Ny Ptet Form

Ny Ptet Form - How to make the election how to modify or revoke the election The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. The election for the ptet is available for tax. If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: (read our insight on the previously enacted changes here.) Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021.

The election for the ptet is available for tax. If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021. How to make the election how to modify or revoke the election The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. (read our insight on the previously enacted changes here.) You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if:

How to make the election how to modify or revoke the election You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021. If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. (read our insight on the previously enacted changes here.) The election for the ptet is available for tax. The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year.

PTET form 2020 PTET form last date Rajasthan PTET form 2020 YouTube

The election for the ptet is available for tax. If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. (read our insight on the previously enacted changes here.) Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income.

PTET 2021 application form submission process extended

You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021. The eligible entity may opt in on or after january.

Rajasthan PTET Application Form 2019 Correction Panel Available

You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: How to make the election how to modify or revoke the election The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. (read our insight on the previously enacted.

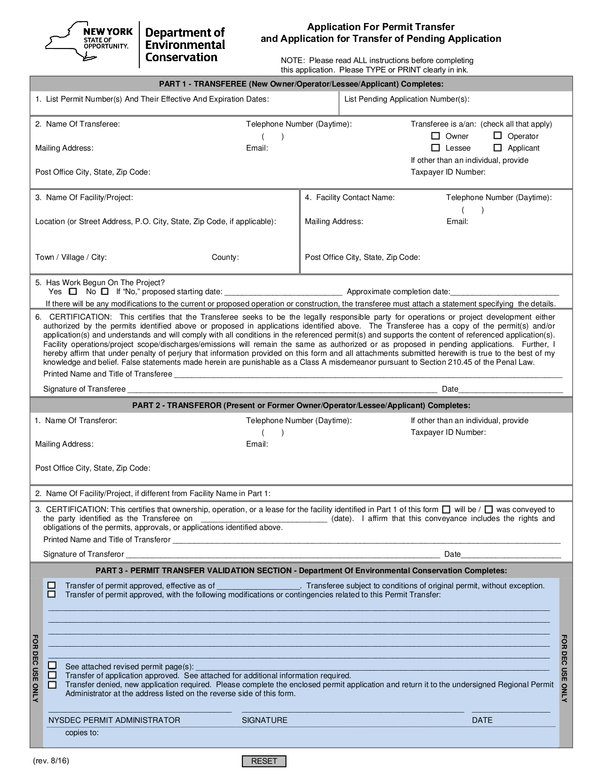

New York State Withholding Tax Form 2022

The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: (read our insight on the previously enacted changes here.) How to make the election how to modify or revoke.

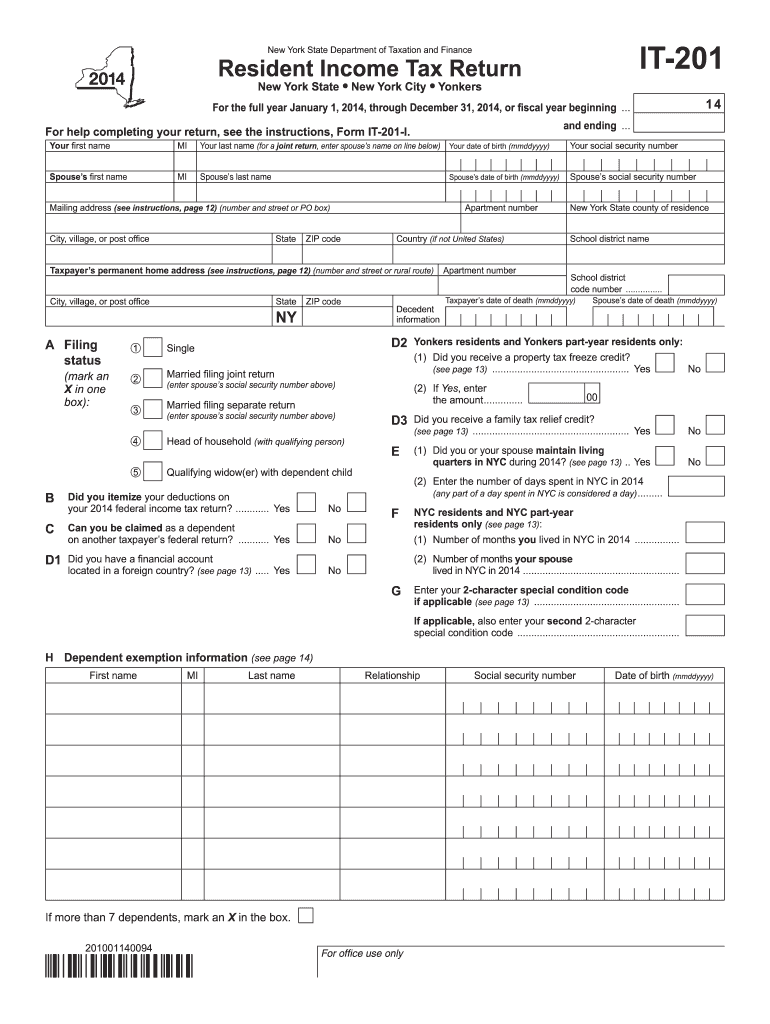

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

The election for the ptet is available for tax. How to make the election how to modify or revoke the election If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: (read.

Llc Annual Report Template in 2021 Annual report, Report template

If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. Web the ptet is an optional tax that partnerships or new york s corporations may annually elect.

PTET 2020 PTET ONLINE FORM 2020 PTET EXAM DATE 2020 PTET LATEST

The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. If the ptet credit exceeds the tax due for the tax year, the excess credit will be refunded without interest. How to make the election how to modify or revoke the election The election for the ptet.

2011 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay.

PTET 2020 / BSTC 2020 / PTET Online form apply // PTET form passing

How to make the election how to modify or revoke the election (read our insight on the previously enacted changes here.) The election for the ptet is available for tax. The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. You are entitled to this refundable credit.

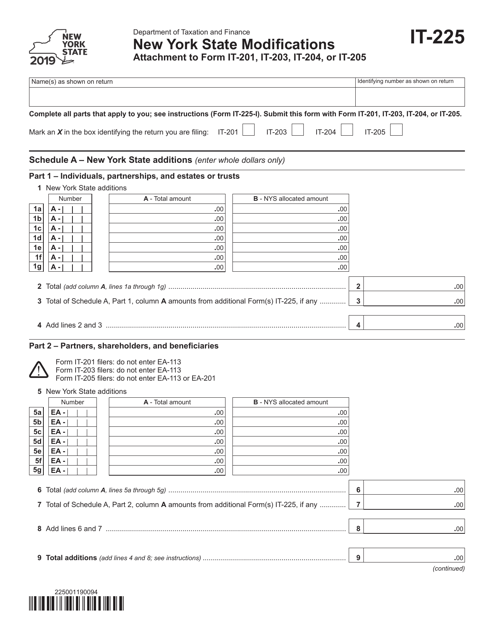

Form IT225 Download Fillable PDF or Fill Online New York State

Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021. You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if: How to make the election how to modify or revoke.

If The Ptet Credit Exceeds The Tax Due For The Tax Year, The Excess Credit Will Be Refunded Without Interest.

The election for the ptet is available for tax. (read our insight on the previously enacted changes here.) The eligible entity may opt in on or after january 1 but no later than march 15 of the current ptet taxable year. You are entitled to this refundable credit for tax years beginning on or after january 1, 2021, if:

How To Make The Election How To Modify Or Revoke The Election

Web the ptet is an optional tax that partnerships or new york s corporations may annually elect to pay on certain income for tax years beginning on or after january 1, 2021.