Mileage Log Template Excel

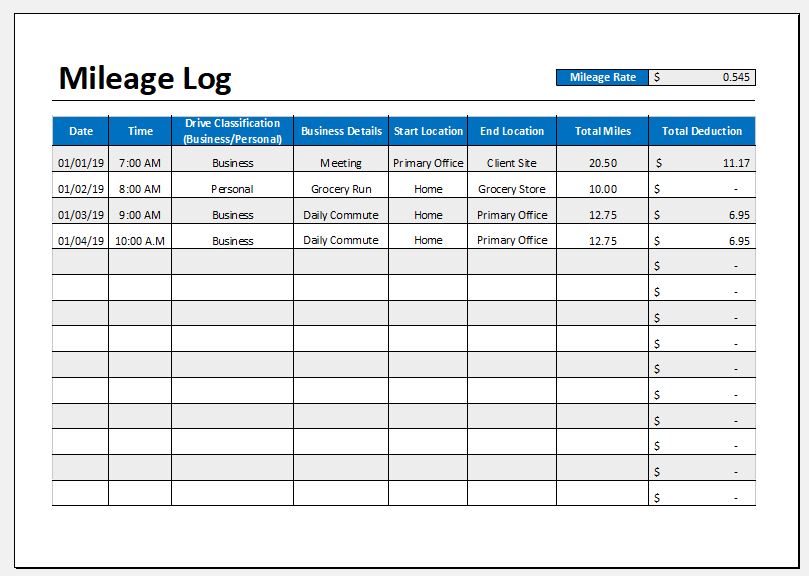

Mileage Log Template Excel - Web download a printable gas mileage log that you can keep in your car or download our mileage calculator for excel to create a mileage chart so you can see how your car is performing over time, and estimate the $cost per mile. Web need to track the miles you and your employees drive? Track mileage automatically with workyard's time tracking app Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on your schedule c tax form. Web download the free 2023 mileage log template as a pdf, sheets or excel version and keep track of your trips. The irs requires every business owner to keep specific and accurate information regarding business mileage deductions. If you receive mileage reimbursement as compensation for driving a vehicle for the. Free irs printable mileage log form to download. Use one of our mileage templates in microsoft excel to track your miles.

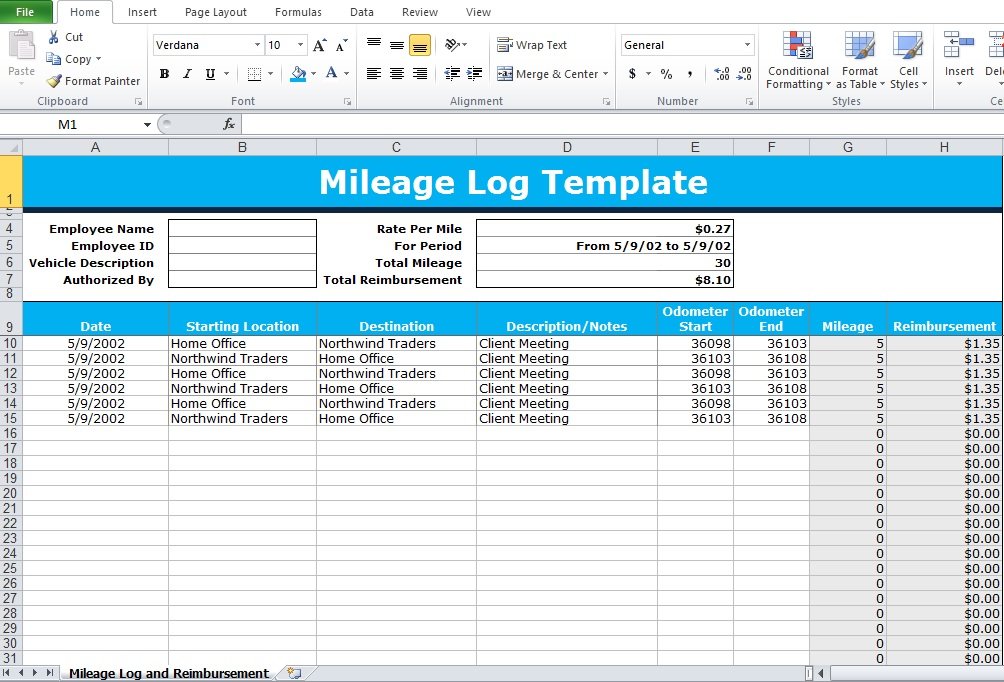

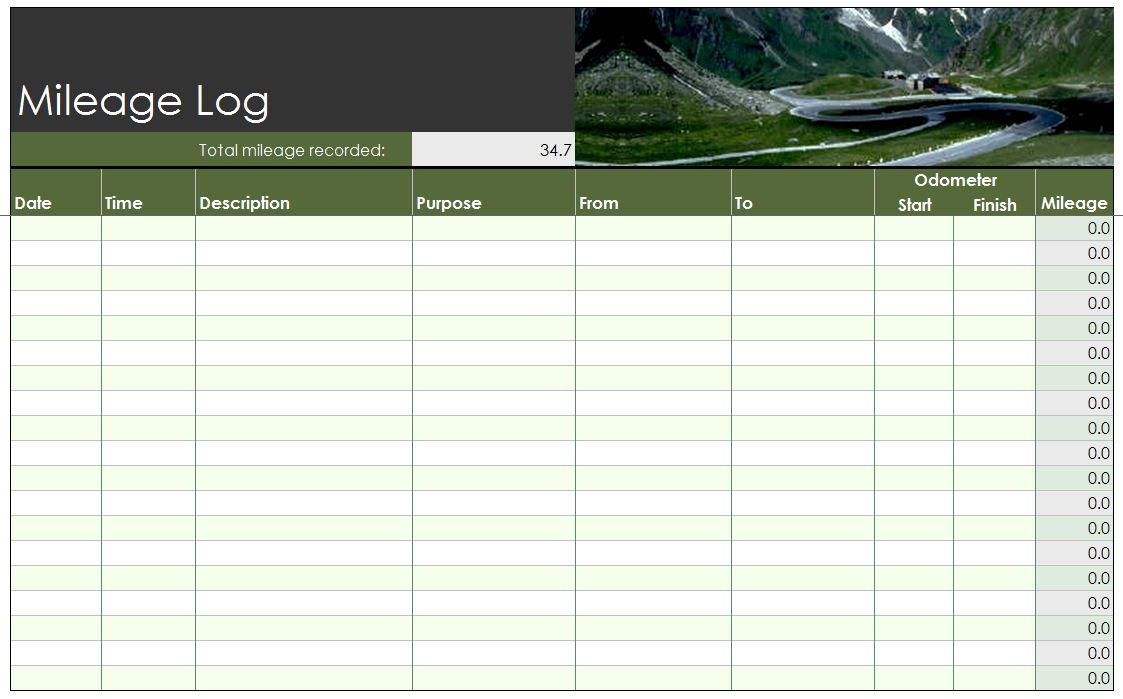

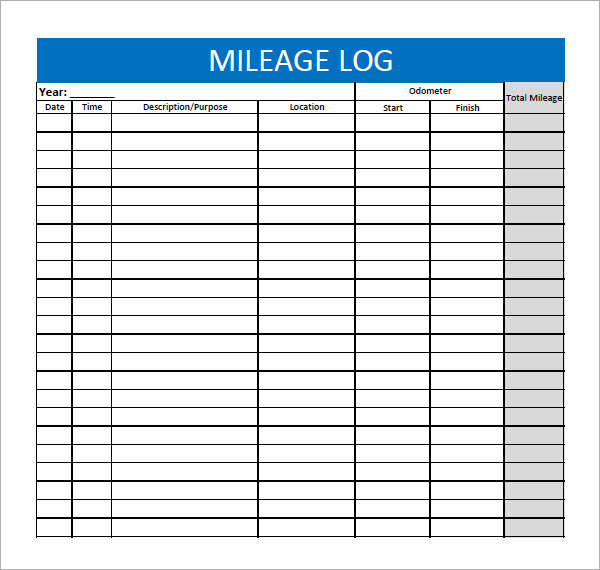

Make a mileage log using excel table a mileage log should include the dates, starting and ending locations, purposes of the trips, odometer readings at the beginning and end of the trips, and the trips’ mileage. Track mileage automatically with workyard's time tracking app Advertisement download the mileage log download the pdf below and print it out. Free irs printable mileage log form to download. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web download a printable gas mileage log that you can keep in your car or download our mileage calculator for excel to create a mileage chart so you can see how your car is performing over time, and estimate the $cost per mile. Mileage log template for excel. Web need to track the miles you and your employees drive? The irs requires every business owner to keep specific and accurate information regarding business mileage deductions. Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis.

Web download a printable gas mileage log that you can keep in your car or download our mileage calculator for excel to create a mileage chart so you can see how your car is performing over time, and estimate the $cost per mile. If you receive mileage reimbursement as compensation for driving a vehicle for the. Track mileage automatically with workyard's time tracking app Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. That's why we created a free downloadable mileage log template will help you track your mileage manually This template is practical for employees who make several trips throughout their workday, with ample space to record the details of their vehicle usage. Web download the free 2023 mileage log template as a pdf, sheets or excel version and keep track of your trips. Keeping a mileage log as an employee. Free irs printable mileage log form to download. Make a mileage log using excel table a mileage log should include the dates, starting and ending locations, purposes of the trips, odometer readings at the beginning and end of the trips, and the trips’ mileage.

8 Excel Mileage Log Template SampleTemplatess SampleTemplatess

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on your schedule c tax form. Make a mileage log using excel.

MS Excel Vehicle Mileage Log Template Word & Excel Templates

That's why we created a free downloadable mileage log template will help you track your mileage manually Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web download the free 2023 mileage log template as a pdf, sheets or excel version and keep track of your trips. All in all, it’s.

10+ Excel Mileage Log Templates Excel Templates

That's why we created a free downloadable mileage log template will help you track your mileage manually Free irs printable mileage log form to download. Use one of our mileage templates in microsoft excel to track your miles. Track mileage automatically with workyard's time tracking app Keeping a mileage log as an employee.

8 Mileage Log Template Excel Excel Templates

Web need to track the miles you and your employees drive? All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Make a mileage log using excel table a mileage log should include the dates, starting and ending locations, purposes of the trips, odometer readings at the.

10+ Vehicle Mileage Log Templates for MS Excel Word & Excel Templates

Web using the standard mileage rate, this template will calculate your deduction per trip, making it easy to calculate your total deduction when it comes time to file your taxes on your schedule c tax form. Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. Web download the.

Mileage Log Excel Template Excel Tmp

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. Track mileage automatically with workyard's time tracking app Free irs printable mileage log form to download. Web using the standard mileage.

Mileage Log Excel Templates

If you receive mileage reimbursement as compensation for driving a vehicle for the. Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. This template is practical for employees who make several trips throughout their workday, with ample space to record the details of their vehicle usage. All in.

Mileage Log Template Free Mileage Log Template

Web download a printable gas mileage log that you can keep in your car or download our mileage calculator for excel to create a mileage chart so you can see how your car is performing over time, and estimate the $cost per mile. Make a mileage log using excel table a mileage log should include the dates, starting and ending.

FREE 17+ Sample Mileage Log Templates in MS Word MS Excel Pages

This template is practical for employees who make several trips throughout their workday, with ample space to record the details of their vehicle usage. That's why we created a free downloadable mileage log template will help you track your mileage manually Keeping a mileage log as an employee. Web 25 free mileage log templates (excel | word | pdf) it.

Mileage Log Template »

Web download the free 2023 mileage log template as a pdf, sheets or excel version and keep track of your trips. Use one of our mileage templates in microsoft excel to track your miles. Web need to track the miles you and your employees drive? The irs requires every business owner to keep specific and accurate information regarding business mileage.

Use One Of Our Mileage Templates In Microsoft Excel To Track Your Miles.

Mileage log template for excel. Free irs printable mileage log form to download. Track mileage automatically with workyard's time tracking app The irs requires every business owner to keep specific and accurate information regarding business mileage deductions.

Web Using The Standard Mileage Rate, This Template Will Calculate Your Deduction Per Trip, Making It Easy To Calculate Your Total Deduction When It Comes Time To File Your Taxes On Your Schedule C Tax Form.

If you receive mileage reimbursement as compensation for driving a vehicle for the. That's why we created a free downloadable mileage log template will help you track your mileage manually Web download a printable gas mileage log that you can keep in your car or download our mileage calculator for excel to create a mileage chart so you can see how your car is performing over time, and estimate the $cost per mile. Web 25 free mileage log templates (excel | word | pdf) it is crucial for businesses to correctly track their business mileage as it could be beneficial in tax deductions.

Therefore, Enter These Labels/Headers In Cells B4 To H4 Respectively As Shown In The Following Picture.

Web our simple mileage log template includes all the necessary fields for keeping track of business miles on a daily basis. Advertisement download the mileage log download the pdf below and print it out. Keeping a mileage log as an employee. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer.

Web This Free Mileage Log Template Tracks Your Trips And Automatically Calculates Your Mileage Deduction On Each One.

Make a mileage log using excel table a mileage log should include the dates, starting and ending locations, purposes of the trips, odometer readings at the beginning and end of the trips, and the trips’ mileage. Web download the free 2023 mileage log template as a pdf, sheets or excel version and keep track of your trips. Web need to track the miles you and your employees drive? This template is practical for employees who make several trips throughout their workday, with ample space to record the details of their vehicle usage.