New York Form It 203 Instructions

New York Form It 203 Instructions - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Were not a resident of new york state and received income during the. Get your online template and fill it in using progressive features. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Web good news for 2022! However, if you both choose to file a joint new york state return, use. Web ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Web nys department of taxation and finance However, if you both choose to file a joint new york state return, use. Enjoy smart fillable fields and interactivity.

Income tax return new york state • new york city • yonkers • mctmt. However, if you both choose to file a joint new york state return, use. Web ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Web nys department of taxation and finance Get your online template and fill it in using progressive features. All requirements stated in the instructions must be met in order to file a group return. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Were not a resident of new york state and received income during the. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. However, if you both choose to file a joint new york state return, use.

Enjoy smart fillable fields and interactivity. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Were not a resident of new york state and received income during the. However, if you both choose to file a joint new york state return, use. Web good news for 2022! All requirements stated in the instructions must be met in order to file a group return. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Get your online template and fill it in using progressive features. Web nys department of taxation and finance Web department of taxation and finance.

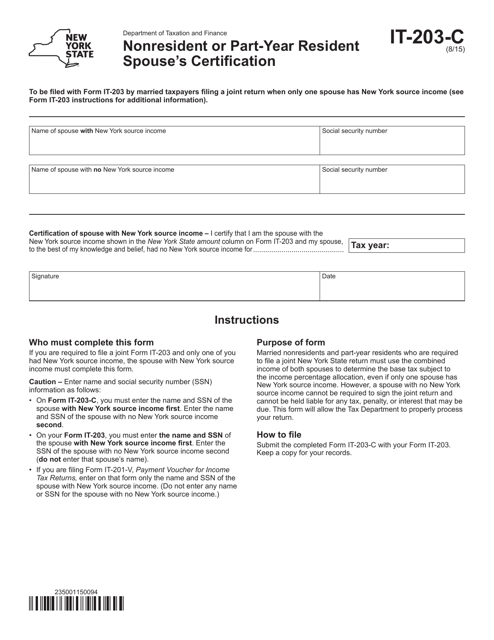

Form IT203C Download Fillable PDF or Fill Online Nonresident or Part

Income tax return new york state • new york city • yonkers • mctmt. Web ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? Web good news for 2022! However, if you both choose to file a joint new york state return, use. All requirements stated in the instructions must be met in order to file.

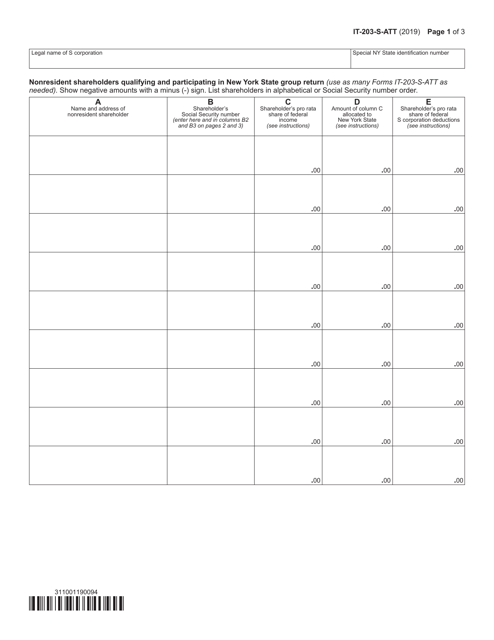

Form IT203SATT Download Fillable PDF or Fill Online Nonresident

Web department of taxation and finance. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Enjoy smart fillable fields and interactivity. However, if you both choose to file a joint new york state return, use. Web nys department of taxation and finance

2018 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Get your online template and fill it in using progressive features. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. 24.00 24.00 25 pensions of nys and local. However, if you both choose to file a joint new york state return, use. All requirements stated in the instructions.

Form IT 203 Nonresident and Part Year Resident Tax Return YouTube

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Web good news for 2022! Income tax return new york state • new york city • yonkers • mctmt. Enjoy smart fillable fields and interactivity. However, if you both choose to file a joint new york state return, use.

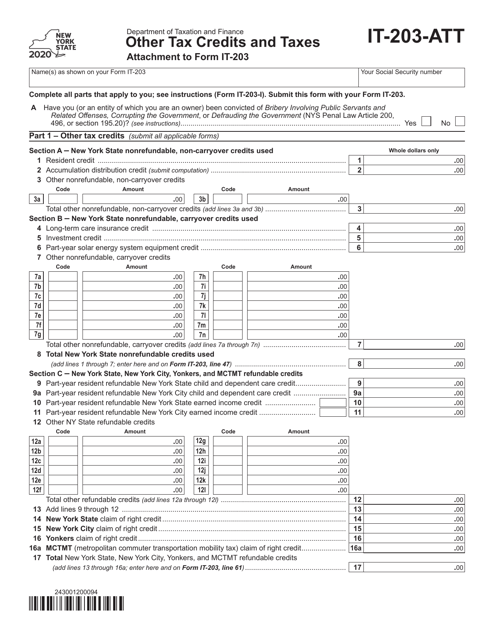

Form IT203ATT Download Fillable PDF or Fill Online Other Tax Credits

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Web good news for 2022! Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web nys department.

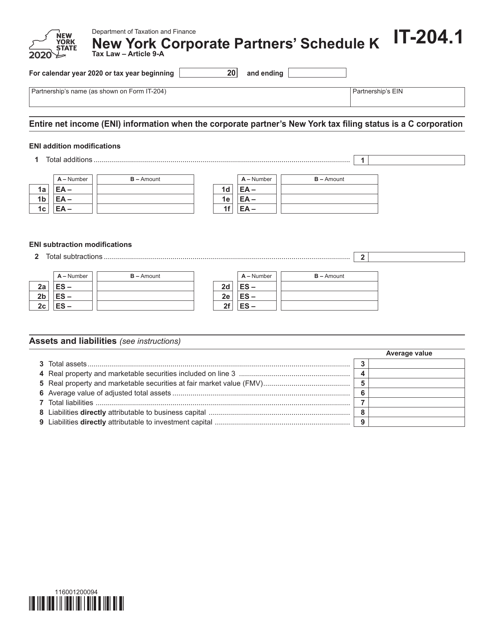

Form IT204.1 2020 Fill Out, Sign Online and Download Fillable PDF

Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Enjoy smart fillable fields and interactivity. 24.00 24.00 25 pensions of nys and local. However, if you both choose to file a joint new york state return, use. Web nys department of taxation and finance

20172022 Form NY DTF IT203D Fill Online, Printable, Fillable, Blank

Enjoy smart fillable fields and interactivity. However, if you both choose to file a joint new york state return, use. Web department of taxation and finance. Web good news for 2022! 24.00 24.00 25 pensions of nys and local.

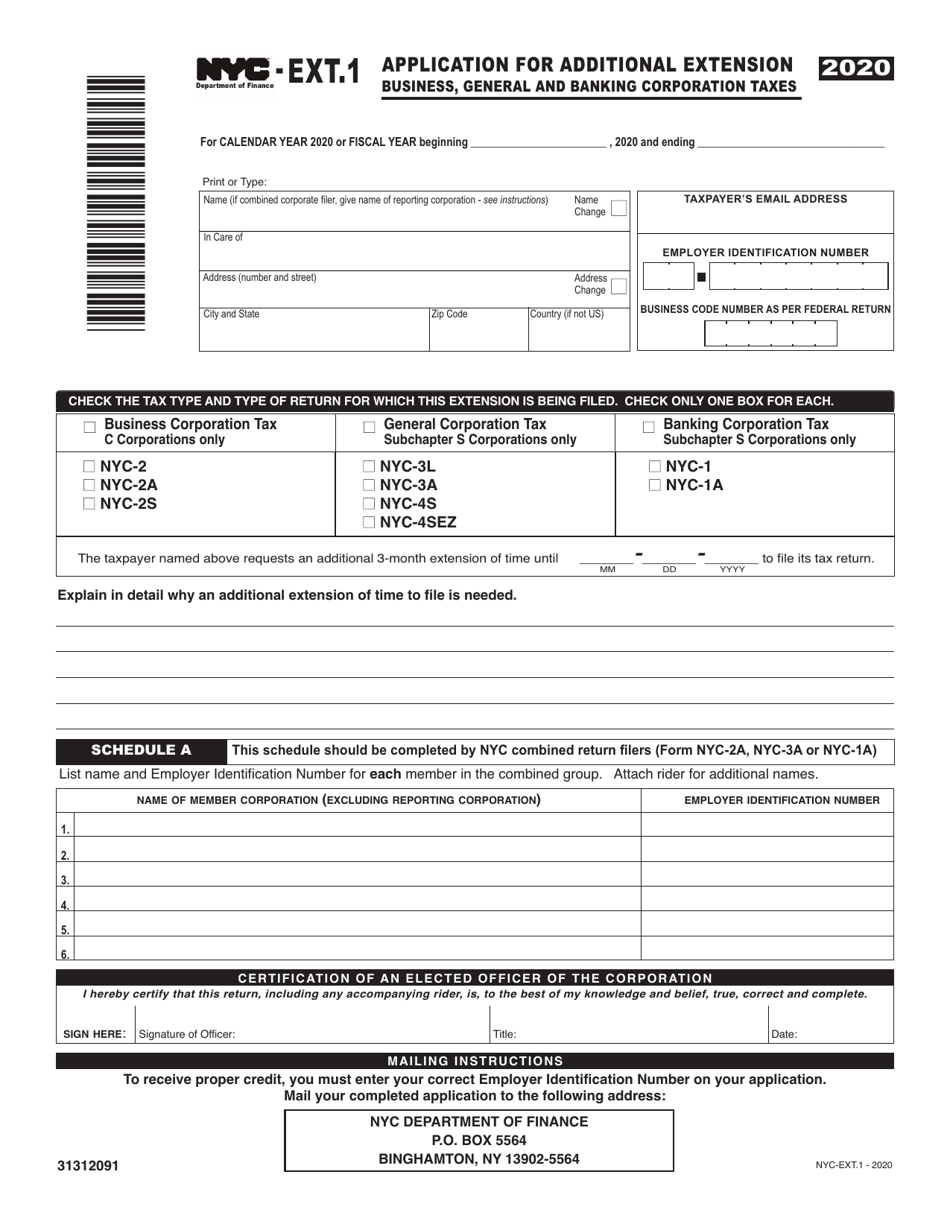

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

24.00 24.00 25 pensions of nys and local. All requirements stated in the instructions must be met in order to file a group return. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Income tax return new york state • new york city • yonkers • mctmt. However,.

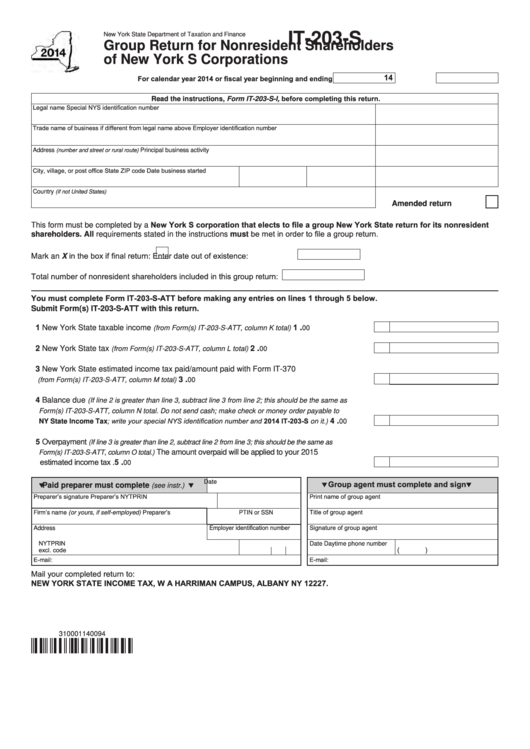

Fillable Form It203S Group Return For Nonresident Shareholders Of

Web good news for 2022! Enjoy smart fillable fields and interactivity. Web department of taxation and finance. Income tax return new york state • new york city • yonkers • mctmt. 24.00 24.00 25 pensions of nys and local.

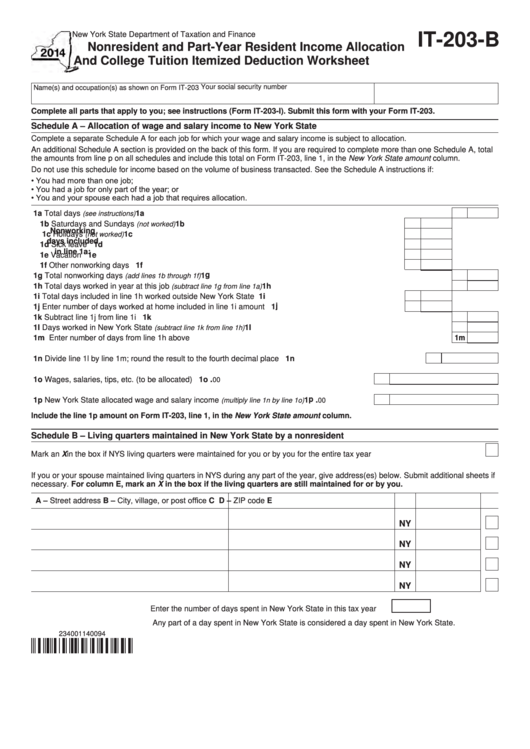

Fillable Form It203B Nonresident And PartYear Resident

Web ★ 4.8 satisfied 57 votes how to fill out and sign it203 online? All requirements stated in the instructions must be met in order to file a group return. Web nys department of taxation and finance Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's.

24.00 24.00 25 Pensions Of Nys And Local.

Enjoy smart fillable fields and interactivity. Your first name and middle initial your last name (for a joint return , enter spouse’s name on line below) your. Web good news for 2022! All requirements stated in the instructions must be met in order to file a group return.

Get Your Online Template And Fill It In Using Progressive Features.

Income tax return new york state • new york city • yonkers • mctmt. Web department of taxation and finance. Web nys department of taxation and finance However, if you both choose to file a joint new york state return, use.

Web ★ 4.8 Satisfied 57 Votes How To Fill Out And Sign It203 Online?

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Were not a resident of new york state and received income during the. However, if you both choose to file a joint new york state return, use.