Profit And Loss Account In Balance Sheet

Profit And Loss Account In Balance Sheet - Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. All income and expenses are added together to gather the net income, which reports as retained earnings. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. That net income becomes a retained earnings. Web profit and loss account. Web the profit and loss statement: A p&l statement provides information about whether a company can. A balance sheet is a statement that discloses the. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The p&l statement is one of three.

Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web the profit and loss statement: That net income becomes a retained earnings. Web profit and loss account. A balance sheet is a statement that discloses the. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A p&l statement provides information about whether a company can. The p&l statement is one of three. All income and expenses are added together to gather the net income, which reports as retained earnings.

Web the profit and loss statement: Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A p&l statement provides information about whether a company can. The p&l statement is one of three. A balance sheet is a statement that discloses the. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. All income and expenses are added together to gather the net income, which reports as retained earnings. Web profit and loss account. That net income becomes a retained earnings.

FREE 14+ Sample Balance Sheet Templates in PDF MS Word Excel

The p&l statement is one of three. That net income becomes a retained earnings. A balance sheet is a statement that discloses the. Web the profit and loss statement: A p&l statement provides information about whether a company can.

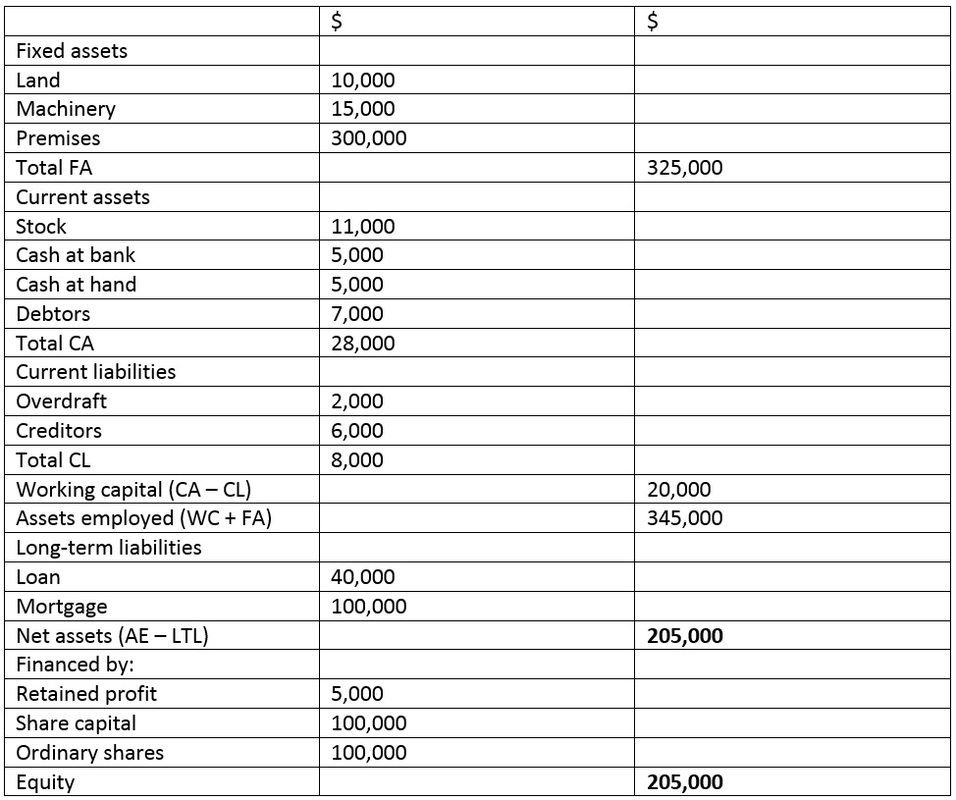

POA Balance sheet

Web profit and loss account. A balance sheet is a statement that discloses the. That net income becomes a retained earnings. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Web the profit and loss statement:

I will make business loss and profit, balance sheet in 24 hour Kashif

Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web the profit and loss statement: Web profit and loss account. The p&l statement is one of three. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary.

Cool Net Balance Sheet Formula Profit And Loss Adjustment

All income and expenses are added together to gather the net income, which reports as retained earnings. Web profit and loss account. Web the profit and loss statement: Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A balance sheet is a statement that discloses the.

Difference Between Balance Sheet and Profit & Loss Account (with

Web profit and loss account. A balance sheet is a statement that discloses the. A p&l statement provides information about whether a company can. The p&l statement is one of three. That net income becomes a retained earnings.

Balance Sheet vs. Profit and Loss Account [2023]

Web the profit and loss statement: That net income becomes a retained earnings. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l statement is one of three. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific.

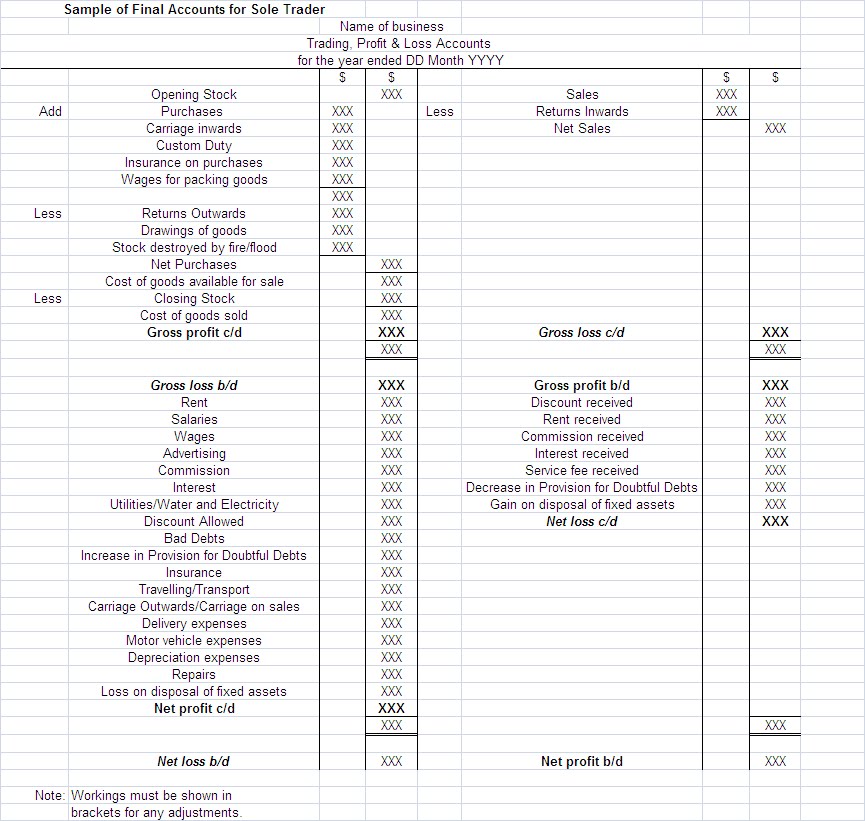

Profit and Loss Accounts + Balance Sheets Monique Lowes' IB Blog

All income and expenses are added together to gather the net income, which reports as retained earnings. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web the profit and loss statement: That net income becomes a retained earnings. Web a profit and loss statement (p&l), or income statement.

Difference Between Profit & Loss Account and Balance Sheet

Web the profit and loss statement: A balance sheet is a statement that discloses the. All income and expenses are added together to gather the net income, which reports as retained earnings. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A p&l statement provides information about whether a.

The Difference Between a Balance Sheet and P&L Infographic

A p&l statement provides information about whether a company can. All income and expenses are added together to gather the net income, which reports as retained earnings. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web profit and loss account. The p&l statement is one of three.

Profit and Loss Accounts + Balance Sheets Monique Lowes' IB Blog

A balance sheet is a statement that discloses the. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The p&l statement is one of three. Web the profit and loss statement: Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses.

The P&L Statement Is One Of Three.

All income and expenses are added together to gather the net income, which reports as retained earnings. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A balance sheet is a statement that discloses the. A p&l statement provides information about whether a company can.

Web A Profit And Loss Statement (P&L), Or Income Statement Or Statement Of Operations, Is A Financial Report That Provides A Summary Of A Company’s Revenues, Expenses, And Profits/Losses Over A Given Period Of Time.

Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web profit and loss account. Web the profit and loss statement: That net income becomes a retained earnings.

![Balance Sheet vs. Profit and Loss Account [2023]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)