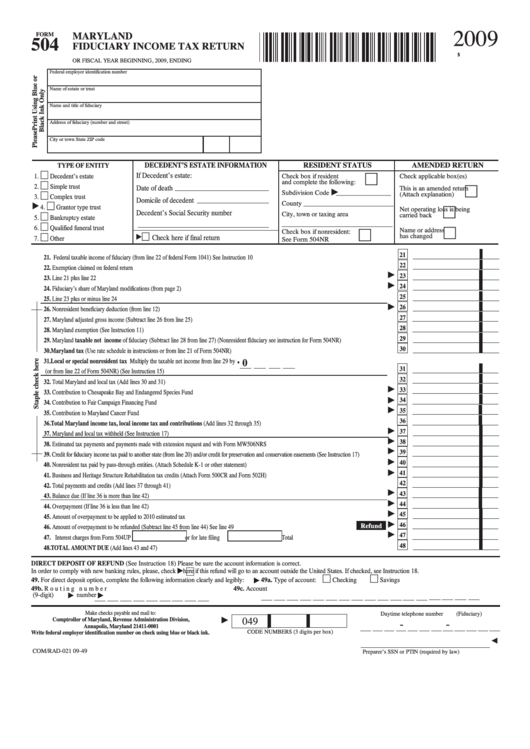

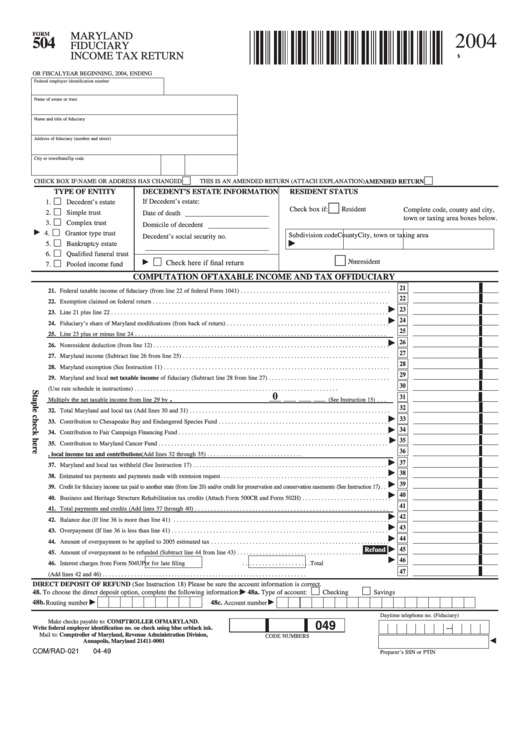

Md 504 Form - Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. Getting a authorized expert, making a scheduled visit and going to the business office for a personal meeting makes finishing a maryland. Save or instantly send your ready documents. Form for filing a maryland fiduciary tax return if the fiduciary: Easily fill out pdf blank, edit, and sign them. Credit for fiduciary income tax paid to another state and/or credit for. Sign online button or tick the preview image of the blank. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web maryland fiduciary income tax return 504form (b) social security number (a) name of beneficiary & domicile state code (c) share of net md modifications if there. These where to file addresses.

Print using blue or black ink only or fiscal year. Save or instantly send your ready documents. Web maryland form 504 fiduciary come tax turn print using blue or black ink only staple check here or fiscal year beginning 2019, ending 2019 $ federal. Save or instantly send your ready documents. Credit for fiduciary income tax paid to another state and/or credit for. Getting a authorized expert, making a scheduled visit and going to the business office for a personal meeting makes finishing a maryland. Web follow the simple instructions below: Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. The advanced tools of the editor will. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland.

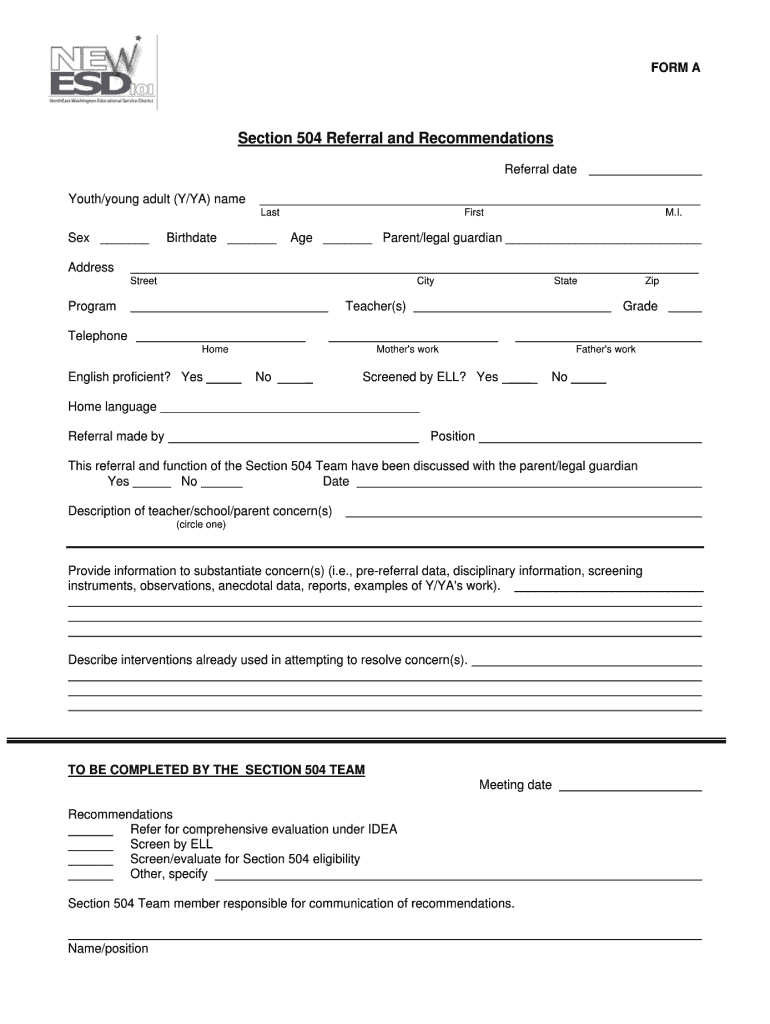

To start the blank, utilize the fill camp; 1999 maryland fiduciary tax return page 2 fiduciary’sshareofmarylandmodifications (a) do not complete lines 1. Web how to fill out the 504 plan fillable forms online: Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs These where to file addresses. Print using blue or black ink only or fiscal year. Save or instantly send your ready documents. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Credit for fiduciary income tax paid to another state and/or credit for.

Eastman MD 504 AStyle « Bluegrass Mandoline

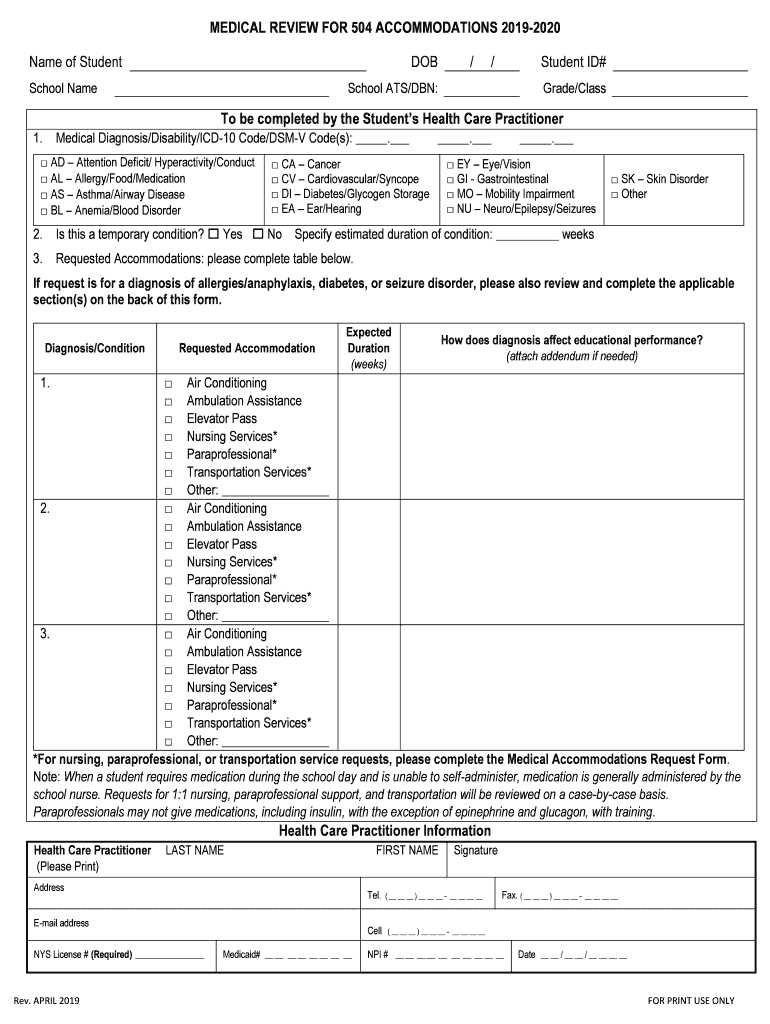

(kids who learn or think differently generally do.) start by gathering any documents about your child’s needs, like any. Web how to fill out the 504 plan fillable forms online: Web maryland fiduciary income tax return 504form (b) social security number (a) name of beneficiary & domicile state code (c) share of net md modifications if there. Save or instantly.

Fillable Form 504 Maryland Fiduciary Tax Return 2009

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web maryland fiduciary income tax return 504form (b) social security number (a) name of beneficiary & domicile state code (c) share of net md modifications if there. Web complete md 504.

20192023 Form NY Medical Review for 504 Fill Online

Credit for fiduciary income tax paid to another state and/or credit for. Web follow the simple instructions below: Getting a authorized expert, making a scheduled visit and going to the business office for a personal meeting makes finishing a maryland. Save or instantly send your ready documents. Sign online button or tick the preview image of the blank.

Fillable Form 504 Maryland Fiduciary Tax Return 2004

Is required to file a federal fiduciary income tax return or is exempt from tax. Web maryland fiduciary income tax return 504form (b) social security number (a) name of beneficiary & domicile state code (c) share of net md modifications if there. These where to file addresses. Save or instantly send your ready documents. Web how to fill out the.

Printable 504 Form Fill Out and Sign Printable PDF Template signNow

Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Easily fill out pdf blank, edit, and sign them. Is required to file a federal fiduciary income tax return or is exempt from tax. Save or instantly send your ready documents..

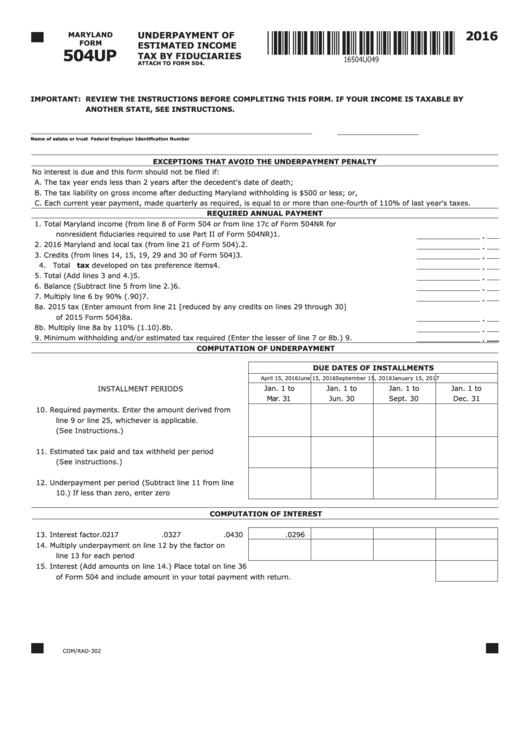

Fillable Maryland Form 504up Underpayment Of Estimated Tax By

(kids who learn or think differently generally do.) start by gathering any documents about your child’s needs, like any. Web maryland fiduciary income tax return 504form (b) social security number (a) name of beneficiary & domicile state code (c) share of net md modifications if there. Web maryland form 504 fiduciary come tax turn print using blue or black ink.

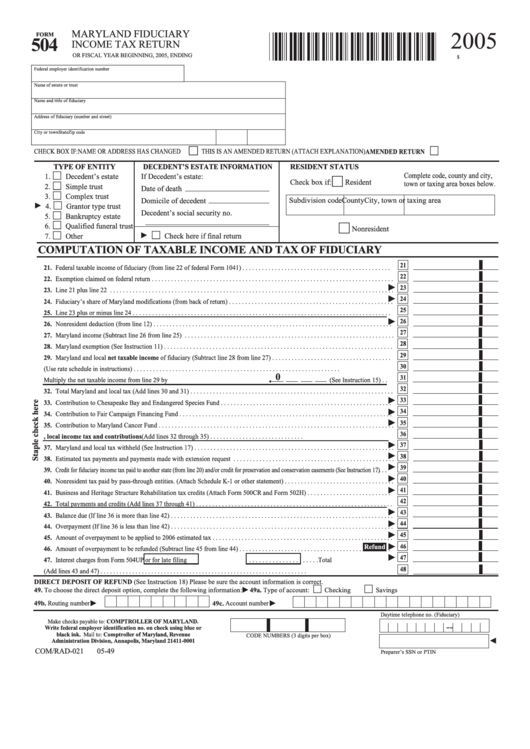

Fillable Form 504 Maryland Fiduciary Tax Return 2005

The advanced tools of the editor will. Web maryland form 504cr business income tax credits for fiduciaries attach to form 504. Form for filing a maryland fiduciary tax return if the fiduciary: 1999 maryland fiduciary tax return page 2 fiduciary’sshareofmarylandmodifications (a) do not complete lines 1. (kids who learn or think differently generally do.) start by gathering any documents about.

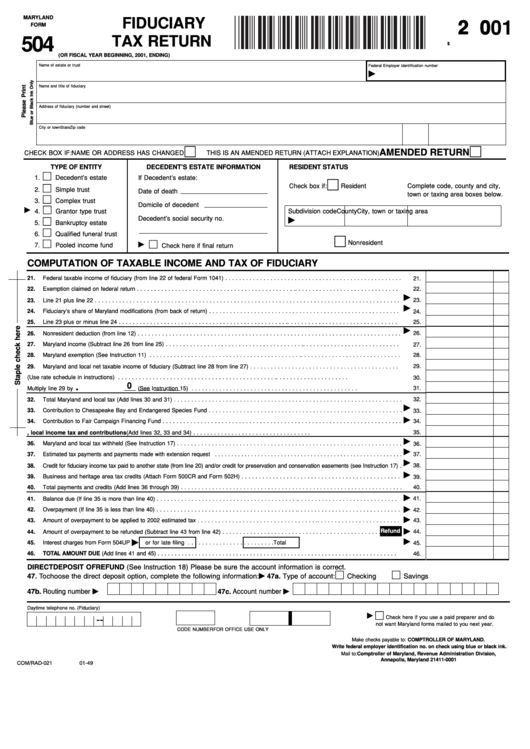

Fillable Maryland Form 504 Fiduciary Tax Return 2001 printable pdf

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. Web maryland form 504 fiduciary come tax turn print using blue or black ink only staple check here or fiscal year beginning 2019, ending 2019 $ federal. Web how to fill out the 504 plan fillable forms online: Sign online.

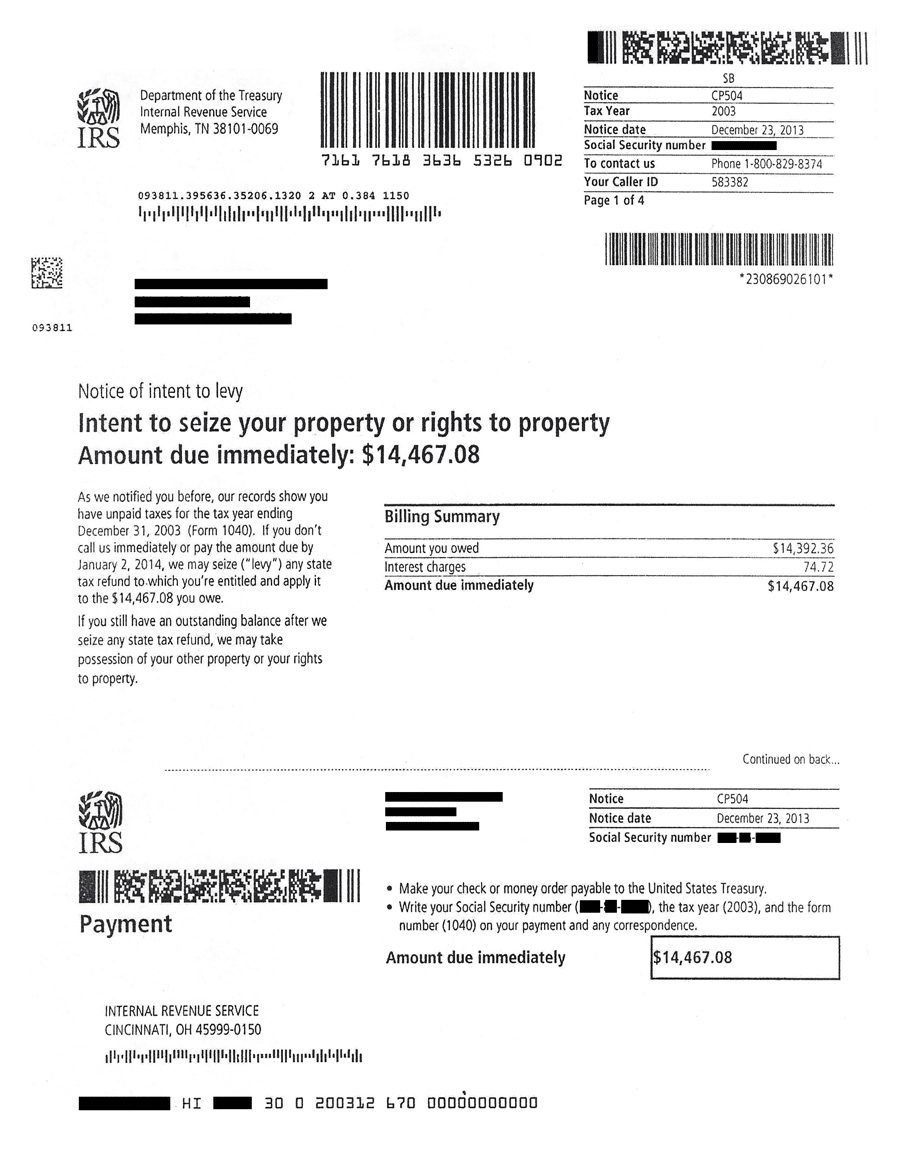

Form CP 504 Instant Tax Solutions

Web how to fill out the 504 plan fillable forms online: Is required to file a federal fiduciary income tax return or is exempt from tax. Save or instantly send your ready documents. Web complete md 504 online with us legal forms. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients.

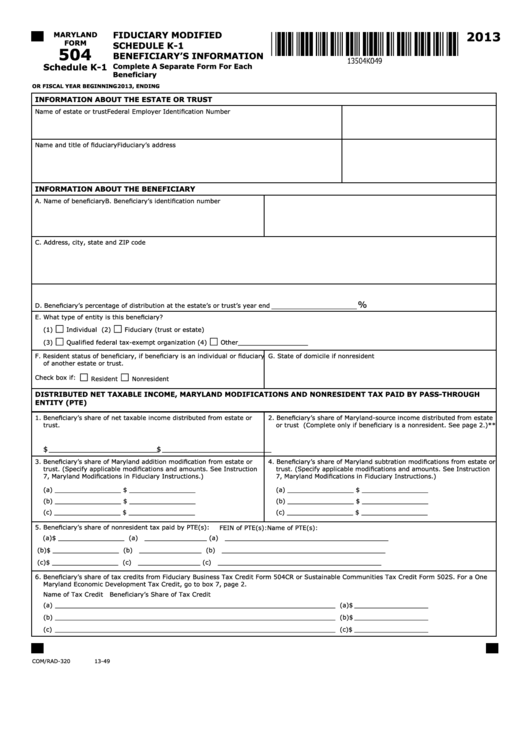

Fillable Maryland Form 504 Schedule K1 Fiduciary Modified Schedule

Getting a authorized expert, making a scheduled visit and going to the business office for a personal meeting makes finishing a maryland. (kids who learn or think differently generally do.) start by gathering any documents about your child’s needs, like any. Sign online button or tick the preview image of the blank. Easily fill out pdf blank, edit, and sign.

These Where To File Addresses.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in maryland. The advanced tools of the editor will. Web section 504 of the rehabilitation act of 1973 is a federal law that prohibits organizations that receive federal money from discriminating against a person on the basis of a disability. (kids who learn or think differently generally do.) start by gathering any documents about your child’s needs, like any.

Web Complete Md 504 Online With Us Legal Forms.

Web how to fill out the 504 plan fillable forms online: Web maryland form 504 fiduciary come tax turn print using blue or black ink only staple check here or fiscal year beginning 2019, ending 2019 $ federal. Save or instantly send your ready documents. Is required to file a federal fiduciary income tax return or is exempt from tax.

Web Maryland Fiduciary Income Tax Return 504Form (B) Social Security Number (A) Name Of Beneficiary & Domicile State Code (C) Share Of Net Md Modifications If There.

Web maryland form 504cr business income tax credits for fiduciaries attach to form 504. Easily fill out pdf blank, edit, and sign them. Getting a authorized expert, making a scheduled visit and going to the business office for a personal meeting makes finishing a maryland. Sign online button or tick the preview image of the blank.

Save Or Instantly Send Your Ready Documents.

Web your child must have a legal disability to get a 504 plan. Credit for fiduciary income tax paid to another state and/or credit for. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Print using blue or black ink only or fiscal year.