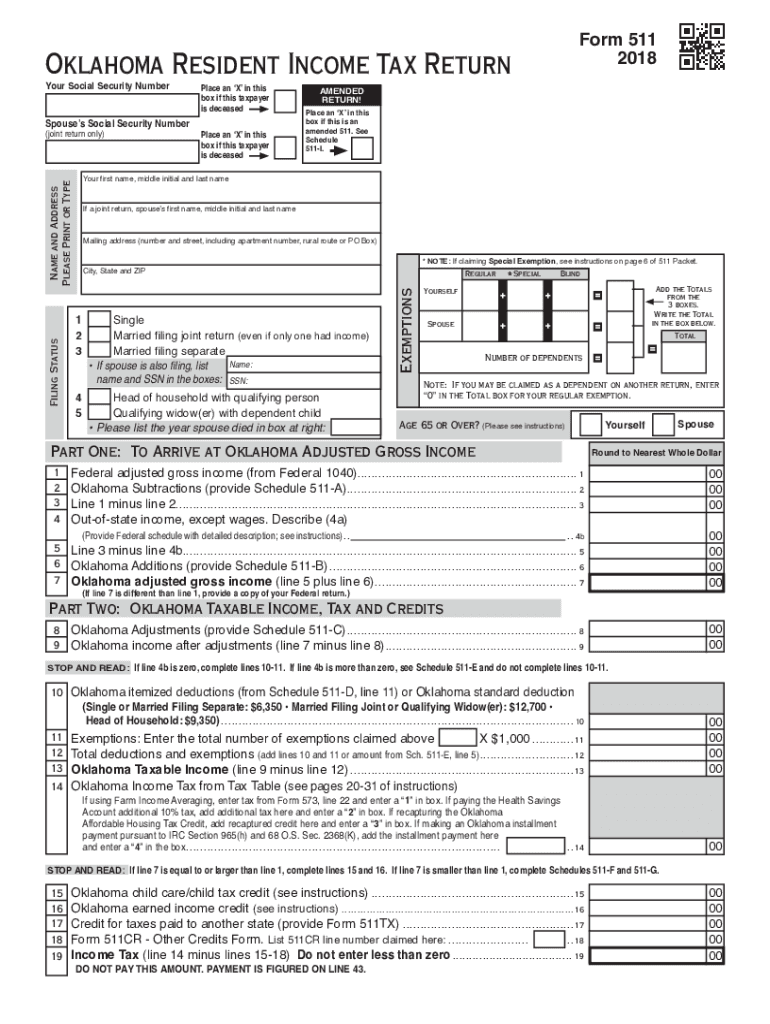

Oklahoma Form 511

Oklahoma Form 511 - Complete, edit or print tax forms instantly. For more information about the oklahoma income. Sales tax relief credit • instructions for the direct deposit option • 2018 income tax. (oklahoma resident income tax return and sales tax relief. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x. Sales tax relief credit form • instructions for the direct deposit option • 2020 income tax tables filing. Web the oklahoma eic is refundable beginning with tax year 2022. Web form 511 is the general income tax return for oklahoma residents. Form 511 can be efiled, or a paper copy can be filed via mail.

Ad download or email ok form 511 & more fillable forms, register and subscribe now! • instructions for completing the form 511: Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x. Web form 511 is the general income tax return for oklahoma residents. This form is for income earned in tax year 2022, with tax returns due in. Oklahoma resident income tax return • form 511: Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Sales tax relief credit form • instructions for the direct deposit option • 2020 income tax tables filing. Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. Web the oklahoma eic is refundable beginning with tax year 2022.

Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x. Sales tax relief credit form • instructions for the direct deposit option • 2020 income tax tables filing. Web the oklahoma eic is refundable beginning with tax year 2022. Oklahoma resident income tax return • form 511: Web if your federal return for any year is changed, an amended oklahoma return shall be filed within one year. Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. For additional information, call our. Complete, edit or print tax forms instantly. Oklahoma resident income tax return form • form. Oklahoma allows the following subtractions from income:

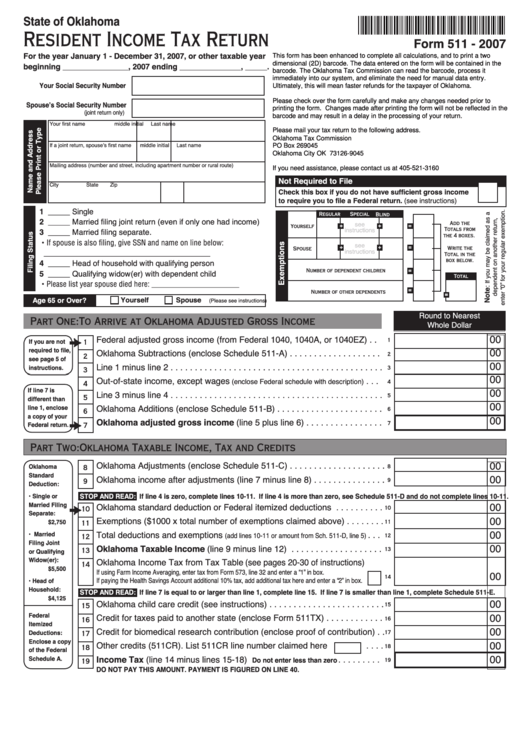

Fillable Form 511 Oklahoma Resident Tax Return 2007

Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. Oklahoma resident income tax return (metropolitan library system) on average this form takes 115 minutes to complete. Oklahoma resident income tax return • form 511: Sales tax relief credit form • instructions for.

2019 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Sign, mail form 511 or 511nr to. Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x. Complete, edit or print tax forms instantly. Download or email ok form 511 & more fillable forms, register and subscribe now! Web 2016 oklahoma.

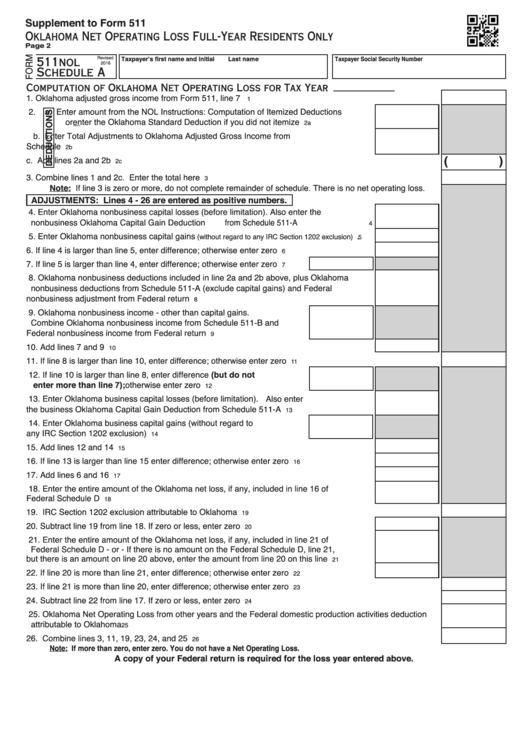

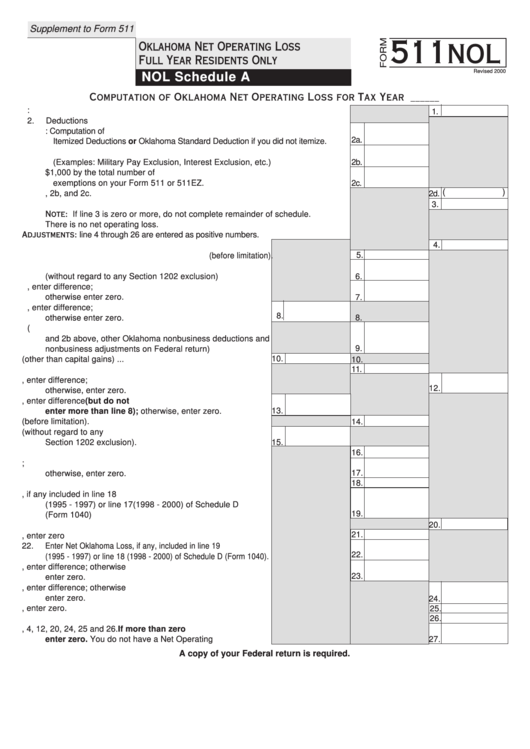

Fillable Form 511Nol Oklahoma Net Operating Loss FullYear Residents

Oklahoma resident income tax return • form 511: Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Get ready for tax season deadlines by completing any required tax forms today. Web 2016 oklahoma resident individual income tax forms and instructions. Sales tax relief credit form • instructions for the direct deposit option • 2020.

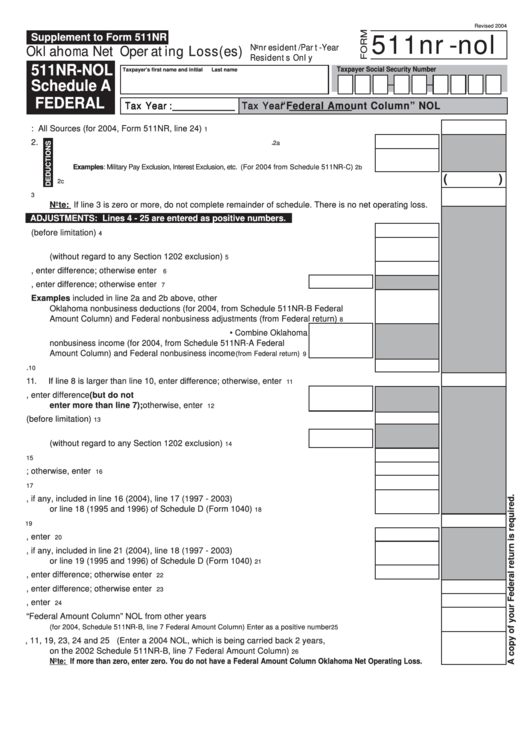

Form 511nrNol Supplement To Form 511nr Oklahoma Net Operating Loss

Form 511 2018 filing status 1 single 2 married filing joint return (even if only one had income) 3 married filing separate • if spouse is name:also filing, list. Ad download or email ok form 511 & more fillable forms, register and subscribe now! For more information about the oklahoma income. This form is for income earned in tax year.

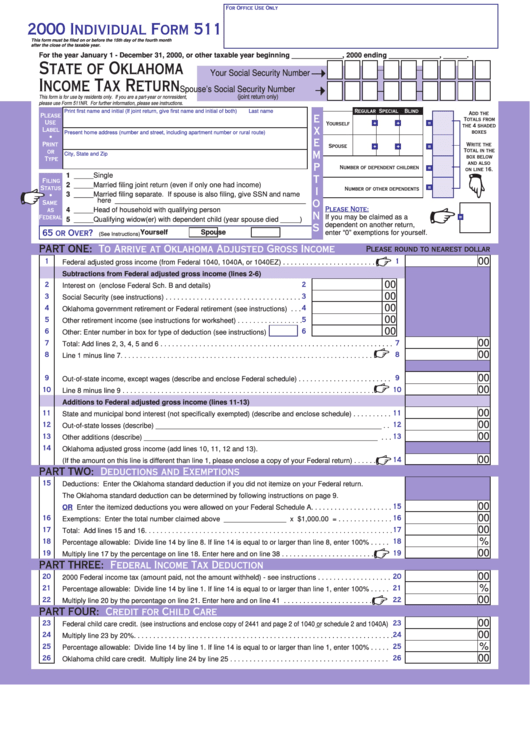

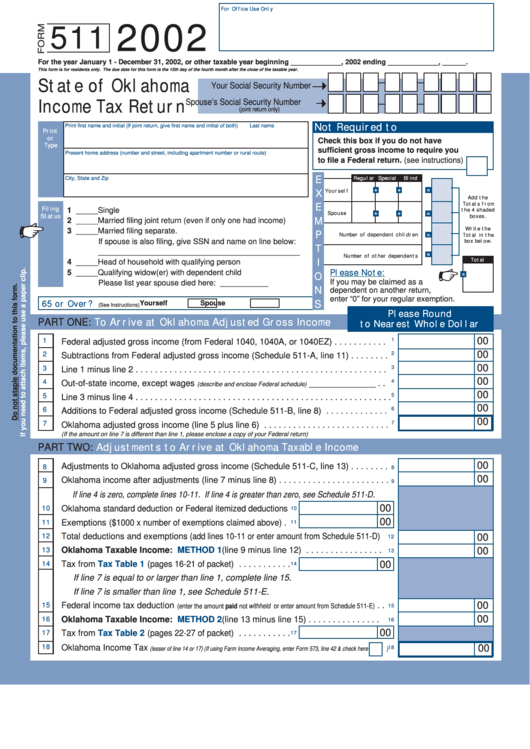

Individual Form 511 State Of Oklahoma Tax Return 2000

Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. Web oklahoma individual income tax declaration for electronic filing. Sign, mail form 511 or 511nr to. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Web if.

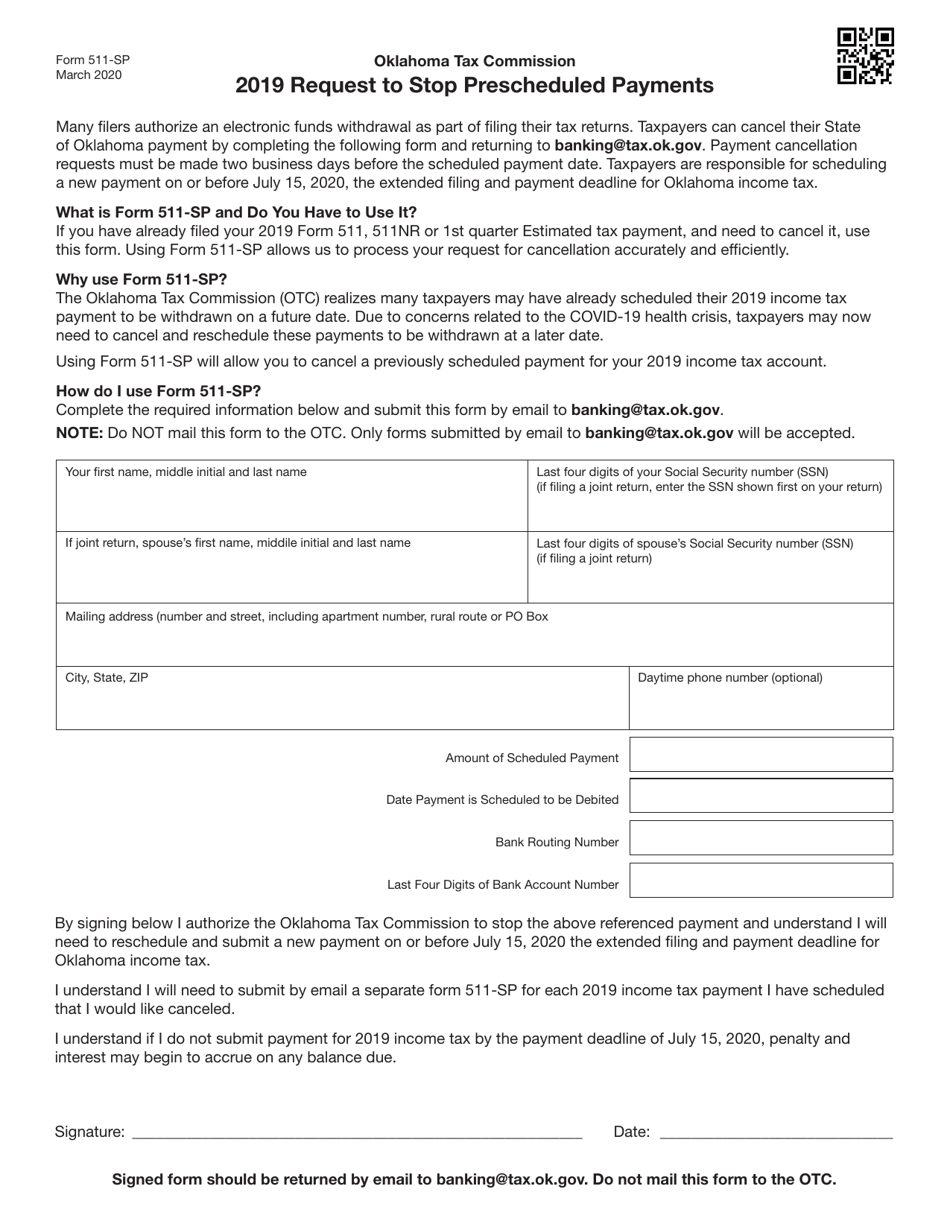

Form 511SP Download Fillable PDF or Fill Online Request to Stop

Complete, edit or print tax forms instantly. • instructions for completing the form 511: Oklahoma resident income tax return • form 511: Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. Web 2016 oklahoma resident individual income tax forms and instructions.

Form 511 State Of Oklahoma Tax Return 2002 printable pdf

Web oklahoma individual income tax declaration for electronic filing. Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x. Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services.

Form 511 Nol Nol Schedule A Oklahoma Net Operating Loss Full Year

Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Download or email ok form 511 & more fillable forms, register and subscribe now! Ad download or email ok form 511 & more fillable forms, register and subscribe now! Sign, mail form 511 or 511nr to. Web 2016 oklahoma resident individual income tax forms and.

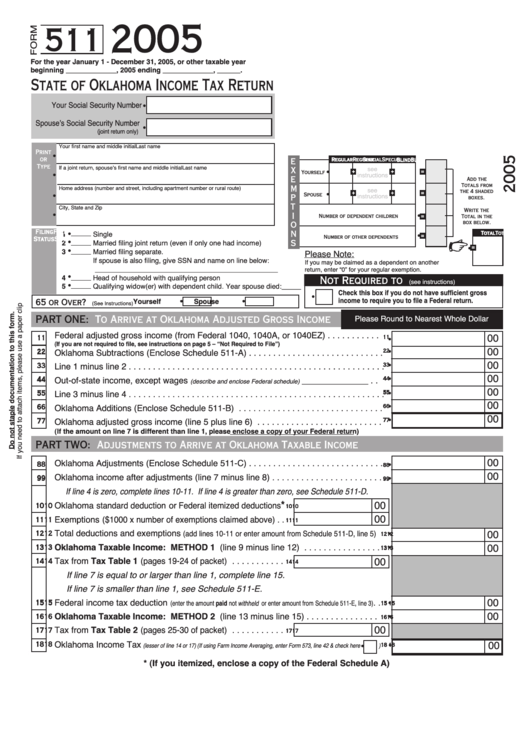

Form 511 State Of Oklahoma Tax Return 2005 printable pdf

Oklahoma allows the following subtractions from income: For more information about the oklahoma income. Individual income tax return (form 511) for oklahoma residents. Download or email ok form 511 & more fillable forms, register and subscribe now! If you amend your federal return, it is recommended you obtain.

2018 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Oklahoma allows the following subtractions from income: Form 511 can be efiled, or a paper copy can be filed via mail. See instructions on page 2 to. For more information about the oklahoma income. (oklahoma resident income tax return and sales tax relief.

If You Amend Your Federal Return, It Is Recommended You Obtain.

Web the oklahoma eic is refundable beginning with tax year 2022. Web if your federal return for any year is changed, an amended oklahoma return shall be filed within one year. Download or email ok form 511 & more fillable forms, register and subscribe now! Oklahoma allows the following subtractions from income:

Web Oklahoma Individual Income Tax Declaration For Electronic Filing.

Web form 511 is the general income tax return for oklahoma residents. For more information about the oklahoma income. Sign, mail form 511 or 511nr to. Form 511 2018 filing status 1 single 2 married filing joint return (even if only one had income) 3 married filing separate • if spouse is name:also filing, list.

Web We Last Updated Oklahoma Form 511 In January 2023 From The Oklahoma Tax Commission.

• instructions for completing the form 511: Ad download or email ok form 511 & more fillable forms, register and subscribe now! Sales tax relief credit • instructions for the direct deposit option • 2018 income tax. Web if you discover you have made an error only on your oklahoma return we may be able to help you correct the form instead of filing form 511x.

Sales Tax Relief Credit Form • Instructions For The Direct Deposit Option • 2020 Income Tax Tables Filing.

Web up to $40 cash back related to form 511 oklahoma 2022 apply for food stamps online missouri department of social services family support division application for. Oklahoma resident income tax return • form 511: Individual income tax return (form 511) for oklahoma residents. This form is for income earned in tax year 2022, with tax returns due in.