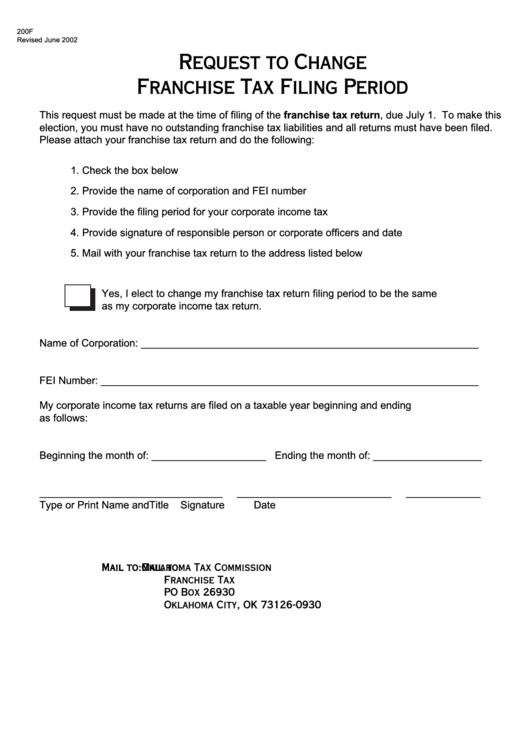

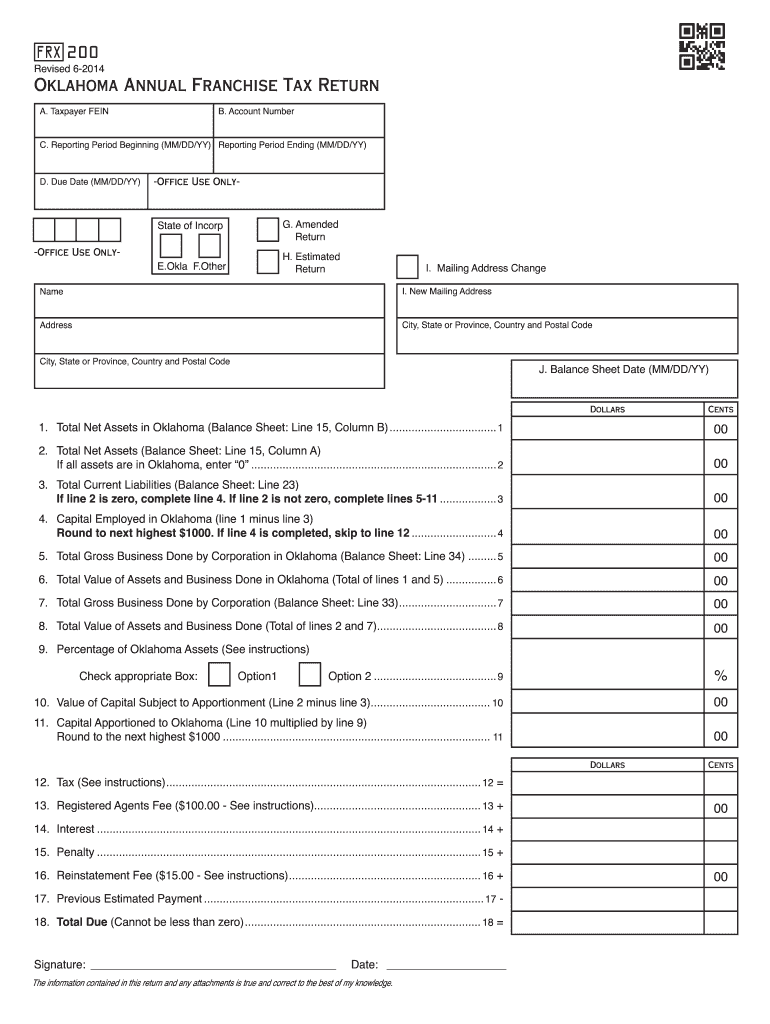

Oklahoma Form 200F

Oklahoma Form 200F - Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Web fill online, printable, fillable, blank form 200: Web how to fill out and sign oklahoma form 200f online? Who must pay the franchise tax? The report and tax will be delinquent if not paid on or. Enjoy smart fillable fields and interactivity. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. (line 16 of form 200.) if you. Complete, edit or print tax forms instantly. Oklahoma annual franchise tax return (state of oklahoma) form.

This government document is issued by tax commission for use in oklahoma. Enjoy smart fillable fields and interactivity. Web maximum filers should complete and file form 200 including a schedule of current corporate officers and balance sheet. Get your online template and fill it in using progressive features. Use fill to complete blank online state of. Web fill online, printable, fillable, blank form 200: Web how to fill out and sign oklahoma form 200f online? Complete, edit or print tax forms instantly. Sign it in a few clicks draw your signature, type it,. If a taxpayer computes the franchise tax due and determines.

Enjoy smart fillable fields and interactivity. I will include franchise tax information on the oklahoma. Sign it in a few clicks draw your signature, type it,. Oklahoma annual franchise tax return (state of oklahoma) form. When the oklahoma business activity tax was. I elect to file one return for both franchise and corporate income taxes. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Get your online template and fill it in using progressive features. Web up to $40 cash back sts20021, oklahoma sales tax return supplement (used with form sts20002 ). Who must pay the franchise tax?

20132022 OK DOC Form 030118B Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. I will include franchise tax information on the oklahoma. Use fill to complete blank online state of. Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. (line 16 of form 200.) if you.

Boats for sale in Bartlesville, Oklahoma

The report and tax will be delinquent if not paid on or. If a taxpayer computes the franchise tax due and determines. (line 16 of form 200.) if you. Enjoy smart fillable fields and interactivity. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement.

Articles Of Incorporation Oklahoma Sample New Sample t

I will include franchise tax information on the oklahoma. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Web maximum filers should complete and file form 200 including a schedule of current corporate officers and balance sheet. If a taxpayer computes the franchise tax due and determines. Complete, edit or print tax forms.

Form 200f Request To Change Franchise Tax Filing Period printable pdf

Get your online template and fill it in using progressive features. Use fill to complete blank online state of. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Web how to fill out and sign oklahoma form 200f online? Web fill online, printable, fillable, blank form 200:

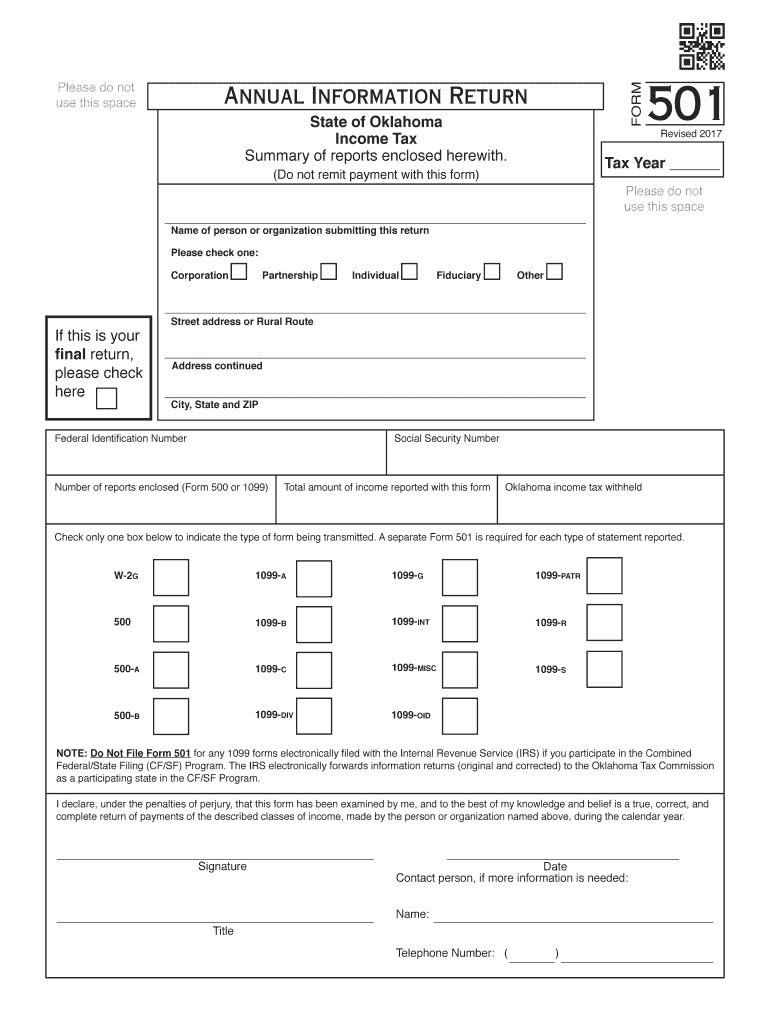

Form 501 Fill Out and Sign Printable PDF Template signNow

Web how to fill out and sign oklahoma form 200f online? Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Get your online template and fill it in using progressive features. Get ready for tax season deadlines by completing any required tax forms today. Sign it in a few clicks draw.

Fill Free fillable forms for the state of Oklahoma

Who must pay the franchise tax? I will include franchise tax information on the oklahoma. Web up to $40 cash back sts20021, oklahoma sales tax return supplement (used with form sts20002 ). Oklahoma annual franchise tax return (state of oklahoma) form. Get your online template and fill it in using progressive features.

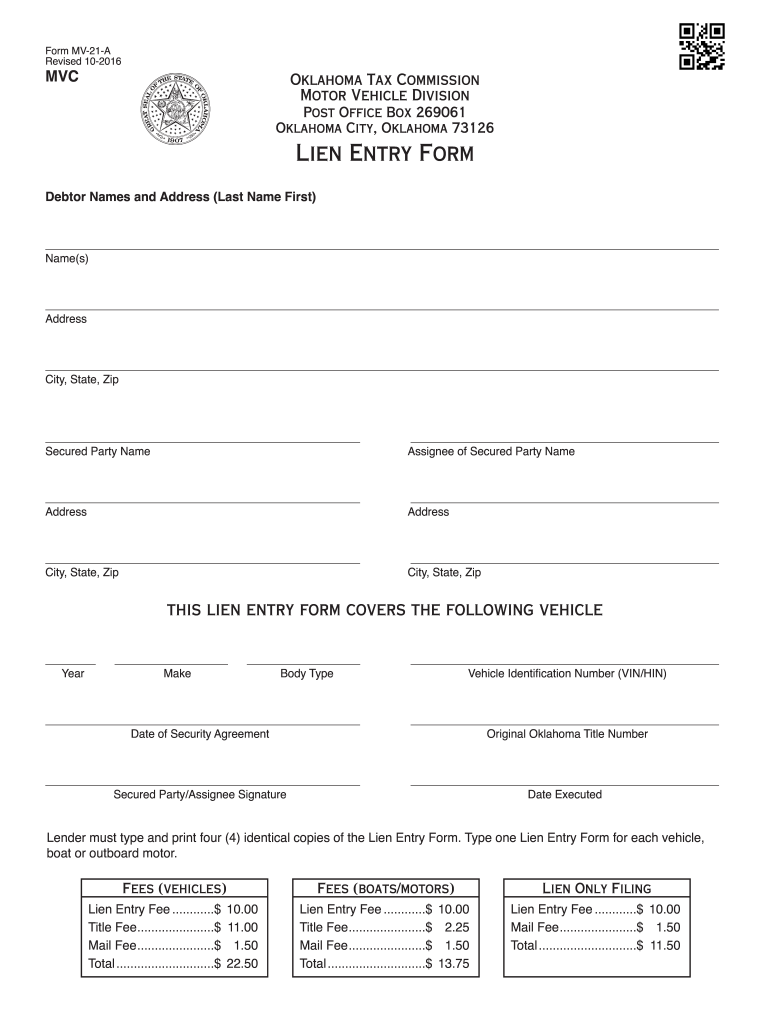

2016 Form OK MV21A Fill Online, Printable, Fillable, Blank pdfFiller

Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Sign it in a few clicks draw your signature, type it,. The report and tax will be delinquent if not paid on or. Web fill online, printable, fillable, blank form 200: Web how to fill out and sign oklahoma form 200f online?

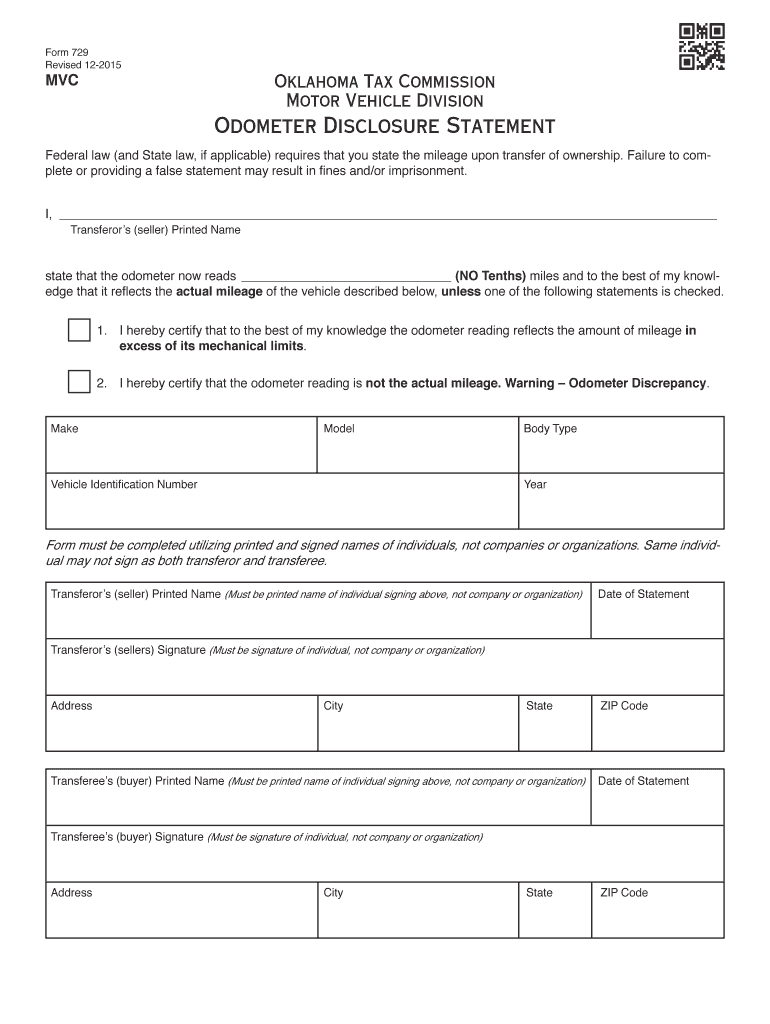

Oklahoma Odometer Statement Form Fill Out and Sign Printable PDF

Web maximum filers should complete and file form 200 including a schedule of current corporate officers and balance sheet. Enjoy smart fillable fields and interactivity. Get your online template and fill it in using progressive features. Complete, edit or print tax forms instantly. If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement.

2014 Form OK FRX 200 Fill Online, Printable, Fillable, Blank pdfFiller

When the oklahoma business activity tax was. Get your online template and fill it in using progressive features. (line 16 of form 200.) if you. Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. Use fill to complete blank online state of.

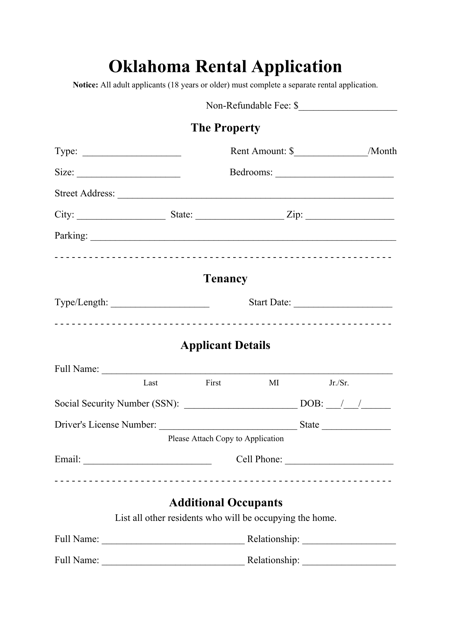

Oklahoma Rental Application Form Download Printable PDF Templateroller

I will include franchise tax information on the oklahoma. Web how to fill out and sign oklahoma form 200f online? Who must pay the franchise tax? Use fill to complete blank online state of. Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more.

When The Oklahoma Business Activity Tax Was.

Web the new franchise tax rule limits taxpayers' annual obligation to a maximum of $20,000 each year. If a taxpayer computes the franchise tax due and determines. Sign it in a few clicks draw your signature, type it,. Web find and fill out the correct ok frx 200 2020 2022 fill out tax template online us legal forms.

This Government Document Is Issued By Tax Commission For Use In Oklahoma.

If the charter or other instrument is suspended, a fee of $150.00 is required for reinstatement. Web maximum filers should complete and file form 200 including a schedule of current corporate officers and balance sheet. Enjoy smart fillable fields and interactivity. Web how to fill out and sign oklahoma form 200f online?

Web Up To $40 Cash Back Sts20021, Oklahoma Sales Tax Return Supplement (Used With Form Sts20002 ).

Edit your form 200 f online type text, add images, blackout confidential details, add comments, highlights and more. Get ready for tax season deadlines by completing any required tax forms today. Oklahoma annual franchise tax return (state of oklahoma) form. Complete, edit or print tax forms instantly.

The Report And Tax Will Be Delinquent If Not.

Web fill online, printable, fillable, blank form 200: The report and tax will be delinquent if not paid on or. Use fill to complete blank online state of. (line 16 of form 200.) if you.