North Dakota Form Nd-1

North Dakota Form Nd-1 - Read across to the amount shown in the married filing jointly column. Web their north dakota taxable income is $49,935. This form is for income. Please use the link below. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. Individuals generally must pay their income tax in one of two ways—through the. View all 45 north dakota income tax forms disclaimer: Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. Web use this form to calculate and pay estimated north dakota individual income tax. Credit for income tax paid to.

View all 45 north dakota income tax forms disclaimer: Individual income tax return (state of north dakota) form. Individual income tax return (state of north dakota) form 2018: Individuals generally must pay their income tax in one of two ways—through the. Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. Web here's a list of some of the most commonly used north dakota tax forms: We last updated the individual income tax. Enter your north dakota taxable income from line 18 of page 1 21. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. Web this application form cannot be processed without these documents.

For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. View all 45 north dakota income tax forms disclaimer: Web use this form to calculate and pay estimated north dakota individual income tax. Please use the link below. We last updated the individual income tax. Read across to the amount shown in the married filing jointly column. Web here's a list of some of the most commonly used north dakota tax forms: This form is for income. Web this application form cannot be processed without these documents. Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a.

Most Generous Counties 2019 Edition North Dakota SmartAdvisor Match

Individuals generally must pay their income tax in one of two ways—through the. View all 45 north dakota income tax forms disclaimer: Individual income tax return (state of north dakota) form. Web here's a list of some of the most commonly used north dakota tax forms: Web their north dakota taxable income is $49,935.

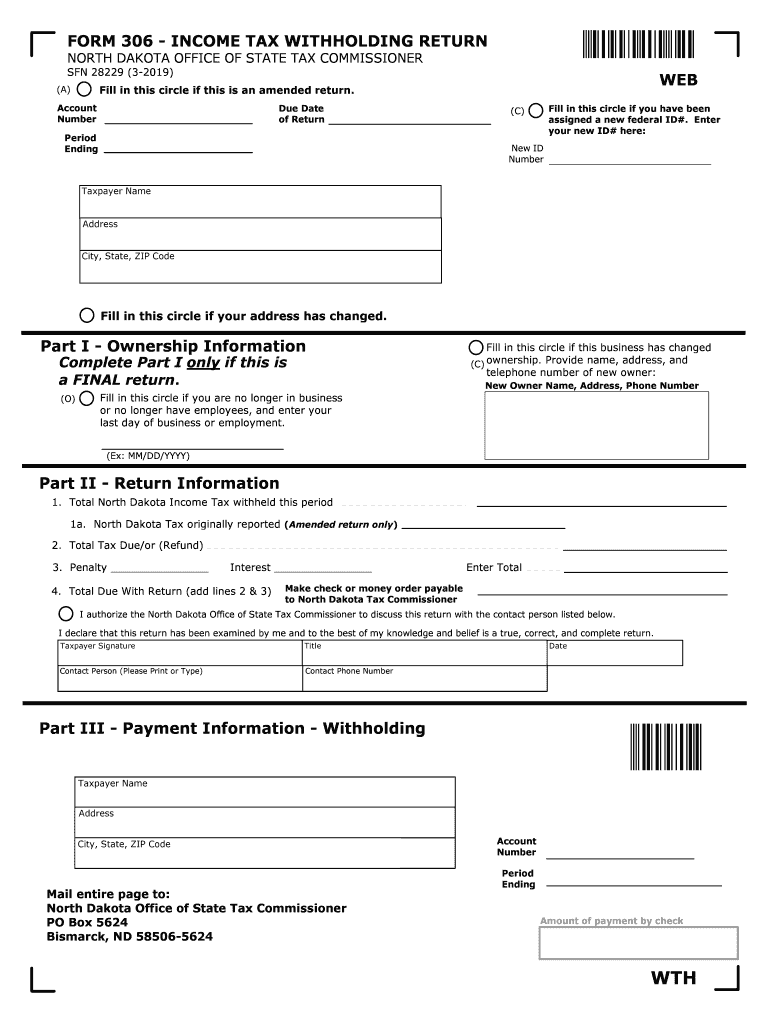

Nd Form 306 Fill Out and Sign Printable PDF Template signNow

Individual income tax return (state of north dakota) form. Please use the link below. View all 45 north dakota income tax forms disclaimer: Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. Web use this form to calculate and pay estimated north dakota individual income tax.

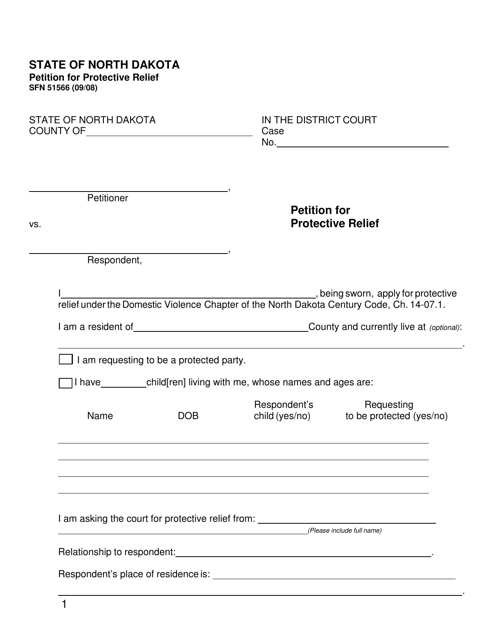

Form SFN51566 Download Fillable PDF or Fill Online Petition for

Please use the link below. Web here's a list of some of the most commonly used north dakota tax forms: This form is for income. Individual income tax return (state of north dakota) form 2018: Enter your north dakota taxable income from line 18 of page 1 21.

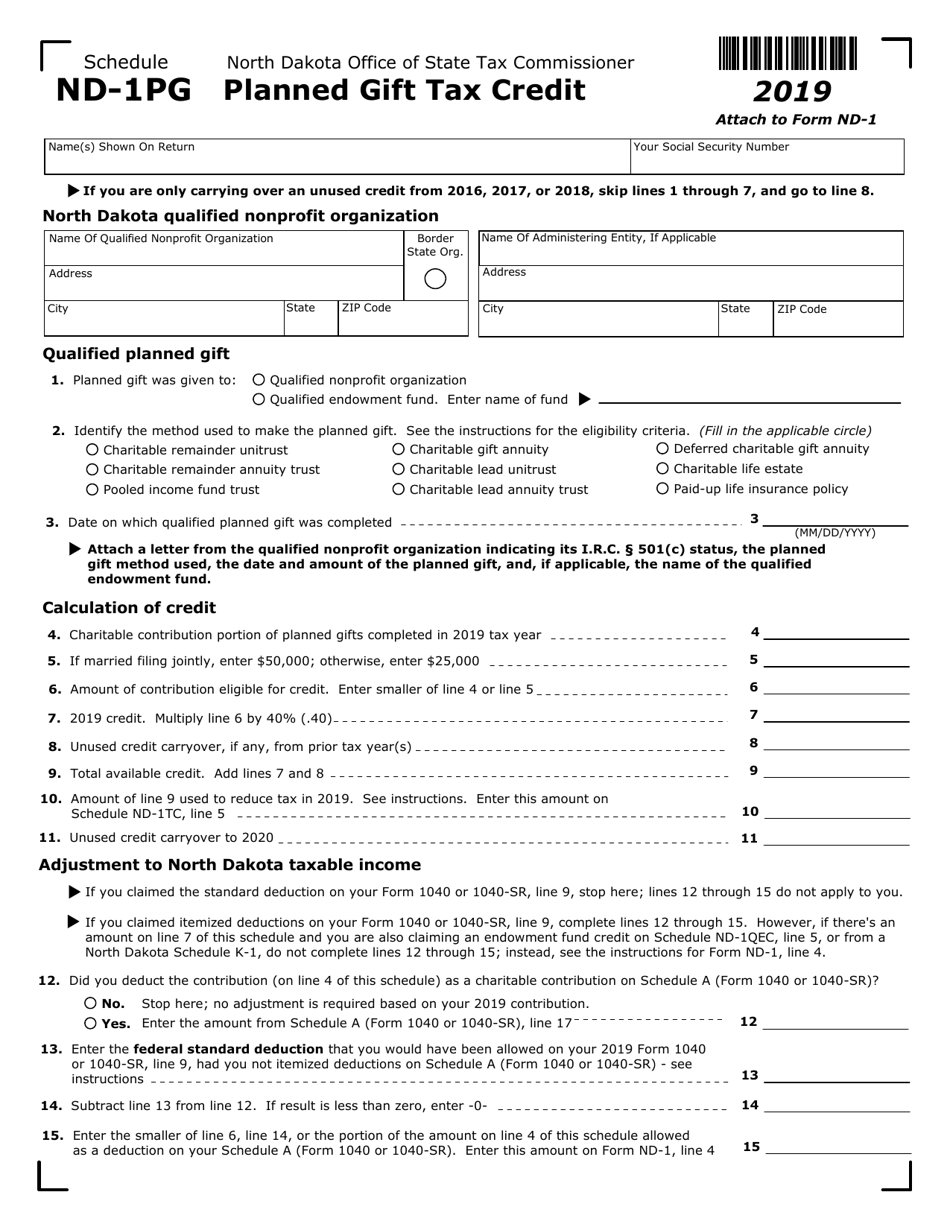

Form ND1 (SFN28705) Schedule ND1PG Download Fillable PDF or Fill

For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. Enter your north dakota taxable income from line 18 of page 1 21. View all 45 north dakota income tax forms disclaimer: Individual income tax return (state of north dakota) form.

Fill Free fillable forms State of North Dakota

Web this application form cannot be processed without these documents. Web use this form to calculate and pay estimated north dakota individual income tax. Credit for income tax paid to. Use fill to complete blank online state of. We last updated the individual income tax.

Fill Free fillable forms State of North Dakota

This form is for income. Read across to the amount shown in the married filing jointly column. View all 45 north dakota income tax forms disclaimer: Web their north dakota taxable income is $49,935. Please use the link below.

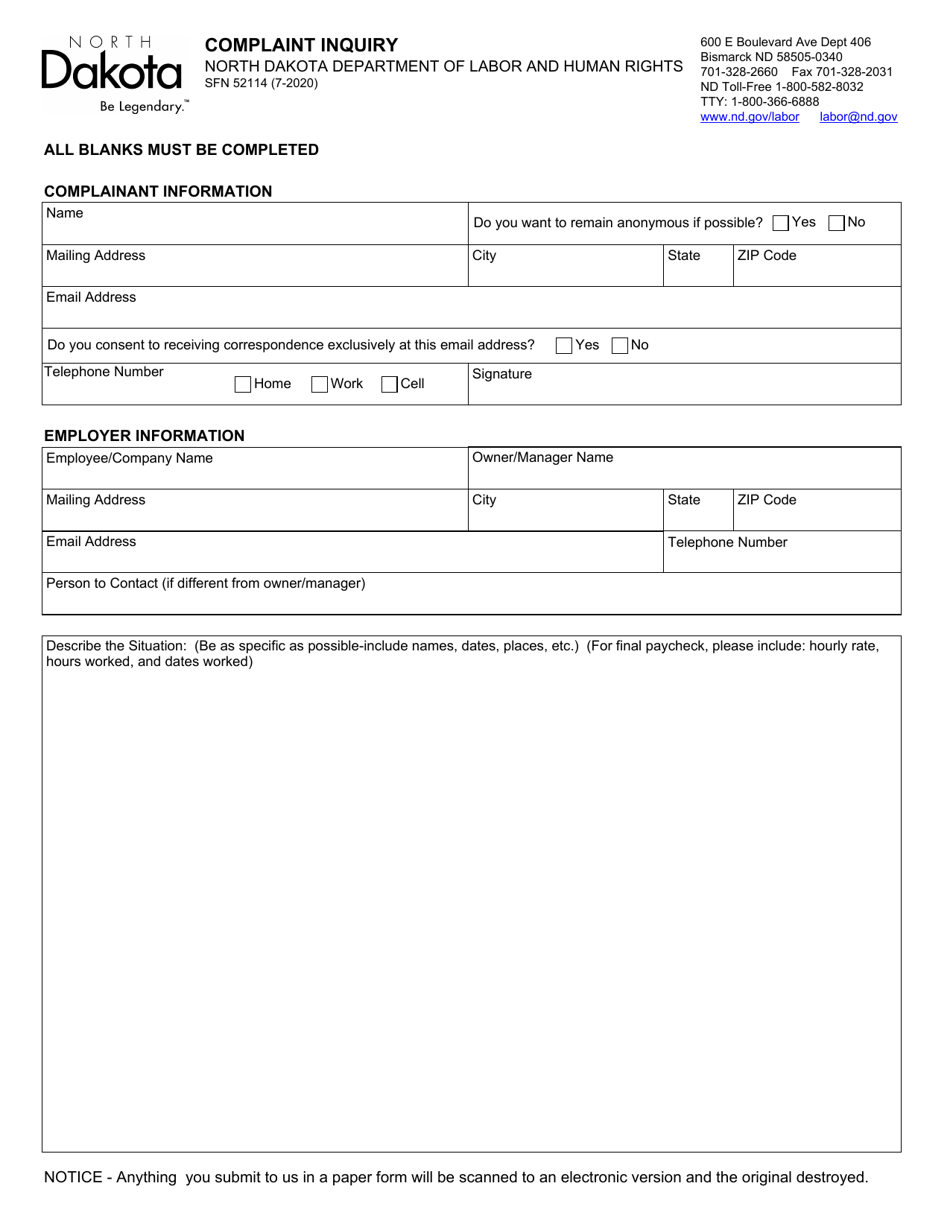

Form SFN52114 Download Fillable PDF or Fill Online Complaint Inquiry

Individual income tax return (state of north dakota) form. For more information about the north. Web this application form cannot be processed without these documents. Web here's a list of some of the most commonly used north dakota tax forms: Read across to the amount shown in the married filing jointly column.

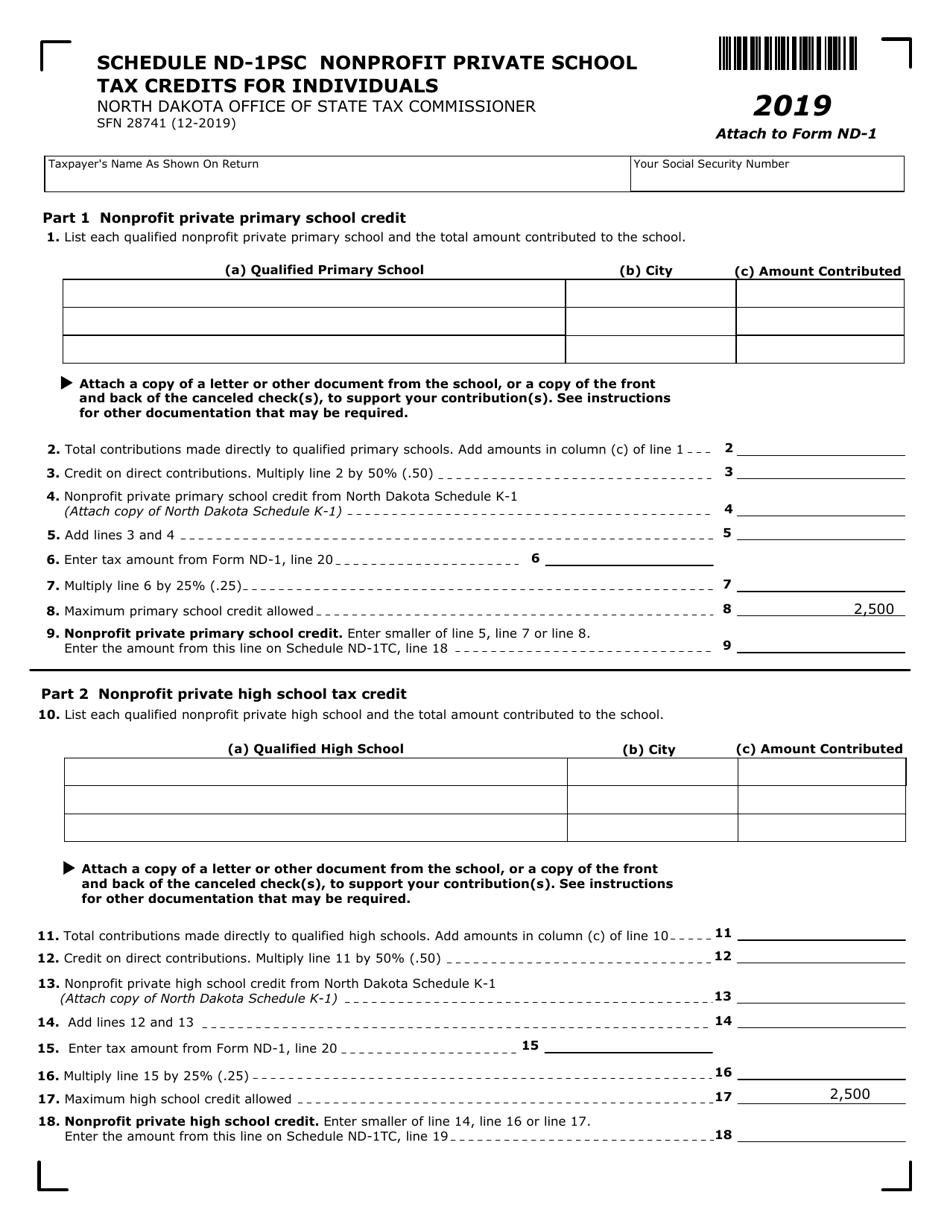

Form ND1 (SFN28741) Schedule ND1PSC Download Fillable PDF or Fill

Web here's a list of some of the most commonly used north dakota tax forms: Please use the link below. If you are required to pay estimated income tax to. Credit for income tax paid to. Individual income tax return (state of north dakota) form.

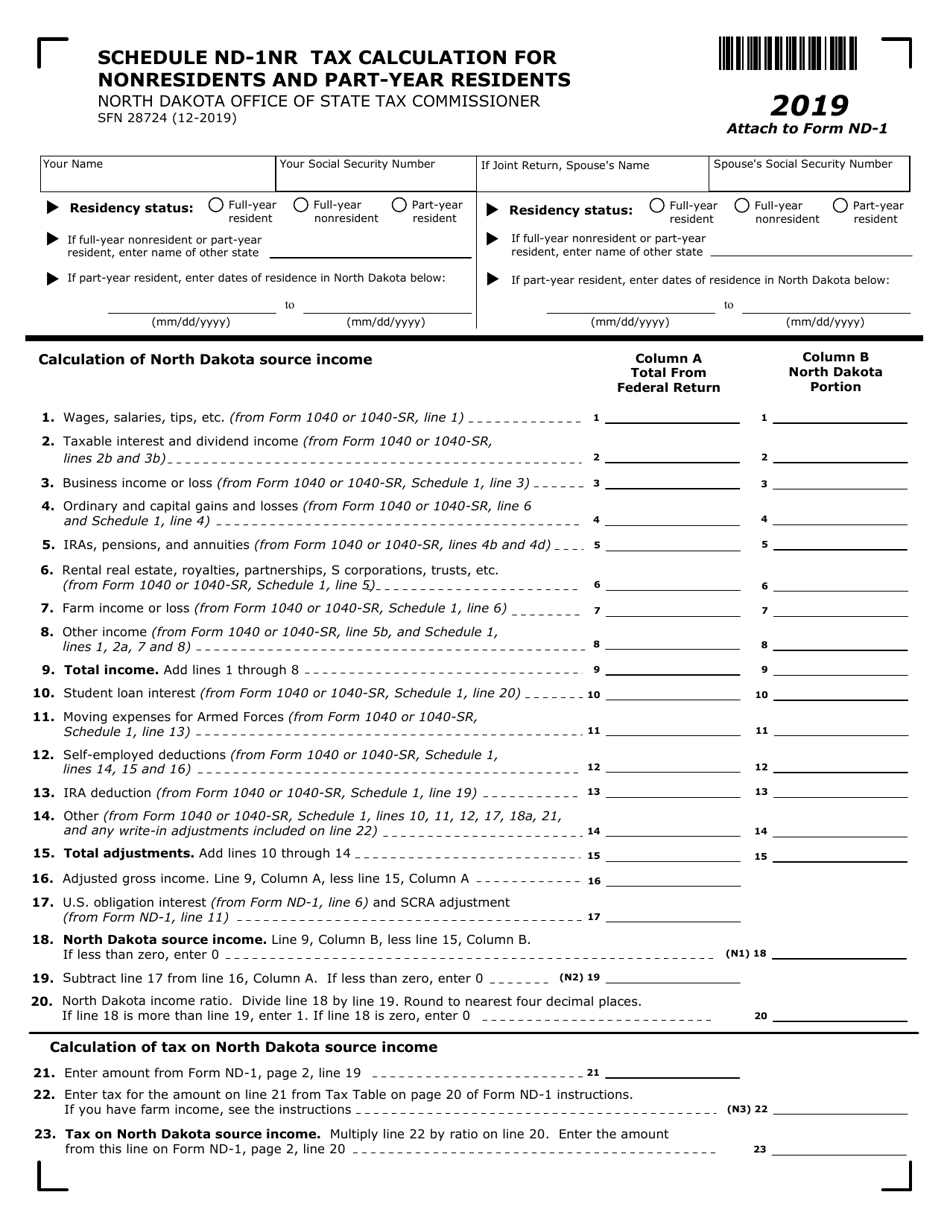

Form ND1 (SFN28724) Schedule NDN1NR Download Fillable PDF or Fill

Use fill to complete blank online state of. Credit for income tax paid to. Enter your north dakota taxable income from line 18 of page 1 21. Web use this form to calculate and pay estimated north dakota individual income tax. Web their north dakota taxable income is $49,935.

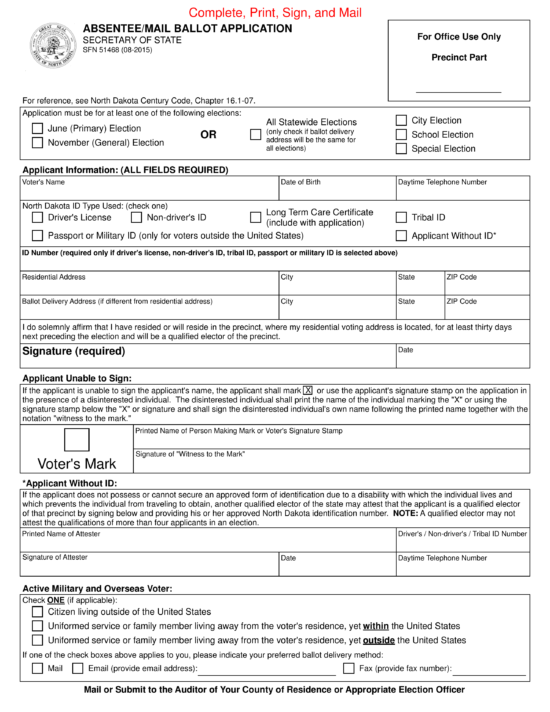

Free North Dakota Voter Registration Form Register to Vote in ND

Web this application form cannot be processed without these documents. Please use the link below. Web use this form to calculate and pay estimated north dakota individual income tax. Individual income tax return (state of north dakota) form 2018: Use fill to complete blank online state of.

Web Their North Dakota Taxable Income Is $49,935.

We last updated the individual income tax. Individual income tax return (state of north dakota) form. Web this application form cannot be processed without these documents. View all 45 north dakota income tax forms disclaimer:

This Form Is For Income.

Individual income tax return (state of north dakota) form 2018: Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. If you are required to pay estimated income tax to. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on.

Please Use The Link Below.

Use fill to complete blank online state of. Credit for income tax paid to. Web here's a list of some of the most commonly used north dakota tax forms: Web use this form to calculate and pay estimated north dakota individual income tax.

For More Information About The North.

Individuals generally must pay their income tax in one of two ways—through the. Read across to the amount shown in the married filing jointly column. Enter your north dakota taxable income from line 18 of page 1 21.