Notes Payable Long Term Balance Sheet

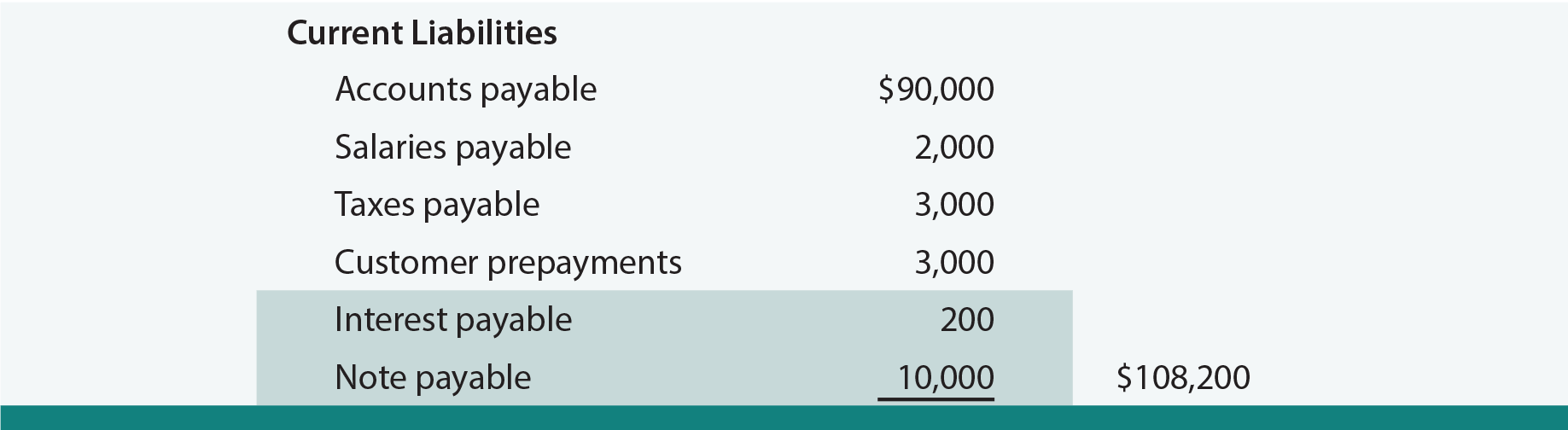

Notes Payable Long Term Balance Sheet - Web notes payable on a balance sheet. To illustrate, assume that a company. When a note’s maturity is. Additionally, they are classified as current liabilities when the amounts are due within a year. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the. Notes payable appear as liabilities on a balance sheet. Notes payable is a valuable financial tool that business owners can use to expand.

When the debt is long‐term (payable after one year) but requires a payment within the. Additionally, they are classified as current liabilities when the amounts are due within a year. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Notes payable is a valuable financial tool that business owners can use to expand. Web notes payable on a balance sheet. When a note’s maturity is. To illustrate, assume that a company. Notes payable appear as liabilities on a balance sheet.

Notes payable is a valuable financial tool that business owners can use to expand. When a note’s maturity is. Additionally, they are classified as current liabilities when the amounts are due within a year. To illustrate, assume that a company. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the. Web notes payable on a balance sheet. Notes payable appear as liabilities on a balance sheet.

[Solved] . A comparative balance sheet and statement is shown

Notes payable appear as liabilities on a balance sheet. When the debt is long‐term (payable after one year) but requires a payment within the. Notes payable is a valuable financial tool that business owners can use to expand. Web notes payable on a balance sheet. Additionally, they are classified as current liabilities when the amounts are due within a year.

Long Term Notes Payable On Balance Sheet

When a note’s maturity is. Notes payable is a valuable financial tool that business owners can use to expand. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the. Web notes payable on a.

What are notes payable BDC.ca / The Difference in Notes Payable Vs

Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Web notes payable on a balance sheet. Additionally, they are classified as current liabilities when the amounts are due within a year. When a note’s maturity is. Notes payable appear as liabilities on a balance sheet.

GRAPHIC

To illustrate, assume that a company. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Additionally, they are classified as current liabilities when the amounts are due within a year. Web notes payable on a balance sheet. Notes payable appear as liabilities on a balance sheet.

Long Term Notes Payable On Balance Sheet

Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the. Web notes payable on a balance sheet. To illustrate, assume that a company. Notes payable appear as liabilities on a balance sheet.

[Solved] Can someone please explain? The balance shee

Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When a note’s maturity is. Notes payable appear as liabilities on a balance sheet. Notes payable is a valuable financial tool that business owners can use to expand. Additionally, they are classified as current liabilities when the amounts are.

Notes Payable

Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Additionally, they are classified as current liabilities when the amounts are due within a year. Web notes payable on a balance sheet. To illustrate, assume that a company. When a note’s maturity is.

A Discount On Bonds Payable Slide Reverse

Additionally, they are classified as current liabilities when the amounts are due within a year. When the debt is long‐term (payable after one year) but requires a payment within the. Notes payable appear as liabilities on a balance sheet. Notes payable is a valuable financial tool that business owners can use to expand. To illustrate, assume that a company.

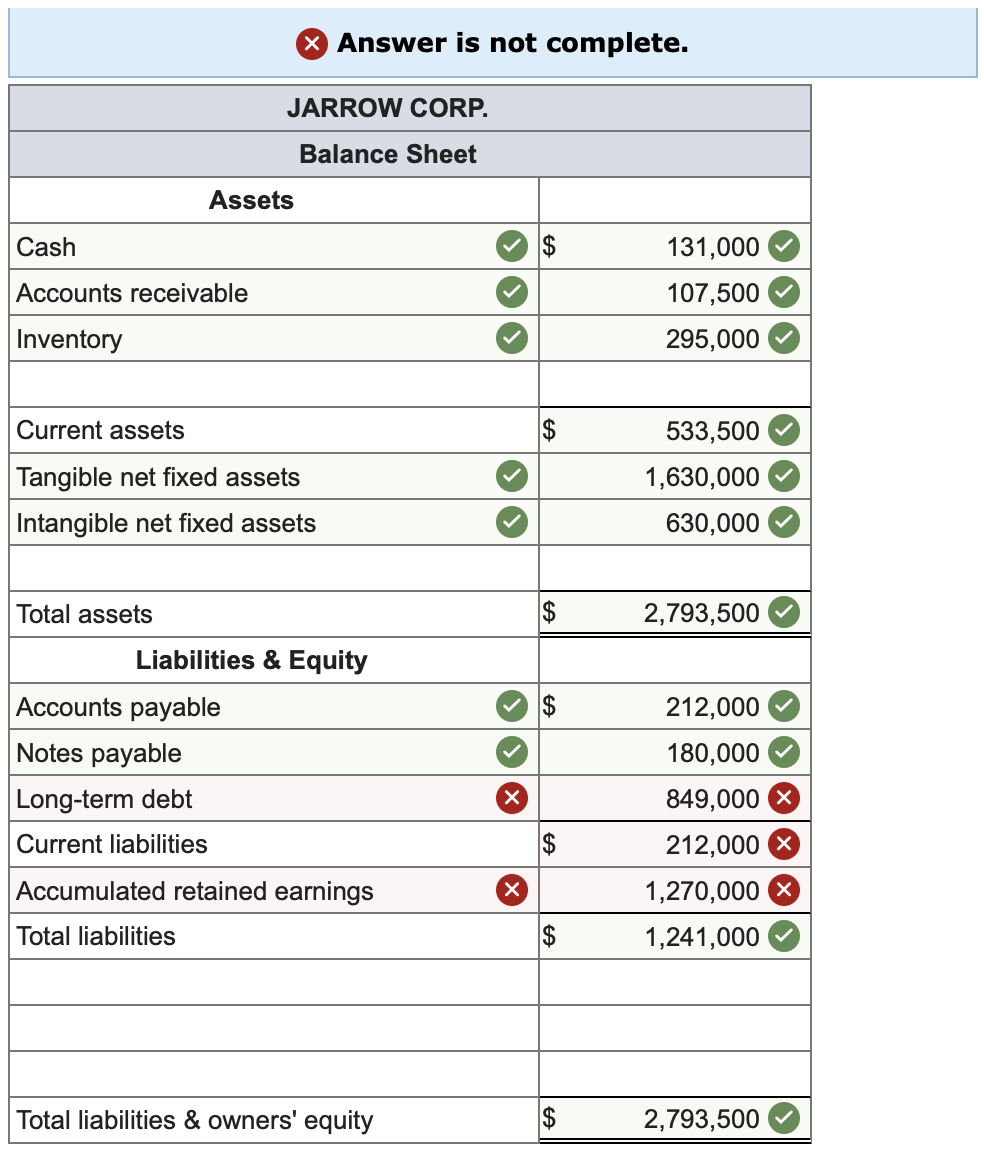

Solved Prepare a 2020 balance sheet for Jarrow Corp. based

Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. When the debt is long‐term (payable after one year) but requires a payment within the. To illustrate, assume that a company. Web notes payable on a balance sheet. When a note’s maturity is.

How do accounts payable show on the balance sheet? شبکه اطلاع رسانی

When the debt is long‐term (payable after one year) but requires a payment within the. When a note’s maturity is. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date. Notes payable appear as liabilities on a balance sheet. Additionally, they are classified as current liabilities when the amounts.

Additionally, They Are Classified As Current Liabilities When The Amounts Are Due Within A Year.

To illustrate, assume that a company. Notes payable appear as liabilities on a balance sheet. When the debt is long‐term (payable after one year) but requires a payment within the. When a note’s maturity is.

Notes Payable Is A Valuable Financial Tool That Business Owners Can Use To Expand.

Web notes payable on a balance sheet. Web notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.

![[Solved] Can someone please explain? The balance shee](https://media.cheggcdn.com/study/495/49565683-5152-4e24-9ac7-d3a8fb46b066/image)