Nc 1099 Form

Nc 1099 Form - Web download tax forms and instructions. Click on view my 1099g” in the menu on the left side. If you want to download a tax form, use the navigation above, search the site, or choose a link. Unemployment benefits are counted as part of a claimant’s income and must be reported. The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. Web general receiving, missing, or past year 1099 faqs. Log into your claimant account, accessible online at des.nc.gov. An itin is issued by the irs to a person who is required to have a taxpayer identification number but does not have. Dornc.com north carolina department of revenue p. Web an official website of the state of north carolina an official website of nc how you know.

However, original, void, or corrected versions of the following forms must be. Click on view my 1099g” in the menu on the left side. Web general receiving, missing, or past year 1099 faqs. Log into your claimant account, accessible online at des.nc.gov. The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. An itin is issued by the irs to a person who is required to have a taxpayer identification number but does not have. Web per the nc dor, north carolina participates in the irs combined federal/state filing program; Web download tax forms and instructions. This page provides answers to general questions about 1099s from nctracks, including receiving 1099s, missing. If you want to download a tax form, use the navigation above, search the site, or choose a link.

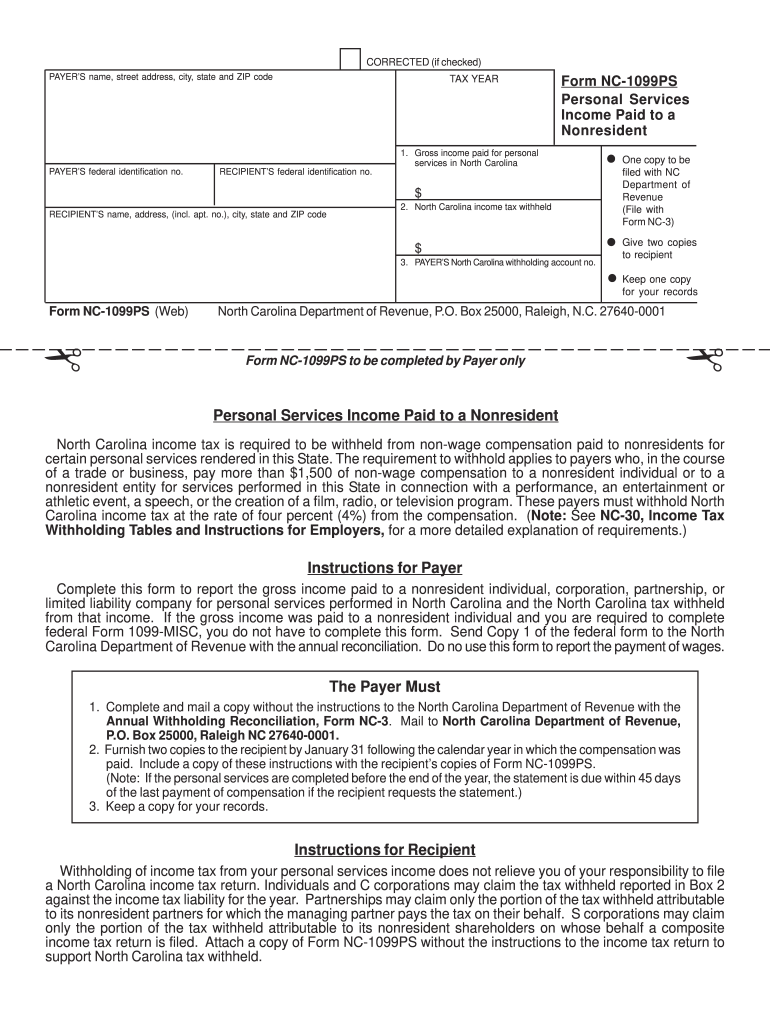

If you want to download a tax form, use the navigation above, search the site, or choose a link. Give two copies to recipient see #1 in the box below for. Web download tax forms and instructions. Log into your claimant account, accessible online at des.nc.gov. This page provides answers to general questions about 1099s from nctracks, including receiving 1099s, missing. Click on view my 1099g” in the menu on the left side. Ncdor has recently redesigned its website. State government websites value user privacy. Web per the nc dor, north carolina participates in the irs combined federal/state filing program; Web an official website of the state of north carolina an official website of nc how you know.

Nc 1099 Form Printable Form Resume Examples

Unemployment benefits are counted as part of a claimant’s income and must be reported. Dornc.com north carolina department of revenue p. The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. However, original, void, or corrected versions of the following forms must be. If.

What Are 10 Things You Should Know About 1099s?

However, original, void, or corrected versions of the following forms must be. If you want to download a tax form, use the navigation above, search the site, or choose a link. Log into your claimant account, accessible online at des.nc.gov. Unemployment benefits are counted as part of a claimant’s income and must be reported. Dornc.com north carolina department of revenue.

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

Give two copies to recipient see #1 in the box below for. Unemployment benefits are counted as part of a claimant’s income and must be reported. If you want to download a tax form, use the navigation above, search the site, or choose a link. Web an official website of the state of north carolina an official website of nc.

1099 NEC Form 2022

State government websites value user privacy. Unemployment benefits are counted as part of a claimant’s income and must be reported. Web general receiving, missing, or past year 1099 faqs. Ncdor has recently redesigned its website. Click on view my 1099g” in the menu on the left side.

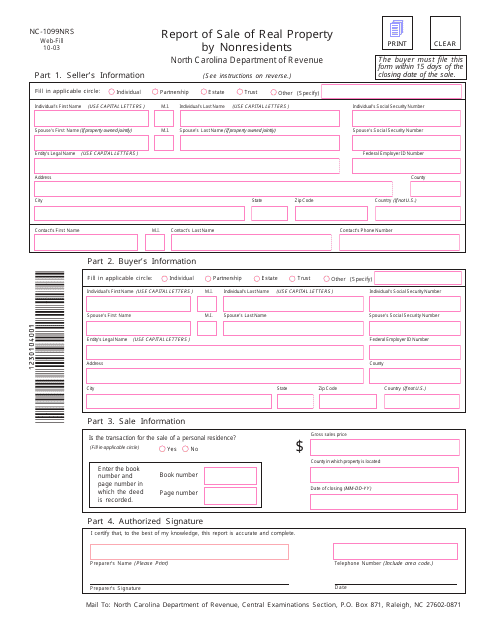

Form NC1099NRS Download Fillable PDF or Fill Online Report of Sale of

Unemployment benefits are counted as part of a claimant’s income and must be reported. The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. Log into your claimant account, accessible online at des.nc.gov. Dornc.com north carolina department of revenue p. An itin is issued.

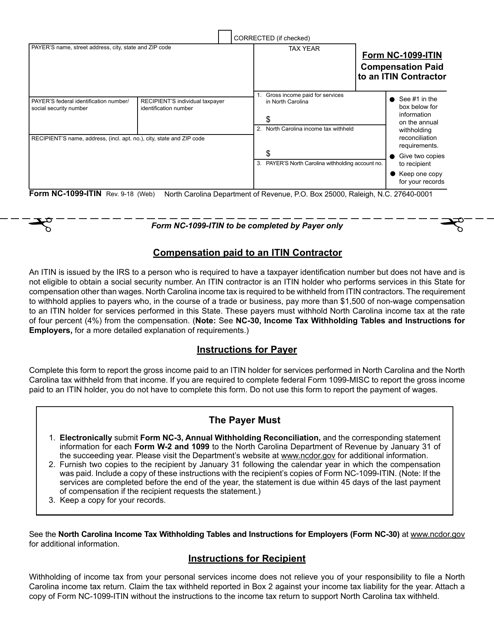

Form NC1099ITIN Download Printable PDF or Fill Online Compensation

Ncdor has recently redesigned its website. However, original, void, or corrected versions of the following forms must be. Web an official website of the state of north carolina an official website of nc how you know. Give two copies to recipient see #1 in the box below for. An itin is issued by the irs to a person who is.

Form 1099 Tax Withholding Form Resume Examples EVKY227306

Web per the nc dor, north carolina participates in the irs combined federal/state filing program; The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. Ncdor has recently redesigned its website. Click on view my 1099g” in the menu on the left side. This.

Nc 1099 Form Fill Out and Sign Printable PDF Template signNow

If you want to download a tax form, use the navigation above, search the site, or choose a link. Web general receiving, missing, or past year 1099 faqs. Web an official website of the state of north carolina an official website of nc how you know. Unemployment benefits are counted as part of a claimant’s income and must be reported..

Nc 1099 amulette

Web an official website of the state of north carolina an official website of nc how you know. If you want to download a tax form, use the navigation above, search the site, or choose a link. Log into your claimant account, accessible online at des.nc.gov. Ncdor has recently redesigned its website. However, original, void, or corrected versions of the.

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

Ncdor has recently redesigned its website. Unemployment benefits are counted as part of a claimant’s income and must be reported. Click on view my 1099g” in the menu on the left side. Web download tax forms and instructions. If you want to download a tax form, use the navigation above, search the site, or choose a link.

Web Download Tax Forms And Instructions.

The north carolina department of revenue mandates the filing of form 1099 (nec, misc, int, div, b, g, k) only if there is state tax withholding. This page provides answers to general questions about 1099s from nctracks, including receiving 1099s, missing. Web general receiving, missing, or past year 1099 faqs. Ncdor has recently redesigned its website.

Click On View My 1099G” In The Menu On The Left Side.

Dornc.com north carolina department of revenue p. Log into your claimant account, accessible online at des.nc.gov. Web per the nc dor, north carolina participates in the irs combined federal/state filing program; If you want to download a tax form, use the navigation above, search the site, or choose a link.

State Government Websites Value User Privacy.

Unemployment benefits are counted as part of a claimant’s income and must be reported. An itin is issued by the irs to a person who is required to have a taxpayer identification number but does not have. Give two copies to recipient see #1 in the box below for. Web an official website of the state of north carolina an official website of nc how you know.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)