Missouri Rent Rebate Form

Missouri Rent Rebate Form - The first social security number shown on your tax return. Complete, edit or print tax forms instantly. Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. A security deposit (counts as one month's rent) and first month’s rent; You must provide the contact information for the individual filing this return. Required to file an individual income tax return; Web to help alleviate this burden, the state of missouri offers a rent rebate program for eligible individuals and families. Web filling out the missouri renters rebate form 2021 with signnow will give greater confidence that the output template will be legally binding and safeguarded. This guide provides a comprehensive. Please note, direct deposit of a property tax credit.

Required to file an individual income tax return; The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of the real estate. Please note, direct deposit of a property tax credit. The first social security number shown on your tax return. Sign it in a few clicks draw your. Enter the whole dollar amount for your anticipated refund or balance due. You must provide the contact information for the individual filing this return. A completed verification of rent paid (form. The safhr program was designed to provide temporary immediate emergency assistance in. No receipts/letters from the landlord will be accepted.

This guide provides a comprehensive. The first social security number shown on your tax return. Select the filing status of your form. Please note, direct deposit of a property tax credit. Web attach rent receipt (s) for each rent payment for the entire year, a signed statement from your landlord, or copies of canceled checks (front and back). Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. A completed verification of rent paid (form. Enter the whole dollar amount for your anticipated refund or balance due. Edit your missouri rent rebate 2018 online type text, add images, blackout confidential details, add comments, highlights and more. Web to help alleviate this burden, the state of missouri offers a rent rebate program for eligible individuals and families.

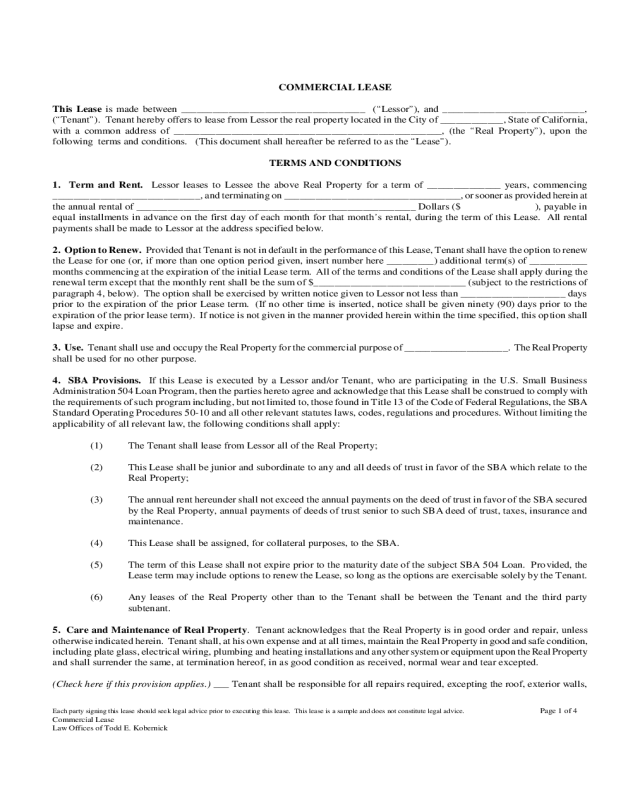

Commercial Rental and Lease FormCalifornia Edit, Fill, Sign Online

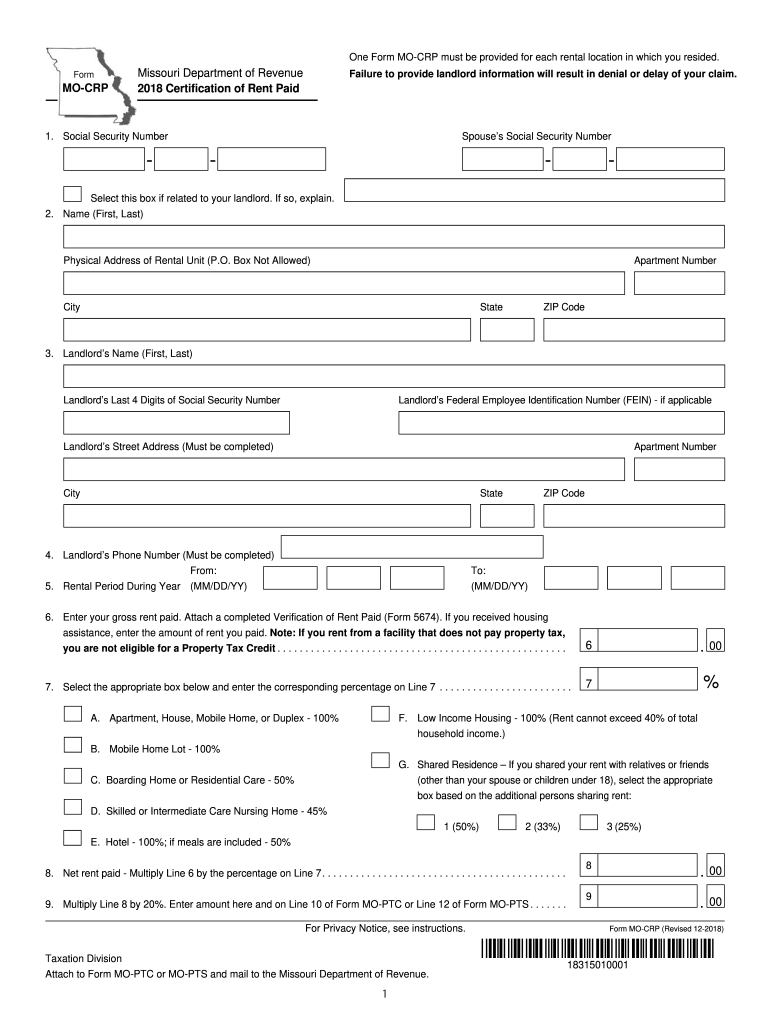

The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of the real estate. Failure to provide landlord information will result in denial or delay of your claim. The safhr program was designed to provide temporary immediate emergency assistance in. A completed verification of rent paid (form. A security deposit.

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Sign it in a few clicks draw your. Web to help alleviate this burden, the state of missouri offers a rent rebate program for eligible individuals and families. Please note, direct deposit of a property tax credit. Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. Web filling out the missouri renters rebate form 2021 with signnow.

Property Tax/Rent Rebate Program Opens Franklin County Freepress

Web the rent rebate form is a valuable initiative provided by the state of missouri to assist eligible individuals and families in managing their housing expenses. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. The.

FREE 7+ Sample Rent Rebate Forms in PDF

Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web attach rent receipt (s) for each rent payment for the entire year, a signed statement from your landlord, or copies of canceled checks (front and back)..

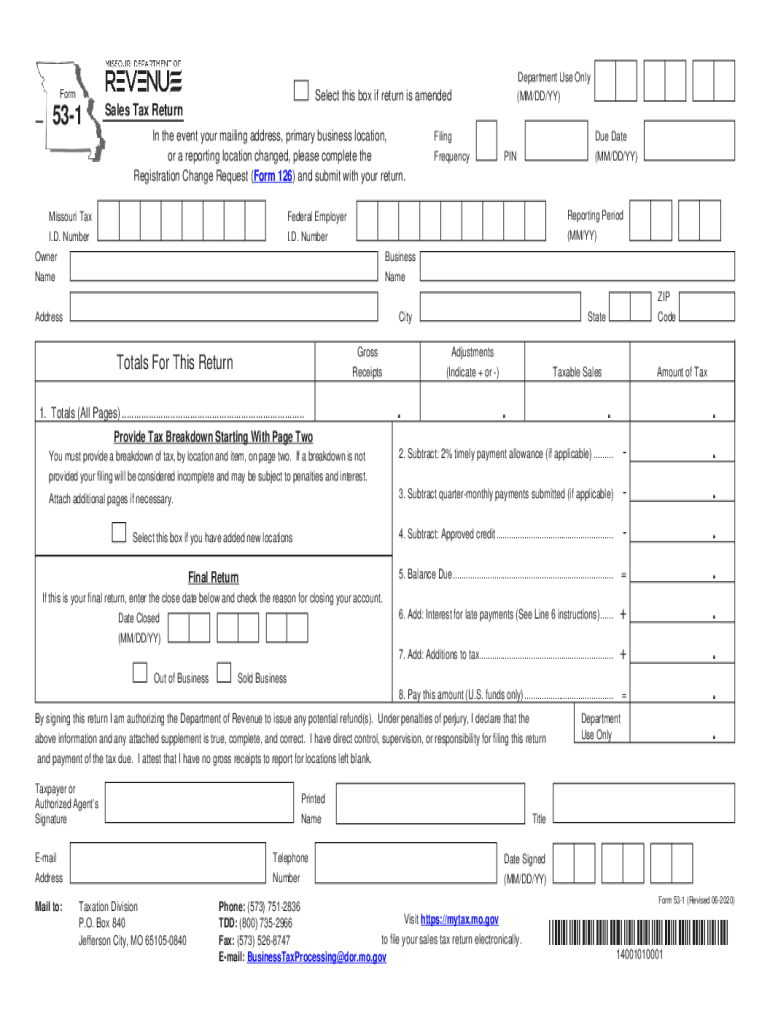

2020 MO DoR Form 531 Fill Online, Printable, Fillable, Blank pdfFiller

Edit your missouri rent rebate 2018 online type text, add images, blackout confidential details, add comments, highlights and more. Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. You must provide the contact information for the individual filing this return. Web the rent rebate form is a valuable initiative provided by the state of missouri to assist.

Renters Rebate Sample Form Free Download

If you are a homeowner, you will. Web attach rent receipt (s) for each rent payment for the entire year, a signed statement from your landlord, or copies of canceled checks (front and back). Web up to three months of rent. Web filling out the missouri renters rebate form 2021 with signnow will give greater confidence that the output template.

2018 Form MO MOCRP Fill Online, Printable, Fillable, Blank pdfFiller

A security deposit (counts as one month's rent) and first month’s rent; It also provides a link to the forms:. Failure to provide landlord information will result in denial or delay of your claim. Complete, edit or print tax forms instantly. Edit your missouri rent rebate 2018 online type text, add images, blackout confidential details, add comments, highlights and more.

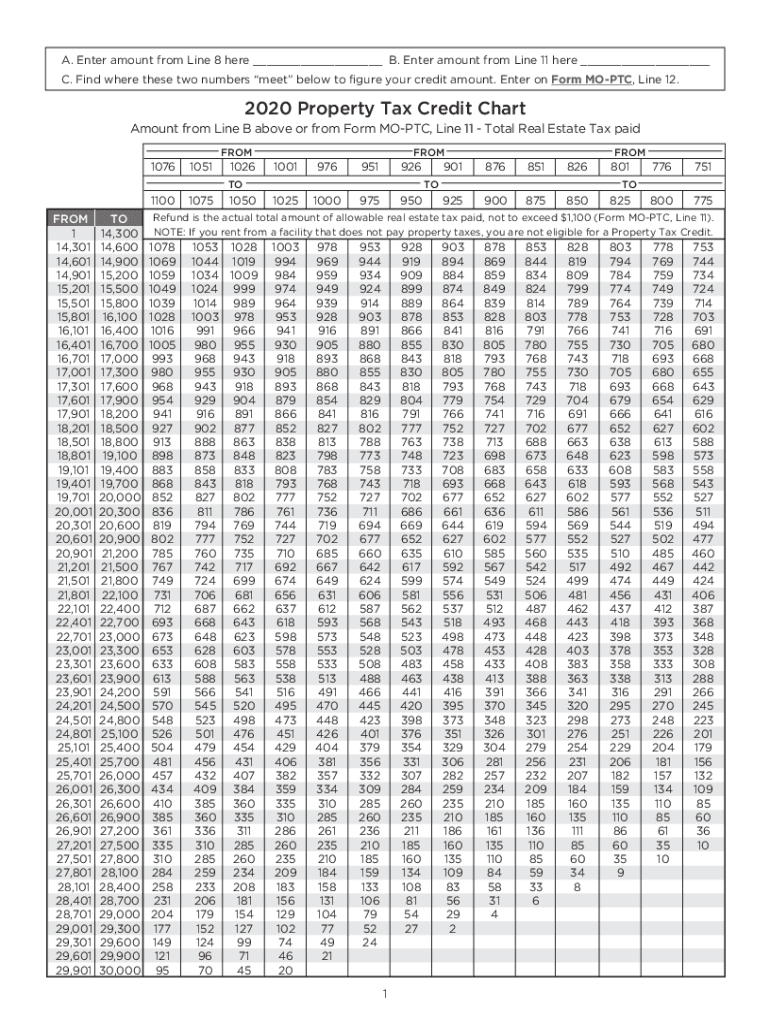

Missouri property tax credit chart Fill out & sign online DocHub

Failure to provide landlord information will result in denial or delay of your claim. This web reference will tell you if you're eligible in missouri. The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disable individuals for a portion of the real estate. The first social security number shown on your tax return. Web.

2019 Rent Rebate Form Missouri justgoing 2020

You must provide the contact information for the individual filing this return. The first social security number shown on your tax return. It also provides a link to the forms:. Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. Web the rent rebate form is a valuable initiative provided by the state of missouri to assist eligible.

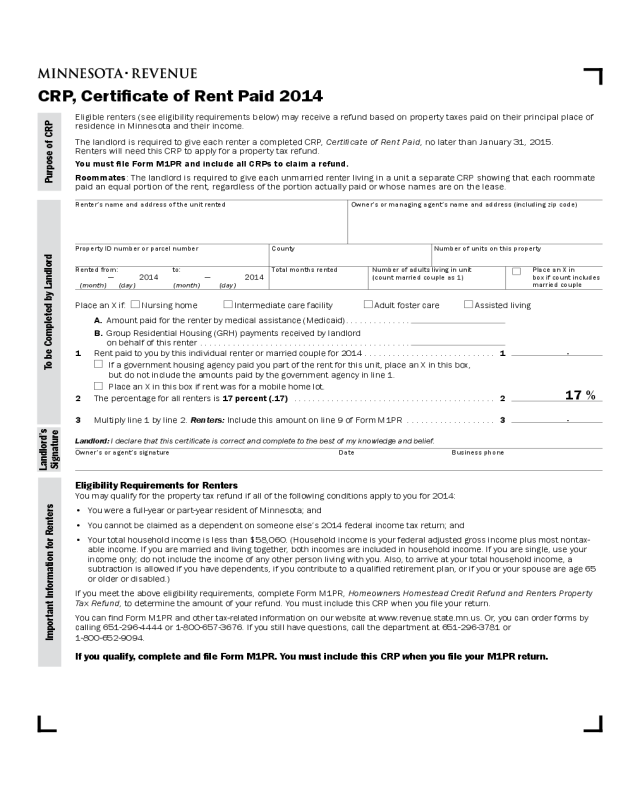

Fillable Form M1pr Homestead Credit Refund (For Homeowners) And

This web reference will tell you if you're eligible in missouri. The safhr program was designed to provide temporary immediate emergency assistance in. A security deposit (counts as one month's rent) and first month’s rent; You must provide the contact information for the individual filing this return. A completed verification of rent paid (form.

It Also Provides A Link To The Forms:.

Web filling out the missouri renters rebate form 2021 with signnow will give greater confidence that the output template will be legally binding and safeguarded. Select the filing status of your form. Web attach rent receipt (s) for each rent payment for the entire year, a signed statement from your landlord, or copies of canceled checks (front and back). No receipts/letters from the landlord will be accepted.

Web The Rent Rebate Form Is A Valuable Initiative Provided By The State Of Missouri To Assist Eligible Individuals And Families In Managing Their Housing Expenses.

Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Enter the whole dollar amount for your anticipated refund or balance due. A security deposit (counts as one month's rent) and first month’s rent; Web up to three months of rent.

The Missouri Property Tax Credit Claim Gives Credit To Certain Senior Citizens And 100 Percent Disable Individuals For A Portion Of The Real Estate.

You must provide the contact information for the individual filing this return. Web all inquiries regarding 1099 tax forms should be directed to mo.safhr@mhdc.com. Complete, edit or print tax forms instantly. If you are a homeowner, you will.

Web To Help Alleviate This Burden, The State Of Missouri Offers A Rent Rebate Program For Eligible Individuals And Families.

Required to file an individual income tax return; Web the above answer refers to pennsylvanians. Sign it in a few clicks draw your. Failure to provide landlord information will result in denial or delay of your claim.