Michigan Veterans Property Tax Exemption Form

Michigan Veterans Property Tax Exemption Form - Web go to the frequently asked questions guide prepared by the michigan state tax commission. Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Web state tax commission affidavit for disabled veterans exemption. You will need to provide your va disability rating letter to your township. Filing and inspection of affidavit; Web property tax relief for active military personnel. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Submit the state tax commission affidavit for disabled veterans exemption to the local city or township assessor, along with supporting documents from. It is necessary to apply for this exemption annually with the city's assessing department. This form is to be.

Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. It is necessary to apply for this exemption annually with the city's assessing department. You will need to provide your va disability rating letter to your township. Has been determined by the united states department of veterans’ affairs to be permanently and totally disabled as a result of military service and entitled to. Filing and inspection of affidavit; You can fill out the form. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); A completed form 3372, michigan sales and use tax certificate of exemption. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act.

Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by disabled veteran who was. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. This form is to be. You may apply by submitting a completed affidavit for disabled veterans. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran. Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Web 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); Has been determined by the united states department of veterans’ affairs to be permanently and totally disabled as a result of military service and entitled to. The affidavit is filed with the assessing office. Issued under authority of public act 161 of 2013, mcl 211.7b.

18 States With Full Property Tax Exemption for 100 Disabled Veterans

Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web in order to claim exemption, the nonprofit organization must provide the seller with both: To apply for property tax relief while on active duty, complete application for property tax relief during active military.

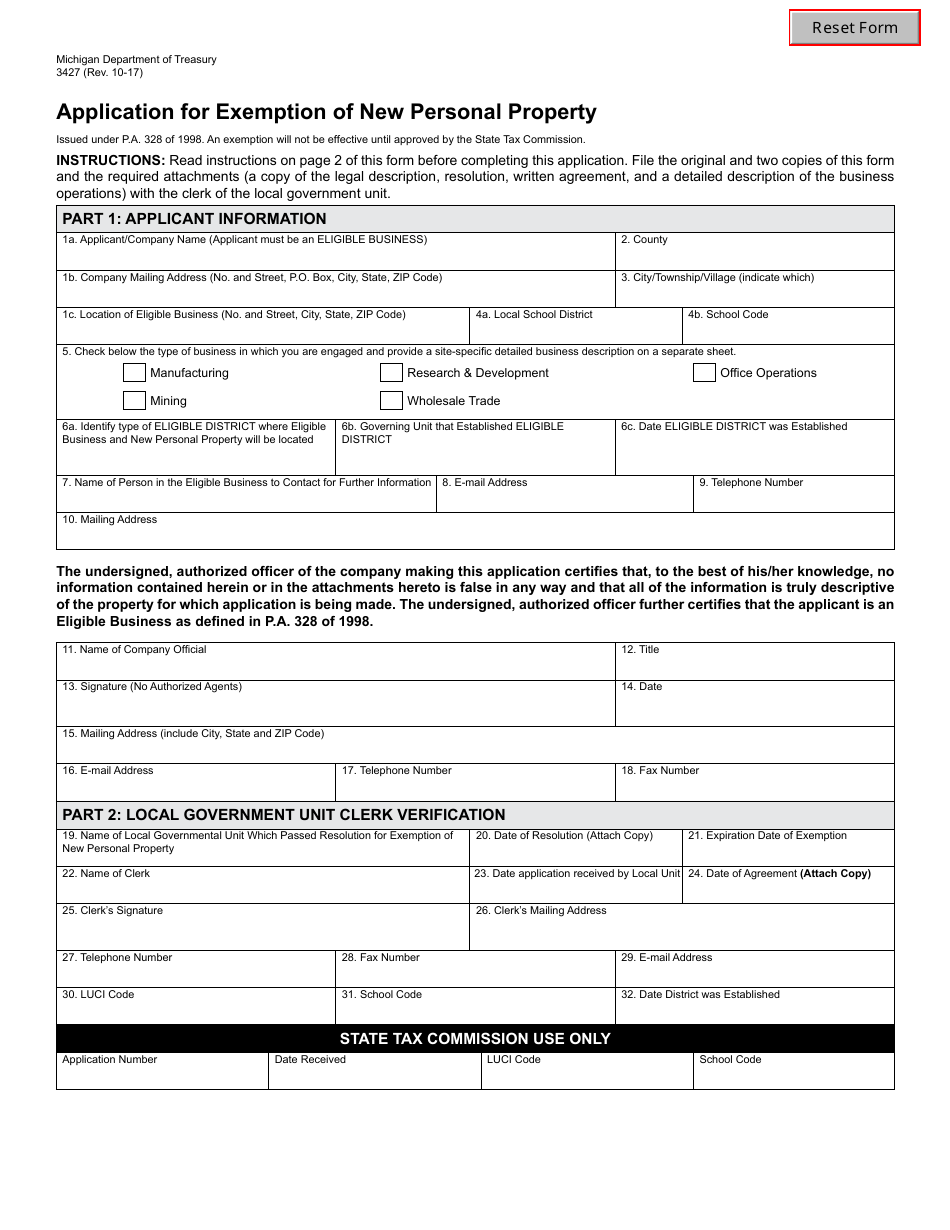

Form 3427 Download Fillable PDF or Fill Online Application for

You may apply by submitting a completed affidavit for disabled veterans. Web the affidavit (mi dept of treasury form 5107) shall be filed at the local assessing office by the property owner or their legal designee. Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act..

Top 7 Veteran Benefits in Arizona VA Claims Insider

The affidavit is filed with the assessing office. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. It is necessary to apply for this exemption annually with the city's assessing department. You can fill out the form. Has been determined by the united states department of veterans’ affairs.

16 States With Full Property Tax Exemption for 100 Disabled Veterans

Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. This form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran. Submit the state tax commission affidavit for disabled veterans exemption to the local city or.

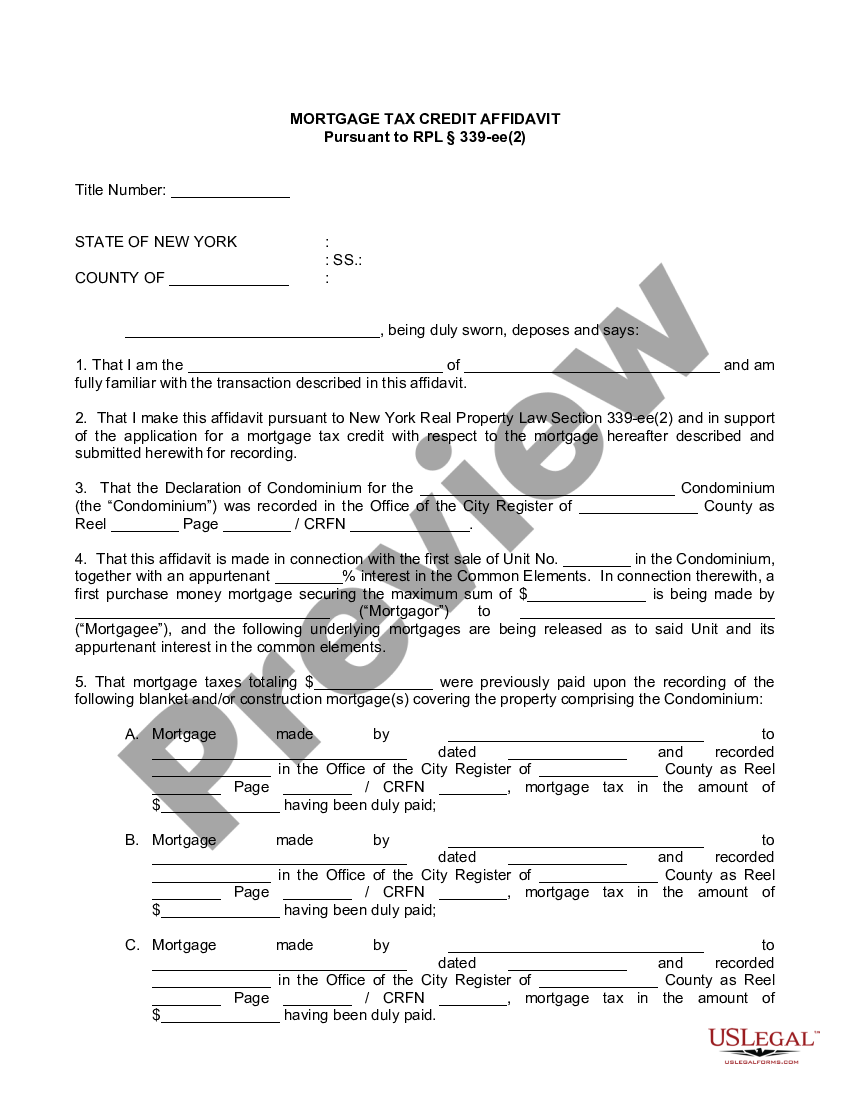

Yonkers New York City Veterans Property Tax Exemption Form US Legal Forms

Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Submit the state tax commission affidavit for disabled veterans exemption to the local city or township assessor, along with supporting documents from. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption,.

18 States With Full Property Tax Exemption for 100 Disabled Veterans

Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. Web go to the frequently asked questions guide prepared by the michigan state tax commission. Web in order to claim exemption, the nonprofit organization must provide the seller with both: The affidavit is filed with the assessing office. Web state tax commission affidavit for disabled.

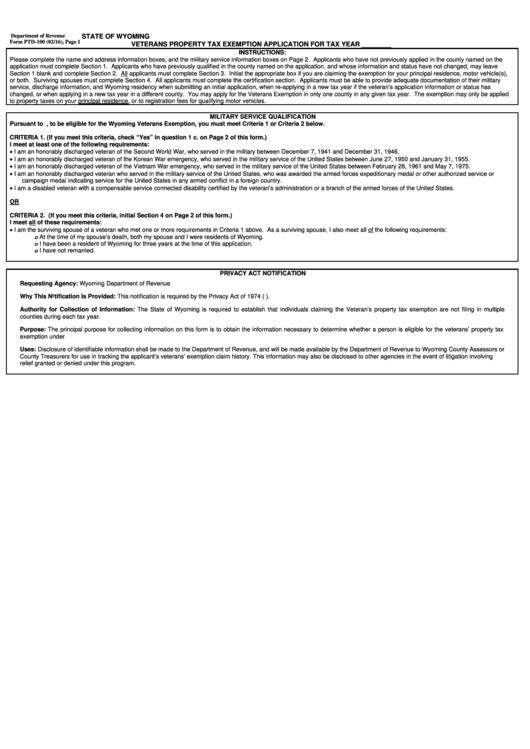

Fillable Form Ptd100 State Of Wyoming Veterans Property Tax

Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those.

Fill Free fillable 2021 CLAIM FOR DISABLED VETERANS' PROPERTY TAX

Web property tax relief for active military personnel. Web state tax commission affidavit for disabled veterans exemption. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by disabled veteran who was. You can fill out the form. Web luckily, disabled veterans and.

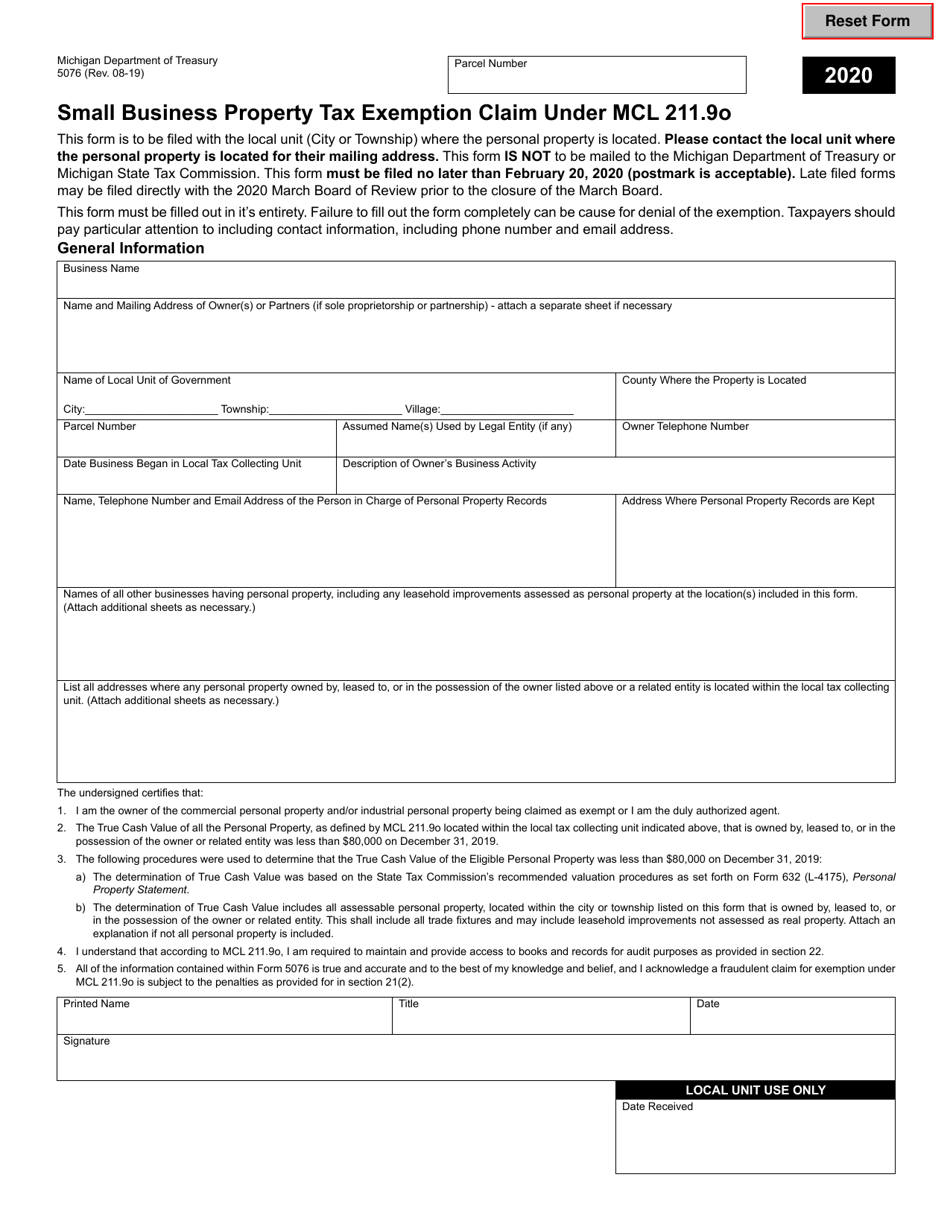

Form 5076 Download Fillable PDF or Fill Online Small Business Property

You will need to provide your va disability rating letter to your township. Web forfeiture and foreclosure information regarding the real property tax forfeiture, foreclosure and auction process in michigan can be found here. Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. A completed form 3372, michigan sales and use tax certificate of.

Michigan veterans property tax exemption form 5107 Fill out & sign

Web luckily, disabled veterans and disabled veterans’ surviving spouses are fully exempt from paying property taxes in michigan under the general property tax act. This form is to be. Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. Web property tax relief for active military personnel. Web this form is to be used to.

Web The Affidavit (Mi Dept Of Treasury Form 5107) Shall Be Filed At The Local Assessing Office By The Property Owner Or Their Legal Designee.

You can fill out the form. Web property tax relief for active military personnel. Web to apply for the exemption, you, as the veteran, or your unremarried surviving spouse or legal designee must annually file an affidavit (form 5107, affidavit. Filing and inspection of affidavit;

To Apply For Property Tax Relief While On Active Duty, Complete Application For Property Tax Relief During Active Military Service,.

You will need to provide your va disability rating letter to your township. It is necessary to apply for this exemption annually with the city's assessing department. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web for the 2022 income tax returns, the individual income tax rate for michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent.

Web Luckily, Disabled Veterans And Disabled Veterans’ Surviving Spouses Are Fully Exempt From Paying Property Taxes In Michigan Under The General Property Tax Act.

Issued under authority of public act 161 of 2013, mcl 211.7b. Web in order to claim exemption, the nonprofit organization must provide the seller with both: The affidavit is filed with the assessing office. Web go to the frequently asked questions guide prepared by the michigan state tax commission.

This Form Is To Be Used To Apply For An Exemption Of Property Taxes Under Mcl 211.7B, For Real Property Used And Owned As A Homestead By A Disabled Veteran.

Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by disabled veteran who was. Disabled veterans exemption faq (updated february 2023) disabled veterans reminded to contact local municipality to. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Web updated on january 23, 2022 reviewed by doretha clemon fact checked by heather van der hoop in this article what is a property tax exemption?