Nc Form D-403

Nc Form D-403 - Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Third party file and pay. Third party file and pay option: The waiver applies to the failure. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. For partners who are c or s. Web safety measures are in place to protect your tax information. Third party file and pay option: Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax.

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and pay option: Third party file and pay option: Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. For partners who are c or s. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. The waiver applies to the failure. Third party file and pay. Web safety measures are in place to protect your tax information.

Web safety measures are in place to protect your tax information. Third party file and pay. Third party file and pay option: Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Third party file and pay option: For partners who are c or s. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. The waiver applies to the failure.

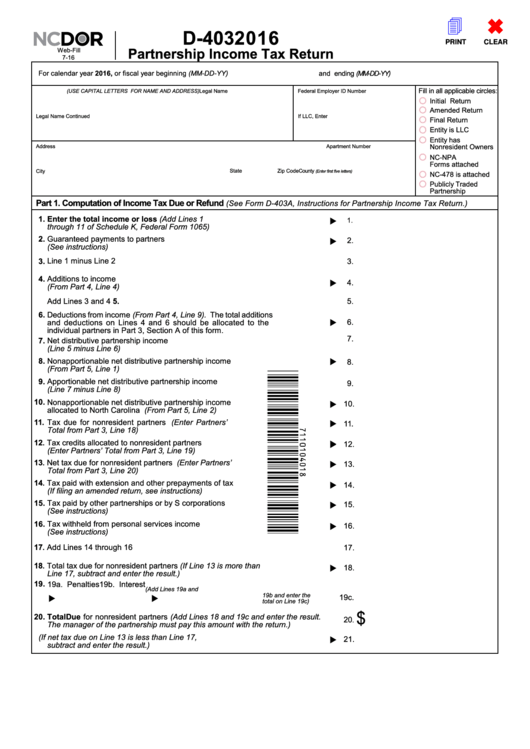

Fillable Form D403 Partnership Tax Return 2016 printable

Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Third.

20192021 Form NC DoR D403 K1 Fill Online, Printable, Fillable, Blank

The waiver applies to the failure. Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in.

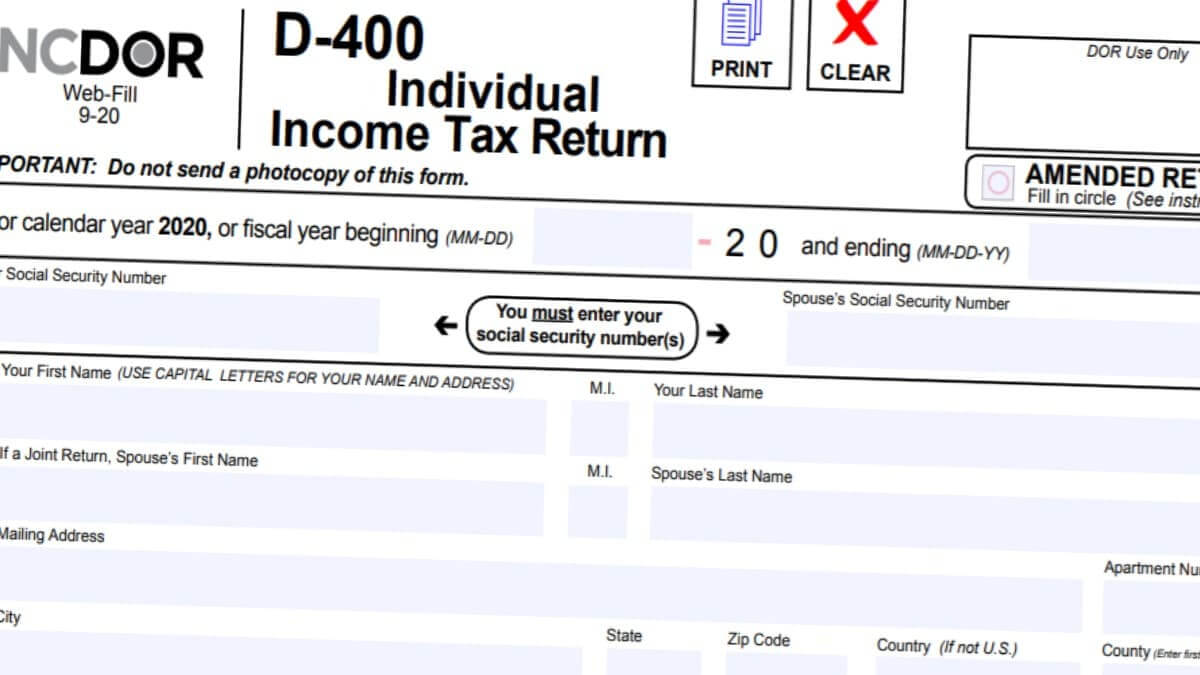

D400 Form 2022 2023 IRS Forms Zrivo

Third party file and pay option: Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Third party file and pay. Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including,.

20182022 Form NC NC3 Fill Online, Printable, Fillable, Blank pdfFiller

Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Third party file and pay. Web safety measures are in place to protect your tax information. Web the term “doing business in north carolina” means the operation of any business enterprise or.

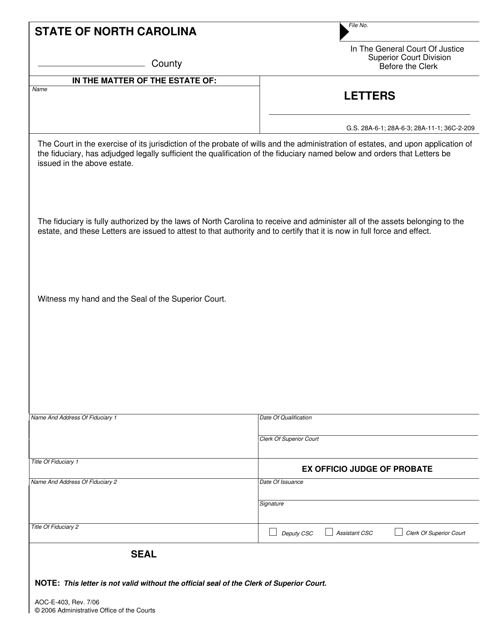

Form AOCE403 Download Fillable PDF or Fill Online Letters North

Third party file and pay option: Third party file and pay. Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Web introduction click on one of the tabs below to find information about available electronic.

NC D403 NCNPA 2013 Fill out Tax Template Online US Legal Forms

Web safety measures are in place to protect your tax information. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,. Third party.

Form D403TC Download Fillable PDF or Fill Online Partnership Tax

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Third party file and pay option: For partners who are c or s. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by.

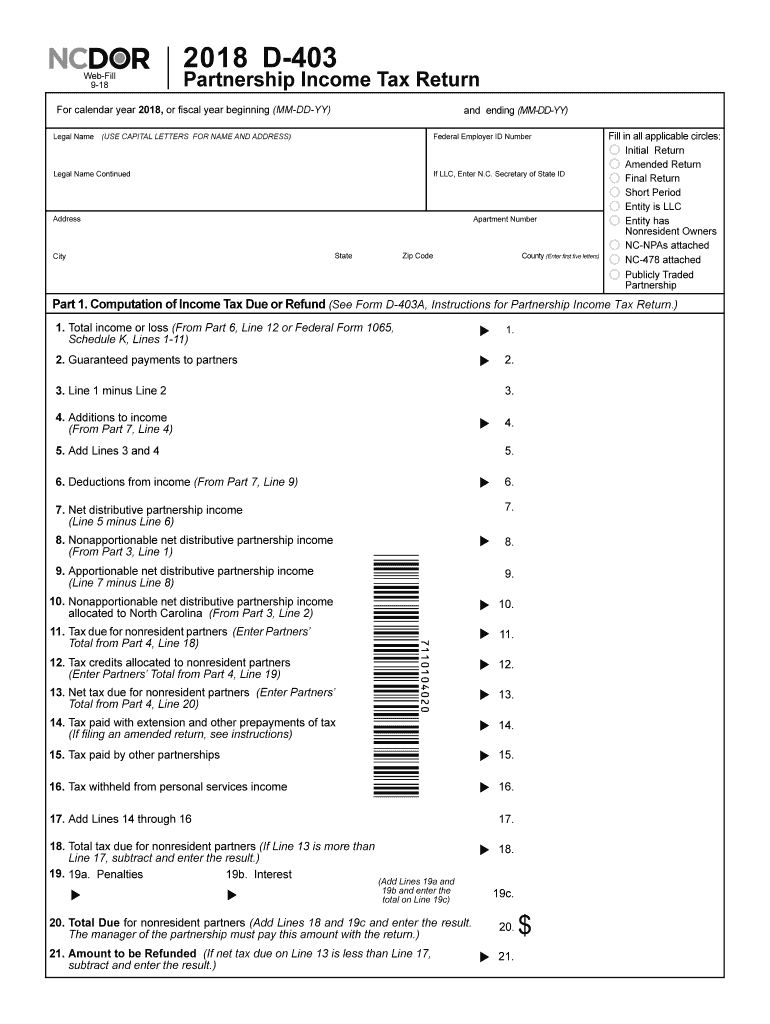

2018 Form NC DoR D403 Fill Online, Printable, Fillable, Blank pdfFiller

Third party file and pay option: The waiver applies to the failure. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. For partners who are c or s. Third party file and pay.

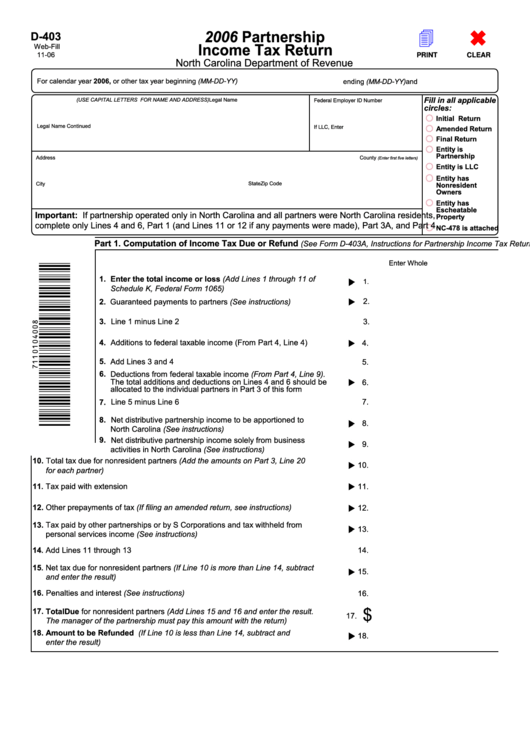

Fillable Form D403 Partnership Tax Return 2006, Form Nc K1

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. For partners who are c or s. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Third party file and.

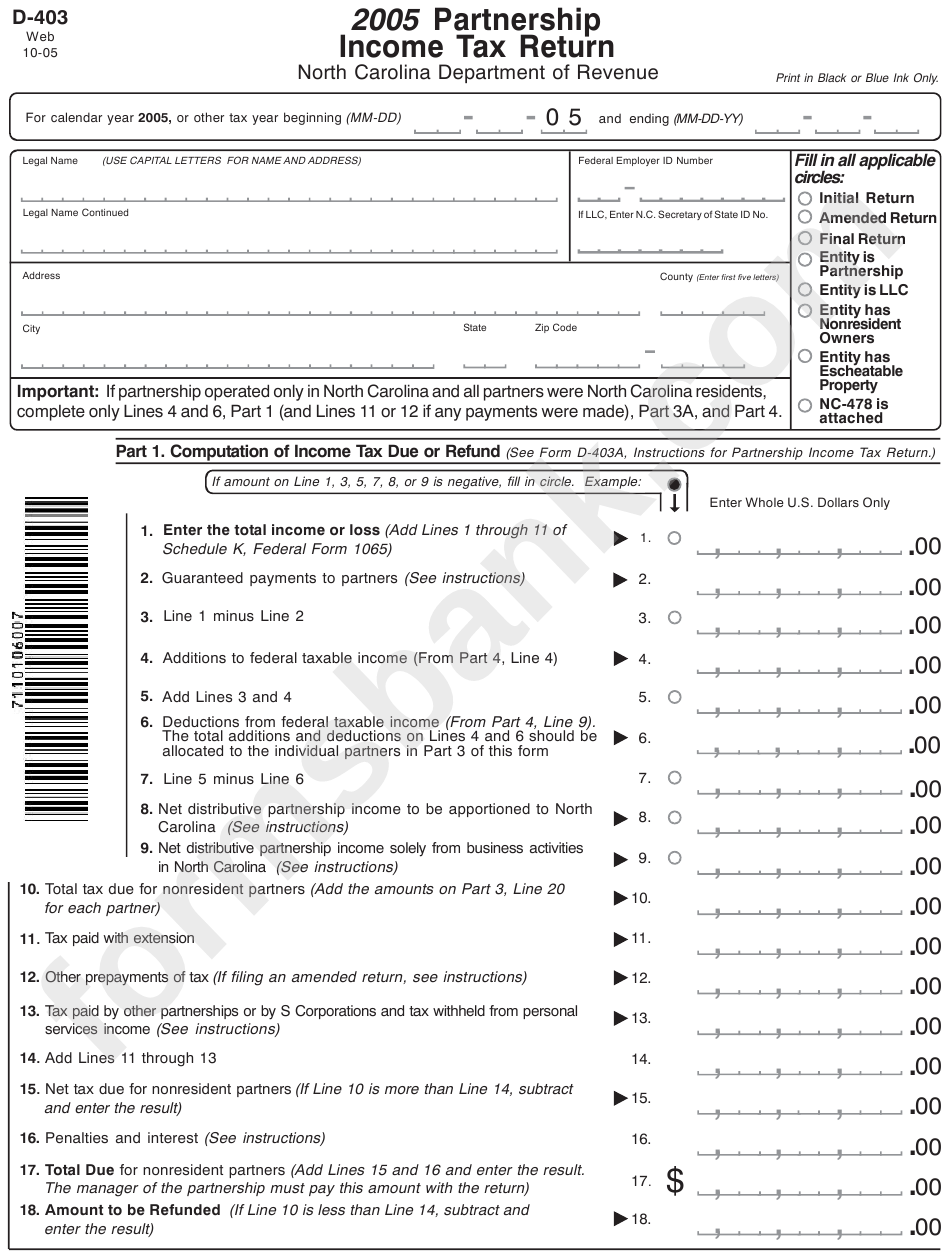

Form D403 Partnership Tax Return 2005, Form Nc K1

Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Third party file and pay option: Third party file and pay. The waiver applies to the failure.

The Waiver Applies To The Failure.

Third party file and pay option: Third party file and pay. Third party file and pay option: Informational return and computation of income tax due or refund for nonresident partners total income or loss (from part 6, line 12 or federal form 1065, schedule k,.

For Partners Who Are C Or S.

Web the term “doing business in north carolina” means the operation of any business enterprise or activity in north carolina for economic gain, including, but not limited to, the following:. Web safety measures are in place to protect your tax information. Web introduction click on one of the tabs below to find information about available electronic filing options and filing requirements for individual and business tax. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue.