Minnesota Rental Tax Form 2022

Minnesota Rental Tax Form 2022 - The refund provides property tax relief depending on your income and property taxes. The state will increase your renter’s property tax refund by 20.572% and send you the. Web 1 can i get a property tax refund if i own my own house? A minnesota rental application is a. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. You can also look for forms by category below the search box. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a. Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. Complete, edit or print tax forms instantly. Schedule m1pr is filed separately from the individual income.

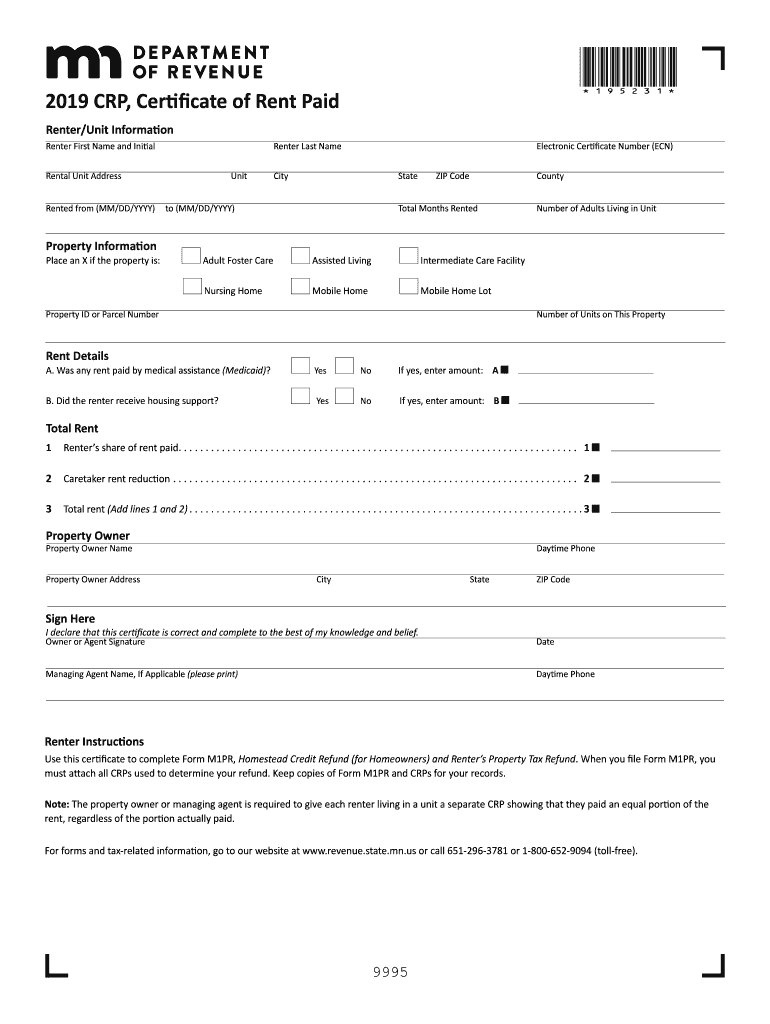

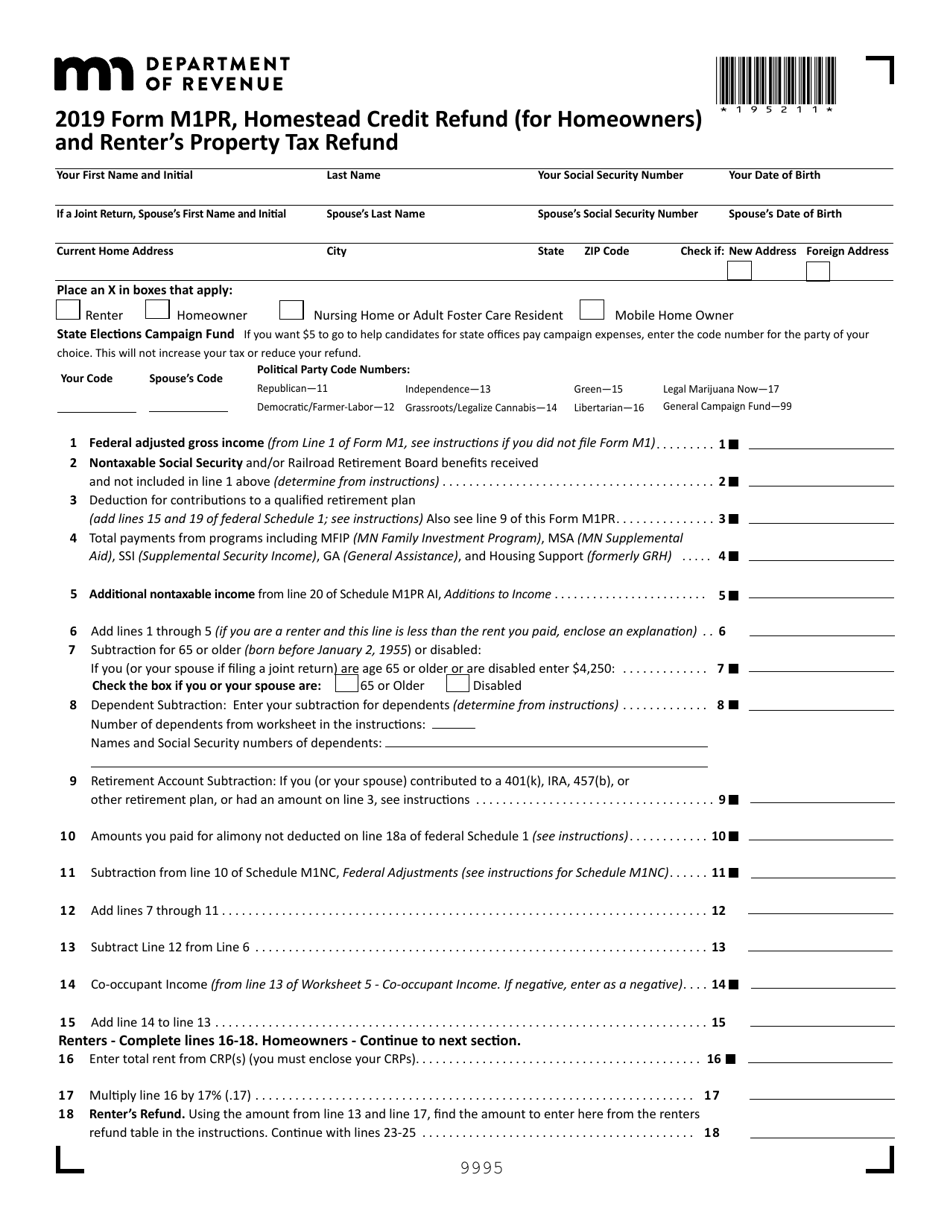

When you file form m1pr, you must attach all crps. You can get minnesota tax forms either by mail or in person. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web how are claims filed? Use this tool to search for a specific tax form using the tax form number or name. Web the minnesota residential lease agreement (“rental agreement”) is a binding agreement that allows a tenant to occupy a landlord’s property for a designated period of. Web drug deaths nationwide hit a record 109,680 in 2022, according to preliminary. A minnesota rental application is a. Web property taxes or rent paid on your primary residence in minnesota. Regular property tax refund income requirements if you are and you may qualify for a refund of up to a.

Web property taxes or rent paid on your primary residence in minnesota. Your landlord is required to. You can also look for forms by category below the search box. If you own, use your property tax statement. Web a minnesota rental application form is a legal document that needs to be filled in by prospective tenants in the state of minnesota so that a landlord can collect all necessary. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web if you filed 2022 form m1pr before june 14, 2023. Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022. Web use this certificate to complete form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web the deadline for filing claims based on rent paid in 2020 is august 15, 2022;

Download Minnesota Rental Application Form for Free Page 2 FormTemplate

Use this tool to search for a specific tax form using the tax form number or name. The refund provides property tax relief depending on your income and property taxes. Web a minnesota rental application form is a legal document that needs to be filled in by prospective tenants in the state of minnesota so that a landlord can collect.

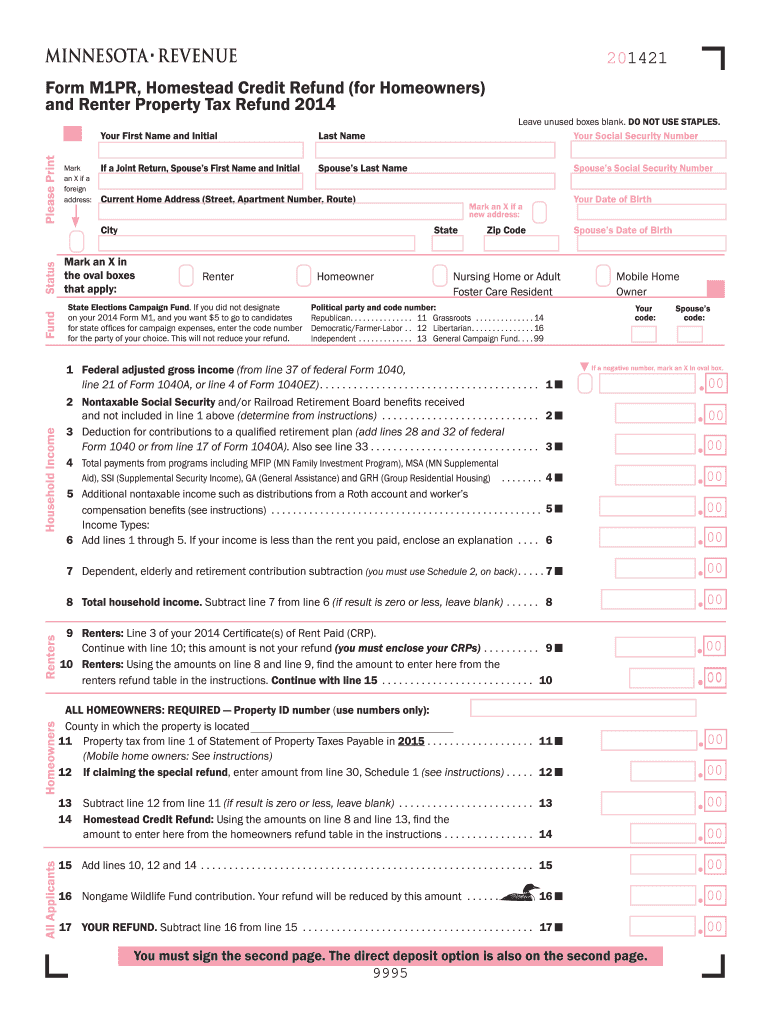

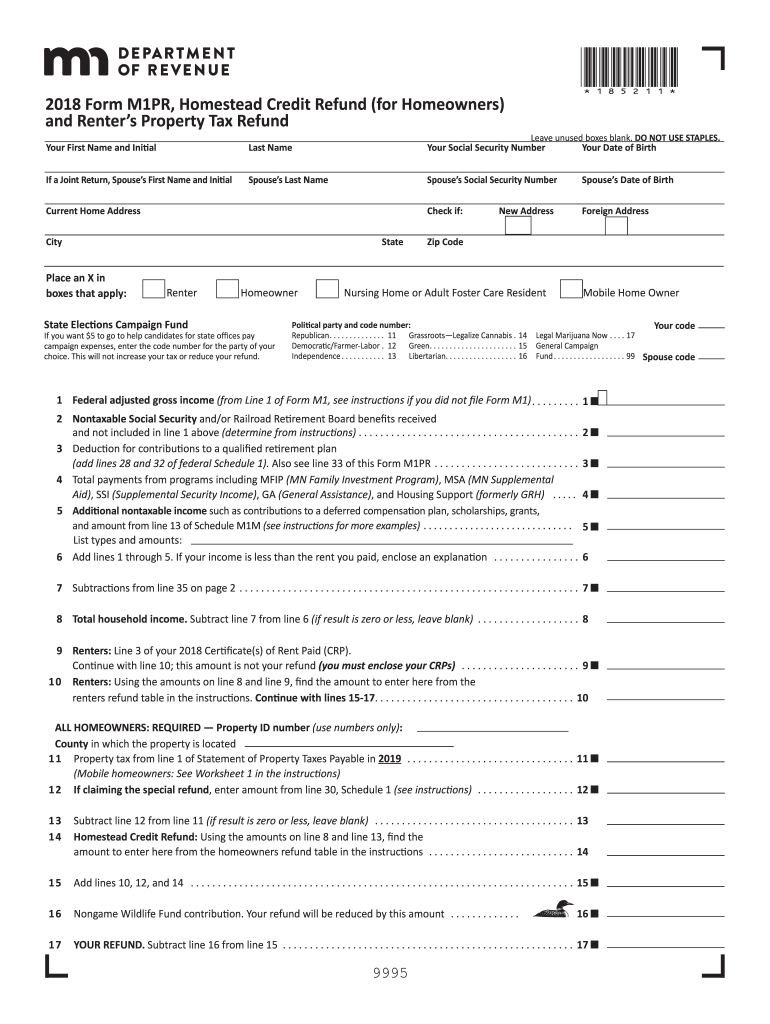

Mn Form Property Tax Fill Out and Sign Printable PDF Template signNow

February 24, 2022 by elizabeth souza. You can get minnesota tax forms either by mail or in person. Web more about the minnesota form m1pr instructions individual income tax tax credit ty 2022 you may be eligible for a minnesota tax refund based on your household income. Web 1 can i get a property tax refund if i own my.

M1pr form Fill out & sign online DocHub

The refund provides property tax relief depending on your income and property taxes. You do not need to do anything. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web more about the minnesota form m1pr instructions individual income.

Crp forms for 2018 Fill out & sign online DocHub

A minnesota rental application is a. Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. 2 do i have to file my renter’s refund with my regular taxes on april 15? Web if you are filing form m1pr for the renter's property tax refund, you must attach the certificate of rent paid (crp) provided by your landlord..

Minnesota Rental Application Free Download

2 do i have to file my renter’s refund with my regular taxes on april 15? You can get minnesota tax forms either by mail or in person. Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022. Web property taxes or rent paid on your primary residence in minnesota..

Form M1PR Download Fillable PDF or Fill Online Homestead Credit Refund

2 do i have to file my renter’s refund with my regular taxes on april 15? If you own, use your property tax statement. February 24, 2022 by elizabeth souza. Complete, edit or print tax forms instantly. A minnesota rental application is a.

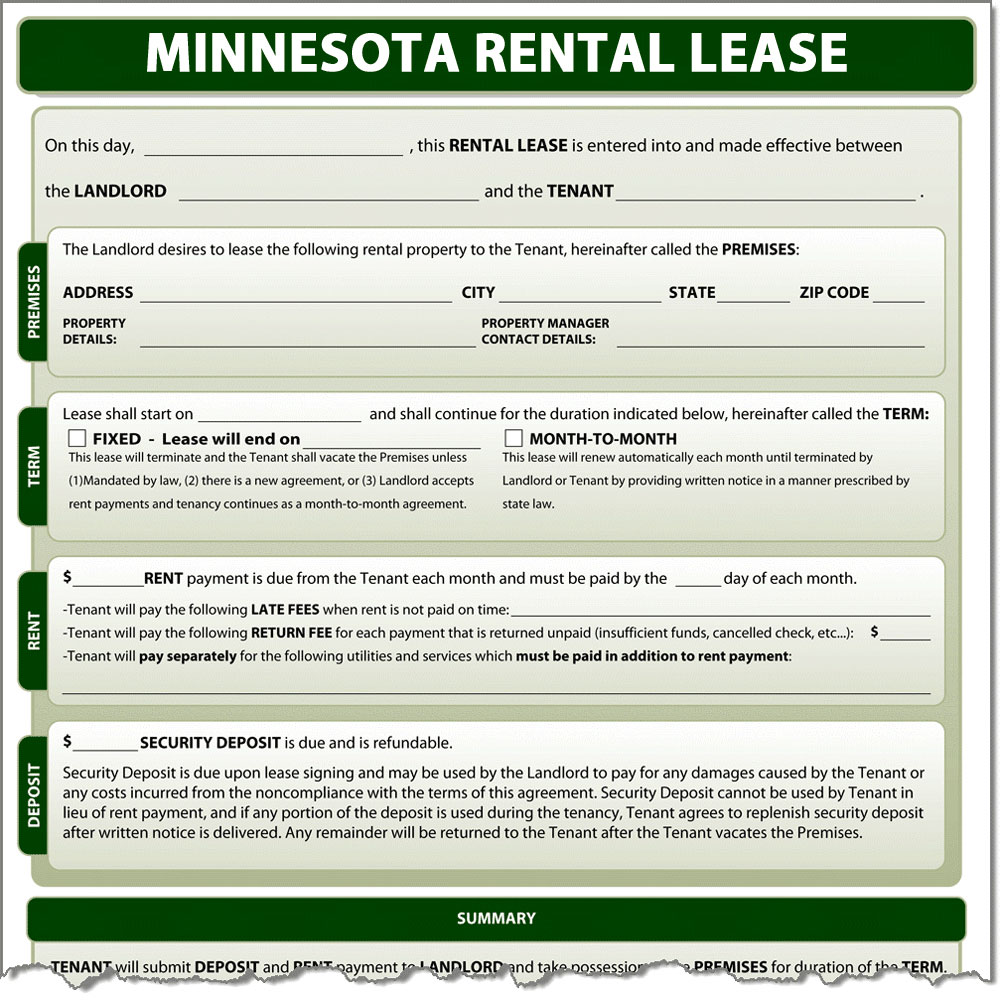

Minnesota Rental Lease

Web the minnesota residential lease agreement (“rental agreement”) is a binding agreement that allows a tenant to occupy a landlord’s property for a designated period of. Download or email mn crp form & more fillable forms, register and subscribe now! 3 can i file my renter’s refund after august 15?. Schedule m1pr is filed separately from the individual income. Complete,.

Download Minnesota Rental Application Form for Free FormTemplate

February 24, 2022 by elizabeth souza. Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. The refund provides property tax relief depending on your income and property taxes. Complete, edit or print tax forms instantly. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

Minnesota State Tax designsportshoesus

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund *225211* 2022 form m1pr, homestead credit refund (for homeowners) and. If you own, use your property tax statement. 2 do i have to file my renter’s refund with my regular taxes on april 15? February 24, 2022 by elizabeth souza. You can get it from a.

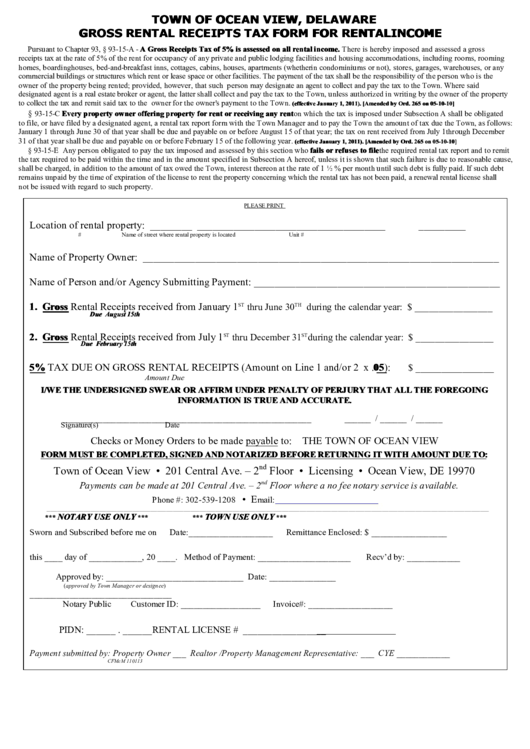

Fillable Gross Rental Receipts Tax Form For Rental Town Of

You can get it from a library, call (651). Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund *225211* 2022 form m1pr, homestead credit refund (for homeowners) and. Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022. Your landlord is required to. Web if.

The Refund Provides Property Tax Relief Depending On Your Income And Property Taxes.

Refund claims are filed using minnesota department of revenue (dor) schedule m1pr. You can get minnesota tax forms either by mail or in person. Web how are claims filed? When you file form m1pr, you must attach all crps.

Web A Minnesota Rental Application Form Is A Legal Document That Needs To Be Filled In By Prospective Tenants In The State Of Minnesota So That A Landlord Can Collect All Necessary.

Web if you're a minnesota homeowner or renter, you may qualify for a property tax refund. The state will increase your renter’s property tax refund by 20.572% and send you the. Complete, edit or print tax forms instantly. 3 can i file my renter’s refund after august 15?.

Web Drug Deaths Nationwide Hit A Record 109,680 In 2022, According To Preliminary.

The minnesota rental application form is a document that is used to collect screening. Your landlord is required to. February 24, 2022 by elizabeth souza. How many renters receive refunds, and.

Web Forbes Advisor's Capital Gains Tax Calculator Helps Estimate The Taxes You'll Pay On Profits Or Losses On Sale Of Assets Such As Real Estate, Stocks & Bonds For The.

Web the deadline for filing claims based on rent paid in 2020 is august 15, 2022; Web • if you rent, your landlord must give you a certificate of rent paid (crp) by january 31, 2022. Web 1 can i get a property tax refund if i own my own house? 2 do i have to file my renter’s refund with my regular taxes on april 15?