Michigan Tax Exemption Form

Michigan Tax Exemption Form - This exemption application must be completed by the buyer, provided to the seller, and is not valid unless the information in. If any of these links are broken, or you can't find the form you need, please let. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Michigan pension and retirement payments. If you fail or refuse to submit. Mc 100, request for exemption from use of mifile and order author: Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax. Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Click on the desired links to learn more. Web michigan sales and use tax exemption certificate.

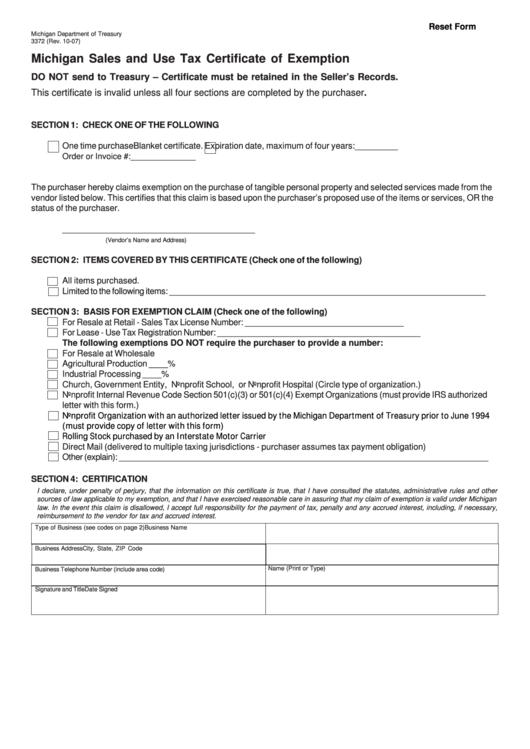

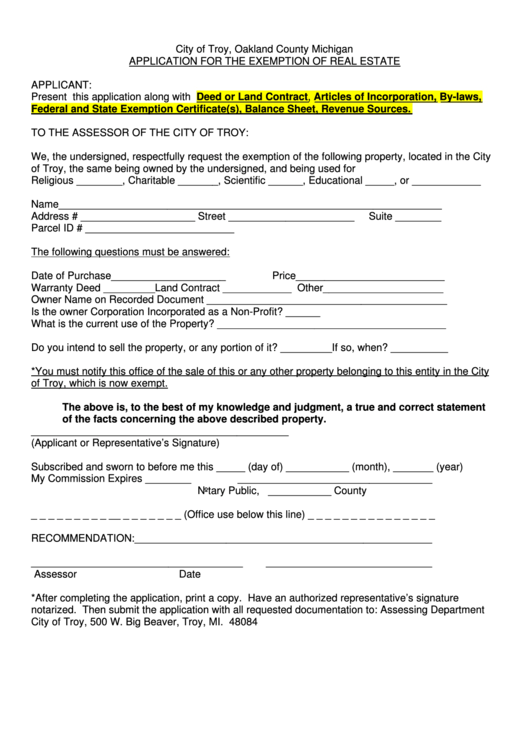

Web once you have that, you are eligible to issue a resale certificate. The property tax exemptions listed below provide eligible taxpayers with a variety of property tax savings. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Click on the desired links to learn more. Web (attach a copy of the exemption certificate granted by the michigan state tax commission.) qualified convention facility check this box only if the property owner is. Web michigan sales and use tax exemption certificate. If you fail or refuse to submit. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Michigan sales and use tax contractor eligibility statement: Web michigan sales and use tax certificate of exemption:

Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Web michigan sales and use tax exemption certificate. Mc 100, request for exemption from use of mifile and order author: This exemption application must be completed by the buyer, provided to the seller, and is not valid unless the information in. The property tax exemptions listed below provide eligible taxpayers with a variety of property tax savings. Web michigan sales and use tax certificate of exemption: Web once you have that, you are eligible to issue a resale certificate. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Suw installment payment options available. 2023 michigan income tax withholding tables:

Outofstate homeowners use loophole to avoid Michigan property taxes

Web (attach a copy of the exemption certificate granted by the michigan state tax commission.) qualified convention facility check this box only if the property owner is. This exemption application must be completed by the buyer, provided to the seller, and is not valid unless the information in. Web we have three michigan sales tax exemption forms available for you.

Michigan State Tax Reform Plan 2018 PDF Tax Exemption Taxpayer

Web (attach a copy of the exemption certificate granted by the michigan state tax commission.) qualified convention facility check this box only if the property owner is. 2023 michigan income tax withholding tables: Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. The property tax exemptions listed below provide eligible taxpayers with a variety of.

michigan use tax exemption form Puissant Bloggers Pictures

Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales. Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. If you fail or refuse to submit. Mc 100, request for exemption from use of mifile and order author: 10/19 mcr 1.109(g) page 1 of 1 jis code:

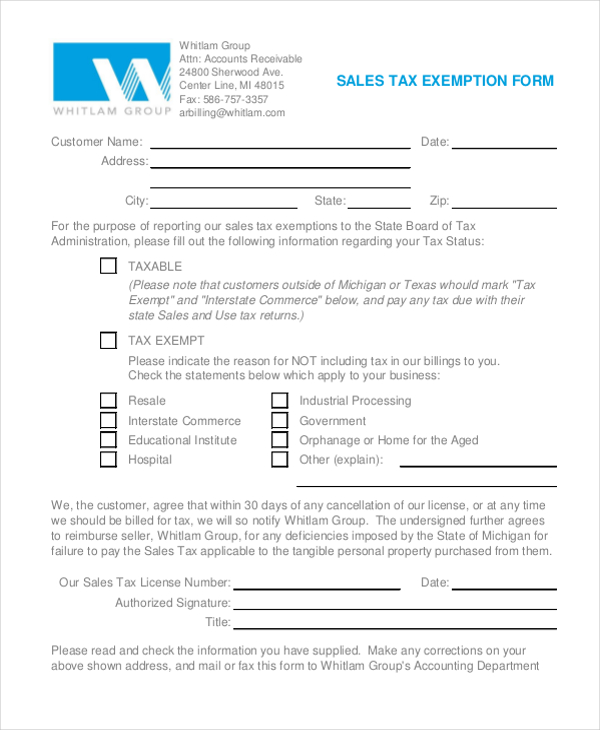

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Web michigan sales and use tax exemption certificate. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Click on the desired links to learn more. Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. Download a copy of the michigan general sales tax.

Michigan certificate of tax exemption from 3372 Fill out & sign online

Michigan sales and use tax contractor eligibility statement: Web michigan sales and use tax exemption certificate. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales and use tax. Employee's michigan withholding exemption certificate and instructions: Web instructions included on form:

Michigan veterans property tax exemption form 5107 Fill out & sign

Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales. 2023 michigan income tax withholding guide: Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. Employee's michigan withholding exemption certificate and instructions: Web michigan sales and use tax certificate of exemption:

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. Michigan sales and use tax contractor eligibility statement: Web once you have that, you are eligible to issue a resale certificate. Web instructions for completing michigan sales and use tax certificate of exemption (form 3372) purchasers may use this form to claim exemption from michigan sales.

Michigan Outlines Tax Benefits Available to Military Members and

Michigan sales and use tax contractor eligibility statement: Sales tax return for special events: Web instructions included on form: If you fail or refuse to submit. Download a copy of the michigan general sales tax.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Web michigan department of treasury form 3372 (rev. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web form mc 100, rev. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan.

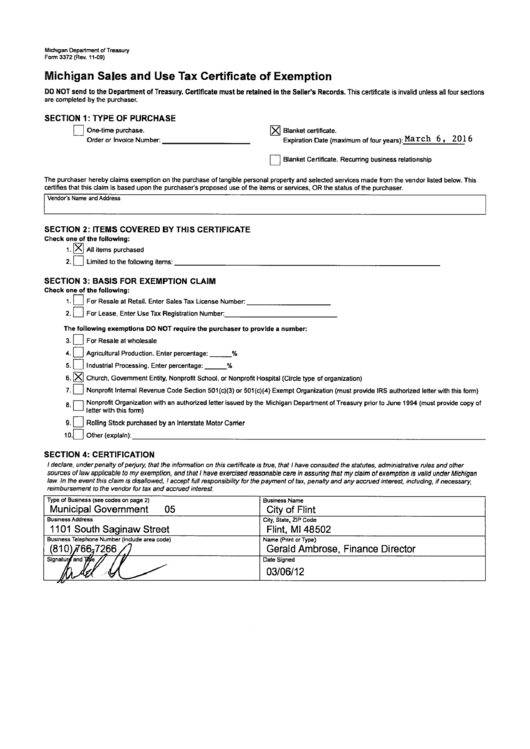

Michigan Sales And Use Tax Certificate Of Exemption City Of Flint

Web michigan department of treasury form 3372 (rev. Click on the desired links to learn more. 10/19 mcr 1.109(g) page 1 of 1 jis code: Web michigan sales and use tax exemption certificate. If any of these links are broken, or you can't find the form you need, please let.

Web Michigan Sales And Use Tax Certificate Of Exemption:

The property tax exemptions listed below provide eligible taxpayers with a variety of property tax savings. Web the certificate that qualifying agricultural producers, organizations and other exempt entities may use, is the michigan sales and use tax certificate of exemption. Web once you have that, you are eligible to issue a resale certificate. Suw installment payment options available.

Sales Tax Return For Special Events:

Web if you would like more information about tax exemptions, visit the state of michigan department of treasury website. Web notice to taxpayers regarding sales and use tax exemptions for feminine hygiene products. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is personal exemption is available if you are the parent of a stillborn child in 2022. Web (attach a copy of the exemption certificate granted by the michigan state tax commission.) qualified convention facility check this box only if the property owner is.

If Any Of These Links Are Broken, Or You Can't Find The Form You Need, Please Let.

10/19 mcr 1.109(g) page 1 of 1 jis code: Click on the desired links to learn more. Employee's michigan withholding exemption certificate and instructions: This exemption application must be completed by the buyer, provided to the seller, and is not valid unless the information in.

2023 Michigan Income Tax Withholding Guide:

Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Michigan sales and use tax contractor eligibility statement: Web michigan sales and use tax exemption certificate. Web form mc 100, rev.