Oklahoma Form 512

Oklahoma Form 512 - Pdf browse oklahoma forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. All forms are printable and downloadable. Web we last updated the return of organization exempt from income tax in january 2023, so this is the latest version of form 512e, fully updated for tax year 2022. Web oklahoma amended corporation income tax return tax year corporate name: Push the“get form” button below. • the corporate income tax rate was reduced from 6% to 4%. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. Once completed you can sign your fillable form or send for signing. You can print other oklahoma tax forms here. Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form.

• the corporate income tax rate was reduced from 6% to 4%. Making an oklahoma installment payment pursuant to irc. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Fill in your chosen form sign the form using our drawing tool • the bank in lieu tax rate was reduced from 6% to 4%. Web what’s new in the 2022 oklahoma tax packet? Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Use fill to complete blank online state of oklahoma (ok) pdf forms for free. You can print other oklahoma tax forms here. All forms are printable and downloadable.

Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. All forms are printable and downloadable. Web oklahoma amended corporation income tax return tax year corporate name: Use fill to complete blank online state of oklahoma (ok) pdf forms for free. • the corporate income tax rate was reduced from 6% to 4%. You can print other oklahoma tax forms here. Web what’s new in the 2022 oklahoma tax packet? Enclose a copy of irs form 1120x or 1139 and a copy of Push the“get form” button below. Once completed you can sign your fillable form or send for signing.

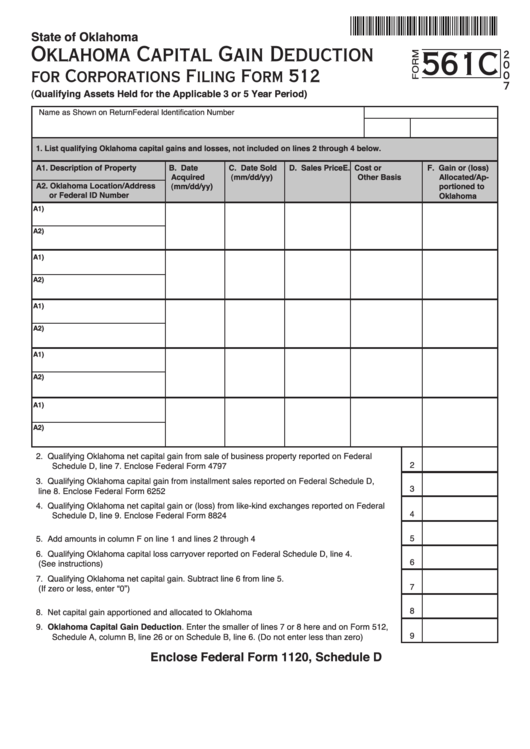

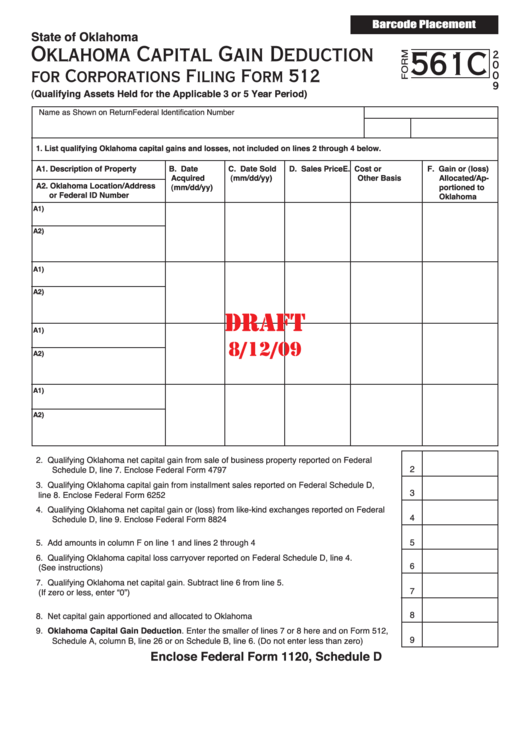

Form 561c Oklahoma Capital Gain Deduction For Corporations Filing

• the corporate income tax rate was reduced from 6% to 4%. • the bank in lieu tax rate was reduced from 6% to 4%. Web what’s new in the 2022 oklahoma tax packet? Once completed you can sign your fillable form or send for signing. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains:

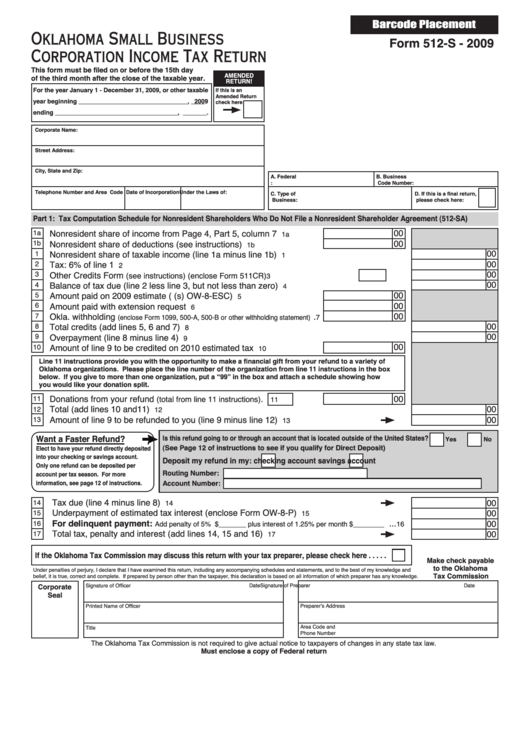

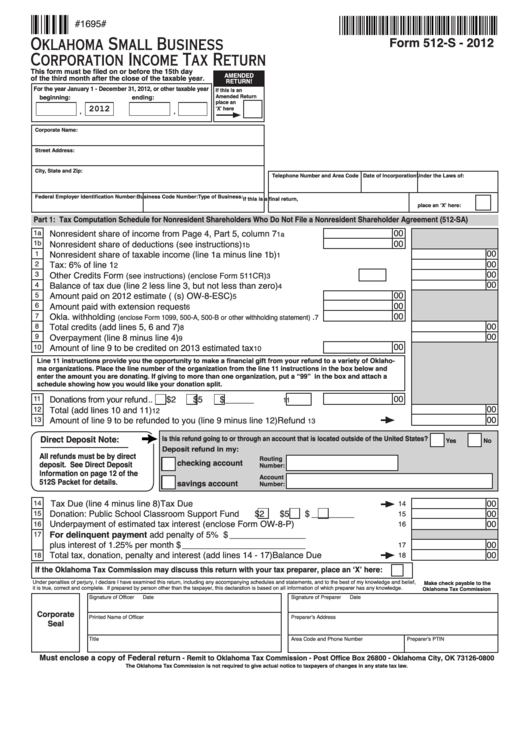

Fill Free fillable 2021 Form 512S Oklahoma Small Business

• the corporate income tax rate was reduced from 6% to 4%. Once completed you can sign your fillable form or send for signing. Web oklahoma amended corporation income tax return tax year corporate name: • the bank in lieu tax rate was reduced from 6% to 4%. Pdf browse oklahoma forms fill has a huge library of thousands of.

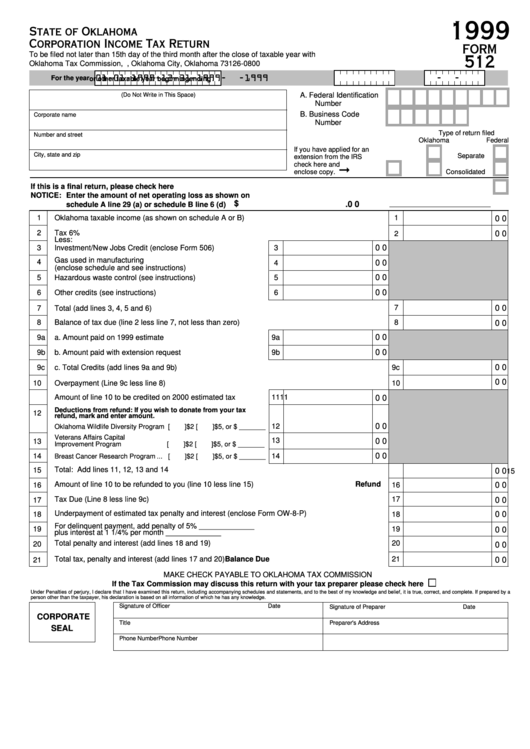

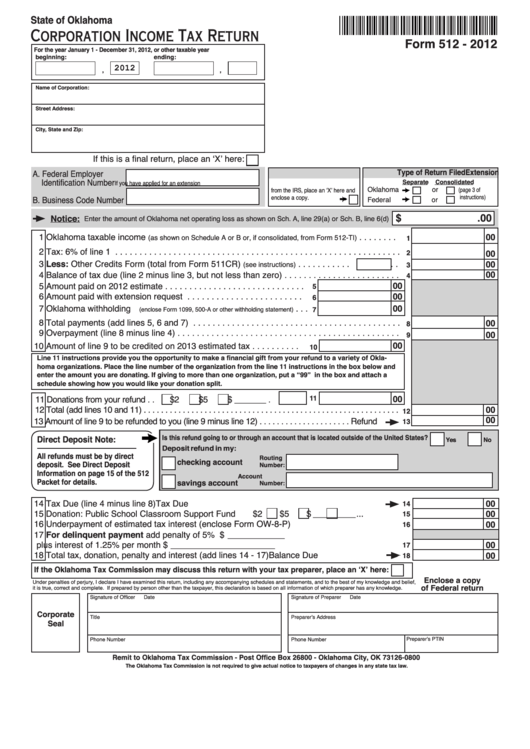

Form 512 Oklahoma Corporation Tax Return 1999 printable pdf

• the bank in lieu tax rate was reduced from 6% to 4%. B if this return is being filed due to a federal audit, please furnish a complete copy of the rar. • the corporate income tax rate was reduced from 6% to 4%. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web.

Fill Free fillable 2021 Form 512S Oklahoma Small Business

Web oklahoma amended corporation income tax return tax year corporate name: Use fill to complete blank online state of oklahoma (ok) pdf forms for free. Making an oklahoma installment payment pursuant to irc. Once completed you can sign your fillable form or send for signing. Pdf browse oklahoma forms fill has a huge library of thousands of forms all set.

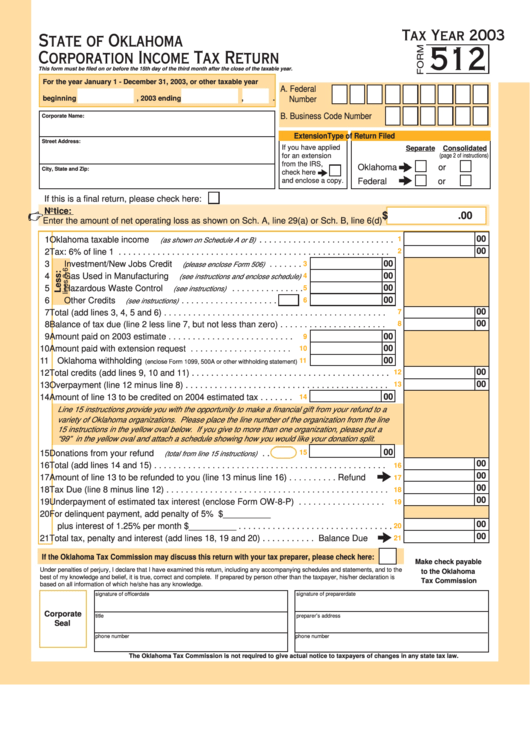

Fillable Form 512 Oklahoma Corporation Tax Return 2003

Making an oklahoma installment payment pursuant to irc. Once completed you can sign your fillable form or send for signing. Web oklahoma amended corporation income tax return tax year corporate name: You can print other oklahoma tax forms here. Pdf browse oklahoma forms fill has a huge library of thousands of forms all set up to be filled in easily.

Form 512S Oklahoma Small Business Corporation Tax Return

Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Pdf browse oklahoma forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. Web we last updated the return of organization exempt from income tax in january.

Form 561c Draft Oklahoma Capital Gain Deduction For Corporations

You can print other oklahoma tax forms here. Web what’s new in the 2022 oklahoma tax packet? Push the“get form” button below. All forms are printable and downloadable. Use fill to complete blank online state of oklahoma (ok) pdf forms for free.

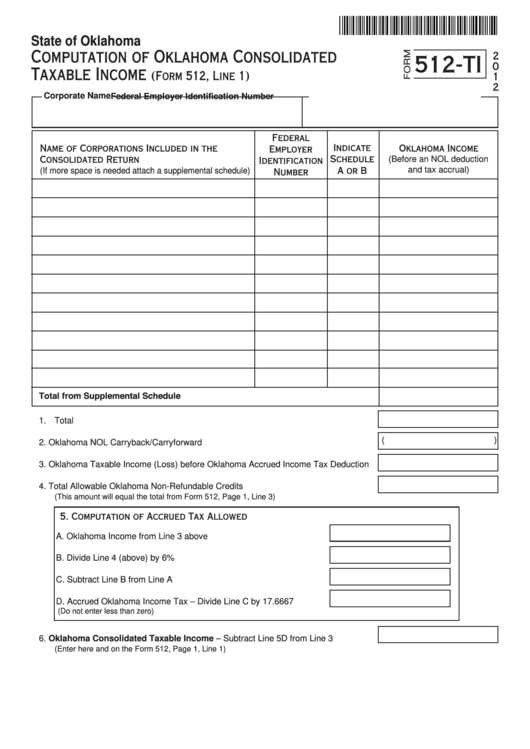

Fillable Form 512Ti Computation Of Oklahoma Consolidated Taxable

You can print other oklahoma tax forms here. • the bank in lieu tax rate was reduced from 6% to 4%. Pdf browse oklahoma forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. B if this return is being filed due to a federal audit, please furnish a complete.

Fillable Form 512 Oklahoma Corporation Tax Return 2012

• the corporate income tax rate was reduced from 6% to 4%. Once completed you can sign your fillable form or send for signing. Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form. Enclose a copy of irs form 1120x or 1139 and a copy of.

Fillable Form 512S Oklahoma Small Business Corporation Tax

Once completed you can sign your fillable form or send for signing. B if this return is being filed due to a federal audit, please furnish a complete copy of the rar. Enclose a copy of irs form 1120x or 1139 and a copy of • the bank in lieu tax rate was reduced from 6% to 4%. Push the“get.

B If This Return Is Being Filed Due To A Federal Audit, Please Furnish A Complete Copy Of The Rar.

Pdf browse oklahoma forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. • the bank in lieu tax rate was reduced from 6% to 4%. Fill in your chosen form sign the form using our drawing tool All forms are printable and downloadable.

Enclose A Copy Of Irs Form 1120X Or 1139 And A Copy Of

You can print other oklahoma tax forms here. Once completed you can sign your fillable form or send for signing. Making an oklahoma installment payment pursuant to irc. Web oklahoma amended corporation income tax return tax year corporate name:

Use Fill To Complete Blank Online State Of Oklahoma (Ok) Pdf Forms For Free.

• the corporate income tax rate was reduced from 6% to 4%. Push the“get form” button below. Web the 2020 512 packet instructions (oklahoma) form is 48 pages long and contains: Web fill online, printable, fillable, blank 2021 form 512 oklahoma corporation income and franchise tax return packet & instructions (state of oklahoma) form.

Web What’s New In The 2022 Oklahoma Tax Packet?

Web we last updated the return of organization exempt from income tax in january 2023, so this is the latest version of form 512e, fully updated for tax year 2022.