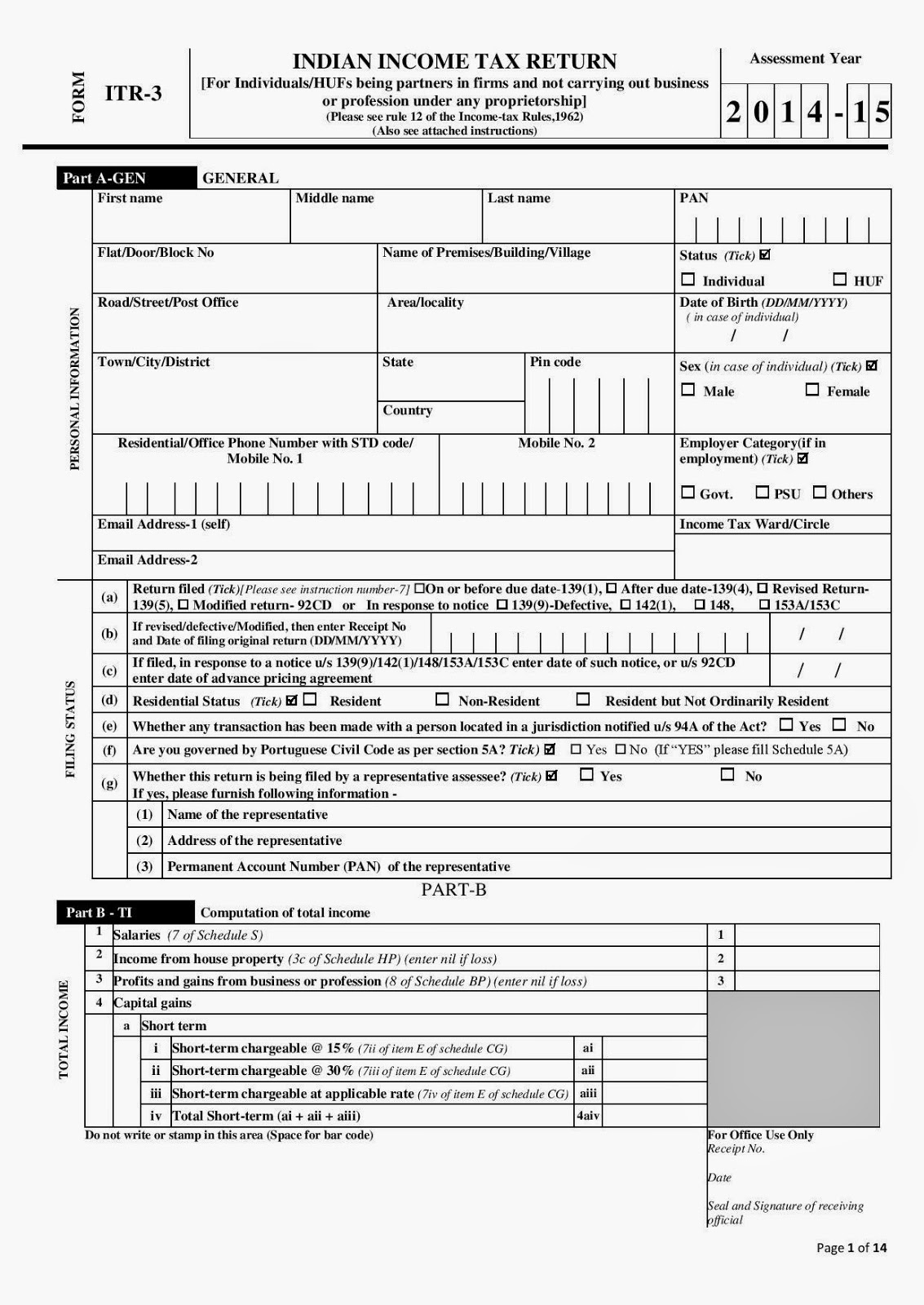

Nri Income Tax Return Form

Nri Income Tax Return Form - Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Fill out the separate section for exemptions and one more for dependents’. Stir and make sure no rice is out of the liquid. Who is eligible to use this return form? Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its citizens heavily. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Efile your income tax return online. Click the fill out form button to start filling. Whether an nri is required to pay advance tax? Place the chicken thighs over the rice.

Whether an nri is required to pay advance tax? 31, 1999 or other tax year beginning _____, 1999, ending _____, 20_____ check block ¤ if application for. Nonresident alien income tax return 2022 department of the treasury—internal. Click the fill out form button to start filling. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web remove the air fryer basket and add stock, seasoning and rice into the cooking pot. Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well as immovable) located in india and the corresponding. Who is eligible to use this return form? Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its citizens heavily. Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return.

Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its citizens heavily. Whether an nri is required to pay advance tax? Stir and make sure no rice is out of the liquid. Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return. Click the fill out form button to start filling. Efile your income tax return online. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Web many nris have been unable to file their income tax returns because of inoperative pans. Place the chicken thighs over the rice. Who is eligible to use this return form?

Is it Mandatory for NRI to File Tax Return in India? SavingsFunda

Get ready for tax season deadlines by completing any required tax forms today. Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well as immovable) located in india and the corresponding. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web this return form is.

How NRIs can file their India tax returns NRI Tax Returns Filing

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return. Web many nris have been unable to file their income tax returns because of inoperative pans. Nonresident alien income tax return 2022 department.

NRI efiling

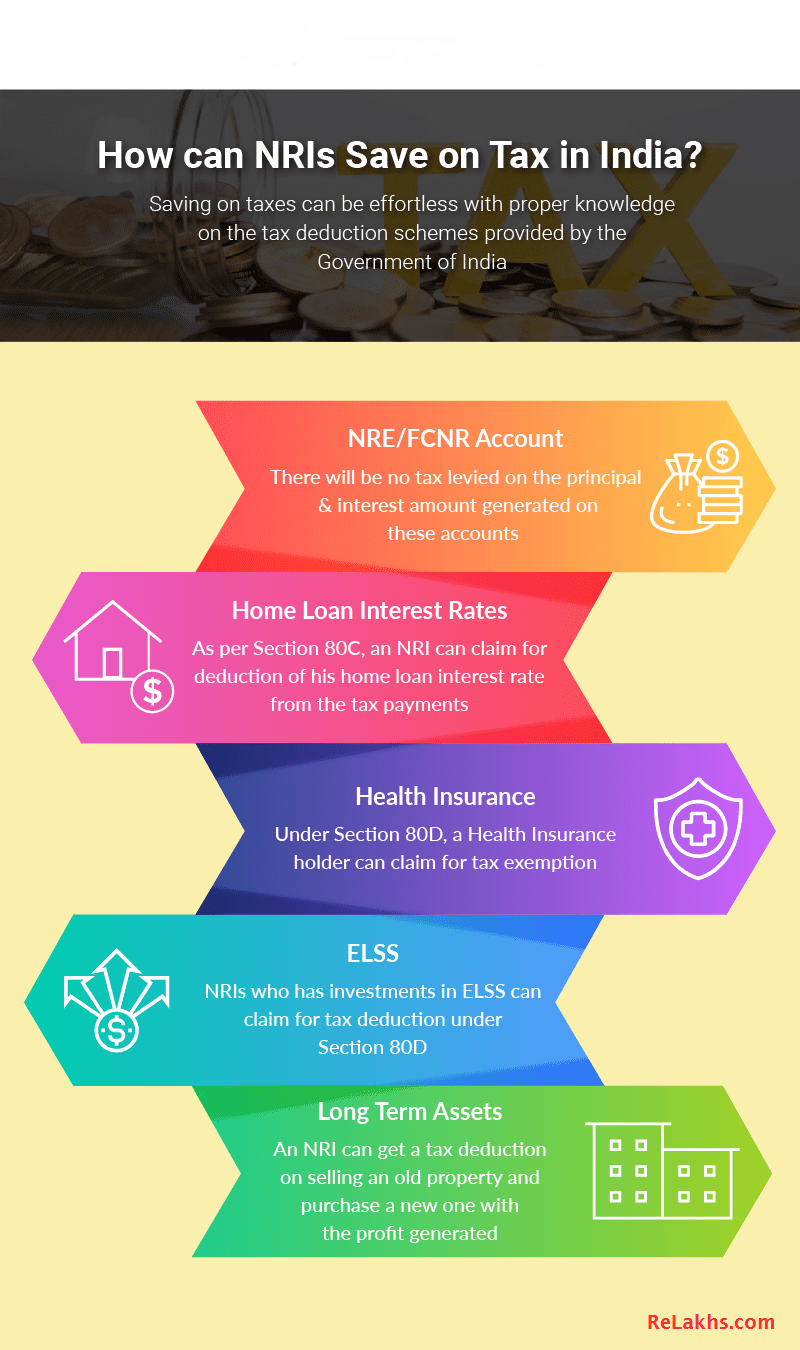

Have a look at this quick guide & save your income tax burden in india as an nri. Web when is an nri required to file his income tax return? Who is eligible to use this return form? Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its citizens heavily..

How to File ITR 2 Form For NRI Tax Return on New Portal AY 2022

Efile your income tax return online. Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return. Place the chicken thighs over the rice. Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well.

Which tax return form should I fill if I am an NRI with no

Whether an nri is required to pay advance tax? Who is eligible to use this return form? Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web when is an nri required to file his income tax return? Get ready for tax season deadlines by completing any required tax forms today.

How to File NRI Tax Return NRI Tax Return NRI

Stir and make sure no rice is out of the liquid. Have a look at this quick guide & save your income tax burden in india as an nri. 31, 1999 or other tax year beginning _____, 1999, ending _____, 20_____ check block ¤ if application for. Web nri tax filing india, just like several other countries across the globe,.

NRI Tax Slab Rates for FY 202223/202324 (AY 202324) SBNRI

Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return. 31, 1999 or other tax year beginning _____, 1999, ending _____, 20_____ check block ¤ if application for. Due date for filing income tax return; Web nri tax filing india, just like several other countries.

Tax for NRI Tax Rules For NRIs Explained DBS Treasures

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well as immovable) located in india and the corresponding. Web when is an nri required to file his income tax return? Whether an nri is required to.

Is it Mandatory for NRI to File Tax Return in India? NRI

Fill out the separate section for exemptions and one more for dependents’. Web remove the air fryer basket and add stock, seasoning and rice into the cooking pot. Get ready for tax season deadlines by completing any required tax forms today. Have a look at this quick guide & save your income tax burden in india as an nri. Web.

Best NRI Tax Saving options 202021 How NRIs can save on Tax?

Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well as immovable) located in india and the corresponding. Nonresident alien income tax return 2022 department of the treasury—internal. Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its.

Web Many Nris Have Been Unable To File Their Income Tax Returns Because Of Inoperative Pans.

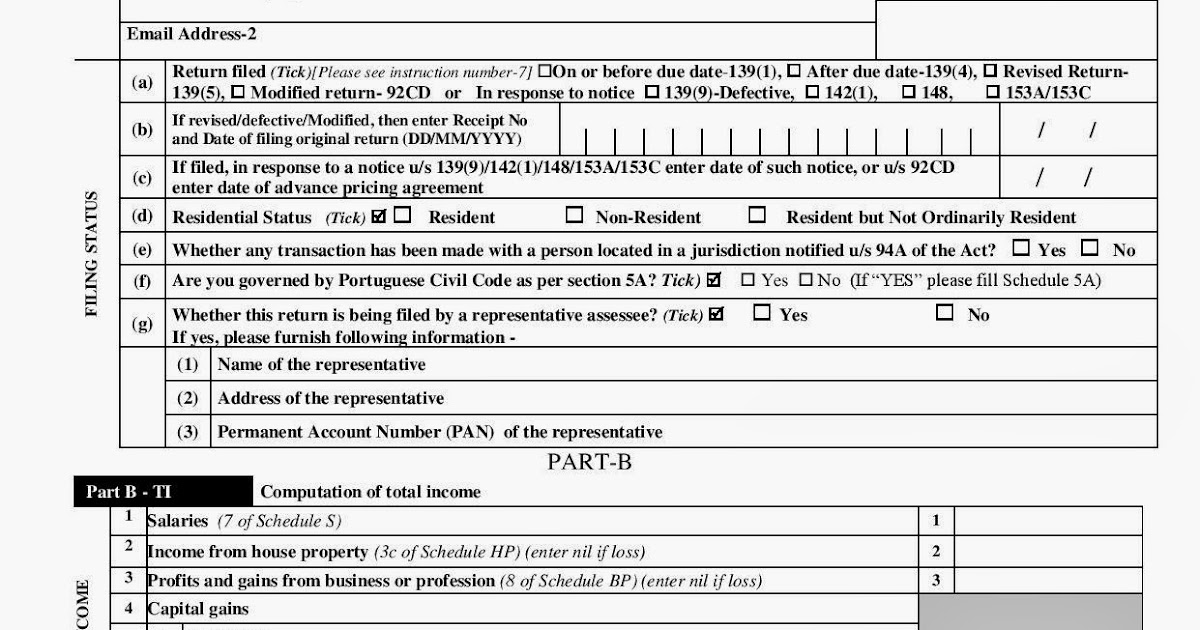

Web 2 days agothis option must be exercised using form 10ee, which needs to be filed electronically before the due date for filing tax return. Web this return form is applicable for assessment year2021‐22only, i.e., it relates to income earned in financial year2020‐21. Web nri tax filing india, just like several other countries across the globe, relies on the taxes paid by its citizens heavily. Due date for filing income tax return;

Click The Fill Out Form Button To Start Filling.

Stir and make sure no rice is out of the liquid. Who is eligible to use this return form? Web when is an nri required to file his income tax return? Web remove the air fryer basket and add stock, seasoning and rice into the cooking pot.

Whether An Nri Is Required To Pay Advance Tax?

Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Web as the due date to file the income tax return (itr) comes close, individual investors grapple with the complexities of itr filing.among the various components of. Efile your income tax return online. Get ready for tax season deadlines by completing any required tax forms today.

Nonresident Alien Income Tax Return 2022 Department Of The Treasury—Internal.

Web here are 4 steps for nris on filing income tax return in india. Web nris, whose total income is above ₹ 50 lakhs are subjected to report the cost of certain assets (movable as well as immovable) located in india and the corresponding. 31, 1999 or other tax year beginning _____, 1999, ending _____, 20_____ check block ¤ if application for. Web in which itr form nris need to furnish income tax return?