Missouri Renters Rebate Form 2021

Missouri Renters Rebate Form 2021 - It also provides a link to the forms:. Please note, direct deposit of a property tax credit. You must provide the contact information for the individual filing this return. 3946 bellefontaine avenue, kansas city, mo 64130. Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750. Web use this program finder to locate rental and utility assistance throughout the u.s. The program ran from 2021 until feb 2023, and is now. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. If you are a homeowner, you will. If you rent from a facility that does not pay.

You must provide the contact information for the individual filing this return. Web use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. The first social security number shown on your tax return. Complete, edit or print tax forms instantly. It also provides a link to the forms:. Please note, direct deposit of a property tax credit refund claim is not an. Missouri property tax credit claim. This web reference will tell you if you're eligible in missouri. Web houses for rent in missouri city, mo; Please note, direct deposit of a property tax credit.

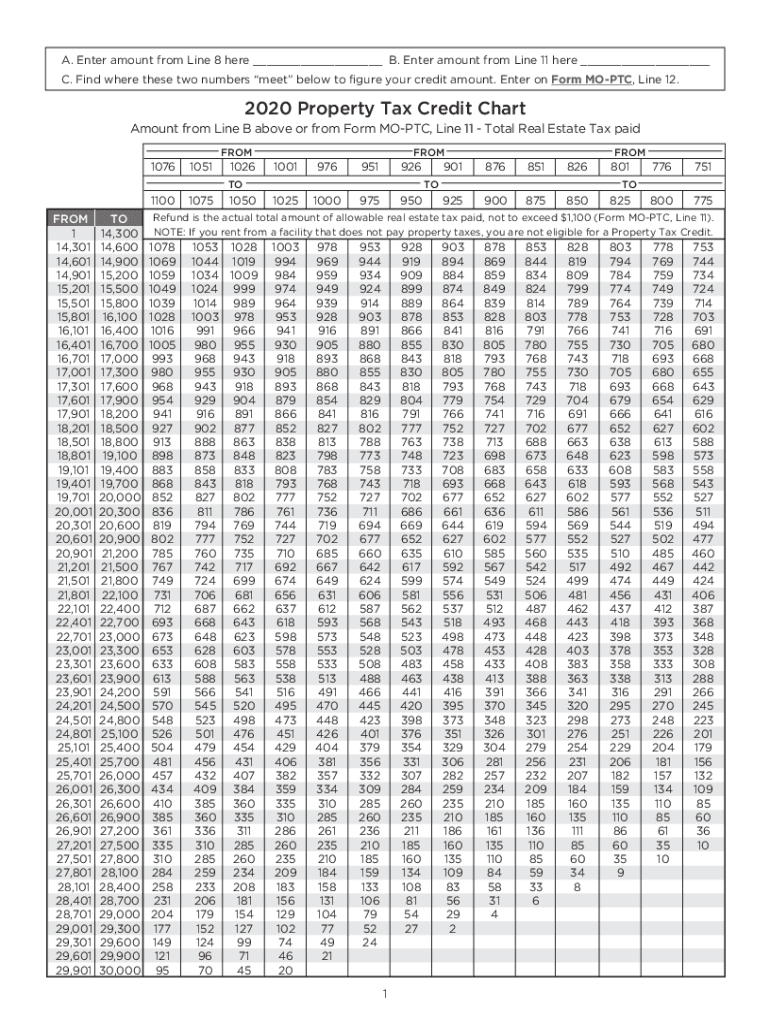

Web use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750. Web the above answer refers to pennsylvanians. It also provides a link to the forms:. Web you can submit your mn homeowner and renter reimbursement form online with efile express and get your refund as soon as minnesota law permits. Please note, direct deposit of a property tax credit. Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. The first social security number shown on your tax return. Web enter the following four items from your tax return to view the status of your return. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy.

Menards Catalog Rebate Program From Jan 24 2021 Printable Crossword

You must provide the contact information for the individual filing this return. Web april 10, 2022 by fredrick. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web houses for rent in missouri city, mo; Please note, direct deposit of.

Renters' Rebate Program Opens April 1st Connecticut House Democrats

Get rent rebate form missouri 2022 here on our website so that you can claim tax credit up to $750. If you rent from a facility that does not pay. You must provide the contact information for the individual filing this return. Missouri property tax credit claim. All missouri short forms allow the standard or itemized deduction.

14 Best Renters Insurance Companies in Missouri

Please note, direct deposit of a property tax credit. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. No receipts/letters from the landlord will be accepted. Web the above answer refers to pennsylvanians. Web short forms help you avoid becoming.

Missouri Renters Rebate 2023 Printable Rebate Form

The program ran from 2021 until feb 2023, and is now. If you are a homeowner, you will. It also provides a link to the forms:. You must provide the contact information for the individual filing this return. Web enter the following four items from your tax return to view the status of your return.

Missouri Tax Forms 2020

Web you can submit your mn homeowner and renter reimbursement form online with efile express and get your refund as soon as minnesota law permits. All missouri short forms allow the standard or itemized deduction. Web enter the following four items from your tax return to view the status of your return. Web short forms help you avoid becoming confused.

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

No receipts/letters from the landlord will be accepted. The program ran from 2021 until feb 2023, and is now. Please note, direct deposit of a property tax credit refund claim is not an. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. This web reference will tell you if you're.

Mo crp form 2018 Fill out & sign online DocHub

Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web you can submit your mn homeowner and renter reimbursement form online with efile express and get your refund as soon as minnesota law permits. Web april.

FREE 7+ Sample Rent Rebate Forms in PDF

Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web april 10, 2022 by fredrick. Web enter the following four items from your tax return to view the status of your return. This web reference will.

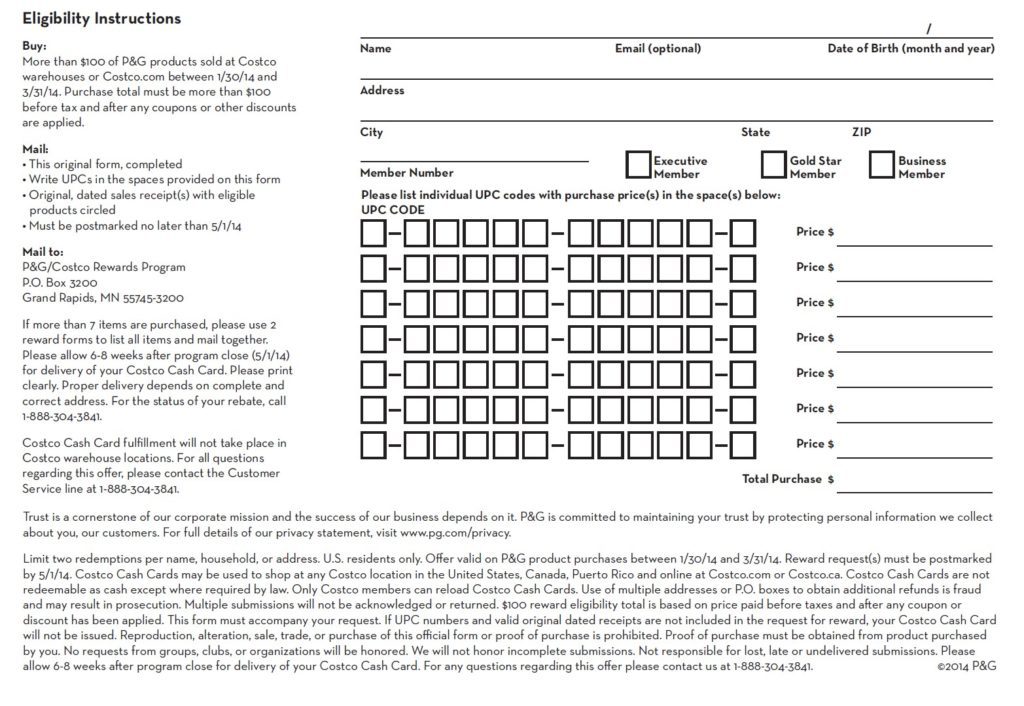

Costco P&G Rebate Printable Rebate Form

Please note, direct deposit of a property tax credit refund claim is not an. Web enter the following four items from your tax return to view the status of your return. You must provide the contact information for the individual filing this return. If you are a homeowner, you will. All missouri short forms allow the standard or itemized deduction.

Renters Rebate Sample Form Free Download

Web use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. Web houses for rent in missouri city, mo; The first social security number shown on your tax return. No receipts/letters from the landlord will be accepted. Complete, edit or print tax forms instantly.

Get Rent Rebate Form Missouri 2022 Here On Our Website So That You Can Claim Tax Credit Up To $750.

Web the missouri property tax credit allows eligible taxpayers to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web houses for rent in missouri city, mo; This web reference will tell you if you're eligible in missouri. If you are a homeowner, you will.

You Can Download Or Print Current Or.

Web you can submit your mn homeowner and renter reimbursement form online with efile express and get your refund as soon as minnesota law permits. Web use the diagram below to determine if you or your spouse are eligible to claim the property tax credit. If you rent from a facility that does not pay. Web the above answer refers to pennsylvanians.

All Missouri Short Forms Allow The Standard Or Itemized Deduction.

Please note, direct deposit of a property tax credit. The program ran from 2021 until feb 2023, and is now. Please note, direct deposit of a property tax credit refund claim is not an. Missouri property tax credit claim.

Web Use This Program Finder To Locate Rental And Utility Assistance Throughout The U.s.

The first social security number shown on your tax return. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. You must provide the contact information for the individual filing this return. No receipts/letters from the landlord will be accepted.