Pcori Form 720 Instructions

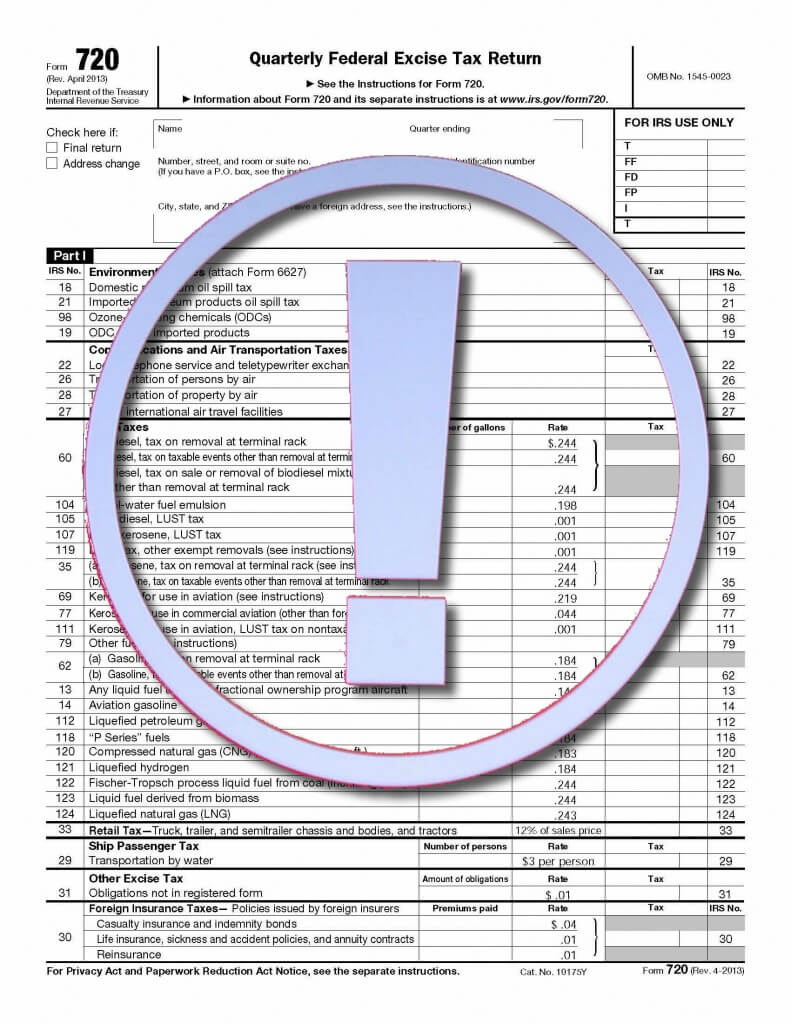

Pcori Form 720 Instructions - Web the irs instructions for filing form 720 include information on reporting and paying the pcori fees. Only one form 720 should be filed for each quarter. Web issuers and plan sponsors who are required to pay the pcori fee as well as other liabilities on a form 720 will use their form 720 for the 2nd quarter to report and pay the pcori fee that is due july 31. Quarterly federal excise tax return. Web to report and pay the pcori fee, an employer should first complete form 720, filling out the pcori section that can be found on the second page of the form, under part ii, irs no. June 2023) department of the treasury internal revenue service. Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Use the most current revision of the form 720 quarterly return when reporting and paying. Web while peoplekeep cannot file this form on your behalf, we provide the necessary numbers and detailed instructions for how to fill out and file form 720. You can access your pcori annual report for 2022 by visiting the reports section on your peoplekeep dashboard.

June 2023) department of the treasury internal revenue service. Quarterly federal excise tax return. Web the pcori fee is filed using form 720. Web while peoplekeep cannot file this form on your behalf, we provide the necessary numbers and detailed instructions for how to fill out and file form 720. See the instructions for form 720. The act made the following changes to the definition of renewable diesel and the treatment of kerosene, effective for fuel sold or used after 2022. Add the total of lives covered for each day of the plan year and divide that total by the total number of days in the plan year. Web the irs instructions for filing form 720 include information on reporting and paying the pcori fees. Here's what the instructions state for calculating the number of lives: Use the most current revision of the form 720 quarterly return when reporting and paying.

For instructions and the latest information. For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due july 31, 2023. June 2023) department of the treasury internal revenue service. Web while peoplekeep cannot file this form on your behalf, we provide the necessary numbers and detailed instructions for how to fill out and file form 720. This is where an employer will report the average number of participants (i.e., eligible employees) using one of the calculation methods described in. Web according to form 720 instructions, there are three ways to count the number of lives for plan years. The act made the following changes to the definition of renewable diesel and the treatment of kerosene, effective for fuel sold or used after 2022. *although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Quarterly federal excise tax return. Web the pcori fee is filed using form 720.

Updated Form 720 Issued For PCORI Fee Payments Woodruff Sawyer

Web the pcori fee is filed using form 720. For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due july 31, 2023. Add the total of lives covered for each day of the plan year and divide that total by the total number of days in the plan year. Although form 720 is.

PCORI on Form 720 IRS Authorized Electronic Filing

Use the most current revision of the form 720 quarterly return when reporting and paying. Web the irs instructions for filing form 720 include information on reporting and paying the pcori fees. Web issuers and plan sponsors who are required to pay the pcori fee as well as other liabilities on a form 720 will use their form 720 for.

IRS Form 720 Instructions for the PatientCentered Research

*although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. June 2023) department of the treasury internal revenue service. Web according to form 720 instructions, there are three ways to count the number of lives for plan years. Renewable diesel and kerosene changes. Use the most current revision of the form 720.

» PCORI deadline just passed “What happens if I messed up?”

53 and 16 are added to form 720, part i. Web according to form 720 instructions, there are three ways to count the number of lives for plan years. For instructions and the latest information. You can access your pcori annual report for 2022 by visiting the reports section on your peoplekeep dashboard. This is where an employer will report.

How to complete IRS Form 720 for the PatientCentered Research

This is where an employer will report the average number of participants (i.e., eligible employees) using one of the calculation methods described in. See the instructions for form 720. Use the most current revision of the form 720 quarterly return when reporting and paying. Web issuers and plan sponsors who are required to pay the pcori fee as well as.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

For instructions and the latest information. See the instructions for form 6627, environmental taxes. Form 720 is used by taxpayers to report liability by irs number and to pay the excise taxes listed on the form. You can access your pcori annual report for 2022 by visiting the reports section on your peoplekeep dashboard. Use the most current revision of.

Compliance Reminder PCORI Fee Notice Brinson Benefits Employee

Use the most current revision of the form 720 quarterly return when reporting and paying. You can access your pcori annual report for 2022 by visiting the reports section on your peoplekeep dashboard. See the instructions for form 720. It is reported on irs form 720.*. For plans that ended december 2022, the pcori fee is $3.00 per employee, and.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Web to report and pay the pcori fee, an employer should first complete form 720, filling out the pcori section that can be found on the second page of the form, under part ii, irs no. For instructions and the latest information. Web issuers and plan sponsors who are required to pay the pcori fee as well as other liabilities.

Electronic filing for Form 720 ease your tax reporting

*although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. See the instructions for form 6627, environmental taxes. Use the most current revision of the form 720 quarterly return when reporting and paying. Renewable diesel and kerosene changes. Form 720 is used by taxpayers to report liability by irs number and to.

Form 720 and PCORI Fees Due July 31st Gilroy Kernan & Gilroy

The act made the following changes to the definition of renewable diesel and the treatment of kerosene, effective for fuel sold or used after 2022. Add the total of lives covered for each day of the plan year and divide that total by the total number of days in the plan year. Use the most current revision of the form.

Here's What The Instructions State For Calculating The Number Of Lives:

Web information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. June 2023) department of the treasury internal revenue service. Although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. For plans that ended december 2022, the pcori fee is $3.00 per employee, and it is due july 31, 2023.

Web Issuers And Plan Sponsors Who Are Required To Pay The Pcori Fee As Well As Other Liabilities On A Form 720 Will Use Their Form 720 For The 2Nd Quarter To Report And Pay The Pcori Fee That Is Due July 31.

The act made the following changes to the definition of renewable diesel and the treatment of kerosene, effective for fuel sold or used after 2022. Quarterly federal excise tax return. This is where an employer will report the average number of participants (i.e., eligible employees) using one of the calculation methods described in. It is reported on irs form 720.*.

Use The Most Current Revision Of The Form 720 Quarterly Return When Reporting And Paying.

Web while peoplekeep cannot file this form on your behalf, we provide the necessary numbers and detailed instructions for how to fill out and file form 720. Web it is required to be reported only once a year in july. Renewable diesel and kerosene changes. Reporting the pcori fee on form 720 issuers and plan sponsors will file form 720 annually to report and pay the pcori fee, no later than july 31 of the calendar year following the policy or plan year to which the fee applies.

You Can Access Your Pcori Annual Report For 2022 By Visiting The Reports Section On Your Peoplekeep Dashboard.

See the instructions for form 6627, environmental taxes. Web the pcori fee is filed using form 720. 53 and 16 are added to form 720, part i. Web according to form 720 instructions, there are three ways to count the number of lives for plan years.