Ny State Form It 370

Ny State Form It 370 - Simply mailing in a payment voucher to pay the tax due is not sufficient. You are not required to. Ny requires full payment with balance due extensions. If you pay by credit card, you do not file thisform. Page last reviewed or updated: You must apply for an extension of time to file your return when you mail in your payment voucher; If you use a payroll service, you may list them as a secondary contact; Separate extension requests must be submitted for a husband andwife who file separate returns. Web application for automatic extension of time to file for partnerships and fiduciaries; See related links below for details on this screen.

You are not required to. Complete the pmt screen before electronically filing the extension using state/city selection code nye. Page last reviewed or updated: You must apply for an extension of time to file your return when you mail in your payment voucher; If you use a payroll service, you may list them as a secondary contact; Web application for automatic extension of time to file for partnerships and fiduciaries; Simply mailing in a payment voucher to pay the tax due is not sufficient. Ny requires full payment with balance due extensions. Separate extension requests must be submitted for a husband andwife who file separate returns. See related links below for details on this screen.

Complete the pmt screen before electronically filing the extension using state/city selection code nye. Ny requires full payment with balance due extensions. Separate extension requests must be submitted for a husband andwife who file separate returns. Page last reviewed or updated: See related links below for details on this screen. If you use a payroll service, you may list them as a secondary contact; If you pay by credit card, you do not file thisform. You must apply for an extension of time to file your return when you mail in your payment voucher; Simply mailing in a payment voucher to pay the tax due is not sufficient. You are not required to.

3118 State Route 370, Cato, NY 4 Bed, 2 Bath SingleFamily Home 26

Ny requires full payment with balance due extensions. If you use a payroll service, you may list them as a secondary contact; Page last reviewed or updated: You are not required to. If you pay by credit card, you do not file thisform.

NY 370 Photos New York State Roads

Complete the pmt screen before electronically filing the extension using state/city selection code nye. See related links below for details on this screen. Simply mailing in a payment voucher to pay the tax due is not sufficient. If you pay by credit card, you do not file thisform. Separate extension requests must be submitted for a husband andwife who file.

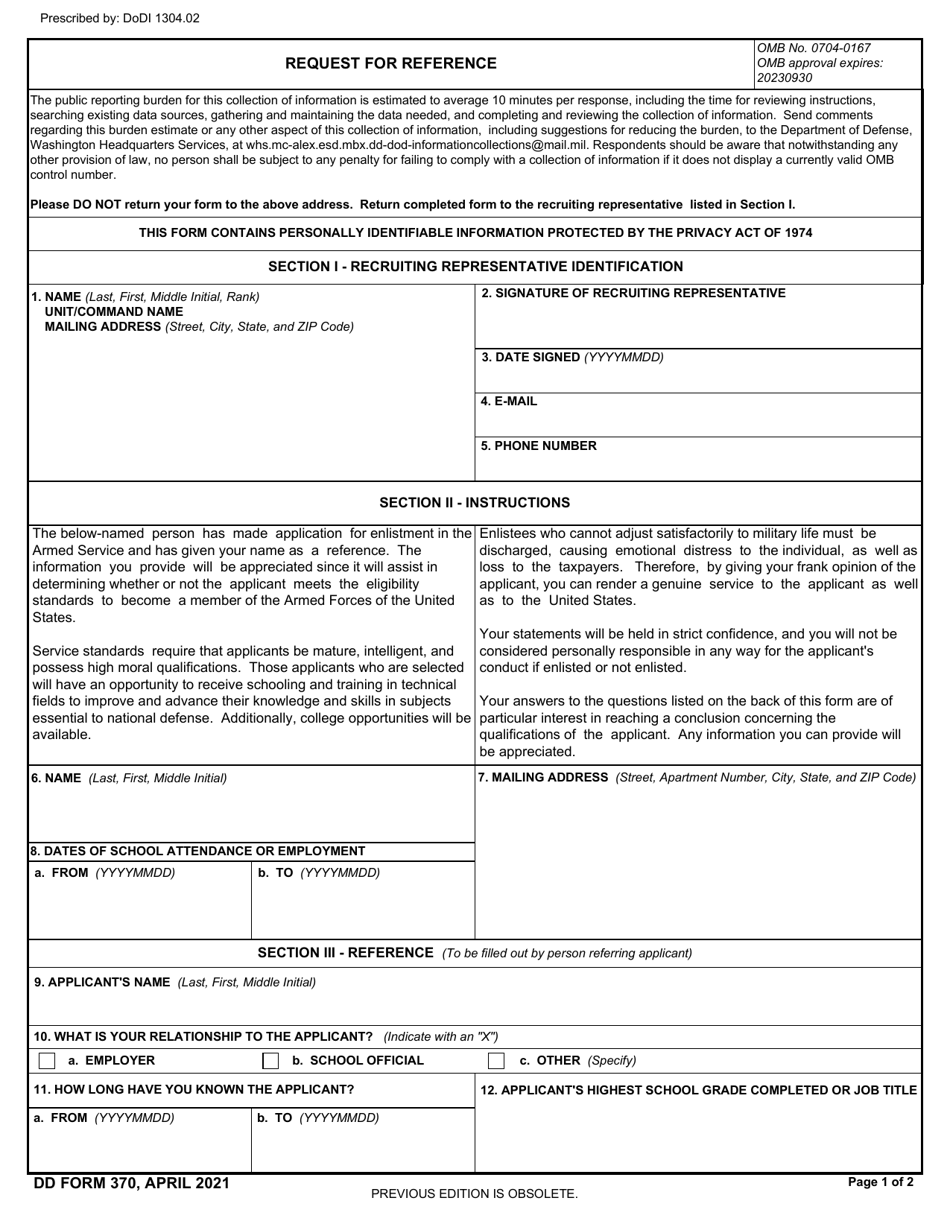

DD Form 370 Download Fillable PDF or Fill Online Request for Reference

Separate extension requests must be submitted for a husband andwife who file separate returns. Ny requires full payment with balance due extensions. You are not required to. If you pay by credit card, you do not file thisform. See related links below for details on this screen.

2018 Form NY DTF IT370 Fill Online, Printable, Fillable, Blank pdfFiller

If you use a payroll service, you may list them as a secondary contact; Ny requires full payment with balance due extensions. If you pay by credit card, you do not file thisform. Complete the pmt screen before electronically filing the extension using state/city selection code nye. Simply mailing in a payment voucher to pay the tax due is not.

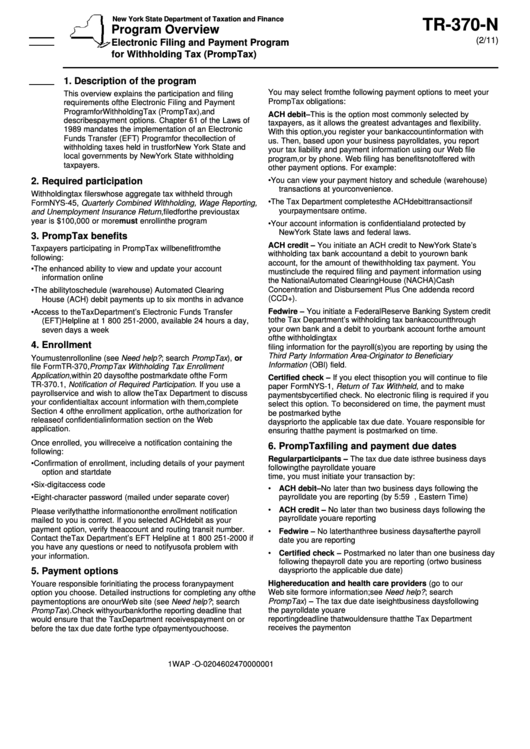

Form Tr370N Program Overview Electronic Filing And Payment Program

Ny requires full payment with balance due extensions. Web application for automatic extension of time to file for partnerships and fiduciaries; Simply mailing in a payment voucher to pay the tax due is not sufficient. See related links below for details on this screen. If you use a payroll service, you may list them as a secondary contact;

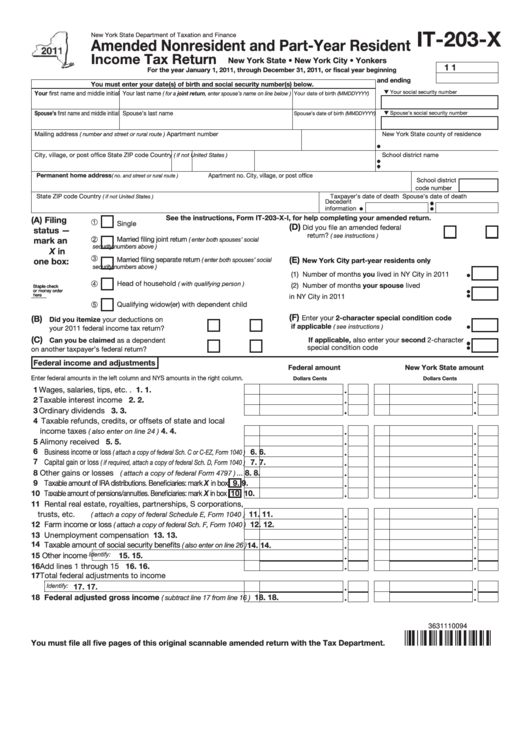

Fillable Form It203X Amended Nonresident And PartYear Resident

Ny requires full payment with balance due extensions. Page last reviewed or updated: You are not required to. If you use a payroll service, you may list them as a secondary contact; Simply mailing in a payment voucher to pay the tax due is not sufficient.

New York State Eviction Forms Form Resume Examples aZDYY2XD79

Page last reviewed or updated: If you use a payroll service, you may list them as a secondary contact; You are not required to. Ny requires full payment with balance due extensions. You must apply for an extension of time to file your return when you mail in your payment voucher;

Ny State Tax Form It 201 Form Resume Examples Vj1yMEV1yl

You are not required to. Separate extension requests must be submitted for a husband andwife who file separate returns. Page last reviewed or updated: Simply mailing in a payment voucher to pay the tax due is not sufficient. If you use a payroll service, you may list them as a secondary contact;

1984 Form DD 370 Fill Online, Printable, Fillable, Blank PDFfiller

Ny requires full payment with balance due extensions. Web application for automatic extension of time to file for partnerships and fiduciaries; You must apply for an extension of time to file your return when you mail in your payment voucher; If you use a payroll service, you may list them as a secondary contact; See related links below for details.

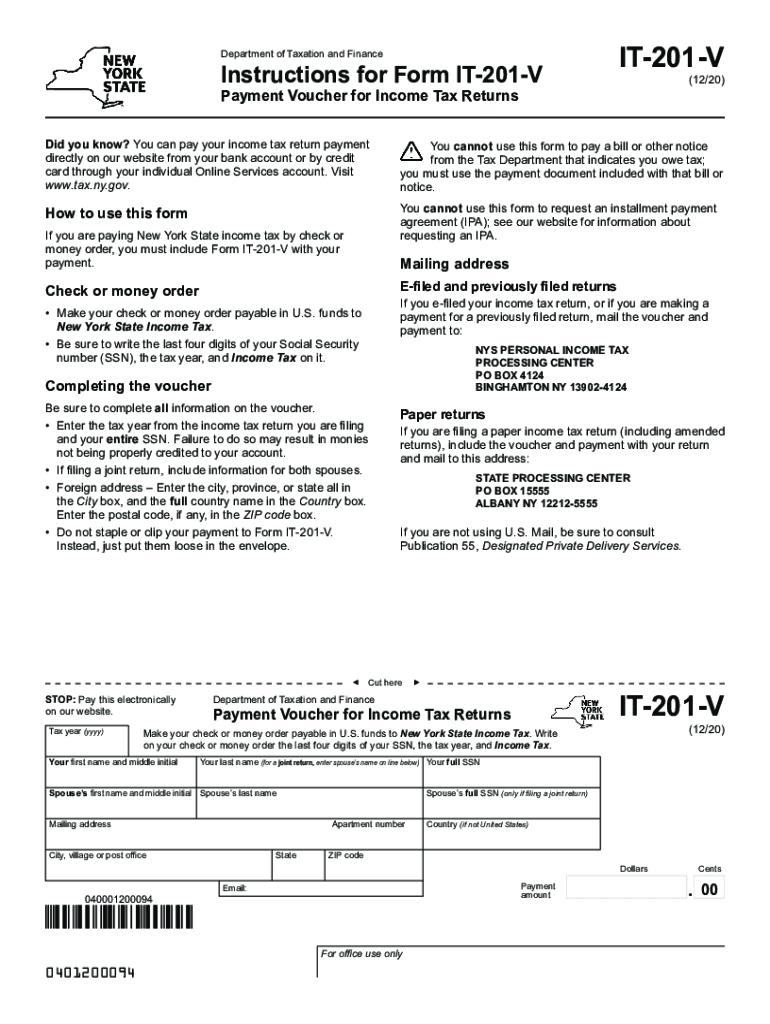

NY IT201V 2020 Fill out Tax Template Online US Legal Forms

If you use a payroll service, you may list them as a secondary contact; You must apply for an extension of time to file your return when you mail in your payment voucher; See related links below for details on this screen. If you pay by credit card, you do not file thisform. Web application for automatic extension of time.

Web Application For Automatic Extension Of Time To File For Partnerships And Fiduciaries;

Simply mailing in a payment voucher to pay the tax due is not sufficient. Page last reviewed or updated: If you pay by credit card, you do not file thisform. Ny requires full payment with balance due extensions.

You Are Not Required To.

See related links below for details on this screen. If you use a payroll service, you may list them as a secondary contact; You must apply for an extension of time to file your return when you mail in your payment voucher; Separate extension requests must be submitted for a husband andwife who file separate returns.