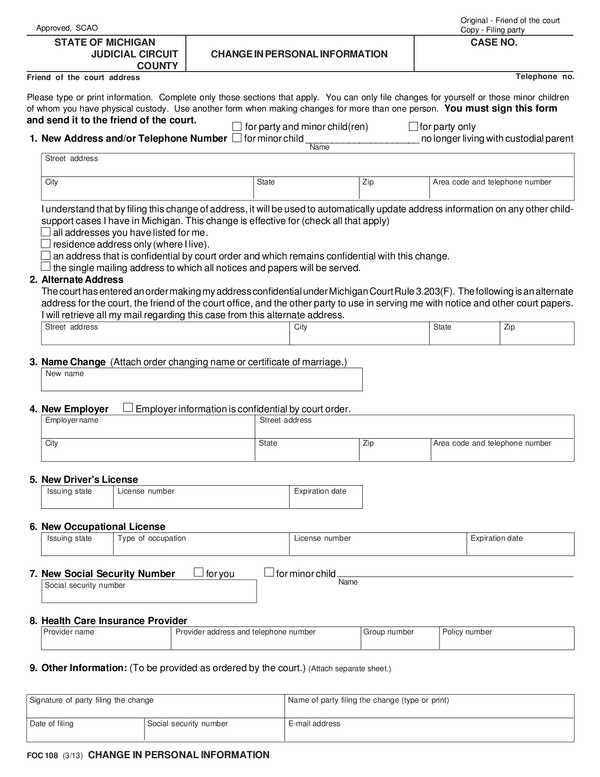

Michigan Withholding Form

Michigan Withholding Form - Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. After receiving the order, the employer must: Use the applicable monthly withholding table from either the pension. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. Web 2020 sales, use and withholding taxes annual return: 2021 sales, use and withholding. A) treat a notice that appears proper as if it. Web to send an income withholding notice directly to a supp payer’orts michigan employer.

Web 2021 sales, use and withholding taxes annual return: 2020 sales, use and withholding taxes amended annual return: A) treat a notice that appears proper as if it. Use the applicable monthly withholding table from either the pension. Web to send an income withholding notice directly to a supp payer’orts michigan employer. 2021 sales, use and withholding. Change or discontinuance (form 163). Mto is free and provides secure 24/7 online access. Web 2020 sales, use and withholding taxes annual return: Keep a copy of this form for your.

2020 sales, use and withholding taxes amended annual return: Web michigan department of treasury 4924 (rev. Use the applicable monthly withholding table from either the pension. 2021 sales, use and withholding taxes amended annual return: 2021 sales, use and withholding. After receiving the order, the employer must: Treasury is committed to protecting sensitive taxpayer information while providing. Web instructions included on form: Web 2021 sales, use and withholding taxes annual return: Mto is free and provides secure 24/7 online access.

2022 Michigan Michigan Withholding Tax Form

2021 sales, use and withholding taxes amended annual return: Web mto is the michigan department of treasury's web portal to many business taxes. Keep a copy of this form for your. A) treat a notice that appears proper as if it. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be.

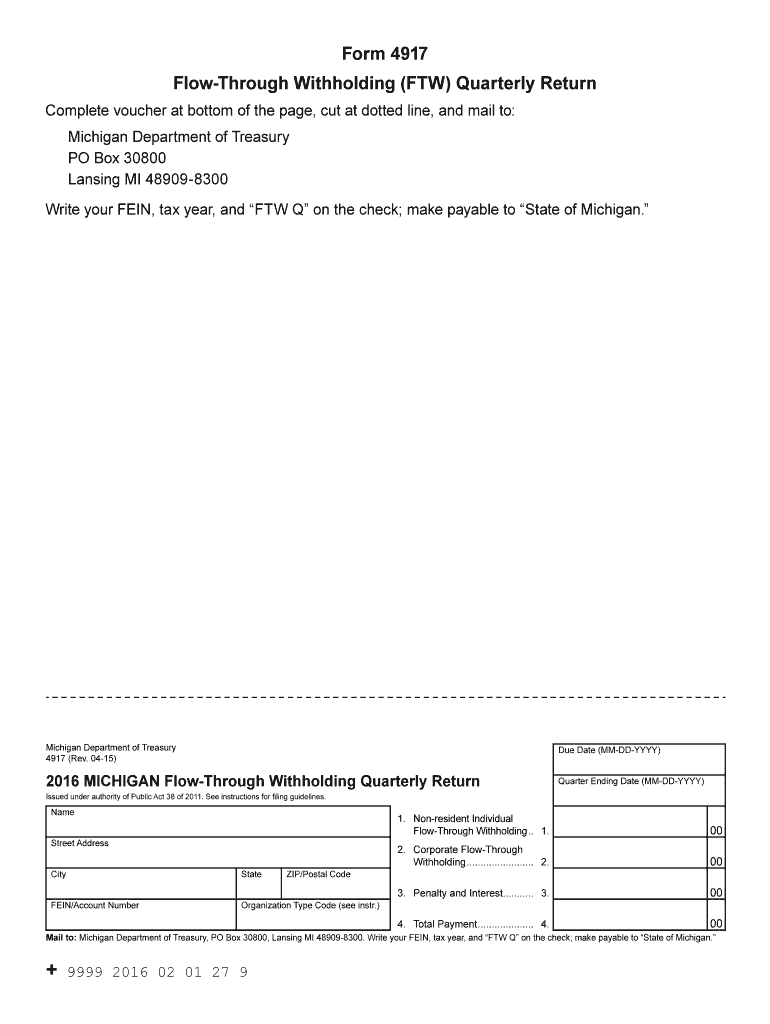

20162021 Form MI DoT 4917 Fill Online, Printable, Fillable, Blank

Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. 2021 sales, use and withholding. Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. Web 2020 sales, use and withholding taxes annual return: Web instructions included on form:

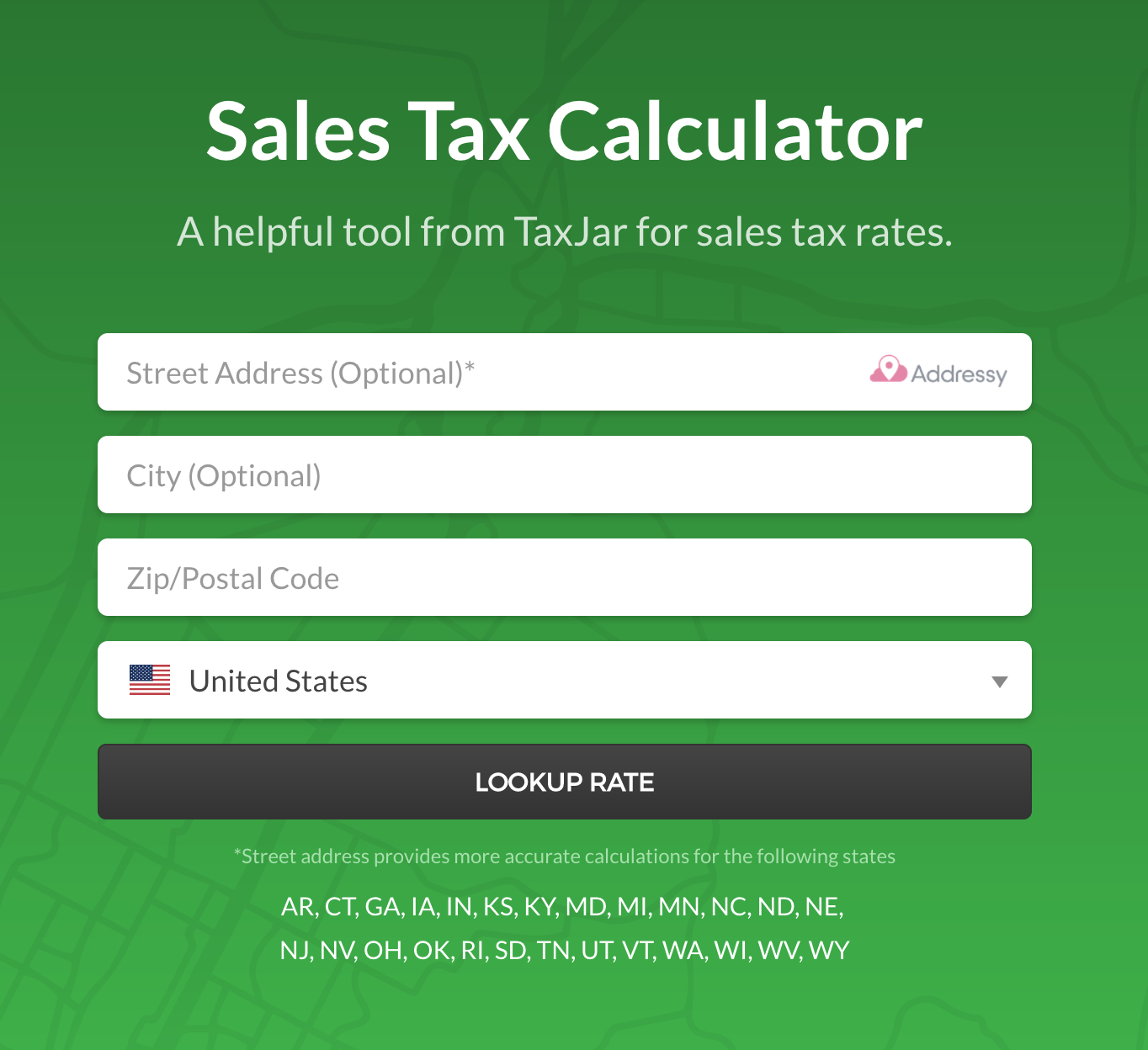

Michigan Sales Use And Withholding Tax Form 5081

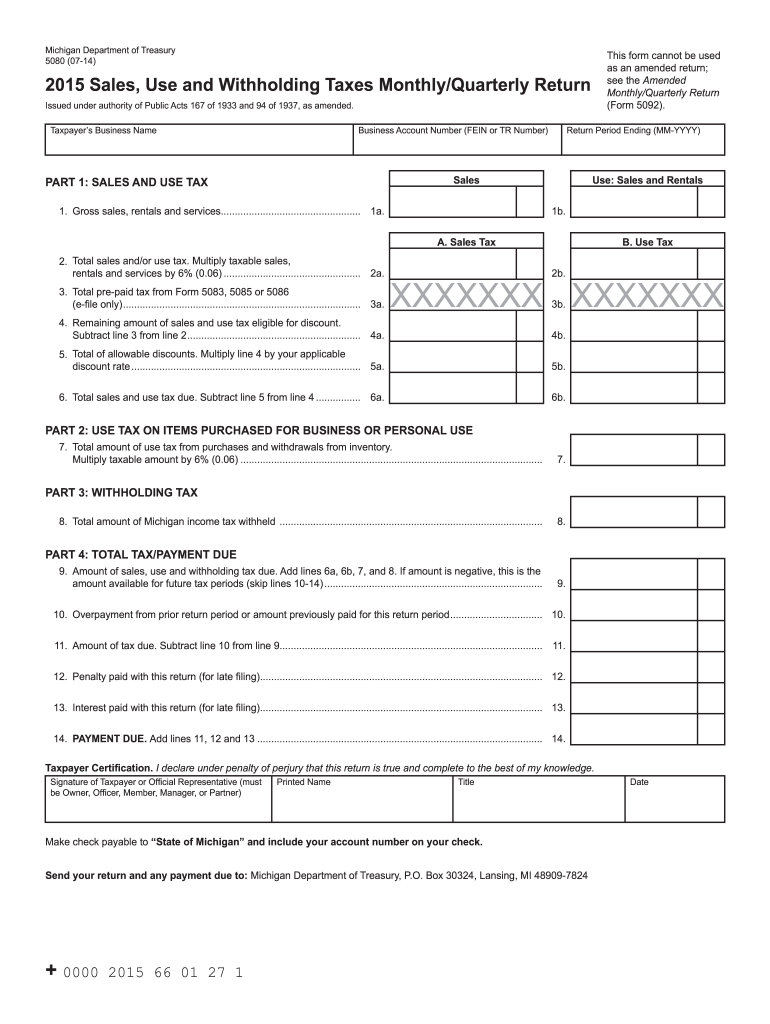

Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. Use the applicable monthly withholding table from either the pension. If you fail or refuse to submit. Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. Web 2020 sales, use and.

Michigan Tax Withholding Form 2021 2022 W4 Form

The biden administration is blocking funding for elementary and secondary schools with hunting or archery programs under its interpretation of a recent. Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. 2020 sales, use and withholding. Web 2020 sales, use and withholding taxes annual return: A) treat a notice that appears proper as if it.

by Carrollton Public

Keep a copy of this form for your. 2021 sales, use and withholding. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. • if the tax is more than $5,400 and paid by the 20th,. A) treat a notice that appears proper as if.

2022 Michigan Withholding Tax Form

2020 sales, use and withholding taxes amended annual return: 2020 sales, use and withholding. Mto is free and provides secure 24/7 online access. Web 2020 sales, use and withholding taxes annual return: Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed.

State Of Michigan Withholding And Sales Tax Payment Forms 2022

• if the tax is more than $5,400 and paid by the 20th,. Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. Web instructions included on form: Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year. If you fail.

Michigan Sales Tax And Withholding Form 2022

Change or discontinuance (form 163). Use the applicable monthly withholding table from either the pension. Keep a copy of this form for your. Web instructions included on form: Web filers must file form 5081, sales, use, and withholding taxes annual return, by february 28th of the following year.

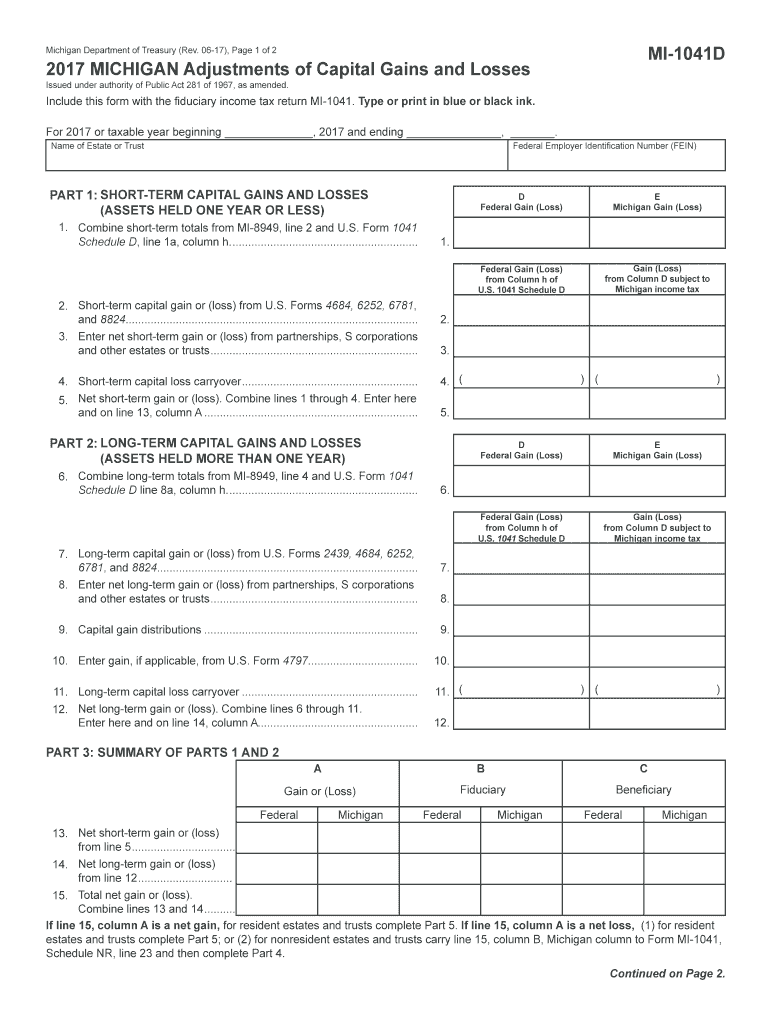

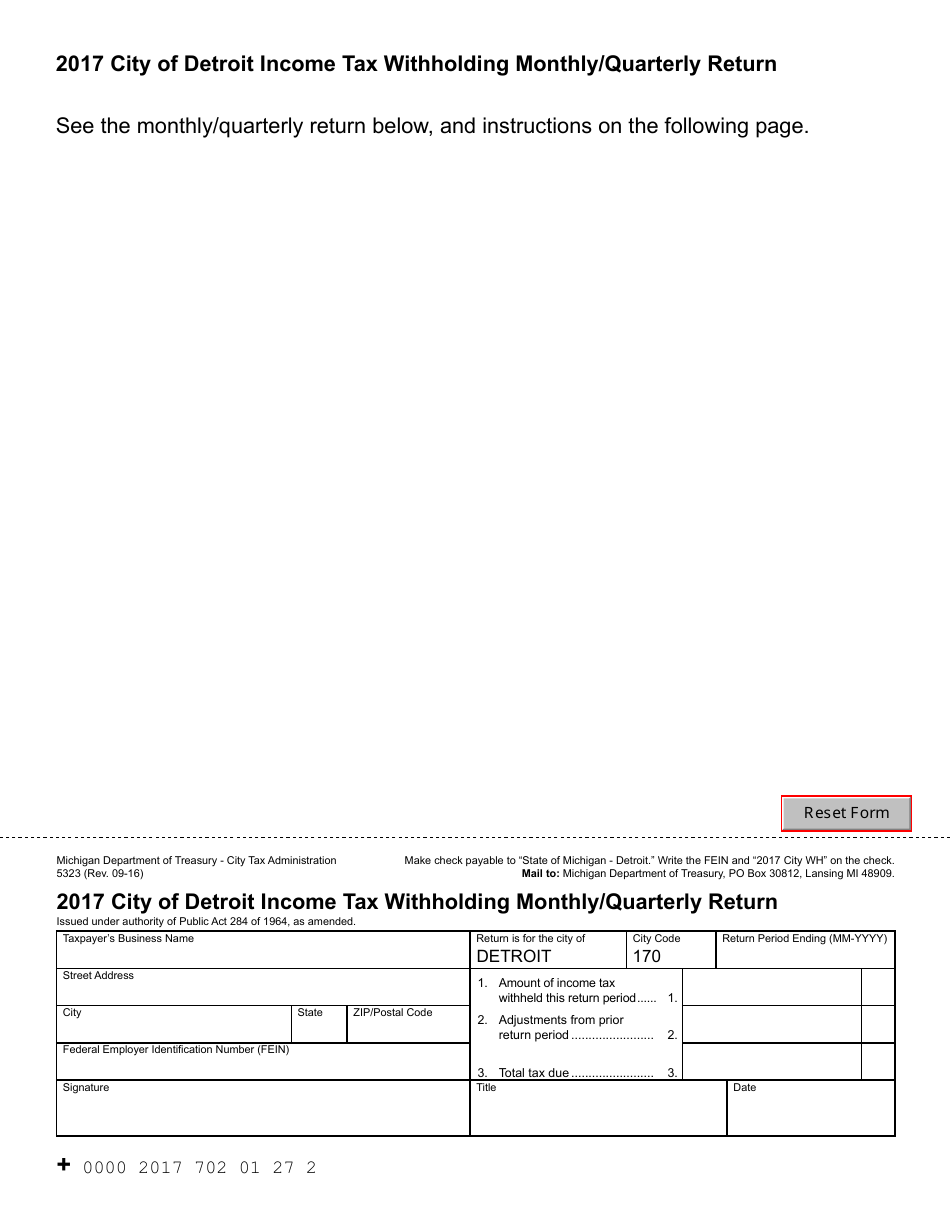

Form 5323 Download Fillable PDF or Fill Online City of Detroit

After receiving the order, the employer must: Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for any exemptions. Sales and other dispositions of capital assets: Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. 2020 sales, use and withholding.

Michigan Employee Withholding Form 2022 2023

If you fail or refuse to submit. A) treat a notice that appears proper as if it. Web mto at mto.treasury.michigan.gov or mail a notice of for the tax period. Sales and other dispositions of capital assets: Web if you fail or refuse to file this form, your employer must withhold michigan income tax from your wages without allowance for.

Use The Applicable Monthly Withholding Table From Either The Pension.

Web michigan treasury online (mto) is available for registration, sales, use and withholding (suw) tax years 2015 and beyond. Mto is free and provides secure 24/7 online access. A) treat a notice that appears proper as if it. • if the tax is more than $5,400 and paid by the 20th,.

2021 Sales, Use And Withholding.

Web 2020 sales, use and withholding taxes annual return: Web mto is the michigan department of treasury's web portal to many business taxes. Change or discontinuance (form 163). If you fail or refuse to submit.

Sales And Other Dispositions Of Capital Assets:

2020 sales, use and withholding taxes amended annual return: After receiving the order, the employer must: Treasury is committed to protecting sensitive taxpayer information while providing. 2020 sales, use and withholding.

2021 Sales, Use And Withholding Taxes Amended Annual Return:

Web instructions included on form: Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. The biden administration is blocking funding for elementary and secondary schools with hunting or archery programs under its interpretation of a recent. Web to send an income withholding notice directly to a supp payer’orts michigan employer.