Printable 1099 Form 2020

Printable 1099 Form 2020 - Copy a for internal revenue service center. Copy b report this income on your federal tax return. Web instructions for recipient recipient’s taxpayer identification number (tin). Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. To order these instructions and additional forms, go to. See your tax return instructions for where to report. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. It may arrive in about 10 business days. You may also have a filing requirement. It is necessary to define the level of taxes the individuals have to pay.

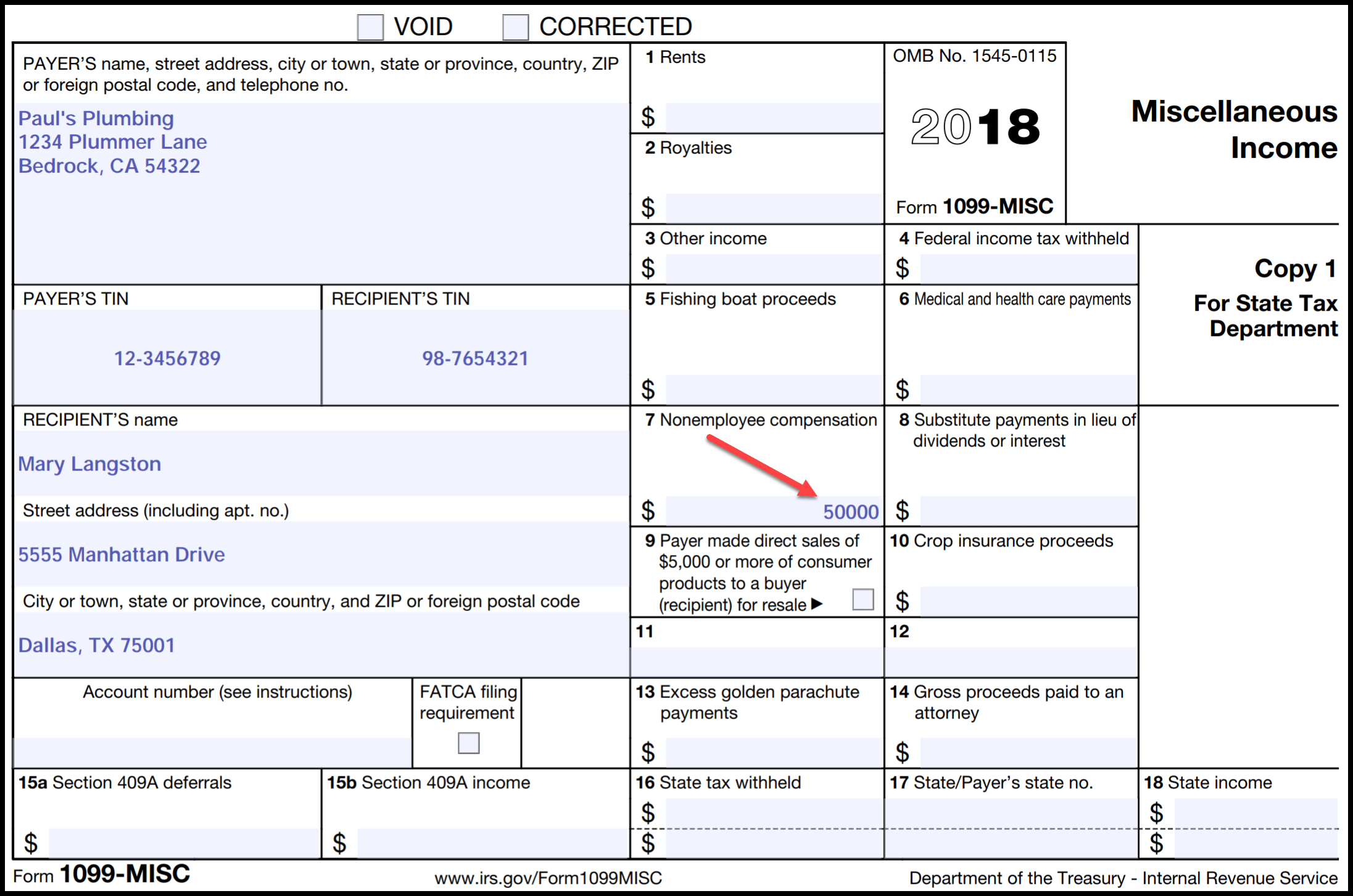

1099 tax form 2020 printable version; Copy b report this income on your federal tax return. Finish filling out the form with the done button. Web instructions for recipient recipient’s taxpayer identification number (tin). Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. All the templates of the 1099 irs tax forms for 2020; The independent contractor has to identify the name, provide an id, ssn, and personal information. Web if you are looking for printable 1099 tax form 2020 instructions and guidelines, you are at the right website. Easily fill out pdf blank, edit, and sign them. It may arrive in about 10 business days.

Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the irs website. See your tax return instructions for where to report. It is necessary to define the level of taxes the individuals have to pay. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. The term information return is used in contrast to the term tax return although the latter term is sometimes used. For privacy act and paperwork reduction act notice, see the. Copy b report this income on your federal tax return. See the instructions for form 8938. Fill, generate & download or print copies for free. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure.

2020 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Identify someone to manage benefits for you; Copy a for internal revenue service center. The independent contractor has to identify the name, provide an id, ssn, and personal information. Postal service will deliver them. Web select which type of form you’re printing:

J. Hunter Company Businesses use form 1099NEC to report contractor

See the instructions for form 8938. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. It may arrive in.

1099 Form Printable 📝 Get IRS Form 1099 Printable for 2021 in PDF

Web instructions for recipient recipient’s taxpayer identification number (tin). To order these instructions and additional forms, go to. Communicate changes to personal situation; Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498.

1099 Form 2020 📝 Get IRS Form 1099 Printable Blank PDF Online Tax Form

The list of payments that require a business to. The term information return is used in contrast to the term tax return although the latter term is sometimes used. Copy a for internal revenue service center. Web so, when seeking a printable 1099 form 2020, most times you will need to visit the order forms & publications section of the.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

The list of payments that require a business to. Web select which type of form you’re printing: Web instructions for recipient recipient’s taxpayer identification number (tin). Web any us resident taxpayer can file form 1040 for tax year 2020. It may arrive in about 10 business days.

There’s A New Tax Form With Some Changes For Freelancers & Gig Workers

2020 general instructions for certain information returns. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. For privacy act and paperwork reduction act notice, see the. The term information.

What the 1099NEC Coming Back Means for your Business Chortek

Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See the instructions for form 8938. It may arrive in about 10 business days. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Copy a for internal revenue service.

2020 W9 Form Printable Example Calendar Printable

If you need to amend a federal income tax return, file form. Finish filling out the form with the done button. Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structure. All the templates of the 1099 irs tax.

TSP 2020 Form 1099R Statements Should Be Examined Carefully

Copy a for internal revenue service center. 2020 general instructions for certain information returns. To order these instructions and additional forms, go to. You may also have a filing requirement. Web 11 1st year of desig.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). The list of payments that require a business to. There, you can order your business’s tax forms and the u.s. Web 11 1st year of desig. The.

1099Formirs.com Provides All The Needed Information And Files, Including:

Furnish copy b of this form to the. For privacy act and paperwork reduction act notice, see the. Add new signature and select the option you prefer: Type, draw, or upload an image of your handwritten signature and place it where you need it.

Web On This Form 1099 To Satisfy Its Account Reporting Requirement Under Chapter 4 Of The Internal Revenue Code.

It is necessary to define the level of taxes the individuals have to pay. To order these instructions and additional forms, go to. The term information return is used in contrast to the term tax return although the latter term is sometimes used. Save or instantly send your ready documents.

You May Also Have A Filing Requirement.

The short form 1040a and easy form 1040ez have been discontinued by the irs. Web if you are looking for printable 1099 tax form 2020 instructions and guidelines, you are at the right website. Finish filling out the form with the done button. Web so, when seeking a printable 1099 form 2020, most times you will need to visit the order forms & publications section of the irs’ website.

Copy B Report This Income On Your Federal Tax Return.

Web any us resident taxpayer can file form 1040 for tax year 2020. Identify someone to manage benefits for you; To order these instructions and additional forms, go to. 1099 tax form 2020 printable version;