Minnesota Form M1 Instructions 2022

Minnesota Form M1 Instructions 2022 - This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web if you were a nonresident ,. 2022 minnesota income tax withheld (onscreen version) get. The following draft forms and instructions are for. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Find them using find a form. Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. Form m1 is the most common individual income tax return filed for minnesota residents.

Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota. 2022 income additions and subtractions (onscreen version) get form m1m: Find them using find a form. Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. 2022 minnesota income tax withheld (onscreen version) get. Web 9 minnesota taxable income. Share your form with others send m1x. Web you must register to file withholding tax if any of these apply: Form m1 is the most common individual income tax return filed for minnesota residents.

Subtract line 8 from line 3. The final deadline to claim the 2022 refund is august 15, 2024. This form is for income earned in tax year 2022, with tax returns due in april. Web forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule m1sa minnesota. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota. The following draft forms and instructions are for. Web filing a paper income tax return. Web here's how it works 02. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. Form m1 is the most common individual income tax return filed for minnesota residents.

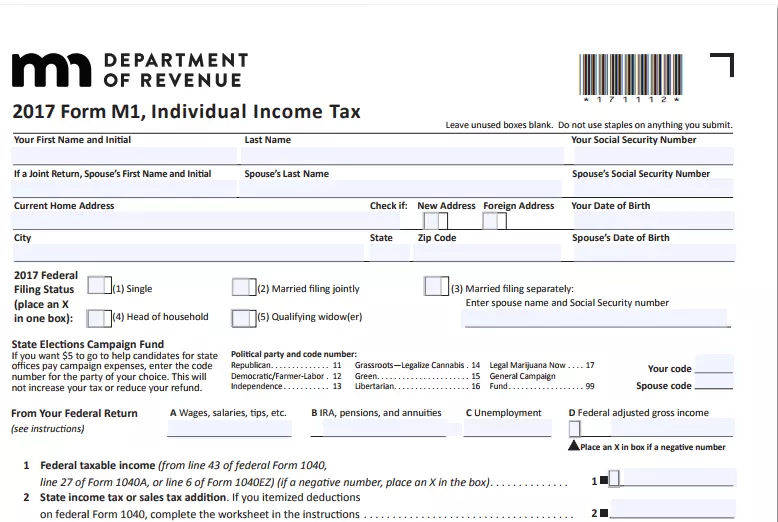

2020 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Web filing a paper income tax return. 2022 minnesota income tax withheld (onscreen version) get. If zero or less, leave blank. Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota. You may qualify for certain minnesota itemized deductions.

Fill Free fillable Minnesota Department of Revenue PDF forms

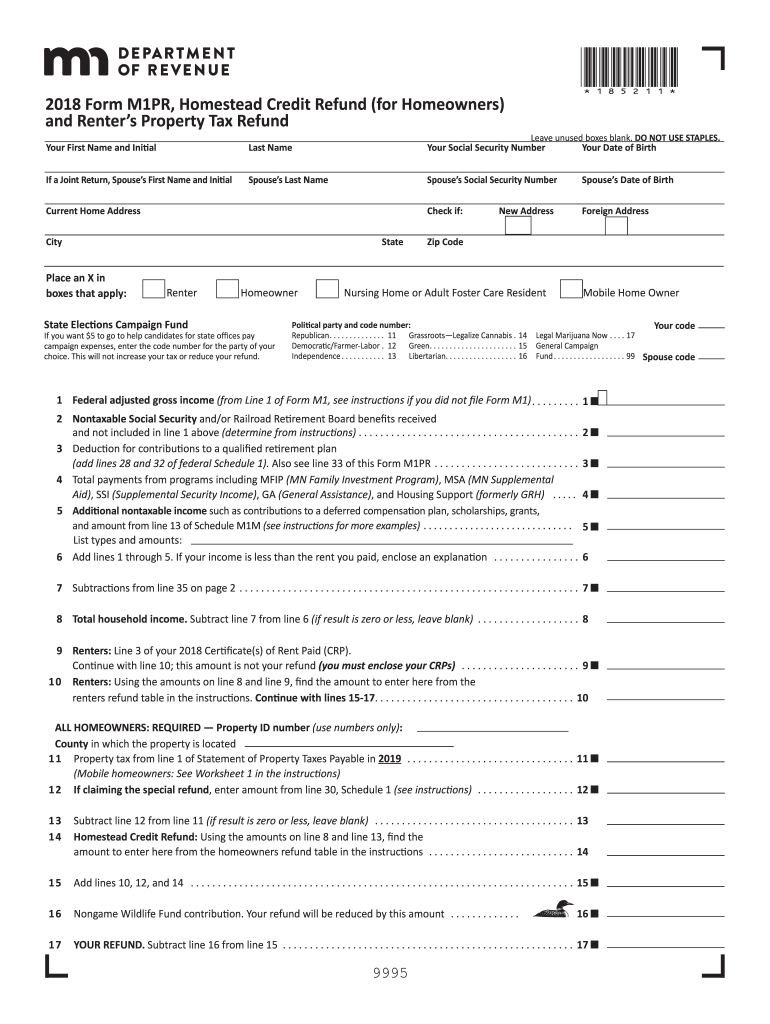

Web forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule m1sa minnesota. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. The final deadline to claim the 2022 refund is august 15, 2024. You must file yearly by april 17. Yes, you.

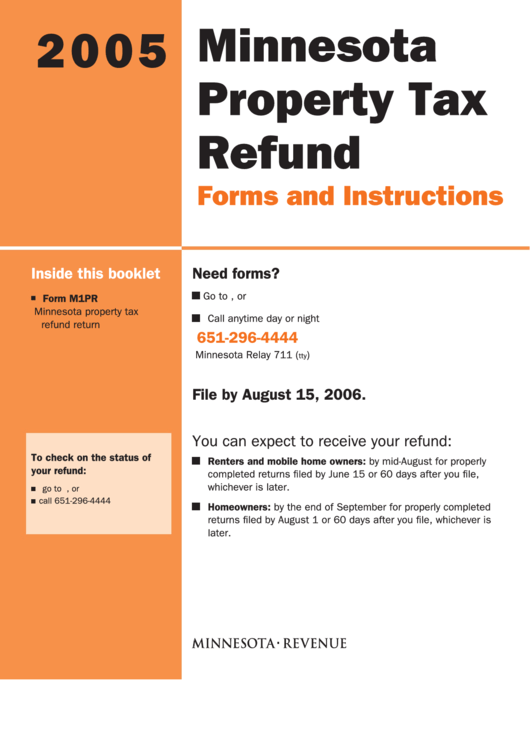

Form M1pr Minnesota Property Tax Refund Return Instructions 2005

This form is for income earned in tax year 2022, with tax returns due in april. We'll make sure you qualify, calculate your. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue. Web we last updated the individual income tax return in december 2022, so this is the latest version of form m1,.

Minnesota Form M1

Web 9 minnesota taxable income. Web here's how it works 02. 2022 minnesota income tax withheld (onscreen version) get. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Minnesota tax forms Fill out & sign online DocHub

You must file yearly by april 17. You may qualify for certain minnesota itemized deductions. Web your 2022 return should be electronically filed, postmarked, or dropped off by august 15, 2023. Web if you were a nonresident ,. The following draft forms and instructions are for.

Fill Free fillable Minnesota Department of Revenue PDF forms

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. This form is for income earned in tax year 2022, with tax returns due in april. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Before starting your minnesota income tax return ( form m1, individual income tax ),.

How To File Minnesota Property Tax Refund

Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. 2022 income additions and subtractions (onscreen version) get form m1m: • you have employees and anticipate withholding tax from their wages in the next 30 days • you agree to withhold. This form is for income earned in tax year 2022, with tax returns.

Minnesota Tax Table M1 Instructions 2020

Web 5 rows we last updated minnesota form m1 instructions in february 2023 from the minnesota. From the table in the form m1 instructions. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue. You can download or print current or. Form m1 is the most common individual income tax return filed for minnesota.

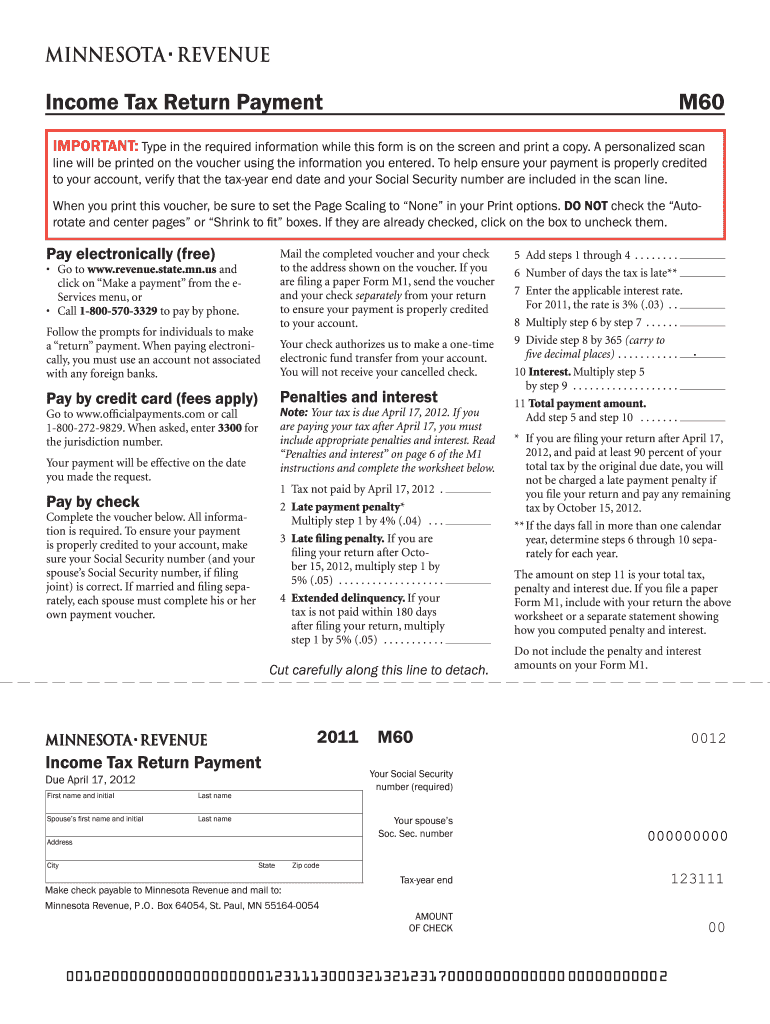

Mn tax payment voucher m60 Fill out & sign online DocHub

Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Web you must register to file withholding tax if any of these apply: We'll make sure you qualify, calculate your. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. Web.

MN DoR M4 20202022 Fill out Tax Template Online US Legal Forms

Web your 2022 return should be electronically filed, postmarked, or dropped off by august 15, 2023. It will help candidates for state offices. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. 2022 income additions and subtractions (onscreen version) get form m1m: Web if you were a nonresident ,.

Web You Must Register To File Withholding Tax If Any Of These Apply:

Form m1 is the most common individual income tax return filed for minnesota residents. • you have employees and anticipate withholding tax from their wages in the next 30 days • you agree to withhold. Web 9 minnesota taxable income. Web 2020 form m1, individual income tax state elections campaign fund to grant $5 to this fund, enter the code for the party of your choice.

Web We Last Updated Minnesota Form M1Lti In February 2023 From The Minnesota Department Of Revenue.

We'll make sure you qualify, calculate your. Subtract line 8 from line 3. From the table in the form m1 instructions. Web your 2022 return should be electronically filed, postmarked, or dropped off by august 15, 2023.

Web Forms And Instructions > Form M1 Minnesota Individual Income Tax Return > Schedule M1W Minnesota Income Tax Withheld > Schedule M1Sa Minnesota.

Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Find them using find a form. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your.

2022 Income Additions And Subtractions (Onscreen Version) Get Form M1M:

Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web here's how it works 02. It will help candidates for state offices. You must file yearly by april 17.