Nebraska Form 13

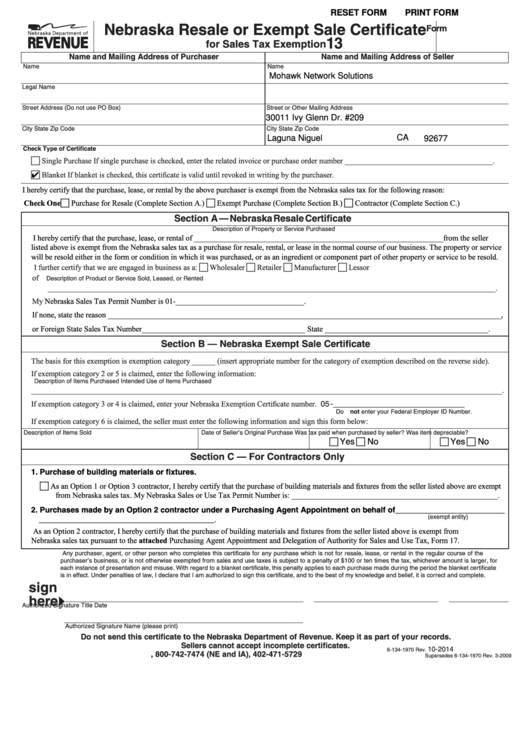

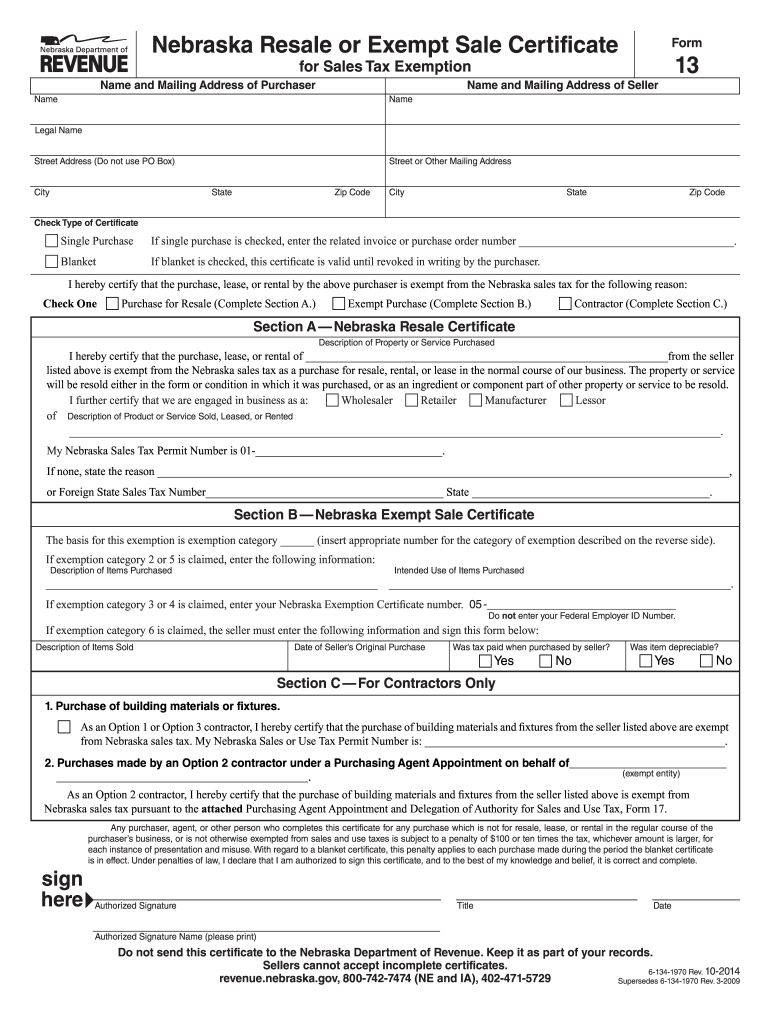

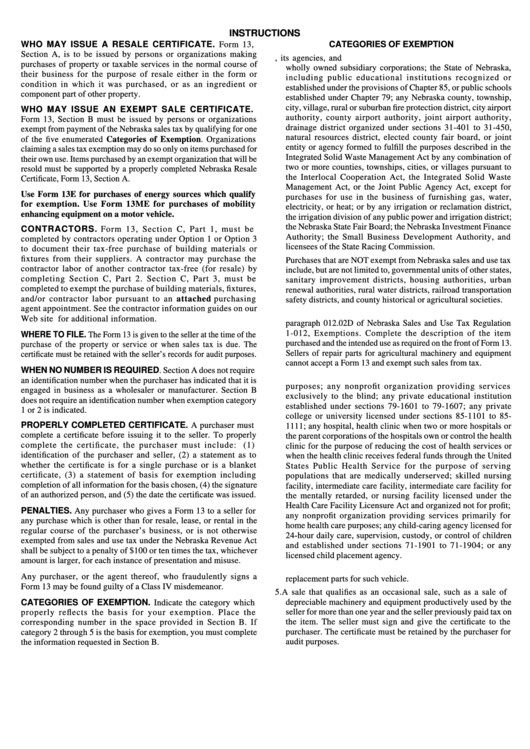

Nebraska Form 13 - Numeric listing of all current nebraska tax forms. Web completed nebraska resale certificate, form 13, section a. Web completed nebraska resale certificate, form 13, section a. Nebraska resale or exempt sale certificate form 13 completed by state of nebraska. Web 58 rows 13. Register and subscribe now to work on your ne resale or exempt sale certificate. Web to obtain a resale certificate in nebraska, you will need to complete the nebraska resale or exempt sale certificate for sales tax exemption (form 13). Previous years' income tax forms. The requirement to obtain a form 13 applies even if the purchaser of the new or used depreciable agricultural. Web form 13, section a, is to be issued by persons or organizations making purchases of property or taxable services in the normal course of their business for the purpose of.

Nebraska resale or exempt sale certificate form 13 completed by state of nebraska. Web fill online, printable, fillable, blank form 13: The form 13 is given to the seller at the time of the purchase of the property or when sales tax is. Web nebraska resale or exempt sale certification 13 step 1: Keep in mind that you first. Numeric listing of all current nebraska tax forms. Web once you have that, you are eligible to issue a resale certificate. Web sellers must keep each form 13 with their books and records. The requirement to obtain a form 13 applies even if the purchaser of the new or used depreciable agricultural. Web you can download a pdf of the nebraska resale or exempt sale exemption certificate (form 13) on this page.

Register and subscribe now to work on your ne resale or exempt sale certificate. Streamlined sales tax agreement certificate of. Web fill online, printable, fillable, blank form 13: Nebraska & local sales and use. Register and subscribe now to work on your ne resale or exempt sale certificate. The form 13 is given to the seller at the time of the purchase of the property or when sales tax is. The form 13 is given to the seller at the time of the purchase of the property or when sales tax is. The requirement to obtain a form 13 applies even if the purchaser of the new or used depreciable agricultural. Try it for free now! Keep in mind that you first.

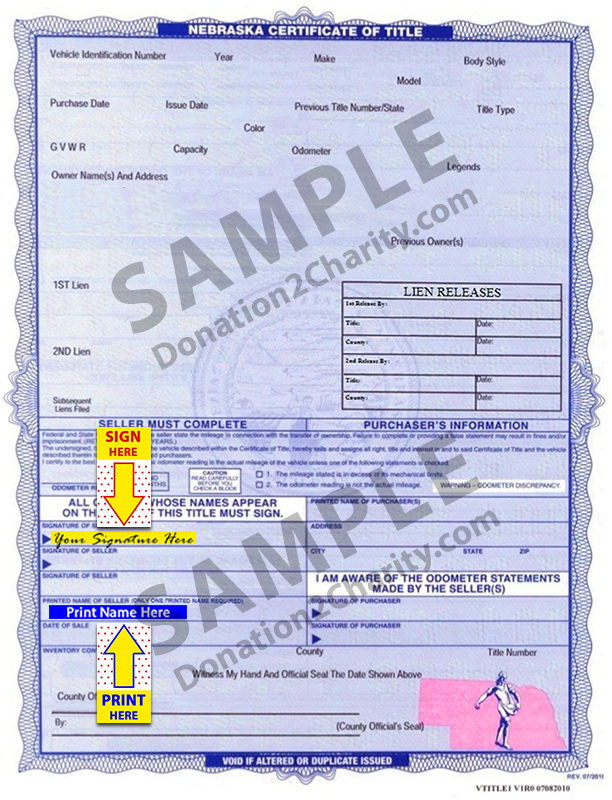

Nebraska Donation2Charity

Web sellers must keep each form 13 with their books and records. Previous years' income tax forms. Register and subscribe now to work on your ne resale or exempt sale certificate. Register and subscribe now to work on your ne resale or exempt sale certificate. At the top right, give the same information for the seller.

Fillable Form 13 Nebraska Resale Or Exempt Sale Certificate printable

Web completed nebraska resale certificate, form 13, section a. Web to obtain a resale certificate in nebraska, you will need to complete the nebraska resale or exempt sale certificate for sales tax exemption (form 13). Use fill to complete blank online nebraska pdf. Streamlined sales tax agreement certificate of. Numeric listing of all current nebraska tax forms.

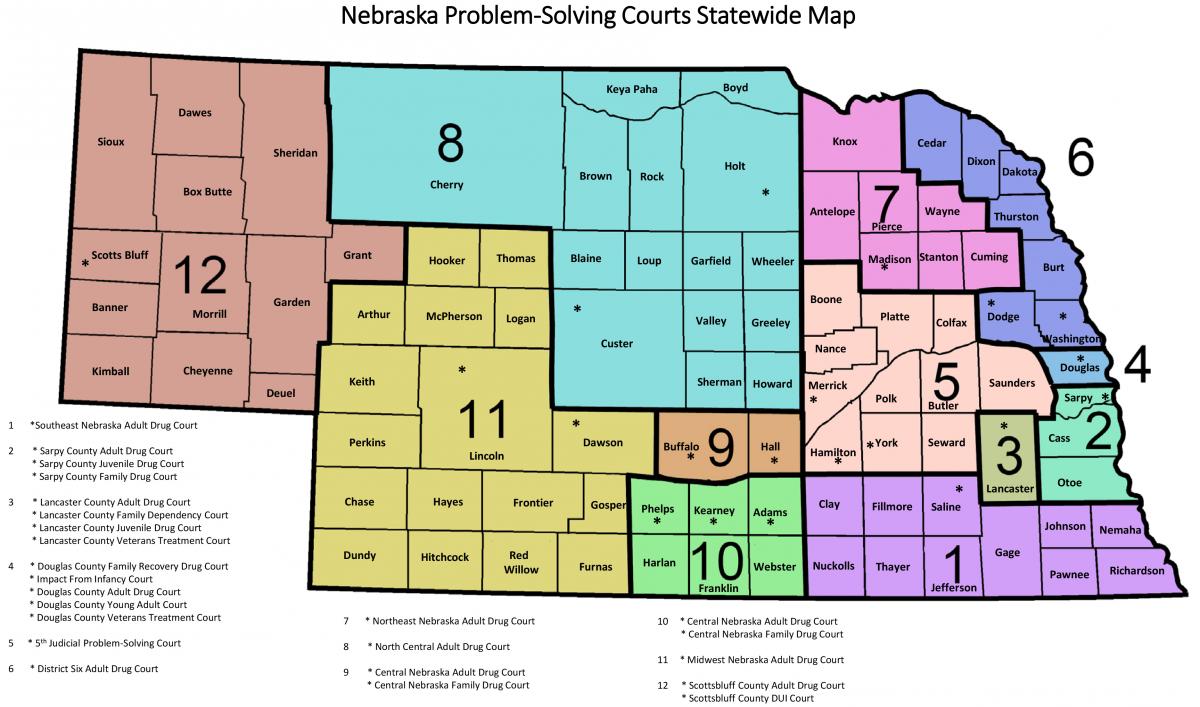

Nebraska Drug Courts Expand In 2019, Mental Health Courts Possible In

Lincoln, ne chief standing bear building $3,000 hiring bonus to join the judicial branch! Nebraska & local sales and use. For other nebraska sales tax exemption certificates, go here. Web completed nebraska resale certificate, form 13, section a. At the top left, give the name and address of the purchaser.

Printable 2021 Nebraska Form 4797N (Special Capital Gains Election and

Web fill online, printable, fillable, blank form 13: Place the corresponding number in the. Web state of nebraska office of the governor lincoln executive order no. Indicate the category which properly reflects the basis for your exemption. Web up to $40 cash back form 13 section b can only be issued by persons or organizations exempt from payment of the.

Form 61 Download Fillable PDF or Fill Online Nebraska Severance and

Numeric listing of all current nebraska tax forms. Web quality compliance reviewer location: Web once you have that, you are eligible to issue a resale certificate. Try it for free now! Web sellers must keep each form 13 with their books and records.

Fillable Form 13 From Nebraska 20202021 Fill and Sign Printable

Use fill to complete blank online nebraska pdf. Lincoln, ne chief standing bear building $3,000 hiring bonus to join the judicial branch! Numeric listing of all current nebraska tax forms. Exemption permit that is to be used in conjunction with a nebraska resale or exempt. Web nebraska resale or exempt sale certification 13 step 1:

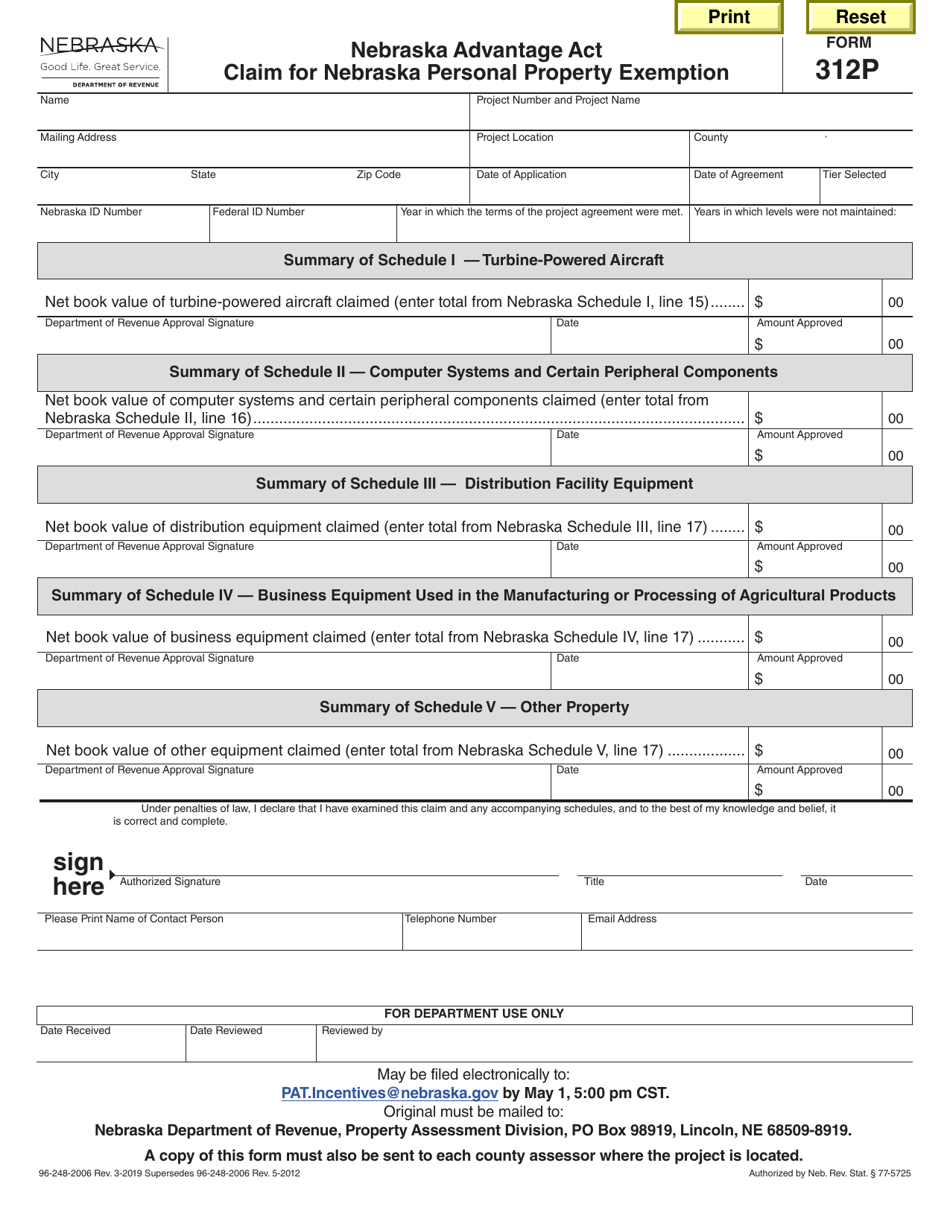

Form 312P Download Fillable PDF or Fill Online Nebraska Advantage Act

Use fill to complete blank online nebraska pdf. Web once you have that, you are eligible to issue a resale certificate. Numeric listing of all current nebraska tax forms. Complete, edit or print tax forms instantly. For other nebraska sales tax exemption certificates, go here.

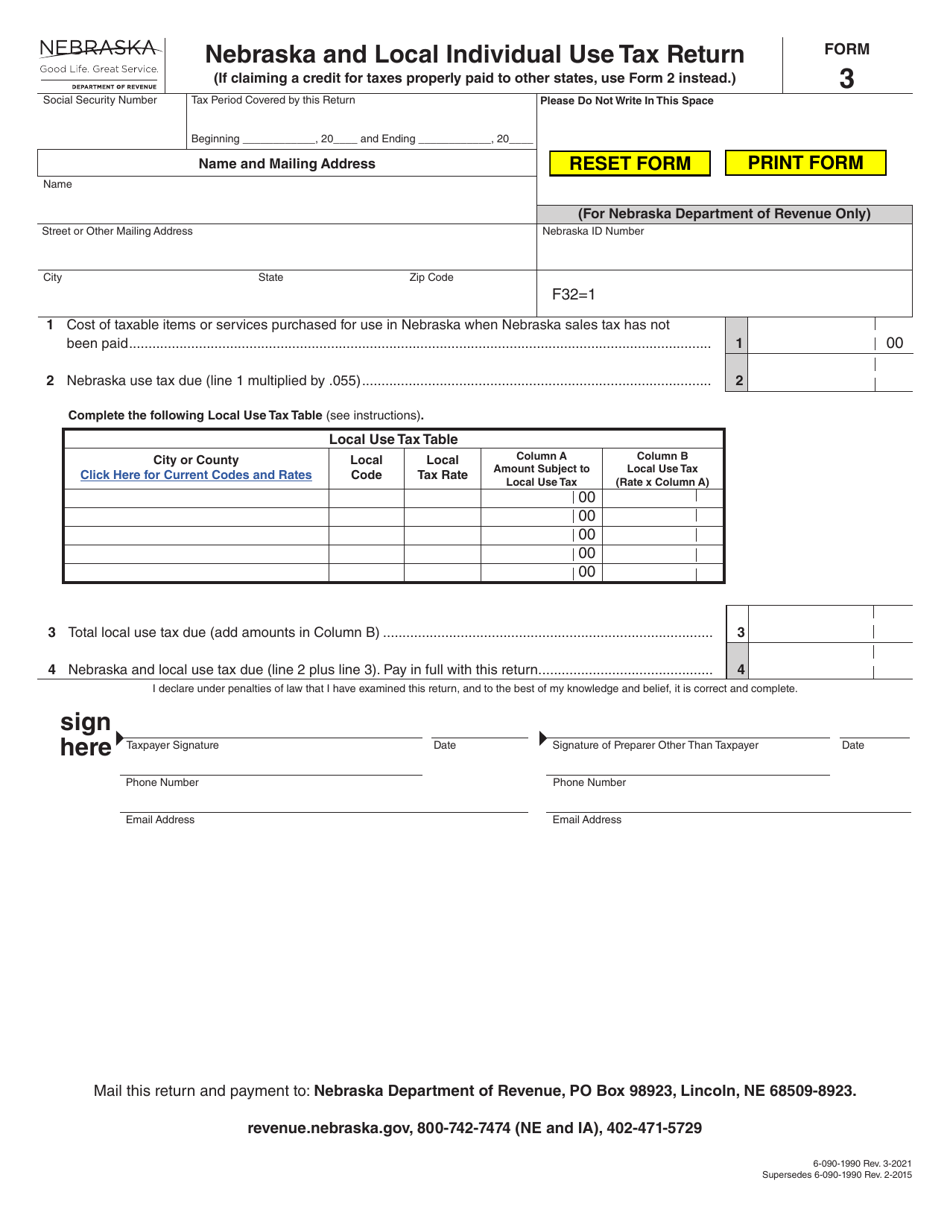

Form 3 Download Fillable PDF or Fill Online Nebraska and Local

Lincoln, ne chief standing bear building $3,000 hiring bonus to join the judicial branch! The form 13 is given to the seller at the time of the purchase of the property or when sales tax is. Nebraska & local sales and use. Use fill to complete blank online nebraska pdf. Indicate the category which properly reflects the basis for your.

Benco Dental Exemption Certificate Information Benco Dental

Web to obtain a resale certificate in nebraska, you will need to complete the nebraska resale or exempt sale certificate for sales tax exemption (form 13). Web you can download a pdf of the nebraska resale or exempt sale exemption certificate (form 13) on this page. At the top right, give the same information for the seller. Place the corresponding.

Instructions For Form 13 Nebraska Resale Or Exempt Sale Certificate

Therefore, you can complete the 13 resale certificate form by providing your nebraska sales tax permit. Web nebraska resale or exempt sale certification 13 step 1: Try it for free now! Web once you have that, you are eligible to issue a resale certificate. Web completed nebraska resale certificate, form 13, section a.

The Requirement To Obtain A Form 13 Applies Even If The Purchaser Of The New Or Used Depreciable Agricultural.

The judicial branch is a state. Register and subscribe now to work on your ne resale or exempt sale certificate. Web sellers must keep each form 13 with their books and records. Web you can download a pdf of the nebraska resale or exempt sale exemption certificate (form 13) on this page.

The Form 13 Is Given To The Seller At The Time Of The Purchase Of The Property Or When Sales Tax Is.

The form 13 is given to the seller at the time of the purchase of the property or when sales tax is. Web 58 rows 13. For other nebraska sales tax exemption certificates, go here. Streamlined sales tax agreement certificate of.

Complete, Edit Or Print Tax Forms Instantly.

At the top right, give the same information for the seller. Try it for free now! Web quality compliance reviewer location: Web upon approval of this application, the nebraska department of revenue will issue an.

Form 10, To Determine Your Net Nebraska Taxable Sales (See Form 10 Instructions)(Code.

Web up to $40 cash back form 13 section b can only be issued by persons or organizations exempt from payment of the nebraska sales tax by qualifying for one of the six enumerated. Lincoln, ne chief standing bear building $3,000 hiring bonus to join the judicial branch! Indicate the category which properly reflects the basis for your exemption. At the top left, give the name and address of the purchaser.